Summary:

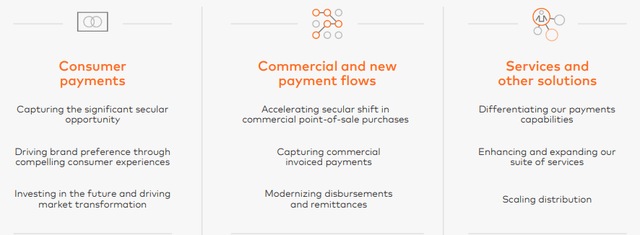

- Mastercard’s growth is driven by three pillars: consumer payments, new flows, and value-added services, each with substantial growth potential.

- Despite misconceptions, Mastercard’s diversified business model and expansive services offer significant growth opportunities, with mid-teens EPS growth projected for 2025-2027.

- Trading at a fair multiple of 32x, Mastercard is expected to provide annual returns in line with earnings growth, justifying a ‘Buy’ rating.

- The company’s investor day highlighted its path to sustained mid-teens earnings growth, reinforcing its position as a highly profitable, capital-light global leader.

jbk_photography

Counterintuitively, despite Mastercard Incorporated (NYSE:MA) being one of the most recognized brands globally, its business is commonly misunderstood.

Historically, the misunderstanding revolved primarily around the fact that Mastercard does not provide credit.

Today, many are missing just how expansive and diversified this company is and, to a greater extent, how much more growth it has ahead.

Its recent investor day should help make the long-term thesis much more clear.

Let’s dive in.

Introduction To Mastercard

Mastercard is one of the most profitable companies in the world, with profit margins above 45%. The company facilitates about $10tn in payment volumes annually, or about 10% of global GDP. In addition, Mastercard provides ancillary services to its clients in security, marketing, acceptance, and more under a ‘value-added services’ vertical.

In a series of articles beginning in April 2023, I delved into Mastercard’s revenue streams, business model, and differences from Visa Inc. (V), as well as set out my long-term investment thesis in the company.

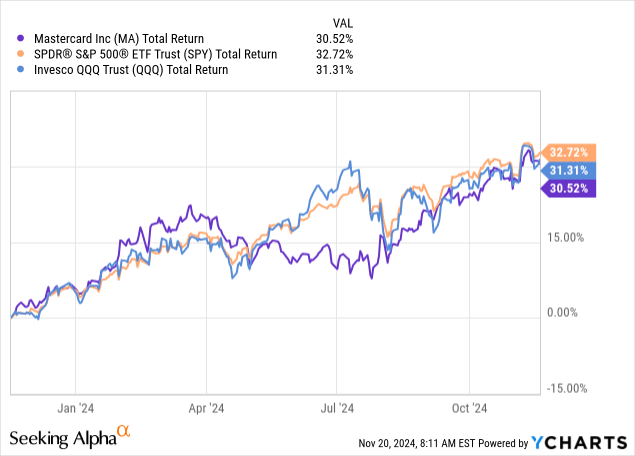

So far, I’m fine with the results, although Mastercard is lagging the market by a few points:

This is on the back of really strong results from the company, offset by a declining multiple that reflects market pessimism about Mastercard’s runway for growth, specifically in consumer payments.

With that, let’s turn to Mastercard’s investor day, and why I believe it should support a multi-year market-beating trajectory.

Revisiting The Three-Pillar Investment Thesis

It will take time for the market to digest the fact that Mastercard’s future no longer relies entirely on consumer payments.

This is the key theme I’ve been discussing in my articles, and why I believe the last year was a great opportunity to accumulate shares ahead of a continued mid-teens growth trajectory.

Mastercard Investor Day Presentation November 2024

In short, Mastercard generates about 62% of its revenues from payments (this includes both consumer and non-consumer), and about 38% from its value-added services.

Both value-added services and new flows are growing more than twice as fast as consumer payments, and in the far future, they should be able to surpass it. This doesn’t go to say the consumer payments line isn’t growing. In fact, it’s growing at a very attractive high-single-digit to low-double-digit rate.

