Summary:

- Alphabet Inc. aka Google remains a top tech pick despite potential DoJ sanctions, with strong ad revenue and AI tools monetization supporting our buy pick.

- We think the DoJ case won’t go away easily, but don’t expect it to end with the sale of Chrome.

- The stock is down 5% Thursday, with RSI down to 41 from 71 ten days ago.

- We believe the stock will be a 2025 outperformer and recommend investors take advantage of the current panic.

tomch/iStock Unreleased via Getty Images

Alphabet Inc. (NASDAQ:GOOGL) (NASDAQ:GOOG) remains one of our favorite tech coverage picks for the mid-to long-term guys. We’re updating our thoughts on the stock after Bloomberg reported that the U.S. Department of Justice (DoJ) may force the company to sell its Chrome search engine as part of sanctions to end its monopoly over search engines and ads; Chrome holds a 61% share of the search engine in the U.S.

We’re not too worried about this case ending with Google selling Chrome. Specifically, we don’t think the DoJ will go as far as to force the company to sell off its most profitable limb, and there is little historical evidence to support the DoJ doing this, to begin with. Not to mention that the antitrust lawsuits that’ve gained more ground under the Biden administration aren’t likely to be as fortunate under Trump. Furthermore, the final decision on enforcement has not yet been made and won’t be made until next August by the judge in the case, Amit Mehta.

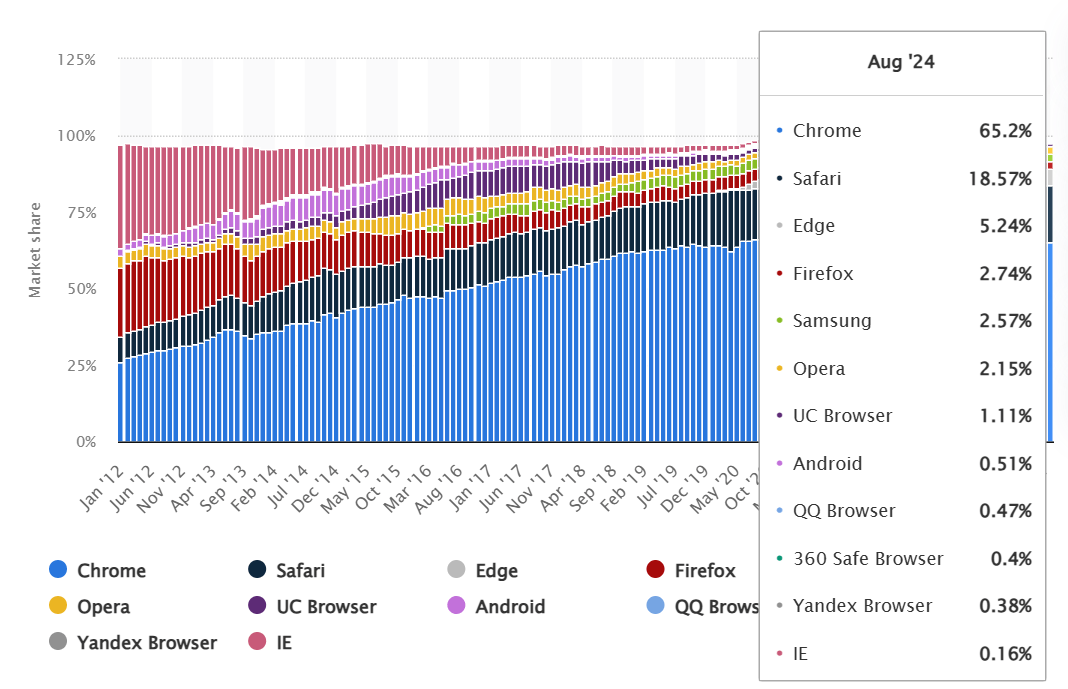

The following chart outlines the global market share held by leading internet browsers from January 2012 to August 2024, placing Chrome on top with a ~65% share of the market globally.

Statista

Our bullish sentiment is largely based on our belief that Google will continue to be an industry go-to for ad dollars spent, even more so now with its generative AI search tools. This quarter’s results and management commentary about its search monetization make a good case for the company turning heavy AI spend to profit faster than perhaps the market had anticipated.

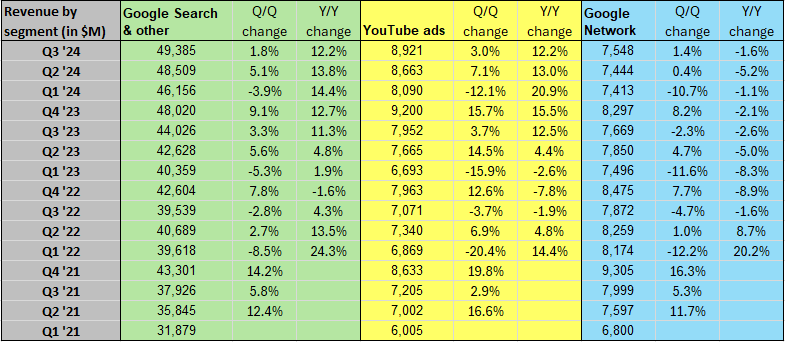

Google search and ad revenue for the quarter grew 1.8% Q/Q and 12.2% Y/Y to $49,385M. We think Google’s dominant share of the search engine, coupled with its generative AI Gemini-driven tools and economies of scale, make it among the best-positioned tech names to leverage AI into profit. Just this October, Sundar Pichai, Google CEO, noted early on the Q3 call that:

In 18 months, we reduced cost by more than 90% for these queries through hardware, engineering, and technical breakthroughs while doubling the size of our custom Gemini model.

