Summary:

- Broadcom’s strategic VMWare acquisition has reduced dependency on major clients like Apple and diversified revenue.

- AVGO’s critical role in Internet and AI infrastructure, with 99% of Internet traffic passing through at least one Broadcom chip, underscores its market strength.

- The near-term success and potential long-term value of the VMWare deal validate Broadcom’s effective M&A strategy.

Sundry Photography

The Broadcom Investment Thesis

Seeking Alpha

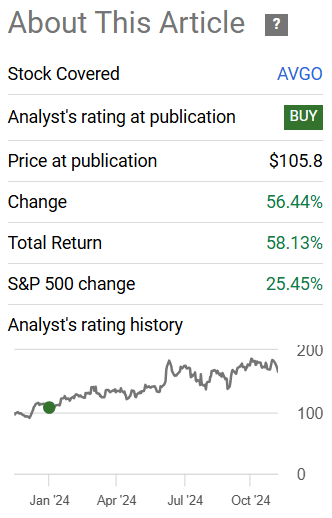

At the end of last year, I was thinking about what topics might dominate the year 2024. And I came to the conclusion that AI will most likely be the hot topic, after which I wrote bullish articles on Broadcom Inc. (NASDAQ:AVGO), NVIDIA (NVDA), and Taiwan Semiconductor Manufacturing Company (TSM) in January 2024. And it looks like I was on to something, as most AI stocks have outperformed strongly so far this year. The big question I have now, however, is whether the outperformance of AI stocks will continue into 2025, or whether they are overvalued.

As I have a relatively large exposure to AI, I am currently in the process of increasing my cash position, even though I still believe that AI will be the dominant theme in 2025. But after the really strong years of 2023 and 2024 in terms of returns, I think there is no harm in being a little bit more defensive.

Broadcom is definitely not cheap after the rapid rise this year, but I think that Broadcom has managed to position itself in a way that they are very important to the AI space because they have an outstanding position in the infrastructure space. And the VMWare idea also seems to be bearing fruit. So I continue to see Broadcom as one of the top players in terms of quality.

What Was My Thesis At The Beginning Of 2024 And What Has Happened Since Then?

In the article titled: Broadcom Will Be a Different Company in 2024, the focus was on the acquisition of VMWare, which was designed to give Broadcom significantly more exposure in the software space. Because even then, Broadcom was a heavyweight in the infrastructure space, with ~99% of Internet traffic passing through at least one Broadcom chip. And also with a very strong position in Wi-Fi infrastructure.

I believe that without Broadcom and its products, known for their reliability, the Internet would not function as smoothly as it does today.

And we’ll get to that in the next couple of paragraphs, but Broadcom has probably achieved the same exceptional position in the AI infrastructure space. Or rather, it looks like they will be among the winners here as well.

With 20% of its 2023 net revenue coming from Apple Inc. (AAPL), and its top five customers accounting for 35% of its net revenue, I saw the VMWare acquisition as a way to reduce risk and move away from this dependence.

| October 2023 | TTM | |

| Products Revenue | $27,891m | $29,194m |

| Subscription and Service Revenue | $7,928m | $17,621 |

And if we look at the TTM numbers vs. October 2023, I think we can clearly see that the subscription and services business has grown a lot, which means that the top 5 customers and especially Apple will most likely have a smaller share of net revenue in the next 10-K. So, in my opinion, the risk mitigation has been successful.

| October 2023 | TTM | |

| Americas Revenue | $8,279m | $13,067m |

| Asia Pacific Revenue | $23,920m | $26,744m |

| EMEA | $3,620m | $7,004m |

And it also shifted the geographic mix of sales to a lower proportion of Asia-Pacific, which I think also mitigated the risk. So in the short term, the impact of the VMware transaction is positive, but I think it will take a couple of years to really assess the impact. But history has shown that Broadcom tends to create value through its M&A activities.

AVGO, The AI Infrastructure Play Of The Future?

