Summary:

- Amazon’s Prime Video is poised to become a leading VOD service, significantly boosting Amazon’s digital advertising revenue and offering a platform for new features like AI and targeted ads.

- Despite Amazon’s Q2 earnings disappointment, the company’s diverse strengths in e-commerce, tech, and media, make it a compelling investment opportunity.

- Prime Video’s ad-supported model is expected to generate substantial revenue, with conservative estimates predicting a significant increase in Amazon’s net income over the next few years.

- Amazon’s strategic investment in Prime Video and digital advertising positions it to capture a larger market share, leveraging its extensive reach and first-party data advantages.

Aziz Shamuratov /iStock Editorial via Getty Images

On February 5th, four days after Amazon (NASDAQ:AMZN) released their (impressive) fourth-quarter earnings, I published an article on Seeking Alpha titled Amazon: Gaining Momentum In The Streaming Wars. I have followed the streaming industry for over a decade and constantly analyze both its products and potential investments. While researching my last article, I became convinced that Amazon’s Prime Video is set to transform from a dark horse to one of the market’s premier Video-On-Demand (VOD) services. Although I expressed these beliefs in that February article, there was one major omittance: just how much is Prime Video worth?

It is a tricky question as Amazon’s primary business is not housed within the media industry, unlike most of Prime Video’s competitors (NFLX, DIS, CMSCA, WBD, etc.) … and even if Prime Video is successful in the long run, there is no guarantee that it will have a material impact on Amazon’s results given the company’s size. I still believe that Amazon’s strategic investment in Prime’s services—principally through content for Prime Video—is a prudent move that will deliver significant returns in the long run. Amazon’s expansion of its streaming business is much more than meets the eye, and I am convinced it will do more than just boost the streaming segment’s financial results. I theorize that Amazon’s investment in content will also help the company gain market share in the digital advertising space, while simultaneously providing a platform to test and implement new features, such as artificial intelligence and targeted advertisements.

I believe investors have overlooked the move to add advertising to Prime Video. Surprisingly, despite investors awaiting an update on the success of ads on the service, “Prime Video” was mentioned just twice during Amazon’s October 31st Q3 conference call. This, compared with eight mentions on each of the two prior calls (Q1 and Q2), is confounding. In all fairness, Prime Video is only a subset of Amazon’s advertising business, which generated $14.3B in revenue during Q3 (18.8% y/y growth).

In addition to the broad scope of its advertising products, Amazon also offers valuable insights and capabilities to advertisers. Amazon spoke about its multiple advertising revenue streams including Sponsored Products, advertisements on Prime Video, and “Generative AI-powered creative tools across display, video, and audio,” among others. CEO Andy Jassy commented that they are seeing “meaningful growth” and plan to continue to ensure ads are relevant for consumers to help ensure further growth. “While we’re generating a lot of advertising revenue today, there remains considerable upside.”

Amazon plans on improving the performance of these ads by ensuring their relevancy to consumers and by adding more optimization controls. Jassy also mentioned Prime Video advertising, which is “entering [its] first broadcast” after “a very strong showing at upfronts.” One group of products that I’d like to highlight: Generative AI-powered creative tools. These can be used across advertisement types (display, video, and audio) and are helping sellers’ market (and sell) their products. One such tool is a “video generator that uses a single product image to curate custom AI-generated videos.” Amazon is offering a better experience for both sellers and buyers and as CEO Jassy mentioned, this is just the beginning of their advertising revenue.

In its October 31st report, Amazon beat Q3 estimates, posting revenues of $158.88B (up 11% year/year) and GAAP EPS of $1.43 (vs. an estimate of $1.14). Amazon showed strength in its AWS and international segments and saw huge gains in both its Operating and Free Cash Flows (up 57% and 122.9% over the trailing twelve months, respectively). It was a strong quarter, although Q4 guidance was affected by a projected “… unfavorable impact of approximately 10 basis points from foreign exchange rates”. Management’s guidance for Q4 revenues between $181.5B and $188.5B (growth of 7% to 11% from Q4 2023) was also mostly in line with the consensus estimate of $186.26B, though its forecast for operating income of between $16B and $20B is an improvement of between 21.2% and 51.5% over Q4 2023 ($13.2B). Overall, it was a positive report as Amazon saw significant improvement in its bottom line. The market also reacted positively with shares rising more than 5% the following trading day and appreciating approximately 8.8% through the end of day November 20th.