Together, Meta Platforms (META) and Alphabet make up ~57% of the total digital advertising revenue worldwide; we recommend investors tap into one of the two to gain exposure to the ballooning digital ad market. Google specifically has the advantage of being uniquely positioned in the search engine, and as Philipp Schindler said on the call, “AI really supercharges search.” The following chart outlines the company’s revenue by segment as of Q3.

Seeking Alpha

YouTube ads are also not immune to this tailwind of gen AI, with YouTube ads delivering its second consecutive quarter of sequential and Y/Y growth by 3% and 12.2%, respectively. YouTube is a part of Alphabet that shouldn’t be overlooked, and there’s a simple reason why: ads. YouTube ads allow the company to capture the streaming media traction and ad spend that comes with it.

With that out of the way, Google has a lot more working in its favor, particularly when it comes to cloud computing and AI. While Google’s search engine and ad business are taking center stage, its Google Cloud remains the fastest growing business line. Google Cloud reported better-than-expected revenue for Q3 at $11.35B versus expectations for $10.88B, up 9.7% Q/Q and 35% Y/Y, with operating margins of 17% and operating income of $1.9B.

Valuation & Word on Wall Street

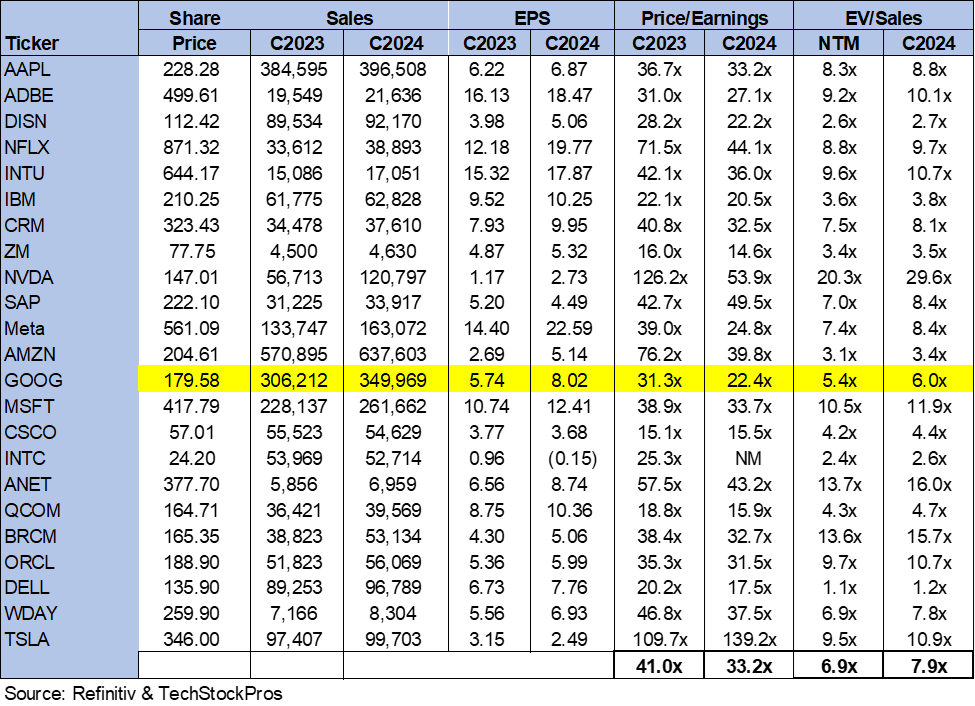

The stock is relatively cheap compared to the large-cap peer group. On a P/E basis, the stock trades at 22.4x C2024 compared to a group average of 33.2x and a previous average of 18.6x last October. The stock also trades below the peer group average on an EV/Sales basis, trading at 6.0x C2024 versus a group average of 7.9x.

The following chart outlines Alphabet’s valuation against the peer group.

TechStockPros

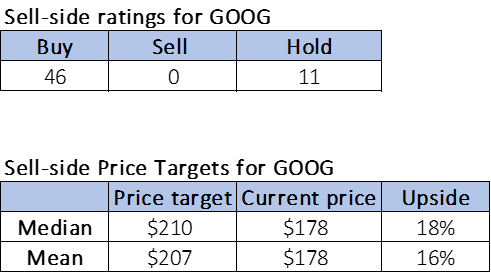

Wall Street is extremely bullish on the stock. Of the 57 analysts covering GOOGL, 46 are buy-rated, and the remaining are hold-rated. The stock trades at $178 per share at current levels, with a median and mean of $210 and $207, respectively. The potential upside from the sell side price targets is 16-18%. Also worth mentioning is that Google’s short interest declined by 6.2% over the past month, signaling less bears on the name. We see a wider upside surprise ahead in FY25, but we think Wall Street’s current expectations for the stock will enable it to outperform more meaningfully. The following charts outline sell-side ratings and price-targets.

TechStockPros

What to do with the stock?

Alphabet stock is trading lower Thursday, down 5% so far. We think this pullback provides a buying opportunity on investor panic because, in our opinion, the stock is still a likely 2025 outperformer. The company continues to channel its heavy capex spend, which came in at $13B for Q3, and is expected to see a similar spend next quarter. We see the capex spend paying off next year with AI monetization picking up across Alphabet’s three reportable segments: Google Services, Google Cloud, and Other Bets.

Furthermore, while the company’s facing troubles at home, it’s catching a break elsewhere with the UK competition regulator, Competition and Markets Authority, clearing Alphabet’s investment in Anthropic. We think Alphabet will be better positioned to outperform next year and see attractive entry points at current levels, with RSI down to 41 from 71 in overbought territory ten days ago.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Tired of losing money? Our Tech Contrarians team of Wall Street analysts sifts through the noise in the tech industry and captures outperformers through a coveted research process. We let the work speak for itself here.