Summary:

- Lucid Group’s losses widened in 3Q24, and with the upcoming Lucid Gravity SUV, operating expenses and losses are expected to increase in 2025.

- The company may need to sell more stock in 2025, leading to further shareholder dilution, making it a less compelling investment.

- Despite a 91% YoY rise in deliveries and increased sales, Lucid Group’s valuation is high at 8.4x sales, compared to Rivian’s 2.2x.

- Given the ongoing need for stock sales to fund operations, I recommend avoiding Lucid Group and considering stronger companies like Rivian Automotive.

Khosrork

The stock price of Lucid Group (NASDAQ:LCID) fell to a new 52-week low after the electric-vehicle manufacturer opened up its books for the third quarter.

Lucid Motors’ losses widened substantially in 3Q24 and the startup is on track to start production of the Lucid Gravity, a new SUV model, late this year, which almost certainly will expand the company’s losses.

Higher operating losses could also necessitate new stock sales in 2025 which would further dilute the company’s existing shareholders.

In my view, Lucid Motors is vulnerable to more selling pressure as it starts production of the Lucid Gravity, and the stock is not a compelling investment candidate at this point.

My Rating History

My last stock classification on Lucid Motors was ‘Sell‘ as the EV company embarked on yet another public stock sale in October. Moreover, Lucid Motors is poised to release a new electric-vehicle next year is almost certainly going to increase the company’s losses in 2025.

Taking these things into consideration, as well as the fact that Lucid Motors’ losses widened substantially in the third quarter, I think that the risk/reward relationship does not favor investors and I therefore suggest to sit an investment in Lucid Motors out.

Losses Are Probably Going To Expand In 2025, Gravity Opens Up Reservations

Net losses of Lucid Motors grew substantially in the third quarter as the company experienced a surge in electric-vehicle deliveries. In 3Q24, the electric-vehicle maker delivered 2,781 electric-vehicles, a 91% YoY increase.

Between January and September, Lucid Motors delivered a total of 7,142 electric-vehicles, beating last year’s entire deliveries by more than 1,100 electric vehicles. As a consequence, Lucid Motors’ sales also skyrocketed: They went up by 45% YoY to $200.4 million. The main figure I am interested in these days is not deliveries or sales, but operating expenses.

Operating expenses obviously include all the money a company spends on creating a good product and delivering it to customers. They include R&D expenses, general & administrative costs, and direct production expenditures.

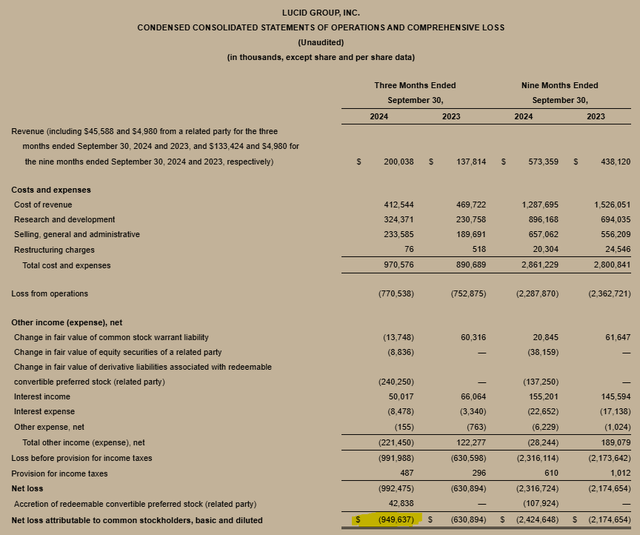

In 3Q24, Lucid Motors’ total production and other costs amounted to 970.6 million, up 9% YoY. Lucid Motors’ net loss widened, unfortunately, and the company was close to incurring a $1.0 billion loss in 3Q24, up 50% YoY.

As Lucid Motors gears up to focus on its second electric-vehicle, the Lucid Gravity, I think we are going to see a substantial increase in operating expenses next year as well as a need for the company to finance its losses via new stock sales.

Condensed Consolidated Statements Of Operations And Comprehensive Loss (Lucid Motors)

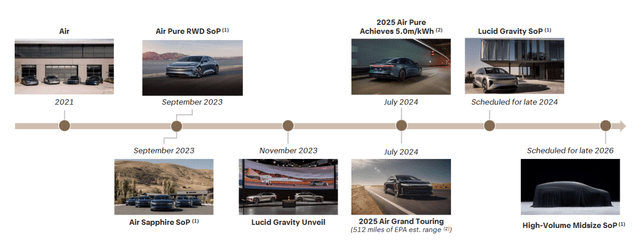

The timeline for Lucid Motors shows, as has been communicated previously, that the EV company is just on the brink of starting production for its Lucid Gravity, an SUV that will cost as much as $96,400 for the top trim level and sport a driving range of up to 440 miles on a single charge.

