Summary:

- Palantir’s Q3 earnings were impressive, showing strong sales growth, continued margin improvements, and continued momentum in AIP.

- Despite excellent revenue quality and improving margins, Palantir’s current market cap and multiples make it one of the most expensive stocks on the market.

- With a market cap of $140 billion, Palantir trades at roughly 52x sales and 300x net income, making it unsustainably overvalued.

- Given the speculative frenzy around AI and the favorable rate environment, it’s time to cash out on Palantir and seek better investment opportunities elsewhere.

Sundry Photography

It’s been about 6 weeks since we last wrote about Palantir Technologies Inc. (NYSE:PLTR) in an article titled “Palantir: Sell Puts For A Great Yield And A Potentially Better Entry Into This High Flyer“.

In the article, we rated the stock a somewhat begrudging ‘Buy‘, based on the fact that the company’s growth and revenue quality is among the best on the market.

We did, however, also argue that the stock’s extremely extended valuation posed challenges, recommending that more cautious investors should consider a net long, ‘short put’ trade, sacrificing upside for a robust yield and more downside protection.

Frankly, we didn’t think we’d be covering the stock again so soon, but things have changed.

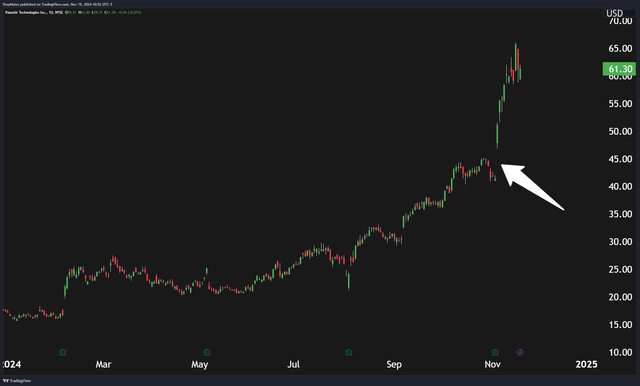

On November 4th, the company reported Q3 earnings, which sent shares skyrocketing 58% (at the peak) over the last two weeks:

While the earnings were impressive and showed PLTR’s real ability to deliver AI value for both customers and shareholders, the stock has now become valued to the extent that we view shares as a ‘Sell‘, simply as a result of the multiple.

It doesn’t matter how good the company’s organic results are, the price alone seems disqualifying.

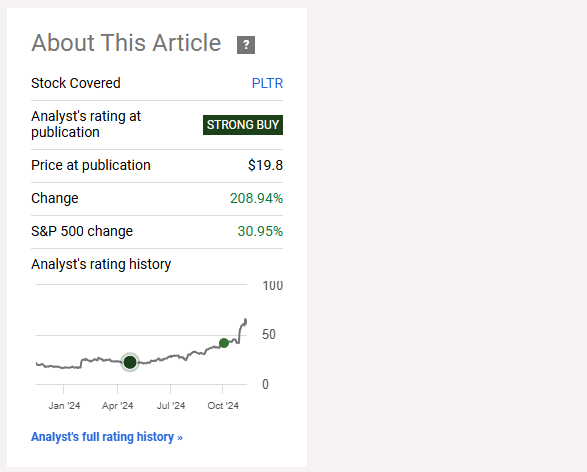

Almost exactly a year ago, we initiated coverage on PLTR with a ‘Strong Buy‘ rating, in an article titled “Palantir: $50 Per Share Is Not Unreasonable“.

At the time, shares were trading under $20, so this price target was bold.

That said, we believed that it was possible, within a few years, if the company could execute:

Seeking Alpha

Now, up more than 208% since our ‘Strong Buy’ rating and trading at more than $60 per share, we can’t justify a bullish position any longer.

Today, we’ll cover the company’s recent financial results, talk about the valuation, and make the case that most investors should cash out while the getting is good.

Sound good? Let’s dive in.

Palantir’s Q3

As has been covered in other articles, PLTR’s Q3 earnings were a thing of beauty.

