Summary:

- Tesla, Inc. has surged post-election due to hype from CEO Elon Musk working directly with President-elect Donald Trump.

- The Trump administration may end the $7,500 EV tax credit, making traditional ICE vehicles more attractive and hurting Tesla’s competitiveness.

- Federal self-driving regulations could benefit Tesla, but slow legislative processes and Waymo’s market lead pose significant challenges.

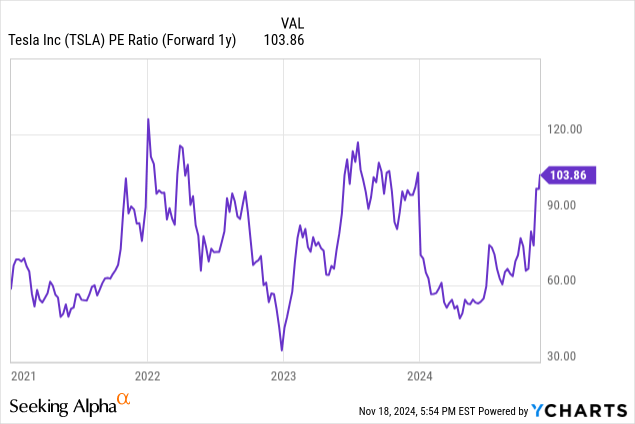

- Investors should wait for the stock to pull back from current hype levels at over 100x forward EPS estimates for a more attractive risk/reward opportunity.

wildpixel/iStock via Getty Images

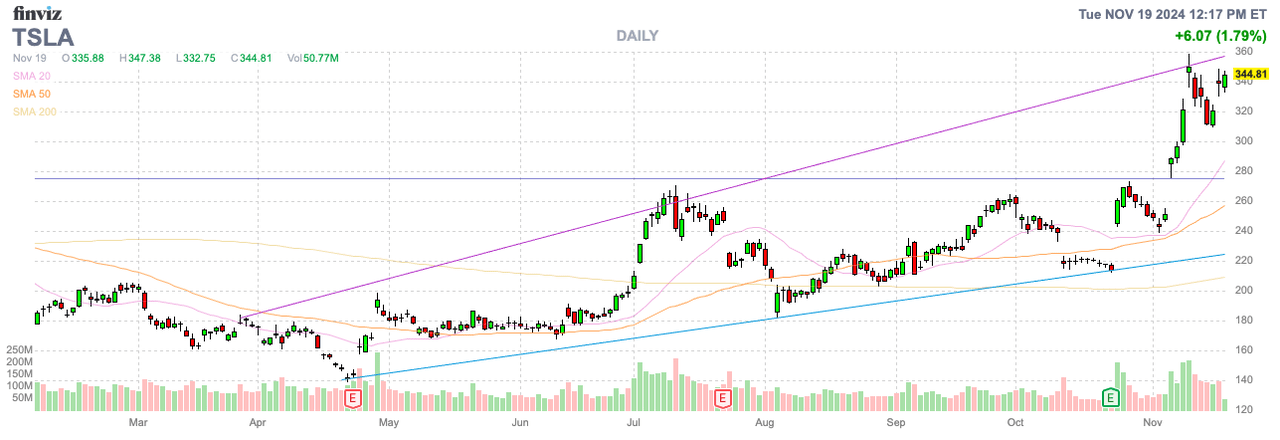

Tesla, Inc. (NASDAQ:TSLA) has soared in the last couple of weeks as CEO Elon Musk aligned with President-elect Donald Trump. The electric vehicle, or EV, company is moving towards a robotaxi business and is apparently working with the Trump Administration on a couple of policies not guaranteed to benefit the company. My investment thesis is now Bearish on the stock, especially after the post-election hype rally of over $100 now.

Eliminating EV Credits

Trump’s transition team may plan to end the $7,500 EV tax credit for consumers, in a move Musk has apparently signalled as ok. Tesla obtains over 60%x of automotive sales from outside the U.S., so the impact would be smaller than feared.

The logic that Tesla can more easily fend off competition in the EV space isn’t as logical here. Without the $7,500 credit, traditional internal combustion, or ICE, vehicles would become more attractive and the incentives wouldn’t exist for the U.S. consumer to transition to EVs.

Tesla is pushing full speed ahead into robotaxis costing $30K with a massive opportunity to get ahead of the market by obtaining the $7,500 EV tax credit on those vehicles. Either way, the loss of the EV credit would appear to hurt Tesla, as much as competitors in the robotaxi race as competitors like Rivian (RIVN).

On the Q3 ’24 earnings call, Musk even hinted at the Cybercab needed the EV tax incentive to compete, as follows:

Yeah. It’ll be with incentive sub-30k, which is kind of a key threshold.

