Summary:

- SLB’s strategic positioning in oilfield services, strong digital solutions growth, and robust financial health make it a compelling investment opportunity.

- Despite near-term headwinds, SLB’s expanding profitability, disciplined capital allocation, and AI/cloud technology partnerships position it for sustainable growth.

- SLB’s solid balance sheet, shareholder-friendly capital returns, and low valuation enhance its appeal for value and potentially strong total returns.

shotbydave

There are many ways to play the oil patch, from high risk, high reward upstream companies like Devon Energy (DVN) to safer integrated players like Chevron (CVX) and ExxonMobil (XOM) and midstream giants like Enterprise Products Partners (EPD) and Energy Transfer (ET).

Alternatively, one may want to consider the picks and shovels players in the industry like oilfield services giant Schlumberger (NYSE:SLB). I last covered SLB back in September, highlighting its strategic focus, solid balance sheet, expanding profitability and undervaluation.

While the company continues to perform well, the stock has sputtered along, rising by just 0.9% since my last article. That’s not a bad thing for value investors, as the stock continues to give the opportunity to layer in during an otherwise frothy market. At the current price of $43.53, SLB trades well off its peak of $55.69 and in the bottom half of its 52-week range, as shown below.

In this article, I revisit SLB including recent business results, and discuss what makes it a continued strong pick for potentially strong total returns from here, so let’s get started!

Why SLB?

SLB is an oilfield services juggernaut with operations in over 100 countries. It provides operationally-essential solutions to onshore and offshore oil companies with subsurface evaluation, drilling, production, and processing services.

SLB continues to evolve and adapt its solutions in a technology-driven landscape. This includes growth in its digital business fueled by increased adoption of its Delfi platform and newly launched Lumi data and AI platform, supported by partnerships with leading AI and cloud services provider Nvidia (NVDA) and Amazon Web Services (AMZN).

Delfi is a digital platform that consolidates what SLB calls the world’s best apps, AI, data management, and physics-based science for oil and gas exploration, development, drilling, production, and midstream solutions.

Meanwhile, SLB demonstrated solid Q3 2024 results, with revenue growing by 10% YoY to $9.2 billion, adjusted EPS growing by 5% sequentially and 14% over the prior year period. This is driven by strong performance in SLB’s Digital & Integration segment, whose revenue grew by 4% sequentially and margins expanded by 456 basis points to 35.5%.

SLB also benefitted from growth the Production Systems segment due to long-cycle projects especially in the Middle East and Asia, with margins growing by 110 bps to 16.7% for this segment, and it has a robust backlog. Reservoir Performance revenue was flat on a sequential basis as higher intervention activity in international markets was offset by lower evaluation revenue in Latin America and the Middle East.

Management is guiding for EBITDA margins to exceed a healthy 25% for the full year, while revenue growth is expected to be muted in the fourth quarter due to E&P budget exhaustion by some top customers in North America and cautious discretionary spending internationally.

Looking out to 2025, management is guiding for low- to mid-single digit growth in international upstream spending by customers while North America spending is expected to remain flat or decline slightly. At the same time, a key growth driver for SLB remains its digital segment, which is forecasted to reach $3 billion next year (equal to about 8% of SLB’s total revenue) with continued investment in high-margin growth areas such as AI and cloud-based solutions. Management highlighted the long-term value proposition of its digital offerings in the recent earnings call:

We had the opportunity to show the digital value proposition we offer in industry across the different domains from geoscience, subsurface to operations, show that we have an integrated platform, open platform approach with partners. And we are extending our technology from the historical on-prem to cloud, edge, and now AI, including GenAI.

I think this resulted into not only a realization by many customers that we can impact all aspects of the operation, unlock value in productivity, in the geoscience space, in operation for performance, and in reducing costs and carbon going forward. So, the pickup, if any, that I have is that this market, in terms of TAM, will expand going forward, will accelerate the expansion as customers realize that there is maturity into offering.