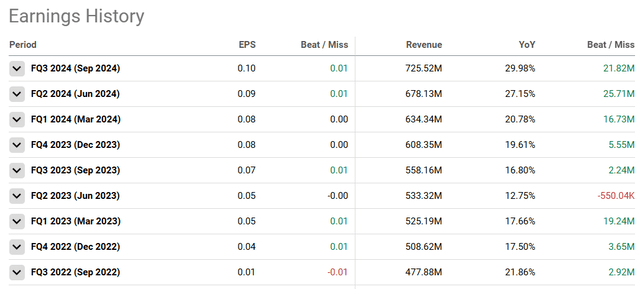

Beating already-inflated expectations on both the top and bottom lines, the company managed to actually re-accelerate sales growth, even as the PLTR’s scale has grown enormously over the last few years:

As we see it, there are three real keys to PLTR’s narrative at the moment:

- Sales Growth/Quality.

- Profit Inflection.

- AI Impact.

Let’s break these down a bit more to get a better sense of where things sit.

On the sales growth and quality side, the company continues to accelerate revenue growth from a higher base, which is quite rare to achieve.

You’ll often see this happen when growth rates are lower, but improving revenue growth rates when they’re already sitting in the 20%+ range is really quite something.

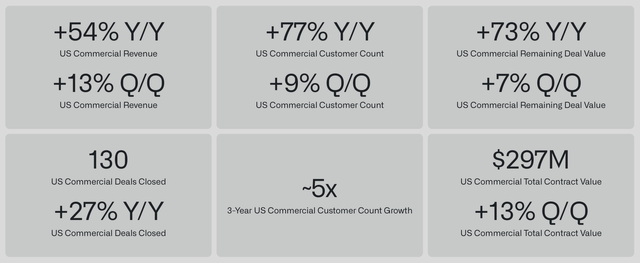

Much of this growth has come from new customer acquisition, as the company has 5x the customer count growth over the last 3 years:

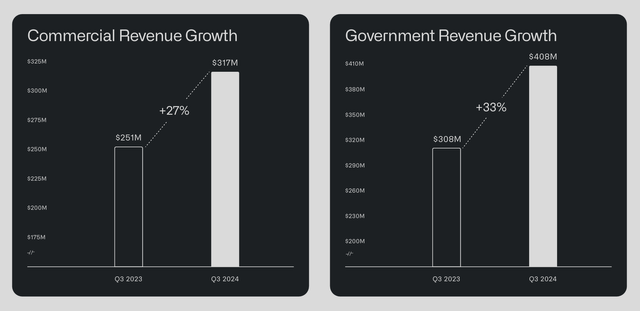

One interesting thing to note is that commercial successes have actually trailed government revenue wins, with revs growing at 33% vs. 27%, which might be a surprise for some:

Either way though, with improving net dollar retention in the 110%+ range, the company’s revenue quality looks as robust as the growth:

Net dollar retention was 118%, an increase of 400 basis points from last quarter. The increase was driven both by expansions of existing customers and new customers acquired in Q3 of last year, as we see the effect of the AI revolution in both industry and government.

As net dollar retention does not include revenue from new customers that were acquired in the past 12 months, it does not yet fully capture the acceleration and velocity in our U.S. business over the past year.

As interest rates continue to move lower, it seems like we live in a world where the market is rewarding high-quality revenue more than anything else, which seems like a key driving factor behind the stock’s impressive run.

Second, as the company has grown, it has achieved operating leverage within the business. As sales have continued apace, the company has had to invest less and less into supporting product delivery infrastructure, which means that more and more dollars have begun dropping to the bottom line.

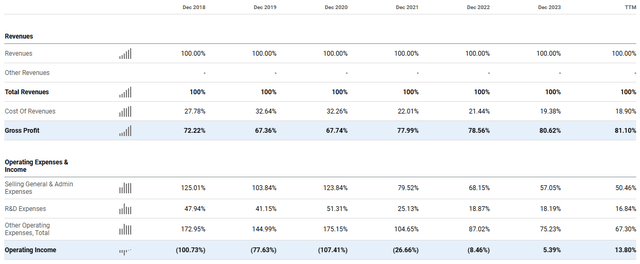

You can see this with the company’s improving gross and operating margins, which recently came in at roughly 81% and 13%:

This is a significant improvement from the TTM figures of 79% and 1.71% the company reported in Q3 of 2023.