Reservations for the Lucid Gravity opened up in the first week of November. With the Lucid Gravity going into production in late 2024, however, the EV company is poised to see higher operating expenditures moving forward, which almost certainly implies higher net losses in 2025.

Lucid Motor Shows Timeline (Lucid Motors)

Lucid Motors’ Balance Sheet

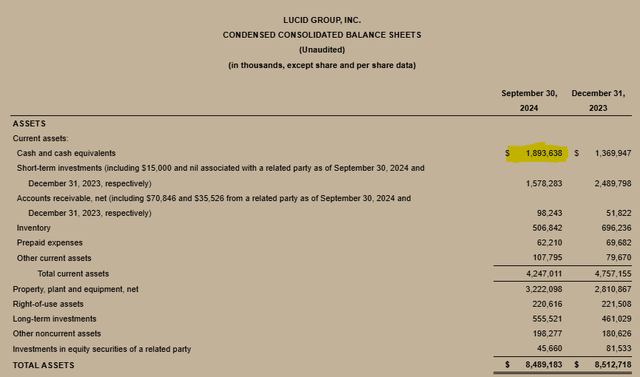

Lucid Motors does have a balance sheet that seems to accommodate its growth plans, with $1.9 billion in cash being available as of September 30, 2024.

With that said, Lucid Motors depends on funds from the Public Investment Fund of Saudi Arabia and the startup is probably going to raise more capital from its main shareholder in order to bring the Lucid Gravity to market next year.

Unfortunately, Lucid Motors’ regular stock sales have led to considerable dilution for shareholders in the last couple of years, and I consider additional stock sales to be a key headwind standing in a way of a stock re-rating moving forward.

Condensed Consolidated Balance Sheets (Lucid Motors)

Lucid Motors Is Expensive, Falls To New 52-Week Low

Lucid Motors repeatedly slashed its production guidance in recent years and presently anticipates to produce a relatively low amount of 9,000 electric-vehicles in the present financial year. The repeatedly slashing of the startup’s production forecast has led to a precipitous decline in Lucid Motors’ sales estimates over time.

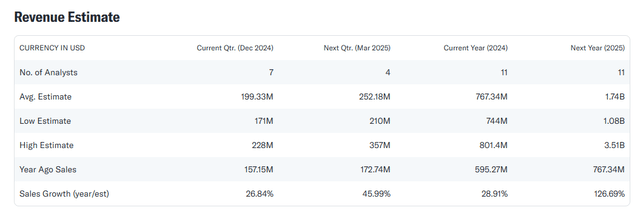

The market presently models $767.3 million in sales this year and the EV company already booked $573.4 million in sales between January through September, which equals 75% of Lucid Motors’ consensus sales estimate for the entire year.

With a market valuation of $6.45 billion, the electric-vehicle startup is selling for an 8.4x sales multiple, which is extremely rich when taking into account that the electric-vehicle company has not yet moved into mass production and really has only one product introduced to the market so far.

Rivian Automotive, Inc. (RIVN) has a market value of $10.3 billion and expected sales of $4.64 billion, which leads us to a 2024 sales multiple of 2.2x, meaning the much bigger EV company is selling for a fraction of Lucid Motors’ multiple. In the last quarter, Rivian Automotive produced sales of $874 million and is therefore more than 4 times bigger than Lucid Motors.

If I were given the choice between those two EV companies, I would most definitely prefer Rivian Automotive over it much smaller peer in the electric-vehicle industry, given its much healthier valuation.

Revenue Estimate (Yahoo Finance)

Why My Assessment About Lucid Motors Might Be Wrong

My stock classification for Lucid Motors is ‘Sell’ and I think there are many good reasons to support a negative outlook for the stock. Mainly, Lucid Motors has miniscule production, is years removed from profitability and the probability that we are going to see a major change with regard to the company’s profitability curve is very low as well, in my view.

With that said, I could definitely be wrong, and I have been wrong about Lucid Motors before. Should Lucid Motors manage to avoid further dilutive stock sales, grow its EV revenue, and narrow its losses, then the electric-vehicle company could be on track for a stock price re-rating.

My Conclusion

If Lucid Motors’ third quarter demonstrated anything, it was that investors will still have to wait many years for any profits to show up in the EV company’s ledgers.

Lucid Motors’ sales got a boost in the third quarter, however, due to a 91% YoY rise in deliveries, the startup did not raise its production forecast for 2024, meaning it continues to anticipate a very moderate 9K production total in the present financial year.

I think that Lucid Motors will continue to rely on stock sales to the public and the Public Investment Fund of Saudi Arabia to support its losses. I also don’t think that Lucid Motors’ valuation makes much sense right now, with the stock selling at a whopping 8.4x 2024 sales.

Lucid Motors will, for the foreseeable future, depend on stock sales to raise cash, which means investors will continue to get diluted. Thus, the risk/reward relationship is anything but compelling at 52-week lows and I recommend investors to give Lucid Motors a pass or instead invest in a company with a stronger balance sheet, like Rivian Automotive.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.