Importantly, management targets a minimum of $4 billion shareholder returns next year supported by free cash flow generation. While SLB’s dividend isn’t particularly high at 2.5%, it’s well-protected by a 32% payout ratio. SLB raised the dividend by 10% this year and should it return to the 2019 level, the dividend yield would be 4.6%. Plus, I would expect SLB to continue share buybacks this year, and share count has been reduced by 1% over the past 12 months.

SLB maintains a strong balance sheet with an A credit rating from S&P. This is supported by $4.5 billion in cash and short-term investments on the balance sheet and a low net debt to TTM EBITDA ratio of 1.05x, sitting far below the 3.0x safe level.

Lastly, I continue to find SLB to be attractive at the current price of $43.53 with a forward PE ratio of 12.9. This appears to be too low of a valuation considering SLB’s strong balance sheet, industry-positioning, and greenfield opportunities in the digital solutions space. With a 2.5% dividend yield and analyst EPS estimates for 8% to 14% annual EPS growth between now and 2026, SLB could deliver potential strong total returns. As shown below, sell side analysts have an average price target of $57.58, which equates to a 17.0x PE valuation.

Risks to SLB include potential for macroeconomic uncertainty which could pressure demand for oil and in turn, lower demand for SLB’s oilfield services. SLB also has geopolitical risks with it having a presence in Russia. Plus, a faster-than-expected ramp in renewable energy could dampen demand for fossil fuels.

Investor Takeaway

SLB presents a compelling investment opportunity with its strategic positioning in the oilfield services sector, supported by strong growth in its high-margin digital solutions segment and robust financial health.

Despite near-term headwinds such as E&P budget constraints and macroeconomic risks, SLB’s expanding profitability, disciplined capital allocation, and partnerships in AI and cloud technology position it for sustainable growth.

Lastly, its solid balance sheet, shareholder-friendly capital returns, including a well-covered dividend and buybacks, and low valuation further enhance its appeal for value and potentially strong total returns from here.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SLB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not an investment advisor. This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

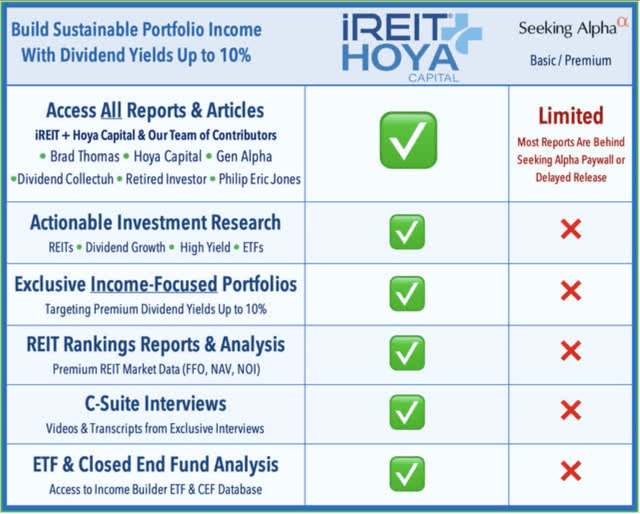

Read The Full Report on iREIT+Hoya

iREIT+HOYA Capital is the premier income-focused investing service on Seeking Alpha. Our focus is on income-producing asset classes that offer the opportunity for sustainable portfolio income, diversification, and inflation hedging. Get started with a Free Two-Week Trial and take a look at our top ideas across our exclusive income-focused portfolios.

With a focus on REITs, ETFs, Preferreds, and ‘Dividend Champions’ across asset classes, members gain complete access to our research and our suite of trackers and portfolios targeting premium dividend yields up to 10%.

With a focus on REITs, ETFs, Preferreds, and ‘Dividend Champions’ across asset classes, members gain complete access to our research and our suite of trackers and portfolios targeting premium dividend yields up to 10%.