Looking forward, investors are clearly looking for continued GAAP operating margin improvements towards 20% and above, as the company has more cash flow to the bottom line.

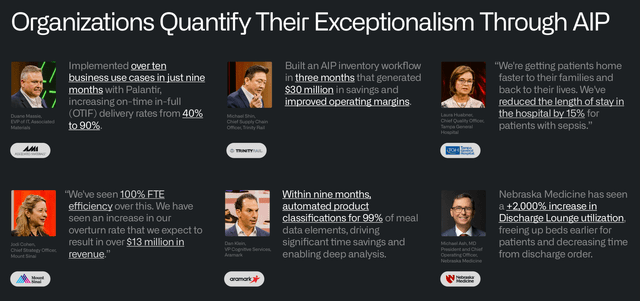

Finally, third, the company is, in many ways, one of the best ‘AI’ stories around. While Microsoft and Google are figuring out how to unlock search and office use cases for recent AI advances, PLTR offers direct AI value with their ‘AIP’ platform:

As opposed to a word-juggler AI model that can help marketers and middle offices operate more efficiently, PTLR has enabled AI across the company’s organizational platform stack, which helps management (and the armed forces) make key decisions about deploying resources efficiently.

Clearly, customers are getting immense value for money from PLTR’s core offering, which is driving the revenue quality and improving margins we talked about above.

Given this, we’d argue that the company has room to raise pricing and juice higher margins out of a similar level of OpEx, which, again, should make investors very happy.

As it stands, between PLTR’s revenue quality and growth, improving margins, and AI business driver, we expect the company’s organic business and business narrative to thrive in the future.

PLTR’s Valuation

Here’s the problem: the stock is too expensive.

While we alluded to this in the intro, the company’s shares are absurdly priced by the market on almost any metric.

Here are the key stats to know:

- TTM Revenue: $2.65 billion.

- TTM Net Income: $476 million.

- Market Cap: $140 billion.

This works out to roughly 52x sales and ~300x net income. Holy moly.

Looking ahead, analysts are predicting the following:

- FY ’25 Revenue: $3.47 billion.

- FY ’25 Net Income: $1.15 billion.

This STILL works out to roughly 43x sales and 121x net income, which are massively, massively expensive numbers on a nominal basis vs. the market.

Plus, this is more than twelve months out, which means there’s execution risk baked into that price.

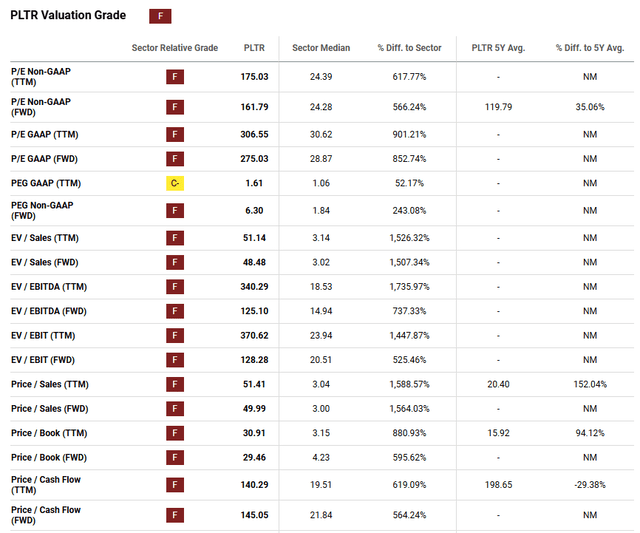

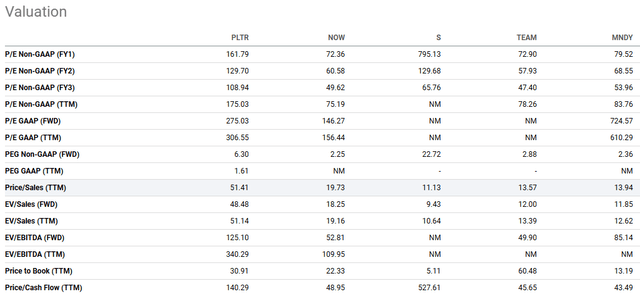

These metrics make PLTR one of the most expensive stocks on the market, and Seeking Alpha’s quant rating system grades PLTR’s valuation at an ‘F’:

We agree wholeheartedly with this assessment.

