Summary:

- Nvidia reported Q3 earnings after the close Wednesday to unimpressed investors.

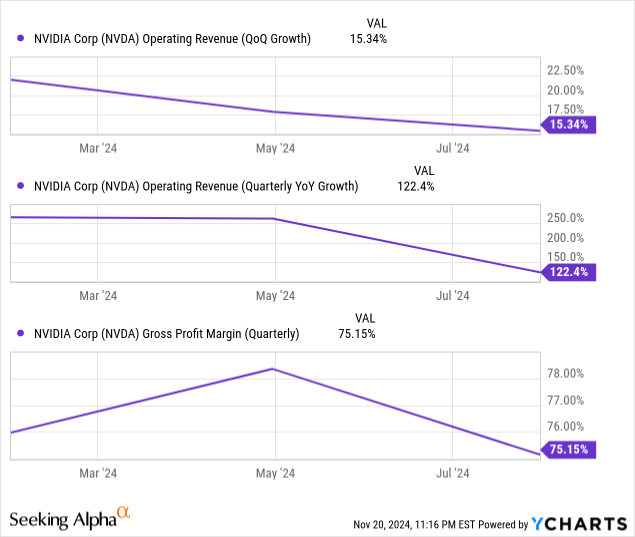

- Revenue growth deceleration and gross margin declines remain concerns.

- NVDA still has a bright long-term future, but the short- and medium-term picture has become murky.

BING-JHEN HONG

Nvidia Q3 Earnings Review

Nvidia (NASDAQ:NVDA) reported earnings after the close Wednesday as the market waited with bated breath to see how the world’s most valuable company and the driver of the AI wave would perform. All in all, the firework show appears to have been cancelled as shares remain muted after hours and investors expecting a big move might wonder how to parse these results. I think Nvidia has continued to make strides amid a feeding frenzy demand environment, but the aura of invincibility might be showing cracks.

Per usual, let’s start with a quick recap of the quarterly results and then get into what I view as the most salient points:

- Revenue came in at $35.1 billion (+94% YoY/17% QoQ) and non-GAAP EPS was $0.81 (+103% YoY/+19% QoQ), continuing a streak of record-highs each quarter for the company.

- Non-GAAP gross margin was 75%, flat YoY and down 70 bps QoQ driven by a revenue mix shift away from H100 to higher-cost offerings.

- Nvidia returned $11.2 billion to shareholders in the form of dividends and share repurchases.

Overall, this is par for the course for Nvidia over the last few quarters: the numbers and margins are absolutely eye-popping as there seems to be no end to the ravenous demand for AI chips. As the market leader, Nvidia is able to command a premium, and command a premium it does! Net income margin for Q3 came in at 57% on more than $35 billion in revenue, which is just a ridiculous amount of cash. And yet, the stock has ticked down in after-hours trading.

This might change by tomorrow, but the fact remains there is a certain standard of expectations to which investors hold Nvidia that might be higher than any other company in the market today. The downside of being a nearly $3.6 trillion growth company is that you need to wow every three months or risk the market’s apathy if you’re lucky and wrath if you aren’t.

That means all eyes are on guidance, and the Q4 2025 outlook was perhaps a bit of a letdown. With Blackwell in volume production and ready to ship, the market was perhaps expecting better projections than $37.5 billion in revenue (+70% YoY/+25% QoQ) and non-GAAP gross margin of 73.5%, which would be a 540 bps decline from a peak in Q1 2025 and a 320 bps YoY decline. CFO Colette Kress mentioned on the earnings call that this was expected as the company prioritizes shipping units to customers over perfecting the manufacturing process and streamlining production and that Nvidia sees margins dipping into the low 70% territory before climbing back up to the mid 70% range when Blackwell is fully ramped.