With that, let’s dive into each of those pillars.

Consumer Payments

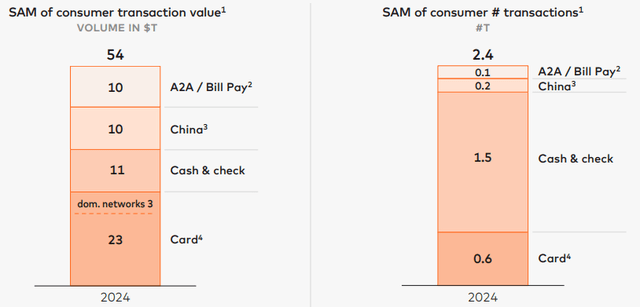

This is the known part of the business, and what many investors and analysts are still almost entirely focused on.

Mastercard facilitates payments in over 220 markets, for over 3.4 billion credentials. It has about 150 million acceptance locations, and 250 million digital access points. All this leads to about 200 billion card transactions annually.

The sheer scale of the business is one reason why some bears are suggesting the growth story is over. Another reason for concern is that in developed countries like the U.S., the gap between PCE and Mastercard’s volumes is narrowing, reflecting a deceleration in the digitalization tailwind.

What they fail to understand is that 1) There are many countries around the world where the gap is still significant; 2) There are many areas that are traditionally non-carded primed for disruption.

Mastercard Investor Day Presentation November 2024

To reach those non-carded categories, like utilities, housing, healthcare, and transit, Mastercard is launching solutions that are tailored to those specific use cases.

Additionally, things like tap-to-pay, and QR payments, are increasing penetration in those areas.

Lastly, there’s a global secular shift to a digital economy that’s predicated on cards. Things like e-commerce, subscriptions, the rise of the gig economy, and more.

All in all, this should remain a high-single-digit growth business for a very long time.

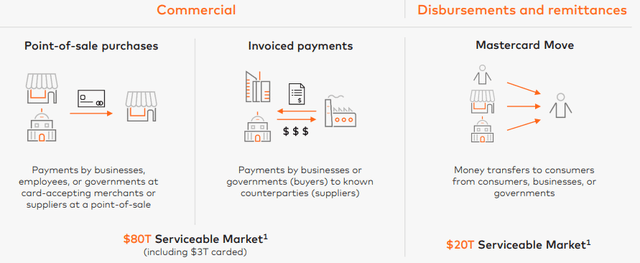

New Flows

Generally speaking, new flows refer to every transaction that isn’t occurring between a consumer and a merchant. This includes payments by businesses, employees, governments, suppliers, insurance companies, and more.

Mastercard Investor Day Presentation November 2024

Mastercard estimates this market at a $100tn of volumes (which is 10x what it’s doing today).

Think about it logically. How simple, secure, and convenient are your transactions as a consumer.

Now, compare that to a transaction between businesses, which requires invoices, a whole treasury department, lots of manual labor, and is very hard to track.

How many times do people struggle to get their funds from their insurers, or receive a government payout?

Mastercard seeks to make this non-consumer landscape as easy, secure, and convenient as the consumer one, and that will take time, but it’s hard to deny there’s a whole lot of room for disruption here.

This is expected to be a mid-to-high-teens growth story.

Value-Added Services

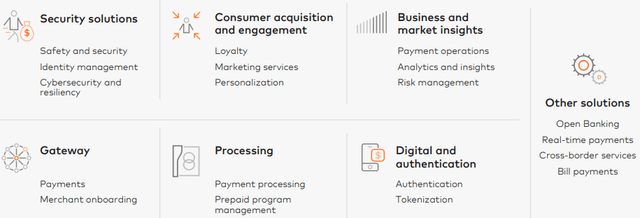

The value-added services pillar is the most diversified and complex to grasp. It comprises six primary verticals, across security, processing, marketing, analytics, identity, and gateway.

