Summary:

- Snowflake’s FQ3 2025 earnings beat expectations, boosting share price by 20%, and showcasing its strong long-term growth strategy and customer-centric approach.

- The company’s innovative Data Cloud platform and consumption-based pricing model drive rapid customer base expansion and high net revenue retention rates.

- Despite high P/E ratios, aggressive R&D and marketing investments are expected to fuel future revenue growth and profitability, with a 44% upside potential.

- Key risks include data security breaches and challenges in international expansion, but management’s consistent execution of growth strategy makes Snowflake a compelling investment.

LWA/Dann Tardif/DigitalVision via Getty Images

Introduction

Snowflake (NYSE:SNOW) share price has spiked by around 20% yesterday after hours as a result of a strong FQ3 2025 earnings release. Confident beat against consensus and guidance boost is not just a one of event but just another point in the company’s long-term growth strategy. Multiple business metrics suggest that Snowflake is exceptionally good in executing its growth strategy. The company’s value proposition and customer-centric approach look like a strong basis to build value for shareholders. The stock has a 44% upside potential even after the post-earnings share price spike. Snowflake is a ‘Strong buy’, in my opinion.

Fundamental analysis

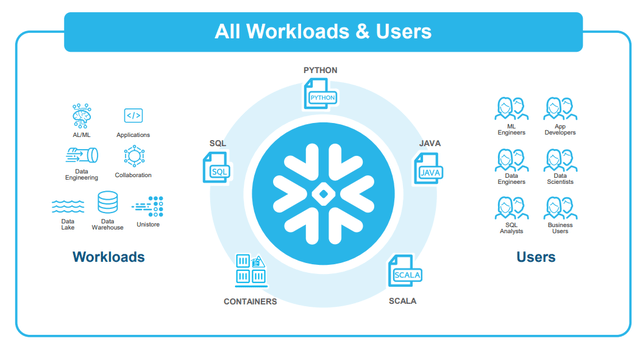

Snowflake’s business is built around its innovative cloud-native platform, the Data Cloud. It is designed to help customers unlock the value of their data as the platform helps to consolidate data into a single source. The range of supported workloads is quite diverse, which includes data warehousing, data lakes, data engineering, and AI/ML.

According to Forbes, “data-driven companies are 23 times more likely to top their competitors in customer acquisition, about 19 times more likely to stay profitable and nearly seven times more likely to retain customers”. Therefore, entities are increasingly seeking opportunities to transform into data-driven businesses.

Snowflake’s value proposition helps customers to solve this complex tax of navigating towards data-driven practices. Among key benefits for customers that the company highlights in its 10-K report are elimination of data silos, scalability, performance, ease of use, and low maintenance costs. The dynamic of Snowflake’s rapid customer base expansion is a robust indication that the company’s offerings are indeed very efficient in helping businesses to transform into data-driven entities.

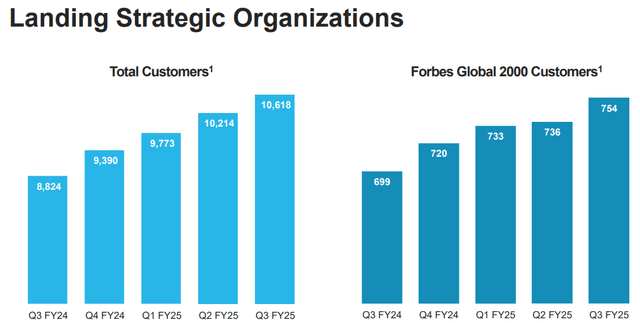

Despite quite large scale, the latest reportable quarter demonstrated a 20% year-over-year increase in the total number of customers. The number of large customers from the Forbes Global 2000 list is also growing, which we can see from the above slide.

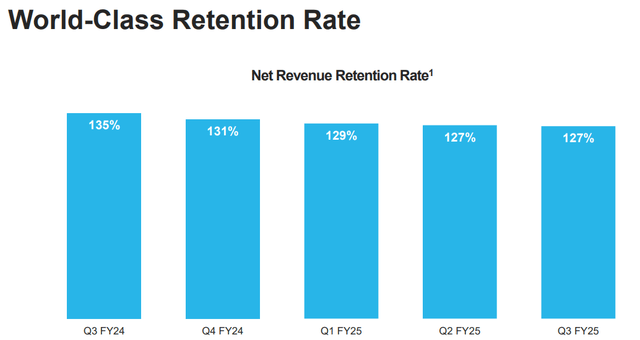

Another way SNOW differentiates itself is its consumption-based pricing. This business model differs from subscription-as-a-service (‘SaaS’) because the company charges customers only for the resources they use. This customer-centric approach helps in building positive long-lasting relationships between SNOW and its customers. The combination of strong value proposition together with customer-centric business model ensures far above 100% net revenue retention rate. This is an indication of an exceptional cross-selling strength.