Regardless, I think it’s apparent that the decline in gross margin is a significant concern for the market. The first three analyst questions on the conference call asked for clarification on just how low margins will go in the first half of 2025 because margin contraction is never what you want to see in a growth company. It could be a sign of competition, market saturation, loss of pricing power, or any number of issues that the world’s most valuable company can’t afford at this valuation. Margins could very well rise back to baseline levels in the second half of 2025, as management predicts, but there will be months of uncertainty as they drop to the low 70s and, further, it appears the days of high 70% range gross margins are a thing of the past.

Another factor that you will no doubt have already heard discussed is decelerating revenue growth:

QoQ growth will get a bump this next quarter with Blackwell’s launch, but the overall trend is towards a slower, more traditional large tech company. By the end of 2025, Blackwell will be significantly outselling Hopper and competition from AMD (AMD) will keep margins low on the previous generation of chips. This will likely lead to gross margin declines and lead revenue to level off significantly. Nvidia is still riding the initial AI wave, which saw its operating results explode, but as the market becomes more saturated, hyperscalers will pare back on the current breakneck pace of demand. Mind you, I still think demand will remain robust for years going forward, but the gold rush atmosphere will fade and Nvidia’s pricing power will eventually come down.

The company is trying to combat this by switching to releasing a new GPU architecture every year rather than every other year in an attempt to keep its lead and maintain pricing power and margins. This will incentivize the top hyperscalers to continue buying the latest and greatest AI chips at a premium, but risks eliminating the long tail for older architectures, which are usually accretive to profitability and would increase R&D and operating expenses to achieve that faster architecture cadence.

So I guess what I’m saying is, if Nvidia was just a hardware company, it might be time to sell. But fortunately for NVDA shareholders, the true moat in AI compute is software, specifically CUDA. With this massive first-mover advantage, Nvidia has not only made billions directly from the sale of its chips, it has created a sticky customer base that will find it difficult to switch to a competitor even if an alternative product offers a better value proposition. While this insulates Nvidia from significant competitive pressure, it doesn’t insulate the company from saturating its market and a valuation that probably doesn’t reflect that eventuality.

Investor Takeaway

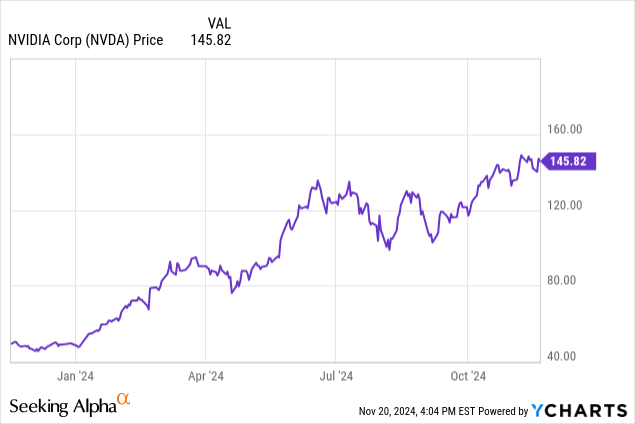

In my previous article on NVDA, I concluded that because of the upcoming launch of Blackwell, outsized margins, a significant technological lead, and a strong moat in CUDA, the stock was a Buy. NVDA has gained 22% since then, compared to 5% for the S&P 500. That article can be read here.

My expectations have been tempered in the months since and in response to this earnings report. Nvidia is a great company and will dominate the AI chip space for years to come, but considering 1) the growth slowdown that will likely manifest rapidly in late 2025 and early 2026 as Blackwell matures and Hopper fades, 2) the current gross margin contraction and potential future margin declines as AMD’s chips compete with Nvidia’s previous generation, 3) and the stock’s extreme valuation, I am downgrading NVDA to a Hold in the short and medium-term timeframes. I think investors with a long-term horizon should still consider the stock a Buy but should perhaps wait for a pullback as an entry point. The AI wave will not last forever and the days of Nvidia’s seeming invincibility are likely behind us.

Thanks for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.