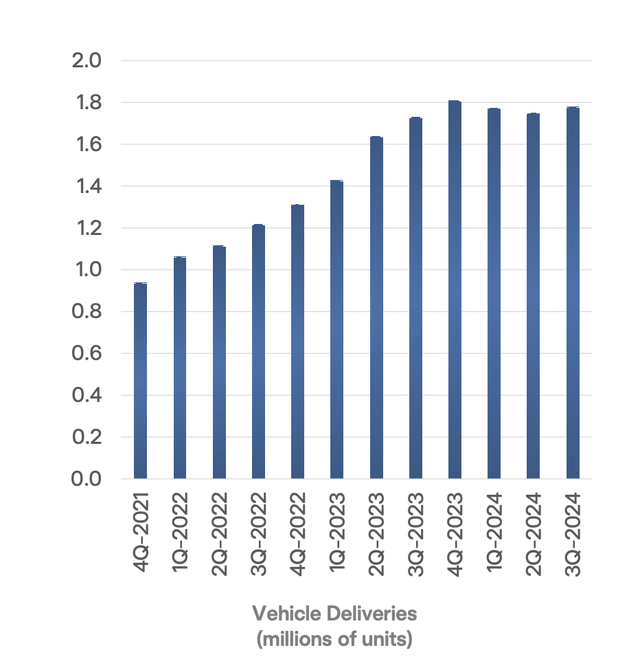

The EV company was already expected to generate substantial growth in 2025 from production growth via higher sales of the Model 3/Y with autonomy, plus a further jump in 2026 from the Cybercab launch. In late October, Tesla guided to plans for vehicle delivery growth of 20% to 30% for 2025.

After delivering 463K vehicles in Q3, the EV company has maintained a pace of ~1.8 million annual vehicles. To reach the 20% to 30% goal, Tesla would need to deliver 2.2 and 2.4 million EVs in 2025.

Source: Tesal Q3’24 presentation

Overall, Tesla has produced over 7 million vehicles. The company has plans to produce upwards of 2 million Cybercabs in 2026, assuming regulatory approvals.

Approving Self-Driving Regulations

The other not so surprising news was the Trump Administration pushing towards easing federal regulations on self-driving cars. Back on the Q3 ’24 earnings call, management discussed the need for federal regulations as follows:

Lars Moravy

I mean, I think it’s important to reiterate this. Like, homogeneity or certifying a vehicle at the federal level in the U.S. is done by meeting FMVSS regulations. All our vehicles today that are produced that are autonomous capable meet all those regulations, cybertruck need those regulations. And so the deployment of the vehicle to the road is not a limitation.

What is a limitation is what you said at the state level where they control autonomous vehicle deployment. Some states are relatively easy as you mentioned for Texas. Yeah. And so other ones have in place like California that may take a little longer. Other ones haven’t set up anything yet, and so we will work through those state by state.

Elon Musk

I do think we should have a federal, I agree. Like, autonomous vehicles should be approved. They just should be — it should be possible to.

Lars Moravy

Congress, if you’re listening, let’s say the federal AV —

Elon Musk

There should — there should be a federal approval process for autonomous vehicles. I mean, that’s how the FMVSS is worked. Federal Motor Vehicle. The FMBSS is federal.

The news isn’t really surprising considering Musk is a part of the Trump team. In addition, passengers should want the Department of Transportation to develop modern rules to address autonomous vehicles, not just for robotaxis from Tesla.

