Summary:

- NIO Inc.’s robust Q3 2024 results and record deliveries were overshadowed by a weaker-than-expected revenue guidance for Q4 this evening.

- Management guided 72,000-75,000 deliveries for Q4, representing substantial sequential acceleration. But the softer-than-expected revenue outlook highlights the weight of near-term ASP pressure.

- Despite near-term ASP pressures, the longer-term scale advantage of added mass-market volumes, complemented by China’s restored policy support for EV adoption, will drive sustained margin expansion.

- This continues to underpin a pulled-forward timeline to profitability for NIO, which remains underappreciated.

Andy Feng

It has been a volatile couple of months for NIO Inc. (NYSE:NIO) stock. Since NIO’s last earnings update, the stock had climbed close to 50% to more than $7 apiece, supported by a combination of ONVO-led momentum, sustained delivery growth, and broader stimulus measures from Beijing. This was subsequently met with a steep selloff in tandem with broader Chinese shares due to fizzling local consumer confidence, insufficient “fiscal buffers,” and softer NIO insurance registrations in early November.

But NIO’s latest earnings results continue to reinforce its longer-term upside potential, in our opinion. Specifically, the 90-bps sequential margin expansion continues to highlight the combined benefit of a sustained mix shift towards more profitable models, and favorable results of ongoing disciplined spend management. Taken together with the impending scale advantage from ramping ONVO volumes and the upcoming Firefly sub-brand launch, NIO remains well-positioned for a fast-tracked trajectory toward profitability, which remains underappreciated at current levels.

Favorable Policy Backdrop

Although the earlier string of Beijing stimulus, which levied a pervasive benefit across Chinese markets, has failed to live up to expectations, the broader EV industry continues to benefit from a favorable policy backdrop. Specifically, the central government announced in July that prospective car buyers can benefit from an RMB 20,000 subsidy when they trade in their used gas-guzzlers for a new plug-in. This is up from the RMB 10,000 trade-in subsidy for eligible NEV purchases announced in April, thus further fuelling EV adoption.

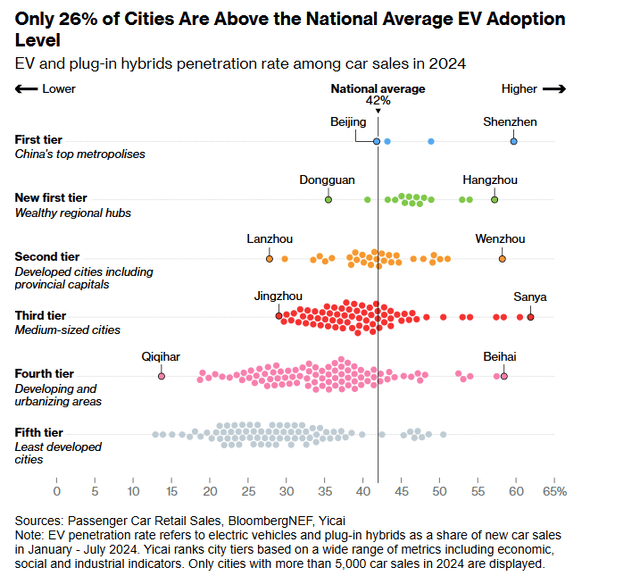

The favorable policy backdrop has been a key driver of EV penetration across China over the past seven months, with more than half of new passenger vehicle sales in the region now an electric plug-in. It has also benefitted NIO significantly, with the company posting its sixth consecutive month of 20,000+ deliveries as of October.

This is further corroborated by NIO’s elevated penetration rate across the more affluent tier 1 and 2 economies across China. The core brand currently boasts a 40% market share in the premium BEV segment priced at more than RMB 300,000.

We believe the recent subsidy increase is expected to further complement NIO’s marketing initiatives aimed at boosting the adoption of its core premium brand. This includes its recent introduction of the “Business Travel” service in October, which we view as a high-return marketing strategy for NIO’s premium line-up.

