Summary:

- Super Micro Computer, Inc. has appointed BDO USA as its new auditor, potentially reducing Nasdaq delisting risks.

- SMCI’s operational performance faces substantial uncertainties, as customer orders could be rerouted further to its key rivals.

- SMCI’s valuation bifurcation suggests the market has priced in extreme pessimism.

- While delisting risks have not been extinguished, it has bought the company valuable time for an expedited audit.

- I argue why the buying opportunity on SMCI has finally returned, as its selling pressure has likely peaked.

JHVEPhoto

Supermicro: Delisting Concerns Not Fully Extinguished

Super Micro Computer, Inc. (NASDAQ:SMCI) aka Supermicro investors have gotten a much-needed respite as the battered AI server company updated the appointment of an independent auditor following the resignation of Ernst & Young. Therefore, the appointment of BDO USA is expected to have a profound near-term uplift for SMCI, potentially lowering the risks of a Nasdaq delisting. Although BDO USA is not a part of the Big Four, it’s assessed to have the necessary capabilities to audit Supermicro’s global operations. It should be noted that the complexity of its operations has also given significant challenges to Deloitte previously. Notably, SMCI ended its partnership with Deloitte after two decades of engagement, which included the restatement of financial results between FY2015 and FY2017. Hence, I assess that investors must not understate the audit uncertainties engulfing Supermicro, as BDO USA is required to step up and fill the void following EY’s unanticipated departure.

The most fundamental issue at stake is whether SMCI can avoid another Nasdaq delisting, which could be untimely as the production for Nvidia’s (NVDA) Blackwell AI chips is expected to ramp. As highlighted in my previous SMCI update (Hold rating), it could give greater impetus for investors to bet on its arch-rivals, potentially benefiting Dell (DELL) and Hewlett Packard Enterprise (HPE). Recent reports suggesting Elon Musk’s xAI has reallocated $6B worth of AI server orders to Dell could affect Supermicro’s outlook further. While SMCI management had already articulated more cautious guidance at its prelim Q1FY2025 business update, it remains to be seen whether more orders could be rerouted to its key competitors. As a result, I assess that Supermicro’s operational performance and outlook are mired in substantial uncertainties, behooving the market to reflect a significant level of pessimism.

BDO USA had likely assessed EY’s letter of resignation and other critical details before the auditor decided to partner with SMCI to conduct an expedited audit. However, the risks of potential restatements have not diminished. Therefore, while the appointment of BDO USA and Supermicro’s submission of its compliance plan to Nasdaq have given it some time, the company is not out of the woods yet.

SMCI’s new auditor must complete an expedited audit for the company to file its delayed 10K and 10Q. In addition, it must also corroborate Supermicro’s assertion that its financial statements aren’t required to be restated. Meanwhile, Nasdaq is expected to take up to two weeks to assess and review Supermicro’s compliance plan, allowing the company and its auditor to complete the audit before the anticipated due date in February 2025. Therefore, investors must consider potentially significant volatility in SMCI’s price action during this period. The critical question investors must ask is whether they believe sufficient pessimism has been reflected, allowing them to consider partaking in a speculative opportunity.

SMCI Stock: Valuation Bifurcation Against Its Growth Thesis

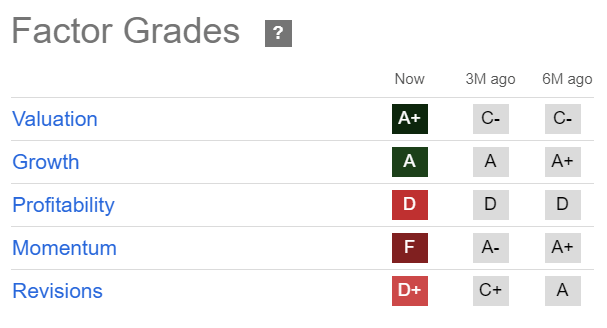

SMCI Quant Grades (Seeking Alpha)

SMCI’s “A+” valuation grade and “A” growth grade corroborate a valuation bifurcation in its growth thesis. Although Wall Street estimates on SMCI have been downgraded considering its uncertainties, more intense competition, and regulatory challenges, analysts have not bailed out of the stock.

Supermicro has prepared its products and solutions ahead of a more scaling up its Blackwell servers. Despite that, concerns about SMCI hitting a potentially lower market share as compared to the Hopper generation are justified. I assess that a positive response from Nasdaq on its submitted compliance plan should afford more assurance to investors who bought its recent dips. It should also lower the aggression by Supermicro short sellers who likely covered recently, driving up its upward momentum this week. Hence, it should help underpin a more robust consolidation zone as investors reassess the potential dip-buying opportunities as SMCI reaches a critical support zone.

Is SMCI Stock A Buy, Sell, Or Hold?

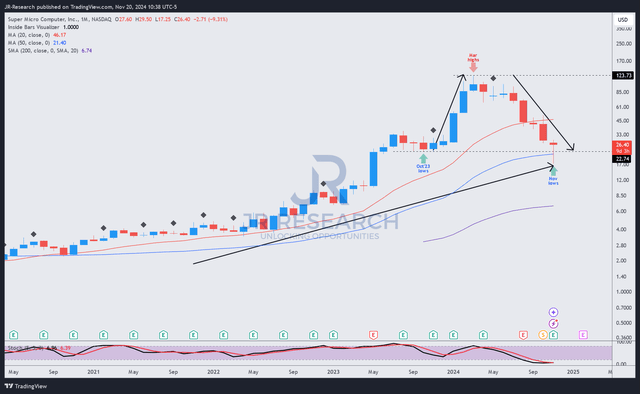

SMCI price chart (weekly, medium-term) (TradingView)

As seen above, SMCI remains in an uptrend bias, with its 50-month moving average (blue line) underpinning its long-term bullish thesis. However, the rapid surge from the stock’s October 2023 lows has been fully digested, although buyers returned to defend the $20 support zone.

Based on SMCI’s price action, buyers appear ready to hold its pivotal support zone, with a potential bullish reversal signal looking increasingly likely. As a result, I believe that the steep decline from SMCI’s March 2024 highs could finally reach a crucial consolidation zone.

Supermicro investors have the timely opportunity to consider SMCI’s valuation bifurcation, as Nvidia’s Blackwell AI chips are expected to ramp up and ship through 2025. While it needs to contend with more intense competition against Dell and HPE, SMCI’s tight partnership and collaboration with the hyperscalers should position it well as it ramps up its DLC solutions.

However, the market is expected to remain cautious, although downside volatility is expected to have reached a bottom and is approaching a critical inflection point. Hence, I believe it’s opportune for me to upgrade the stock, as SMCI demonstrated its urgency and resolve with its new auditor appointment to overcome its previous challenges expeditiously.

Notwithstanding my improved optimism, investors are urged to manage their exposure cautiously and consider adding in phases. The appointment of BDO USA has not ruled out its delisting risks, even though it has bought Supermicro time.

Rating: Upgrade to Speculative Buy.

See the additional disclosure section below for important notes accompanying the Speculative/Cautious Buy rating presented.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SMCI, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Our cautious/speculative ratings carry a higher risk profile. They are only intended for sophisticated investors/traders. We urge new or inexperienced investors to avoid relying on such ratings. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified. Moreover, investors must exercise prudence and devise appropriate risk management strategies, such as pre-defined stop-loss/profit-taking targets, within a suitable risk exposure.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!