With several additional quarters of financial information and management commentary, I am now convinced that Prime Video is not only a leader in the streaming industry, but also an extremely valuable asset that Amazon is just beginning to monetize (more on this later). Amazon’s shares have had a volatile year, dropping ~20% from their July highs in early August, post its mixed Q2 results (and influenced by the general malaise towards technology stocks at the time) before appreciating.

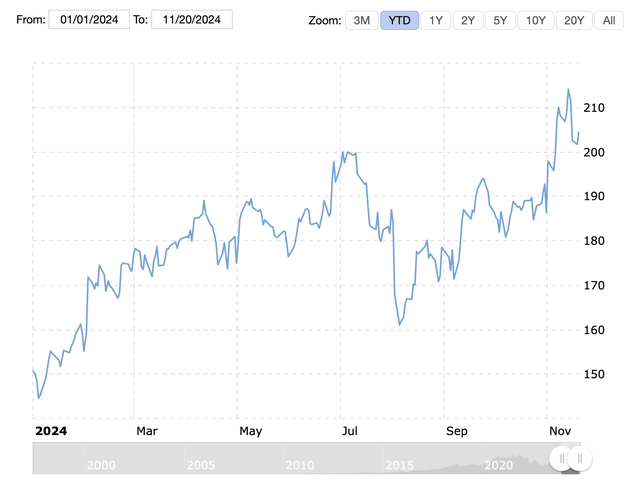

The graph below shows AMZN’s share price YTD through EOD Wednesday, November 20th.While Amazon’s stock has seen tremendous returns, I still believe that this is a compelling opportunity for investors to consider, as Amazon has a lot of exciting offerings that I do not believe are priced into its stock price.

AMZN YTD Performance (Macrotrends)

What’s Changed Since Amazon’s Second Quarter Disappointment?

First a quick review: on August 1st, 2024, Amazon released its second quarter earnings. Although Q2’s GAAP EPS of $1.26 beat by $.23, revenues of $148B came in short by $760M. Despite missing estimates, revenues still increased by 10.2% year/year with much of the growth attributable to AWS, which saw its top-line increase 19% from the prior year to $26.3B. Investors, however, reacted negatively to the mixed report and Amazon’s (light) guidance, with shares dropping more than 4% in after-hours and closing at $167.90 (down almost 9%) the following trading day.

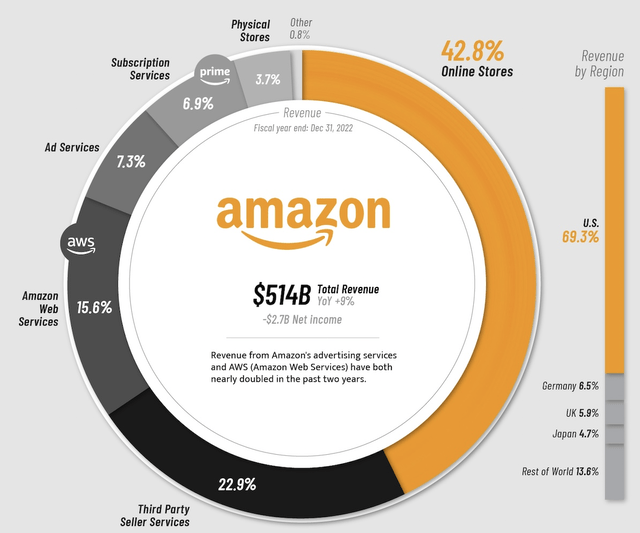

Fast-forward to the present day and Amazon’s stock has recovered from its post-Q2 earnings losses. While Q2 was certainly disappointing, as evidenced by the plunge in AMZN’s stock at the beginning of August, there is still a lot to like about the company. When evaluating an investment in Amazon, one’s attention typically turns to Amazon’s marketplace and AWS – two of their largest segments. One of Amazon’s most attractive attributes, however, is that it has strengths in multiple (often overlapping) industries, such as e-commerce, tech, and media. This is illustrated in the graphic below from Visual Capitalist’s December 2023 article Visualizing How Big Tech Companies Make Their Billions (numbers referenced are from year-end 2022).