Specifically, the service offers a branded chauffeur service with NIO’s premium sedans, including the ET7, at RMB 180 per hour. Assuming operations at a standard 8 hours per day, 20 business days per month, the Business Travel service can generate revenue of RMB 28,800 per vehicle per month. That compares to a monthly payment of about RMB 6,500 per month for an et7 with the BaaS option under a 60-month financing arrangement.

The favorable unit economics on the car alone effectively leaves a sizable buffer for NIO to account for other fees like chauffeur costs, and other maintenance and operational expenses related to the Business Travel service. More importantly, we view the service as a direct marketing effort without the burden of incremental marketing spend, complementing NIO’s ongoing cost optimization efforts. The Business Travel service effectively represents paid “test drives” that can yield adjacent conversions into high-margin vehicle sales, which can be further incentivized by government-funded trade-in subsidies.

Beijing’s favorable policy support for the broader EV industry is also expected to complement NIO’s deepening foray into lower-tier mass market opportunities. While NIO has yet to make a dominant presence in the mass market, its recent introduction of the ONVO and Firefly sub-brands is expected to change the narrative.

Specifically, the majority of the existing passenger vehicle fleet that has yet to make the transition to electric remains concentrated in lower-tier mass markets where consumers are more price-sensitive. This cohort also represents a rapidly aging fleet, which reflects a vastly underserved EV opportunity. These smaller, less affluent towns house about 800 million of the Chinese population, yet the EV penetration rate currently hovers below 30%.

The family oriented ONVO L60 SUV is expected to have its prospective demand complemented by Beijing’s topped-up trade-in subsidy. Priced for the mass market at the RMB 200,000 range – or sub-RMB 150,000 with BaaS – the ONVO L60 SUV would come as low as RMB 129,900 with the RMB 20,000 trade-in subsidy. This is a major appeal to prospective buyers across lower-tier cities, where price is a key consideration of purchase decisions:

There’s also the issue of price — it’s hard to get models much below the 100,000 yuan levels that rural residents can afford, BNEF’s Mi said.

Source: Bloomberg News.

The upcoming launch of its Firefly sub-brand in December at NIO Day 2024 will deepen NIO’s reach into relevant mass market opportunities. Based on sightings in the wild, Firefly’s flagship model is expected to be a compact hatchback five-seater. And priced competitively at the RMB 100,000 range, NIO will effectively address every EV pricing segment with the launch of Firefly.

Firefly will also be a key beneficiary of recent policy support for EV adoption across China – particularly within the government, this time. Based on the latest NEV Adoption Guideline, public government agencies should strengthen the procurement of NEVs, with plugins representing no less than 30% of their vehicle fleets. The price of the government NEV fleet also should not exceed RMB 180,000 per vehicle, making Firefly’s flagship model a strong contender for impending demand.

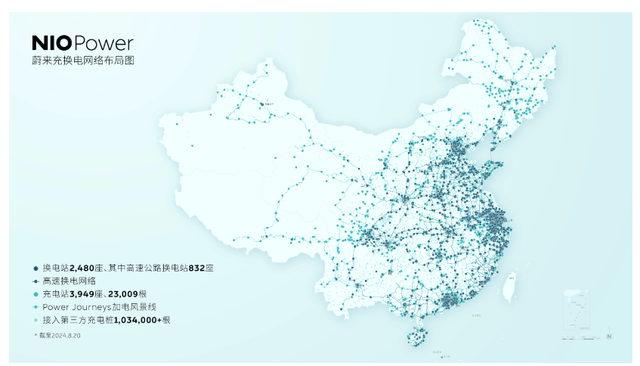

Moreover, NIO is also working to bolster its charging network’s presence across China – even in the smaller towns and counties. The company has recently rolled out the “Xianxiantong” (县县通) charging program aimed at expanding the availability of Power Swap and NIO Power charging stations across China. The program will roll out in three stages starting in 1H25:

- Stage 1 – Install Power Swap and charging stations across 1,200 counties in 14 Chinese provinces, municipalities, and SARs by the end of June 2025. Covered regions will include Shanghai, Beijing, Guangdong, and Macau.