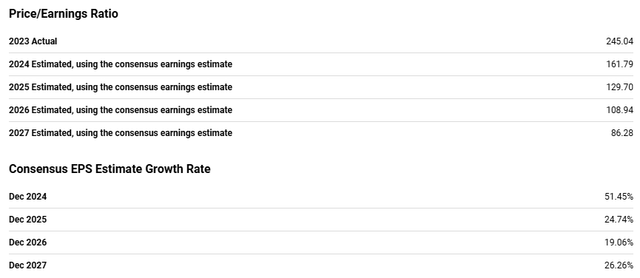

One key thing to note here is that PLTR has inflected on profitability within the last year and a half. This means that going forward, investors should be getting the ‘full force’ of PLTR’s profitability, which makes the 100x+ forward numbers very, very concerning.

Sometimes, when a company is hovering around breakeven, they can produce wild P/E ratios in the hundreds.

In this case, PLTR is really that expensive.

If you take analyst estimates at face value, then at this price, the stock doesn’t reach below a 100x TTM P/E until FY 2027:

Even when you compare PLTR vs. high growth, high margin peers, the stock is in a weight class of its own when it comes to the multiples, particularly on sales:

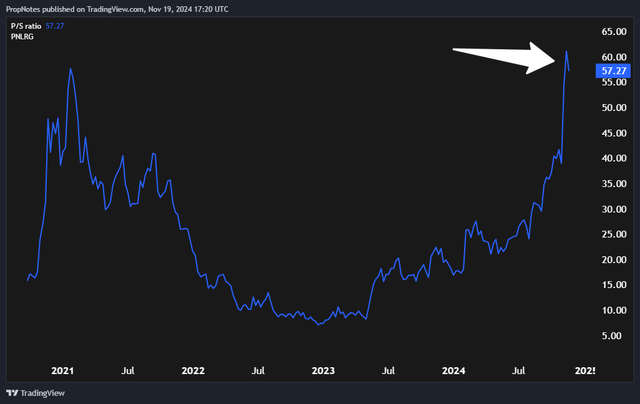

From a historical lens, the company is now more expensive on a sales basis than it was in 2021 when it was listed, which is of note:

While we love the company and the underlying performance, the stock simply appears to be in the middle of an unquenchable speculative frenzy due to AI and falling rates.

In the future, we don’t expect that you’ll be able to get a 50x+ sales multiple for PLTR, hence the article’s title: Cash Out Now, You Won’t Get A Better Price Than This.

Risks

There are two main ways we are wrong.

First, the company’s growth could be understated by current analyst projections, which have failed to grasp how well PLTR would have done up to this point.

If PLTR keeps delivering and beating, then the multiple is actually a lot cheaper than it looks. We think this is possible, but not to the degree that it makes the stock appear reasonably priced at present.

Second, the stock could trade sideways for an extremely extended period as the company ‘catches up’ with the stock price.

This wouldn’t lead to a loss for investors, per se, but it would lead to a long period where capital is tied up in this high-priced, rate-exposed stock. Either way, it’s a potentially bad look.

Summary

Thus, our ultimate conclusion: it’s time to cash out.

It’s been a good run-up to this point, and we’re happy to have been so right about the stock through the present day, but given where it’s trading, and how expensive the market looks on the whole, we think it’s time to cash out some or all of a position in PLTR and move into greener pastures.

Thus, we’re downgrading PLTR to a ‘Sell’.

Here are some ideas we like for those seeking alternatives:

- 3 Key Catalysts That Should Drive Reddit’s Stock Much, Much Higher.

- Google’s Q3 Results Prove YouTube Could Be Worth $750 Billion By 2027.

Stay safe out there!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.