How Big Tech Companies Make Their Billions (Visual Capitalist)

One of Amazon’s continuously overlooked segments is its Ad Services, which already represented 7.3% of sales back in 2022 and has only grown since.

Digital Advertising

Digital advertising is an essential component of the business models of Prime Video and other Advertising Video-On-Demand (AVOD) streaming services (however, customers can usually upgrade to an ad-free plan). As defined by Amazon Ads: “Digital advertising, or online advertising, is a form of marketing used by companies to promote the brand, product, or service through online channels.” As one might imagine, the market for digital ads has exploded in recent years. This is in part, as The Wharton School of Business explains because digital advertising offers superior return on investment due to data analytics.

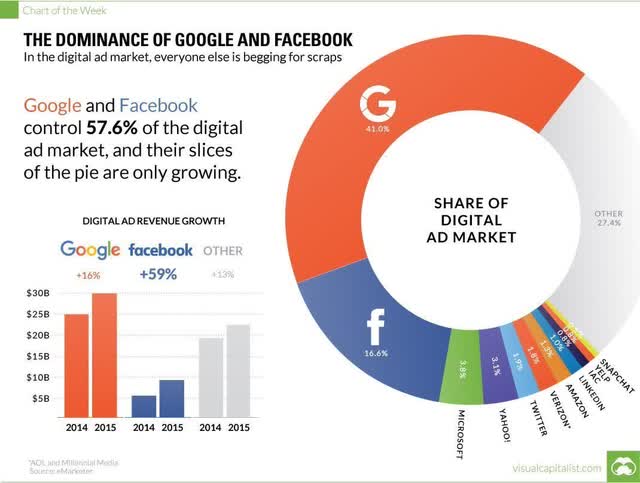

Historically, digital advertising has been dominated by the duopoly of Google and Facebook. A 2016 article by The Visual Capitalist’s Jeff Desjardins stated that “Google and Facebook control 57.6% of the digital ad market, and their slices of the pie are only growing.”

the Dominance of Google and Facebook (Visual Capitalist)

Amazon ranked seventh behind Yahoo! and Verizon, controlling just 1.3% of the digital ad market in 2016. In 2019, just three years after The Visual Capitalist’s article, BrightEdge’s Erik Newton (and others) reported that “Amazon Advertising is Now the Third Largest Advertising Platform.” This is because of the quality of Amazon’s users, not just the quantity. As Forbes explains: “[a]n estimated 70% of Americans with a minimum of $150,000 or more in income and shop online also have an Amazon Prime membership.”

Amazon Advertising’s Emergence

Fast-forward to 2024 and a relatively new player is gaining share. Amazon Advertising was established in 2012 as Amazon Marketing Services and offered much more than just standard ads. The company also released Amazon Media Group and Amazon Advertising Platform that year to differentiate their marketplace (moreover the products within it) and generate additional revenues. According to Conversion Perk: “Collectively, these services were offered by Amazon to those sellers who were selling the same products to beat the competition.” This ignited Amazon’s foray into advertising.

Amazon’s experimentation with new advertising products and services, as well as its willingness to adapt to its customers’ preferences, quickly propelled Amazon Ads to exceed $2B in revenue by 2018 – in just the first quarter ($10B+ for the full year). The pandemic certainly affected the business, slowing its rapid growth. Despite the setback, however, Amazon’s advertising business has managed to grow tremendously in the years since. In 2021 Amazon generated more than $31.1B in worldwide advertising revenue and followed that up with two more extraordinary performances: $37.75B in 2022 (up 21.4% year/year) and $46.9B in 2023 (up 24%+ year/year).

The growth rate of Amazon’s 2024 advertising revenue faced a cyclical dip to begin this year but is already at $38.92B through the first three quarters compared to $32.25B last year (up over 20%). I do not find it surprising that Amazon now generates the third most digital advertising revenue in the world, behind only Google and Meta. This is even more impressive given the fact that Amazon Ads is barely a decade old. While digital advertising has tremendous potential, there is also much uncertainty as the industry is still in its infancy. A 2022 report by PwC explained the near-term prospects of digital advertising, which is a “breakout star” in the $3 trillion entertainment industry. PWC forecasts advertising as a whole to grow 6.6% per year through 2026 (and become a $1T industry) powered by digital advertising, or global internet advertising, which is forecasted to expand at a 9.1% CAGR and reach a $723.6B valuation in 2026.