- Stage 2 – Expand Power Swap and charging stations to 13 more provinces, covering an additional 1,100 counties by the end of 2025.

- Stage 3 – Further extend the NIO Power network to remaining counties across China from 2026 onwards.

This initiative is expected to benefit from further future policy support based on recent disclosures in the central government’s NEV Adoption Guideline. Specifically, the guideline has recommended the build-out of charging infrastructure across China as an essential means for facilitating greater EV adoption. Taken together, the recent string of favorable policy support for EV adoption in China is expected to be a strong and timely complement for NIO’s entry to concentrated, yet underserved, opportunities across lower-tier regions.

Scale Advantage Step-Up

Added volumes stemming from the expanded addressable market through NIO’s entry into lower-tier regions are expected to underpin a greater scale advantage that can translate into improved profitability. This is expected to further complement NIO’s ongoing margin expansion efforts realized through the favorable mix shift within its core premium brand and broader disciplined spend management in recent quarters.

Specifically, the newly introduced ONVO sub-brand has reached cumulative deliveries of more than 7,000 L60 SUVs since its launch. Taken together with consideration of management’s Q4 delivery guidance of 72,000 to 75,000 vehicles, the L60’s production ramp continues to track favorably towards the initially targeted capacity of 10,000 units by December.

More importantly, the company aims to ramp L60 volumes to 20,000 units by March – a key threshold that would potentially turn the model’s margins positive and accretive to consolidated profitability. The company currently targets 15% vehicle margins for ONVO at scaled production. ONVO’s CEO, Alan Ai, has also recently made a bold promise to step down from his rein if the production and delivery targets are not met. Taken together with support from the Q4 delivery guidance, ONVO is well-positioned to become margin accretive to NIO’s bottom line before the end of next year.

In addition to ONVO, Firefly will drive further accretion to NIO’s bottom line as well, as all models will potentially share the same next-generation vehicle platform by the end of 2025. This is consistent with our previous analysis, which concludes that the added scale to manufacturing would be a key driver to NIO’s potentially fast-tracked trajectory to profitability by 2026.

The incremental mass market volumes stemming from ONVO and Firefly will also be substantially margin accretive for NIO’s Power Swap business. NIO has cited that its Power Swap network will reach breakeven when the average swap per station per day hits 60. The current average is about 30 to 40 swaps per day per station, with many constructed across higher-tier cities like Shanghai already profitable. As a result, we expect to see accelerating margin improvements across NIO’s “other sales” business, which includes revenue generated from the provision of power solutions, in the coming quarters as added volumes from ONVO and Firefly start to ramp.

Fundamental Considerations

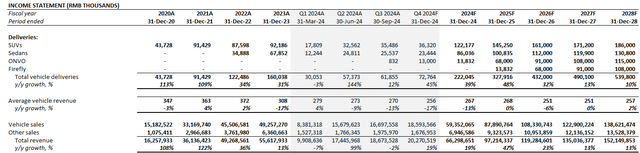

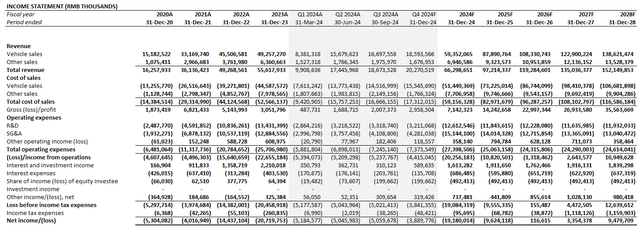

Adjusting our previous forecast for NIO’s actual Q3 performance and forward outlook, we expect the company to expand revenue by 19% y/y to RMB 66.3 billion for the full year 2024. This assumes cumulative 2024 vehicle deliveries of 222,045 units at an average selling price of RMB 267,000. The delivery assumption represents growth of 39% y/y, including 13,832 units of added ONVO volumes.

