Summary:

- Mastercard experienced strong growth in 2023-2024 but has set conservative growth targets through 2027, suggesting a Hold rating due to potential volatility.

- The company’s new growth targets are in the “high end of low double digits,” reflecting a step-down from previous high-teen expectations.

- Mastercard’s Value-added Services, including cybersecurity, show potential but are not yet significant growth catalysts, making the stock appear overvalued at 31x 2025 earnings.

- Slower capital returns to shareholders and reliance on global economic resilience, particularly in the US, further justify a Neutral stance on Mastercard.

numbeos/iStock Unreleased via Getty Images

Investment Thesis

After enduring a stubbornly rough patch of sluggish growth through 2021-2022, Mastercard (NYSE:MA) eventually saw strong years of growth in 2023, which has continued into 2024. Robust consumer spending and elevated demand for the payment company’s value-added services have kept investor enthusiasm up as Mastercard looks to end 2024 by delivering returns in excess of 20%.

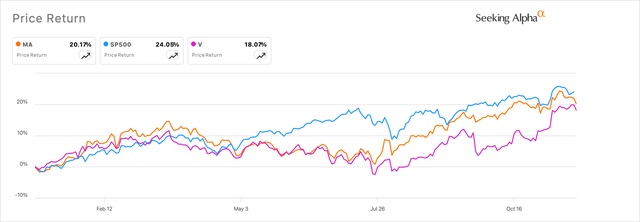

Exhibit A: Mastercard’s stock is expected to close out 2024 with strong double-digit returns. (Seeking Alpha)

Revival in the global economy, led by a resilient resurgence in the US, has been key in boosting the growth prospects of both Mastercard and its peer, Visa (V).

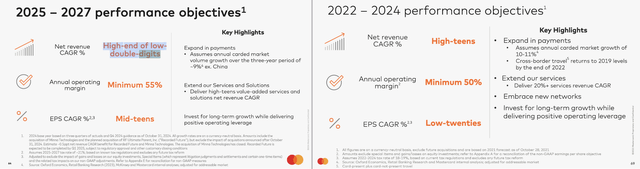

Naturally, expectations were up as Mastercard assembled analysts, investors, and its management at its triennial operating plan, where the Purchase, NY-based payments network company revealed they now plan to pursue a CAGR growth rate in the “high end of low double digits,” through 2027.

To me, this is not surprising but is still a step down for Mastercard, after the company witnessed growth at the lower end of their previous 3-year guidance. The new operating plan looks disconnected from the company’s >30x forward PE, which is going to cycle through some volatility as investors digest these new growth rates.

I am recommending a Hold rating on Mastercard.

Mastercard’s Sluggish Outlook Should Not Have Been Surprising

At Mastercard’s 2024 Investor Day last week, the company’s management outlined new areas of growth for the company as it turns its attention to consume a larger portion of the digital payments markets.

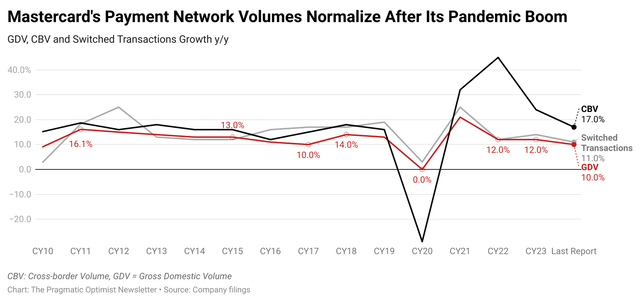

Per the company’s previous 2021 triennial operating plan, management saw encouraging trends in the travel industry as the world emerged from the COVID pandemic, eventually boosting overseas spending. Mastercard’s management expected to benefit from these trends, and thus guided for growth between 2022-2024 to be in the “high teens.”

In hindsight, management was right to point out these catalysts in their 2021 Investor Day. CBV, or cross-border volume, surged as lockdown restrictions eased, opening up the potential for travel, resulting in a larger opportunity for Mastercard to process higher volumes of cross-border transactions while also benefiting from switched transactions as a result.

Exhibit B: Mastercard’s volume growth of network metrics point to further normalization of growth. (Company Filings)

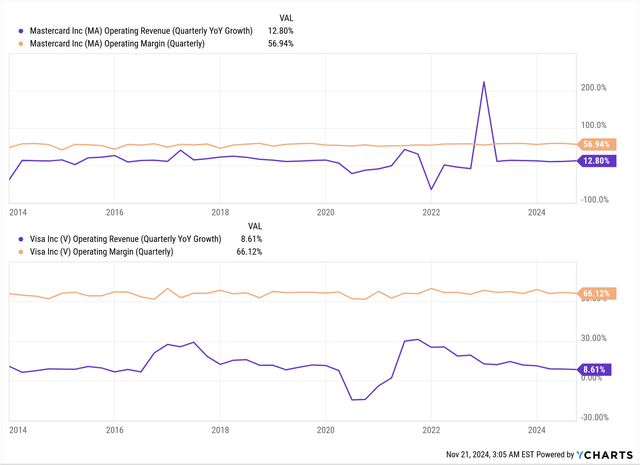

The global strength in Mastercard’s business has led to the company growing at a 12-14% rate per year while operating at margins in excess of 50%, faster than its larger rival, Visa, which grows at a 10-12% rate per year while operating at margins in excess of 60%.