PWC argues that digital advertising is “getting smarter and… more connected to purchasing. All of that is pushing advertising closer to the point of sale and towards platforms where commerce is conducted.” This is certainly a positive for a company like Amazon. Even more so, an interesting takeaway from PWC’s report is the idea “that the platforms on which people spend their time, money and energy continually morph, grow and evolve.” While not every company or consumer will benefit: “Connected television, shoppable commerce, in-app and in-game ad experiences, advertising on e-commerce websites: all of these sectors are not only becoming larger, they are offering advertisers a fundamentally different value proposition—one in which they can more faithfully track the outcomes and return on investment from spending.”

Regarding services such as Prime Video, PwC observed that “[t]he platforms that capture the attention of the youth are seeing [advertising] revenues explode.” These platforms include TikTok, gaming companies, connected TV, and streaming; the latter of which has “encounter[ed] headwinds to subscriber growth, [so] they are also starting to focus on advertising as a potential growth area.” In just the last couple of years alone, we have seen multiple streaming companies offer ad-supported subscription tiers including Netflix (NFLX), Prime Video (AMZN), Disney+ (DIS), Hulu (DIS), HBO Max (T), Paramount+ (PARA), among others.

If I had to summarize this phenomenon, I would say people are willing to spend some of their time watching ads in exchange for paying less – especially younger consumers. This is also illustrated by the Free Ad-Supported Streaming (FAST) TV phenomenon with the likes of Pluto TV (PARA), Tubi (FOX), Roku Channel (ROKU), and others achieving tremendous success. With this trend in mind, I believe the fact that Prime Video is included with a Prime subscription will only increase the adoption and usage of the ad-supported service.

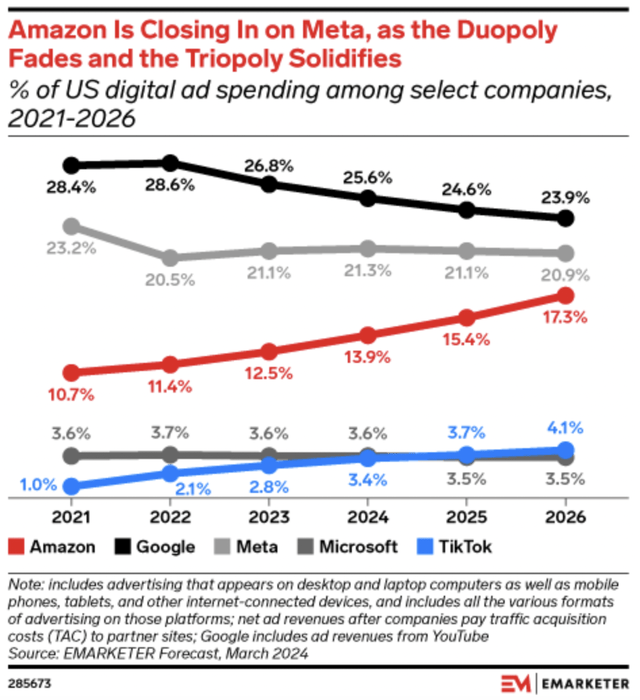

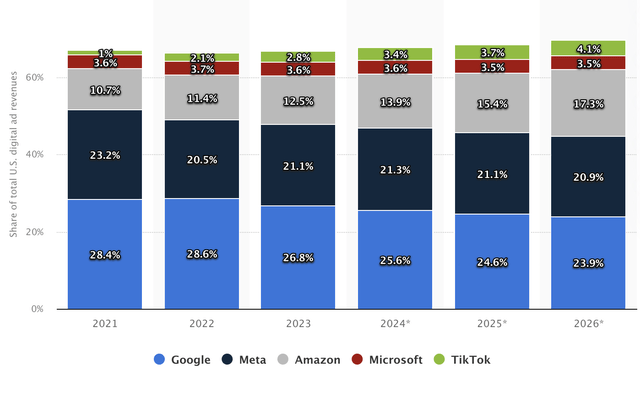

With its business segments placed firmly at the cross-section of technology, e-commerce, and media (streaming), Amazon is uniquely positioned to leverage its varying operating segments to achieve success in the advertising space. We have already witnessed some of this success, with Amazon’s share of US digital advertising spend increasing from 1.3% in 2016 to an estimated 12.5% last year — and this trajectory is only expected to continue, as the company’s share is projected to exceed 17% by 2026 according to eMarketer (graphic below).