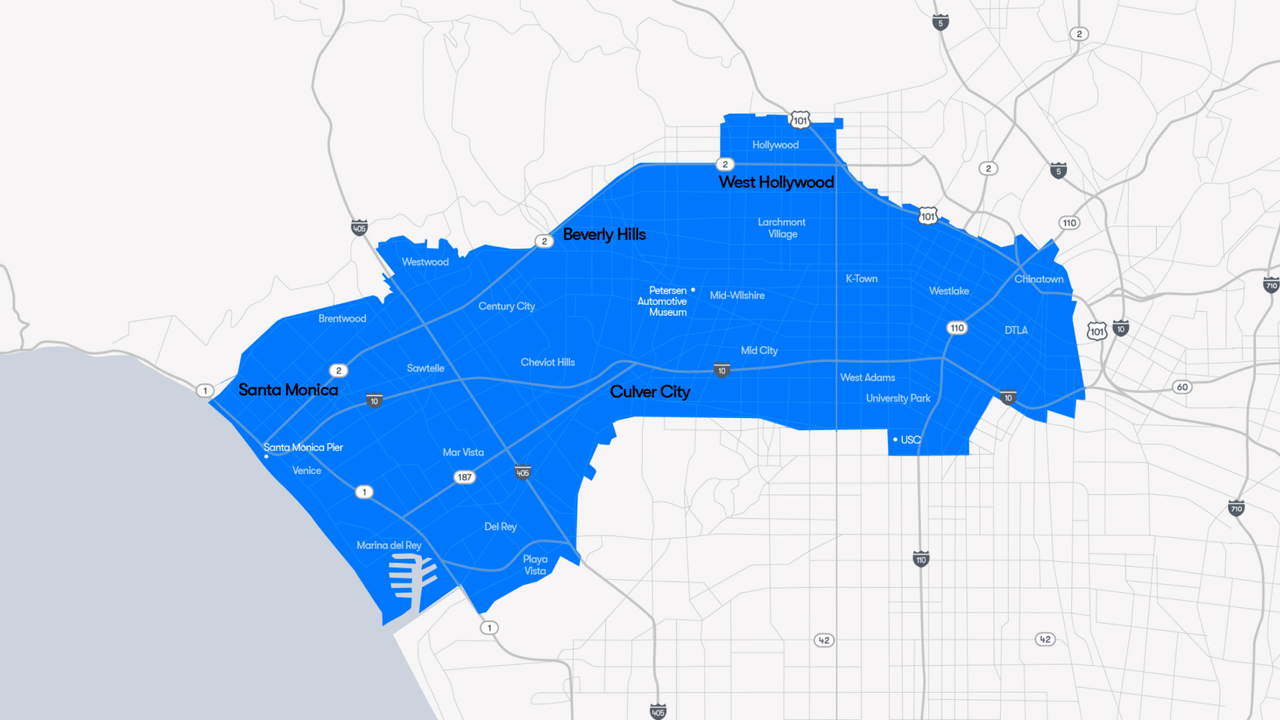

The issue for Tesla is that any regulations will allow the leader in robotaxis to vastly expand beyond current limits in a few major cities. Waymo, owned by Google (GOOG), just entered Los Angeles and is working towards operations in Austin and Atlanta. Investors need to remember that Tesla doesn’t have an approved robotaxi service, while Waymo now operates in 4 cities in 3 different states, with plans to enter Georgia next year.

Waymo has regularly discussed the issues with different municipalities wanting to regulate AVs, including Los Angeles County, wanting more over site of operations. Due in part to technology limitations, but also regulations, the robotaxi service only offers service in controlled areas of these major cities without highway access so far.

Tesla definitely benefits the most from having federal regulations, which would potentially allow the current 7 million customers to become robotaxis at the update of FSD software. In addition, the company intends to have the platform ready to produce a new Cybercab with 2 million vehicles annually.

Remember, Tesla only sells 1.8 million units now. The 2 million Cybercab units at $35K (assuming the sub-$30K price includes the EV tax credit) amounts to $70 billion in annual revenues.

As previous research discussed, Tesla has robotaxi plans to quickly generate more revenue via an internally owned robotaxi. At nearly 1 million miles per vehicle over the lifetime, the robotaxis would earn $1 million in lifetime revenue at $1/mile and the revenues would still hit $500K at $0.50/mile. Either way, Tesla could effectively generate as much revenue in the 1st year a Cybercab operates as the company would generate from selling the EV.

The issue is that Congress doesn’t move very fast, and regulations would likely take years. Under the makeshift regulations at state and municipality levels, Tesla has no real advantage.

The EV company would first have to obtain certification, and Tesla freely admits California will be a problem for 2025. Second, Tesla has to produce vehicles and likely place them into service on an owned basis with limited vehicles in the defined areas of approval.

Either way, the stock has jumped from below $215 towards the end of October to nearly $345 now. Tesla has a $1 trillion market cap and trades at over 100x 2025 EPS targets, a forward P/E multiple where the stock historically meets resistance.

Deepwater Asset Management sees sales growth falling below the current analyst estimates, up at 16% for 2025, due to the EV tax credit removal. Investors should let Tesla pullback from the recent hype, with self-driving regulations unlikely to change rapidly and numerous questions on whether Tesla has the technology to even obtain regulatory approval in the upcoming years.

Takeaway

The key investor takeaway is that investors are now buying into a lot of hype following the elections, some of which isn’t necessarily bullish for the stock. Tesla actually losses a lot of the robotaxi benefits the longer the company doesn’t have approved technology and actual services like Waymo establish the market with a quick Federal approval of AVs.

Investors should allow the recent hype to disappear, where Tesla will fall to more attractive levels, to speculate on the robotaxi future at more attractive risk/reward levels.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to end November, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to started finding the best stocks with potential to double and triple in the next few years.