Broadcom Investor Presentation

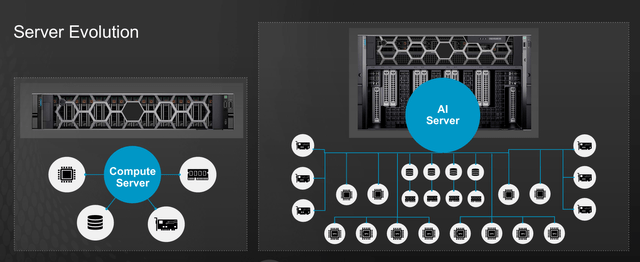

AI servers are more complex than compute servers and consist of more components, as shown in the image above. This is obviously an advantage for companies like Broadcom because they have more parts to sell, and their expertise is even more important. And because Broadcom does a lot of co-development with its customers, they know where the pain points are and how to solve them. As a result, AI revenue as a percentage of semiconductor revenue is expected to jump from less than 5% in 2019 to more than 30% by the end of fiscal 2024.

Broadcom Investor Presentation

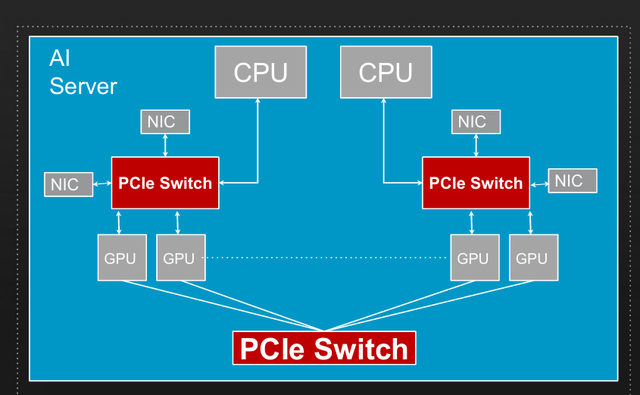

Since AI servers need to connect an incredibly large number of different parts, a suitable solution had to be found. And this is where Broadcom has specialized in so-called PCIe switches, assuming that these will be essential for the AI infrastructure. And with more than 20 years of experience in PCIe, Broadcom is currently able to produce PCIe devices that offer greater reach than the competition and consume less power. That’s why I think Broadcom has a competitive advantage because they have a small piece that’s incredibly important to the AI infrastructure and making it run smoothly. And customers trust Broadcom components because they know they are known for their reliability. After all, downtime is something to be avoided.

Broadcom Investor Presentation

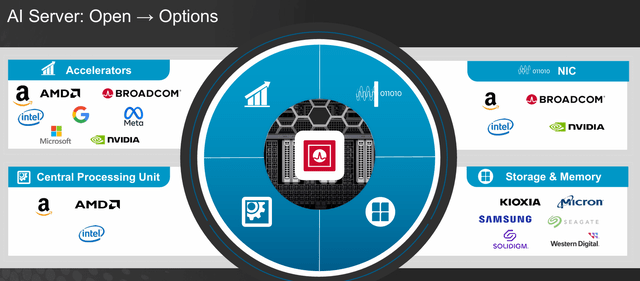

Another technology where Broadcom is, in my opinion, the best is Ethernet. And there is a battle going on right now between Ethernet and Infiniband to see who will win in the AI space. Currently, Infiniband seems to have a slight edge, but Ethernet seems to be the cheaper option for many AI applications, with Infiniband performing better in the high end. But I think Thor 3, which could reach 800 Gb/sec port speeds, and PCI-Express 6.0 have a good chance of swinging the pendulum toward Ethernet.

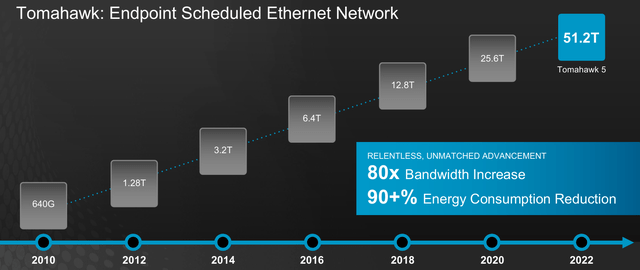

In addition, Broadcom is very diversified in the Ethernet switch space. They have Tomahawk for AI, data centers and hypercalers, Trident for enterprise networking, and Jericho for service providers. But Broadcom also has an additional AI line with Jericho 3 AI. Since Ethernet is one of the key technologies for the Internet, it will be interesting to see if the same will be true for AI. If it does, Broadcom’s position and decades of experience in Ethernet will likely make it the dominant player here as well.