Amazon is Closing in on Meta (EMarketer)

Others, including Statista’s Research Department, have noticed a similar trend:

Share of Major Ad-Selling Companies in Digital Advertising Revenue in the United States from 2021 to 2026 (Statista)

Prime Video’s Future

An ad-supported (AVOD) Prime Video is aligned with Amazon’s focus on digital advertising and simultaneously offers tremendous value to Prime members. What Amazon has accomplished with Prime Video so far is impressive, but I believe that Amazon is building more than just a competitive video-on-demand (VOD) service. They are investing in an asset that will help the company test and deploy future products and services while simultaneously benefiting the consumer, the company, and its shareholders in the long run.

It is important to note that the success (or failure) of Prime Video may affect a lot more than just how or where people consume media. While there is intense competition, there is a large bounty for the winner of the Streaming Wars. As video streaming companies vie to differentiate themselves (and their services), Amazon has made, at least in my opinion, a strategic move by adding advertisements to their service. These additional revenues will allow the company to further invest in content and provide an even better service to consumers, while simultaneously rewarding investors.

The Current Landscape

Not only are the players changing, but so is the game itself. Solomon Partners, a financial advisory firm, highlights this shift in their January 2024 article: Streaming Platforms Shifting from SVOD to AVOD. They explain that the increase in both the amount and popularity of streaming services has consumers cutting subscriptions, largely because of the cost of having too many. This phenomenon is often dubbed Streaming Fatigue, which according to Digital Route is defined as “a phenomenon that occurs when consumers feel overwhelmed and frustrated by the increasing number of subscription services and products available to them.”

Concurrent with consumers experiencing Streaming Fatigue, streaming services, which are primarily “part of publicly owned behemoths that had devoted hundreds of millions of dollars to build up their subscriber bases… saw profit margins sink or were swimming in the red.” The strikes in 2023 (by groups including the Writers Guild of America, the Alliance of Motion Picture and Television Producers, and the Screen Actors Guild-American Federation of Television and Radio Artists (SAG-AFTRA)) resulted in higher content costs for streaming services. These costs were passed onto consumers, with “seven of the top nine streaming services rais[ing] prices by as much as 20% for basic and ad-free plans…” These services included: Netflix, Apple TV+, Disney+, Hulu, ESPN+, Paramount+, and Peacock.

Blue Sea Research published a March 2022 SA article titled: Amazon Is The Clear Winner In Streaming Race. Blue Sea Research predicted that Amazon would be a winner in the streaming industry. Although the subscription figures don’t back this claim yet, Amazon’s Prime membership offers great value (Amazon does sell access to Prime Video for $8.99 per month, a discount from the $14.99 monthly price for Prime). The economics are working for Amazon, as it reported $30B in revenue from its subscription segment in 2021 though it spent just $13B on content.

Variety’s Tyler Aquilina published an article in December 2023 titled: Netflix Won The Year and The Streaming Wars. What Comes Next?While he claims Netflix won the streaming wars, it might have been a bit premature. Others like Indiewire’s Tony Maglo highlight the controversy surrounding whether the war is over…

