Summary:

- NVIDIA 3QFY25 and commentary on the call led us to maintain our hold.

- Our point of concern is NVIDIA’s near-term gross margin issue, with management reporting a sequential decline and guiding for one in Q4 with GM outlook of 73% to 73.5%.

- NVIDIA’s valuation remains priced for perfection, which puts the stock at higher risk with the gross margin issue.

- We’ll watch for the market to digest the news and upgrade on a more attractive buying opportunity.

Spiderplay/E+ via Getty Images

NVIDIA (NASDAQ:NVDA) (NEOE:NVDA:CA) just reported 3QFY25 earnings and outlook, leaving us not too optimistic about the near term. We downgraded the stock to a hold ahead of their Q2 report, expecting a headwind from the product transition from Hopper to Blackwell, and that played out well, with the stock dipping as much as 20% after the report. Our mistake was that we missed the upgrade to ride that intra quarter trade because we didn’t think that near-term risk was gone. Management’s commentary and guide for Q4 lead us to believe there remains a near-term headwind and its gross margin pressure.

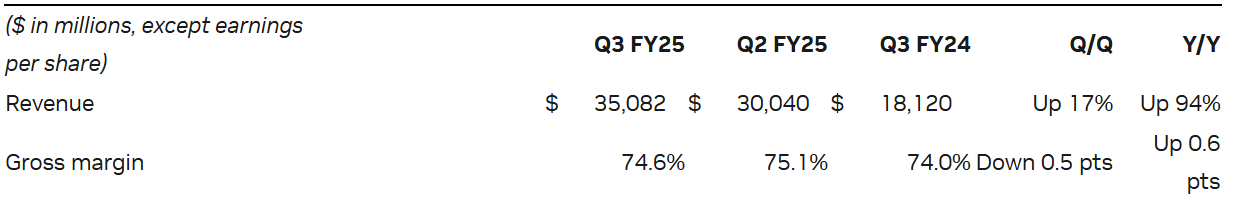

This quarter, management reported a gross margin of 74.6%, down 0.5% sequentially from 75.1% in 2QFY25, and is now guiding for Q4 gross margin to contract 1.1% to 1.6% next quarter to the 73%-73.5% range. On the call, management mentioned that the gross margin could decline further and is later expected to return to the mid-70% level once Blackwell is on the full ramp. This tells us two things. The first is that management is attributing the current gross margin pressure to the Blackwell ramp. The second is that management wasn’t able to give a specific timeframe for when they see that mid-70 % level gross margin returning. Our concern is that it sounds like the 1QFY26 gross margin could be lower than the 4QFY25 one, which could heavily weigh on the stock, considering NVDA can’t afford any slip-ups with its premium valuation.

NVDA 3QFY25

The stock is trading down on Wednesday extended trading, and that’s due to a combo of the gross margin issue and sales outlook for Q4. Management is guiding for Q4 sales of $37.5B, which came in ahead of the Street consensus at $37.07B but missed whisper numbers for the first time since the AI boom in May of last year, for the range of $38B to $38B. The guide didn’t match up with CEO Jensen Huang’s commentary on the call about Blackwell orders for the current quarter exceeding the company’s expectations. NVDA remains, in our opinion, since day one, the primary benefactor of the AI boom, but we think there is some near-term risk that, once digested, should create better buying opportunities into the end of the year.

What else happened?

For the quarter, NVDA reported adjusted EPS of $0.81 and sales of $35.08B, comfortably outpacing the consensus at $0.75 and $33.16B, respectively. The company’s bread and butter data center segment saw sales grow 17% Q/Q and 112% Y/Y to $30.77B, with the bulk of that supported by compute up 22% Q/Q and 132% Y/Y. Gaming also saw sequential momentum, with sales up 14% Q/Q and 15% Y/Y to $3.28B. We continue to see sequential growth in NVDA’s end markets, but now it’s more of a question around pace and margins. The following chart outlines Nvidia’s revenue by market.