The ability to rapidly expand the customer base and cross-sell more services to existing customers is vital, as it improves financial performance. Both factors contribute to revenue growth, which benefits the bottom line by allowing fixed overhead costs to be spread over a larger revenue base. Cross-selling is another profitability booster because selling additional services to existing customers means the company spends nothing on customer acquisition in this case.

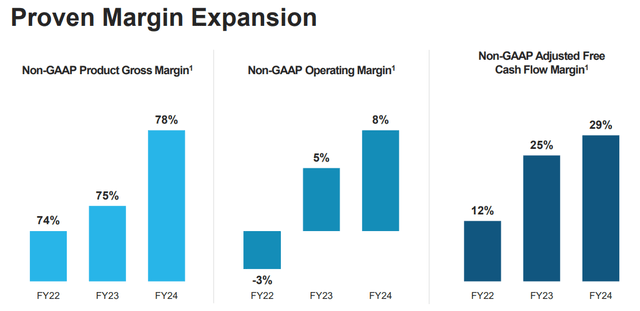

Therefore, SNOW’s profitability benefits from the rapid customer base expansion and exercising cross-selling potential. There is a clear upward trend across crucial profitability metrics, meaning that future revenue growth will help in boosting value for shareholder value. The fresh revenue and margins guidance upgrade from the management is a robust indication of this assertion.

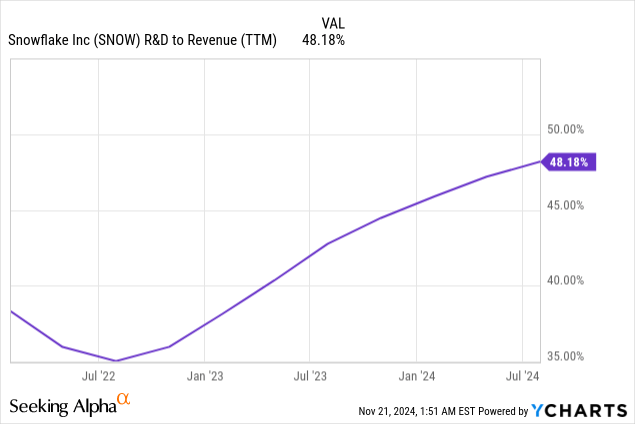

For the full year, the management expects a solid 29% revenue growth, which means that SNOW’s top line grew by around three times since FY2022. The dip in FY2025 profitability ratios compared to FY2024 is explainable. Innovation is the core of SNOW’s growth strategy, and the company has been aggressively expanding its R&D-to-Revenue ratio over the last few quarters. Since this move aligns with the company’s growth strategy, I am okay with the expected dip in profitability because it is likely temporary and aimed at boosting long-term growth.

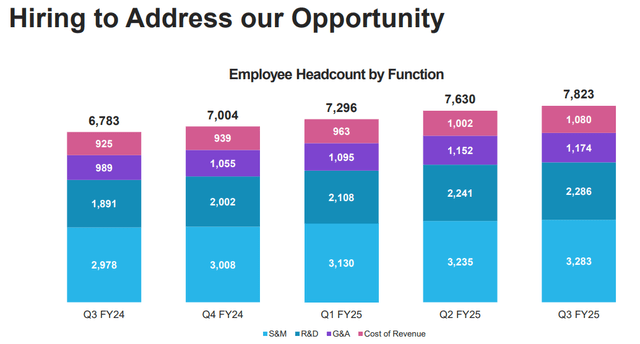

The management’s confidence in its ability to deliver growth and value for shareholders is also seen in the aggressive headcount growth. The headcount grew by around 15% on a year-over-year basis with the R&D department growing by 20%. Since SNOW has a proven track record of converting its aggressive R&D and marketing investments into revenue growth and profitability expansion, I am very positive about the ramp-up in R&D and marketing spending.