Streaming Economics

The success of today’s major streamers is even more impressive given the number of companies that have tried and failed. It is hard to gauge a service’s success and value, as it is often part of a larger (media-focused) business. The US VOD streaming market is dominated by: Netflix, YouTube, Disney+, Max, and Amazon Prime Video. Since the subscriber numbers are often not officially released by the companies, there are varying estimates in the analyst community, making it challenging to make accurate predictions. While only estimates, there is consensus as to who garners the most interest from consumers and has the most subscribers:

|

Service |

N. American Subscribers |

Viewing Hour Market Share |

Revenue |

Subscriber Market Share |

|

Netflix |

77.3M |

20% |

$31.6B |

21% |

|

Prime Video |

80M |

21% |

$5B |

19% |

|

Max |

50M |

15% |

$6B |

15% |

|

Disney+ |

46.3M |

13% |

$5.5B |

15% |

|

Hulu |

48M |

11% |

$10.7B |

10% |

|

Apple TV+ |

39M |

6% |

$2.2B |

7% |

|

Paramount+ |

48M |

7% |

$1.2B |

4% |

|

Peacock |

31M |

2% |

$.83B |

2% |

|

Starz |

26M |

1% |

$1.4B |

3% |

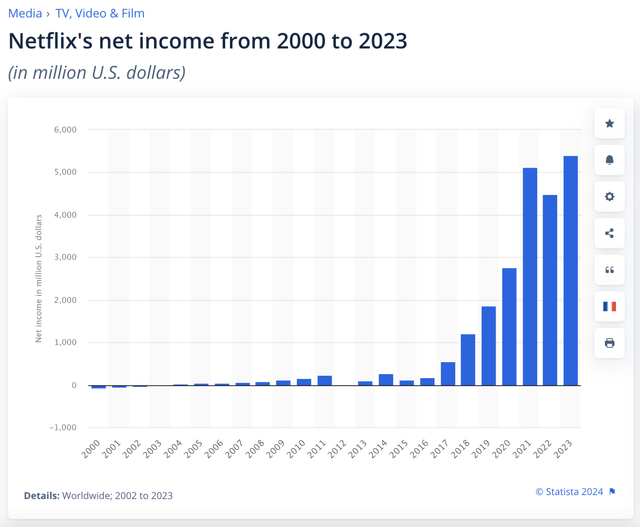

The above table, made with data from a 2024 report by LatentView Analytics, illustrates how Netflix’s dominance is weakening. Media Play News’ Erik Gruenwedel highlights that despite Netflix’s value and 2% churn rate (2023) its dominance in the US is weakening. LatentView reports that Netflix ended 2023 with 77.3M subscribers in North America (approximately 21% of the domestic SVOD market). The report found Amazon’s Prime Video to have a slightly smaller market share (19%) but “found Prime Video (21%) edged Netflix (20%) in viewing hours market share.” While Prime Video certainly reported some impressive engagement metrics, “…Netflix continues to dwarf the competition in annual revenue ($31.6 billion) and profitability ($5.4 billion).” Prime Video recorded only $5B in revenue for the year–less than Netflix’s (worldwide) net income for the same period–but things are about to change.

Net Income of Netflix from 2000 to 2023 (Statista)

The economics of streaming have not always worked… Netflix struggled to increase its profits (see above graph) until 2017, when it tripled year over year to $558.93M (from $186.68M in 2016). This triggered spectacular growth, with profits exceeding $5B within five years, but has leveled off recently. Recently, however, the major streaming players have found a balance between content expenses and subscription revenues as illustrated by Owl & Co. below (forecasts for 2024):

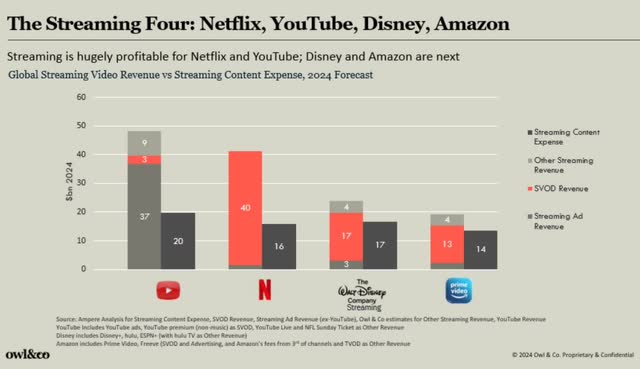

The Streaming Four: Netflix, YouTube, Disney, Amazon (owl&co)

While Netflix dominates in SVOD revenue (orange in the above graphic), YouTube generates more total revenue due to advertising. Owl & Co.’s graphic demonstrates that streaming is profitable for Netflix and YouTube, affording Disney and Amazon room for growth.