NVDA 3QFY25 Earnings

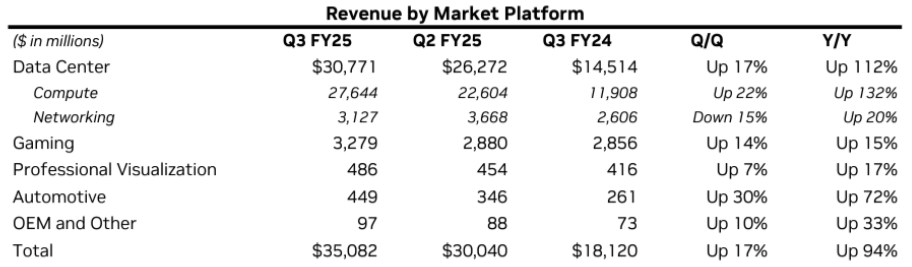

Valuation & Word on Wall Street

NVDA remains expensive, trading well above the semi-peer group average on more metrics than one. On a P/E basis, the stock trades at 53.9x C2024 compared to a peer group of 28.2x and higher than its ratio in late August -post-2QFY25 earnings of 47.6x. The stock trades at EV/Sales ratio of 29.6x C2024 versus a group average of 7.2x and an August ratio of 26.9x. We think the premium multiple is the result of NVDA’s hyper AI growth, and management continues to deliver on its roadmap to lead the industry. Having said that, the high multiples mean that the stock is being watched carefully and needs to perform to perfection at this kind of price. We think this makes NVDA a higher risk for the near-term, considering the gross margin contraction may spill into the April quarter.

The following chart outlines NVDA’s valuation against the peer group average.

TechStockPros

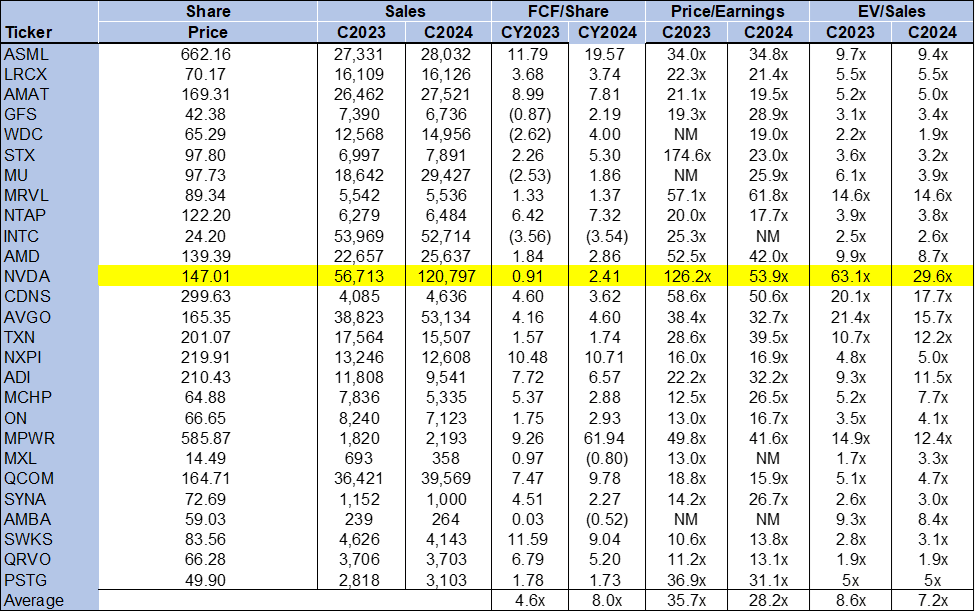

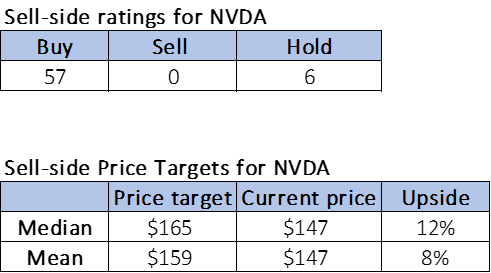

Wall Street is bullish on NVDA, which is not surprising given that the company is nicknamed Wall Street’s AI darling. Of the 63 analysts covering the stock, 57 are buy-rated, and the remaining six are hold-rated. The stock is currently priced at around $147 per share, with a median and mean of $165 and $159, respectively. The sell-side price targets for NVDA project an 8-12% potential upside.

The following chart outlines NVDA’s valuation against the peer group average.

TechStockPros

What to do with the stock?

We continue to like NVDA but expect investors to benefit from better buying opportunities as the market digests the near-term gross margin risk. We’re waiting to upgrade the stock back to a buy on that pullback because we continue to expect NVDA to outperform in the mid-term.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Tired of losing money? Our Tech Contrarians team of Wall Street analysts sifts through the noise in the tech industry and captures outperformers through a coveted research process. We let the work speak for itself here.