On the margin front, we remain confident in NIO’s prospects of exiting 2026 with GAAP-based net income. This is corroborated by consistent sequential margin expansion in recent quarters, thanks to the implementation of ongoing cost optimization efforts. We expect vehicle margins to exceed 15% exiting 2024, which is in line with management’s target. This will be primarily driven by the continued ramp of ONVO volumes, alongside acceleration in core NIO brand deliveries suggested by management’s Q4 delivery guidance.

Incremental scale advantage from the continued ramp of ONVO deliveries through 2025 alongside added volumes from Firefly are likely to expand the metric further. This is consistent with management’s expectations for ONVO volumes to reach the breakeven point of 20,000 units per month by March, and become margin accretive to NIO’s bottom line as production continues to scale.

Valuation Considerations

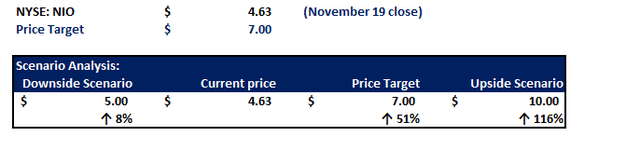

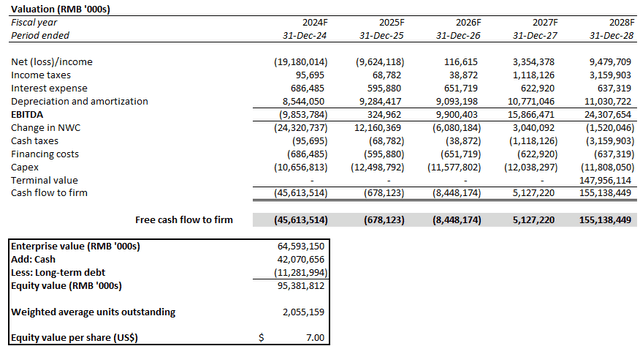

We are maintaining our base case price target for NIO at $7 apiece.

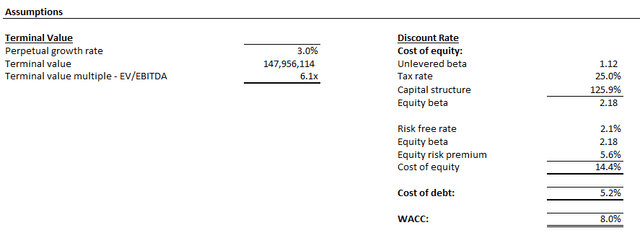

The price target is derived under the discounted cash flow approach, which considers projections from our updated fundamentals for NIO, as discussed in the earlier section. The analysis considers an 8% WACC, which is in line with NIO’s capital structure and risk profile. An implied perpetual growth rate of 3% is also used in determining NIO’s terminal value. The assumption applied is consistent with China’s projected long-term pace of economic expansion and is adequately reflective of NIO’s normalized growth prospects, in our opinion.

Conclusion

Admittedly, NIO continues to face risks of intensifying competition and an evolving macroeconomic landscape in China. While NIO’s vehicle MSRP has stabilized in recent quarters, it continues to face unfavorable near-term implications from a lowering ASP. This is consistent with increasing consumer preference for less expensive models amidst a mixed macroeconomic backdrop and a stabilizing uptake rate across more affluent, early EV adopters. NIO’s introduction of mass-market products through ONVO and Firefly will also have an adverse impact on ASP, despite the additive growth and margin accretion from incremental volumes.

But over the longer term, NIO will benefit from an accelerated scale advantage, as the lower-priced mass market sub-brands target a larger population of untapped opportunities. This is further corroborated by the continued build-out of its extensive charging and battery swap capabilities, particularly across underserved, lower-tier towns and counties across China.

NIO’s latest Q3 outperformance and robust delivery outlook continue to corroborate a fast-tracked trajectory to profitability. This will be a major catalyst for an upward valuation re-rate for the stock, given the lifted fundamental trajectory underpinned by earlier-than-expected profits remains underappreciated at current levels. We believe this is an idiosyncratic positive inflection for NIO. And any beneficial stimulus measures for Beijing aimed at bolstering the local economy would be additive.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.