Prime Video Ad Boost

Adding advertisements will only positively affect the economics of Prime Video. For years, Amazon has spent billions on content, receiving little revenue beyond the cost of a Prime membership. Amazon has undercut the competition as consumers can watch Prime Video with ads for free with a Prime membership, and upgrade to an ad-free experience for just $2.99. And a Prime Video membership on its own is just $8.99/month. Either way, you’re still paying – with your time or wallet.

In January 2024, Todd Spangler published an article on Variety titled Amazon Prime Video’s Move to Steamroll into Ads Could Generate More Than $3 Billion This Year; ‘A Disruptive Force’. Spangler compiled varying analyst estimates, which included:

-

Morgan Stanley: Forecasts Prime Video ads to generate $3.3B in worldwide revenue in 2024, $5.2B in 2025, and $7.1B in 2026. This is high-margin revenue, predicting the move adds nearly $2.3B in EBITDA this year, and implying a projected EBITDA margin of approximately 69.7% – in its first year.

-

MoffettNathanson: While more conservative than Morgan Stanley’s predictions, the firm “still believes Amazon’s move will be seismic.” It predicts that Prime Video ads will generate $1.3B in 2024 and $2.3B in 2025. Furthermore, it forecasts an additional $500M per year from Prime members opting out of ads.

Over the past 12 months, there has been much (warranted) hype surrounding Prime Video’s potential. For instance, Alexys Coronel, head of U.S. entertainment and telecommunications for Amazon Ads, shared at CES 2024 that ads in Prime Video would reach 115 million unique viewers just in the U.S. Amazon CEO Andy Jassy echoed the excitement surrounding ads telling analysts on the third quarter conference call: “We have barely scraped the surface when it comes to better figuring out how to integrate advertising into video, commerce and groceries.” This is startling considering Amazon’s performance in the digital ads market, and begs the question: how much room is there to run?

Even using the lower of the estimates, MoffettNathanson’s prediction of $1.8B in revenues for 2024, the financial impact is still significant. While there will certainly be some associated costs, Amazon owns much of its content (instead of licensing it) through its own studios and acquisitions, like MGM in 2022. Amazon has also tripled its production of original content over the past six years and has grown its studio network, with “in-house studios contributing only 40% of originals.” After posting a surprise net loss in 2022, the company generated $30.425B in net income for FY2023 (and is on track to surpass that in 2024). Conservatively, Prime Video should add approximately 6% to this year’s total — with room for growth. MoffettNathanson’s 2026 estimates have Prime Video ads increasing this year’s net income upwards of 23%.

Prime Video has entered the market with a very low CPM. Estimates from January projected that Prime Video would launch with a CPM in the low- to mid-$30s. This is extremely competitive as it is “far lower than the $50 or even $60 CPMs that rivals like Netflix and Disney+ burst onto the scene in late 2022…” In addition to charging advertisers less, Prime Video is keeping its ad load low. This is a classic Amazon strategy to keep prices (or ad load) low to grow their customer base, before ultimately increasing the price. There are several early indications of Prime Video’s success, but one in particular stands out: EMarketer reported in June that “Amazon Prime Video’s entry into the streaming ad market has forced Netflix to cut its CPMs to approximately $29 to $35, down from $39 to $45 last summer…” Amazon’s strategy has put pressure on other streamers to lower their CPMs.

In closing, the potential for Prime Video is massive, especially considering they could easily increase their ad load or CPM at any point. Another advantage is their price. A Prime membership offers much more for (approximately) the same price as other streaming services. According to a 2024 study by Forbes Home and OnePoll, Americans not only pay an average of $46/month for multiple subscriptions but have also canceled at least one this past year, citing the high cost. This affirms the value Prime and Prime Video offer to consumers. Prime Video (14%) was rated the second favorite service behind Netflix (36%) according to Forbes’ study. I expect this number will only improve as Amazon invests more in its Prime Video service, and suggests that the market is currently overlooking the potential of Prime Video. This could help increase Amazon’s bottom line by 25% within the next few years alone. This does not, however, take into account the potential of integrating AI and other initiatives into the service, making it exciting to see what Amazon does with the service.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.