Broadcom Investor Presentation

The rapid evolution of Tomahawk over the last few years, which has resulted in a 80x increase in bandwidth and a 90%+ reduction in power consumption, certainly gives us hope that Broadcom will emerge victorious.

Broadcom’s Debt Situation

There is currently $66 billion of long-term debt on the balance sheet, up from $37 billion in October 2023. And the net debt position is $60 billion. However, in the last 12 months, Broadcom has also paid back $12 billion in debt, and in the November 2020 report, they even paid back $20 billion in debt within 12 months. This means that Broadcom is willing to repay the debt quickly and has a history of doing so.

But even the net debt of $60 billion is not too high, considering that $28 billion of leveraged FCF was generated in the last 12 months. This means that net debt is only a little more than 2 times leveraged FCF. Therefore, I consider the debt position, which at first glance appears high, to be manageable and assume that it will be significantly reduced by the end of FY25.

AVGO’s Valuation

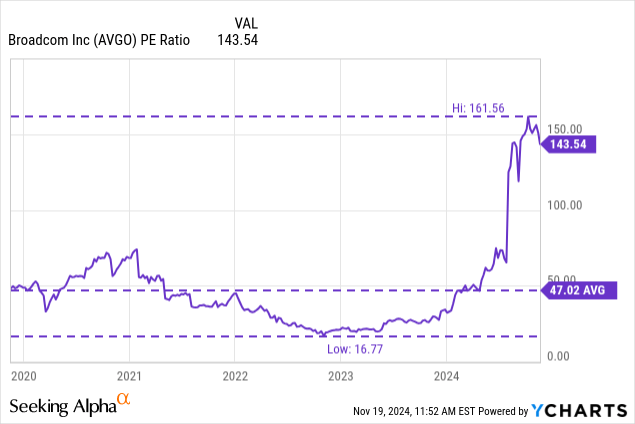

Yes, Broadcom’s current valuation of 143x P/E is far above the 5-year average of 47x and the low of 16x. However, Broadcom’s net income is currently lower than usual. While net income was $14 billion in FY23, it is currently only $5.4 billion TTM. Therefore, the normalized multiple is actually lower and more in line with the average. I also believe that next year’s net income will be in the range of the FY23 net income. So, of course, Broadcom is not cheap, but for a company that has a large share of the Internet infrastructure and may have a similar position in the AI infrastructure, the market simply demands a high multiple based on quality.

What Could EPS Look Like In The Future?

Seeking Alpha Earnings Estimates

My last article was before the 10:1 stock split, so I divide the former analyst target of $82 for October 2028 by 10 to make it comparable. This means that estimates for October 2028 have already been raised from $8.2 EPS then to $11.94 EPS because the outlook for Broadcom has become so positive.

This means that at a 30x multiple, the stock could trade at ~$358, which is more than 100% upside from the current share price of ~$164. So even with multiple contractions, Broadcom remains attractive.

Conclusion

Broadcom may seem expensive at first glance, but the future looks excellent, and I believe Broadcom will be one of the key players in AI. Broadcom’s expertise, customer relationships and M&A track record built over the years also support my view that Broadcom is likely to deliver higher EPS in the future than it does today. And even a lower multiple going forward, which, I think, is a real possibility, does not change my view that Broadcom is attractive.

The fact that Broadcom has been able to become a major player in the AI infrastructure space so quickly, while at the same time integrating VMWare, really shows that the management is top-notch. In fact, Broadcom has really transformed itself in the last year, going from an infrastructure play to an infrastructure/services company that is more diversified than it was before, and even attacking the AI space.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.