Exhibit C: Mastercard’s growth rates versus Visa’s growth rates. (YCharts)

However, Mastercard has marginally underperformed versus its own 2021 targets. The company had called for growth between 2022 and 2024 to be in the high teens. This is most likely expected to be hovering in the low teens at ~13-14% CAGR for those three years, taking management’s “low-teens range“ Q4 guidance into account.

Per management’s next 3-year targets, Mastercard is expected to grow in the “high end of low double digits,” through 2027, which indicates growth will be flat on a CAGR basis over the next 3 years. Given how Mastercard’s growth was slowing in the 13-14% range this year, Mastercard’s 3-year targets were not surprising.

Exhibit D: Mastercard is calling from slower growth over the next three years versus its previous three years. (Mastercard Investor Presentations)

What management’s 2027 targets imply is either some level of conservatism for MasterCard’s new bets to start paying off as they ramp up or that they really see the company growing at these rates as network metrics such as GDV, or Gross Dollar Volume, and Cross Border Volumes normalize.

Mastercard also used its Investor Day to talk up its ambitions to further compete in the rapidly growing digital payments space and payments services industry. Security services form the fastest-growing backbone to Mastercard’s ambitions in the payment services space. The company talked about how it has been ramping up investments and cross-selling payment services such as Security & Market Insights to its client roster, which is eventually becoming a $154 billion serviceable market for Mastercard, growing in the high teens.

Assuming its total carded market grows in the 9-10% range, Mastercard’s Value-added Services and Solutions portfolio, which includes cybersecurity and market insight offerings, is expected to grow in the high teens, per Exhibit D above. There is potential for this segment to grow, but with no proof of this segment moving the needle for Mastercard beyond the 13-14% growth, it will be hard for investors to quantify value in Mastercard’s future efforts here today.

At +30x Multiples, Mastercard is overvalued

With Mastercard’s Value Added Services portfolio not expected to be a major catalyst just yet, in my view, this means we have to take management’s three-year expectations of “high-end of low-double-digits” growth at face value.

As I mentioned earlier, the 3-year targets do not imply any significant growth ramp from Mastercard’s current 13-14% y/y growth rates. This is also going to make it harder for the company to post any significant improvements in their operating margins, which currently hover in the 56-57% range. By the way, management is expecting operating margins to be “minimum 55%,” which again is not a major surprise from the 56-57% range they already report.

Finally, EPS growth also looks to be pressured from earlier trends. Management now expects EPS to be growing in the mid-teens, versus the low-twenties guidance they projected in the 2021 analyst day. Another step down in guidance.

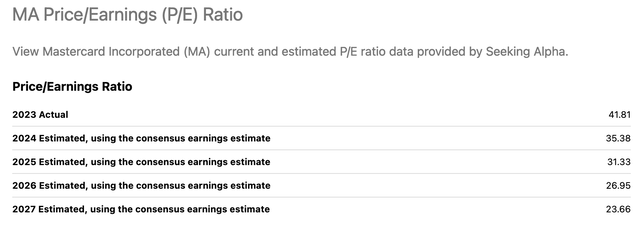

The mid-teen growth expected by management, supported by the 13-14% growth rates, implies a forward PE of 32x at most. Mastercard currently trades at 31.3x 2025 earnings.

Exhibit E: Mastercard’s valuations until 2027 show its priced out. (Seeking Alpha)

Other Factors To Know Of

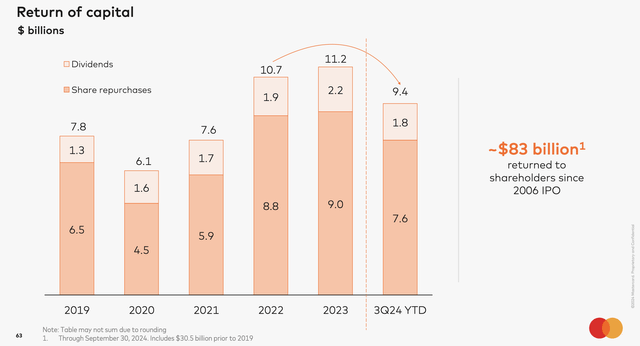

Also, investors should note that Mastercard has slowed down the pace at which it returns capital to shareholders via buybacks and dividends versus its capital management at the start of this decade.

Exhibit E: Mastercard’s valuations until 2027 show its priced out. (Company Presentation)

Unless management improves this trend, investors will be expected to hold out against Mastercard for now.

The other factor that will significantly impact Mastercard’s outlook is the global growth forecast, which has stayed resilient, driven by strong performance in the US. PCE spending and GDP in the US are indicators that impact Mastercard’s GDV and CBV metrics.

Takeaway

Mastercard’s 2024 investor day only seemed to reiterate the growth rates that the company is currently growing at. With the company posting 13-14% growth rates while operating at a 56-57% margin profile, management’s 3-year outlook was sluggish and makes its stock look pricey considering Mastercard is trading at 31x 2025 earnings.

It will take some time to digest Mastercard’s outlook, and until then, expect Mastercard to be range-bound. It’s best to stay Neutral on Mastercard for now.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.