Mastercard Investor Day Presentation November 2024

These are huge individual markets, but Mastercard has a special place in each of those, and a right-to-win predicated on its existing relations with clients, extensive amount of data, and unique capabilities to connect to its payment network.

Today, 60% of value-added services revenue is linked to Mastercard’s network, but the majority of its offering can be offered outside its own network as well.

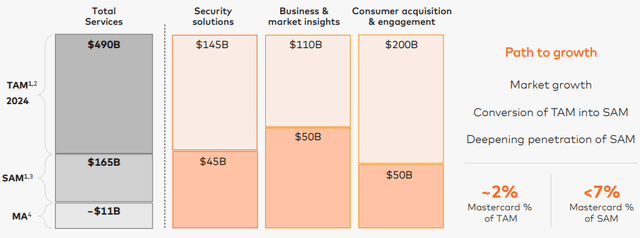

Mastercard Investor Day Presentation November 2024

Mastercard estimates it only holds a 7% share of its serviceable opportunity and a 2% share of its entire TAM.

As Mastercard expands its product suite, more SAM will turn into TAM, and the TAM will continue to expand over time.

This opportunity is hard to quantify, but it’s clear that it should drive mid-to-high teens growth for the foreseeable future.

Valuation & Outlook

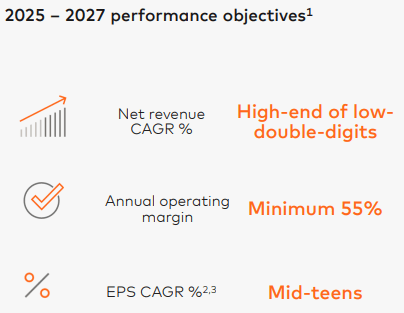

All that we discussed, is the foundation for Mastercard’s newly announced objective of mid-teens EPS growth for 2025-2027, primarily driven by 12%-14% revenue growth.

Mastercard Investor Day Presentation November 2024

So, Mastercard is a highly profitable, capital-light, global company. It operates in a duopoly, and it’s projected to achieve mid-teens EPS growth. What’s the fair multiple for this combination?

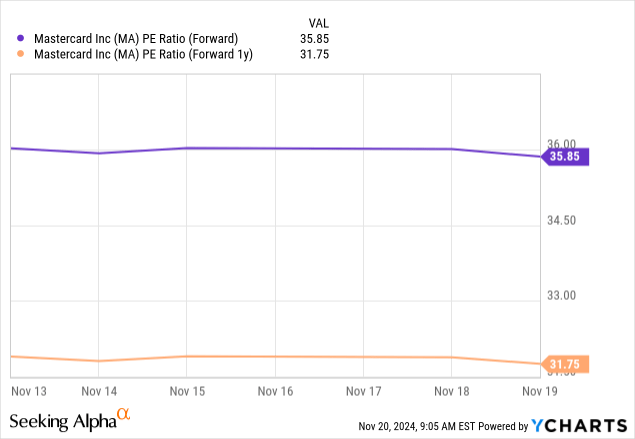

Today, Mastercard trades at 32 times ’25 estimates, about 10% below its five-year average. This reflects a ~2x PEG, which is in line with most high-quality high-growth companies.

In my view, Mastercard is trading at a fair multiple, which it should be able to sustain. This means that the stock should follow earnings growth, reflecting annual returns in the range of 15%.

Conclusion

At its November Investor Day, Mastercard provided investors with everything they needed to understand the company’s significant growth runway.

Across consumer payments, new flows, and value-added services, Mastercard’s opportunities remain huge. They are already executing exceptionally, cementing the company’s path to mid-teens earnings growth for the foreseeable future.

Trading at a fair multiple of 32x, Mastercard is positioned to provide annual returns in line with earnings growth, which is expected to be in the mid-teens.

That’s more than enough to justify a ‘Buy’ rating once again.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of V either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.