The stellar FQ3 2025 performance, with a 30% revenue growth, is not a one-off event but part of the management’s stellar growth strategy execution. Several key metrics suggest that SNOW’s data platform solutions, combined with its customer-centric business model, form an extremely compelling duo. With aggressive innovation spending growth, we can likely expect more growth drivers in the future.

Valuation analysis

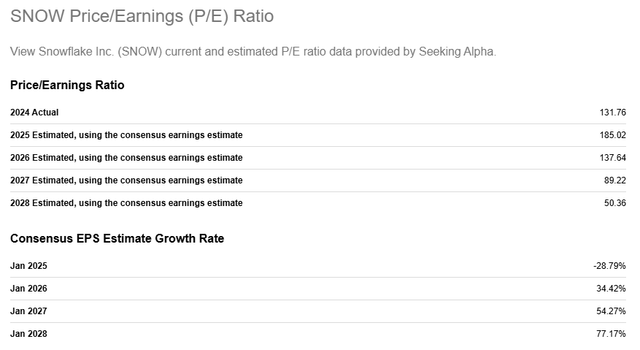

Snowflake’s valuation is sharply growth oriented as its P/E ratio is expected to still be above 100 over the next few years. However, we have to keep in mind Snowflake’s aggressive investments in R&D and marketing to build a basis for future growth. Moreover, the P/E ratio is expected to significantly shrink by 2028.

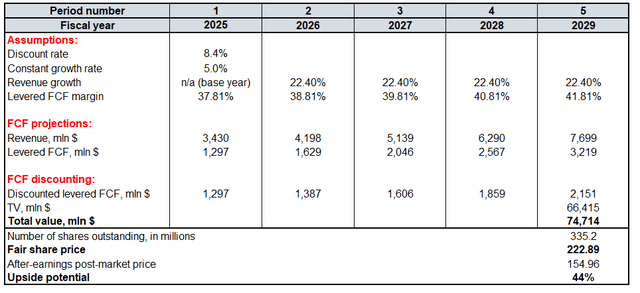

My fundamental analysis reveals that there is a strong revenue growth potential that will highly likely lead to increased profitability. In my discounted cash flow (‘DCF’) model I incorporate a 22.4% revenue CAGR for the next five years because it is the expected growth rate for the data warehousing market. The FY2025 revenue assumption is based on fresh guidance. The FCF margin is 37.81%, and I expect it to expand by at least 100 basis points per year. The WACC of Snowflake is 8.4%. Due to exposure to the thriving industry and a unique mix of value proposition and customer-centric business model, I use a 5% constant growth rate for the terminal value (‘TV’) calculation. According to Seeking Alpha, there are around 335.2 million SNOW shares outstanding.

The fair share price suggested by my DCF model is around $223. This is 44% higher, even after the post-earnings share price spike to around $155. The upside potential is massive, and a $223 target price is within the last 52-week share price range. This means that a 44% upside potential is quite realistic.

Mitigating factors

Snowflake handles vast amounts of sensitive and proprietary data. Ensuring the security and privacy of this data is paramount. Any security breach could lead to significant reputational damage and potential legal implications. Loss of customer trust is another likely adverse outcome of a security breach, which will make it much more challenging to attract new customers and execute further SNOW’s cross-selling strategy.

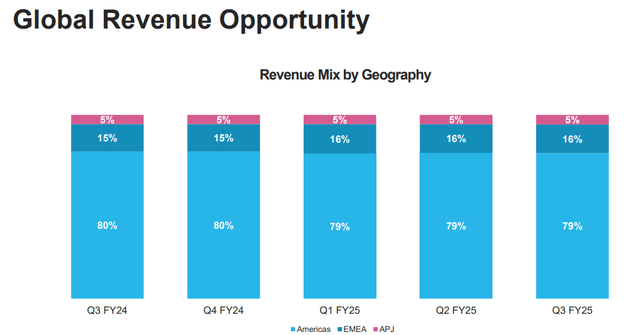

Currently, SNOW primarily generates sales domestically. From a long-term perspective, its potential for domestic revenue growth will gradually diminish due to natural market saturation. Expanding more aggressively internationally will be a logical step to fuel further growth. However, this may not be as straightforward as demonstrating growth domestically due to challenges related to international regulations, cultural differences, and geopolitical risks.

Conclusion

Snowflake is a compelling investment opportunity at this share price because I see clearly that the management is very consistent in executing its growth strategy, which is based on aggressive innovation.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SNOW either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.