Summary:

- Meta’s advertising business remains crucial, with improved ad-targeting capabilities due to AI capabilities.

- The open-source AI strategy with the Llama model aims for rapid developer adoption, enhancing Meta’s platform value and competitive edge.

- Despite Reality Labs’ revenue growth, significant losses persist, but Meta’s valuation suggests a $987 per share target, a 78% premium over the current price.

Kenneth Cheung

Overview

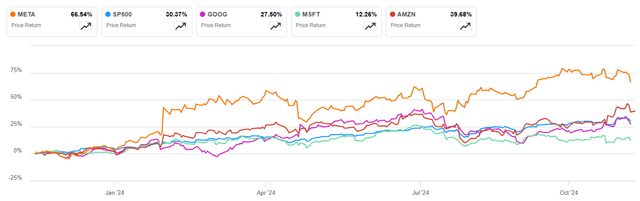

I have been analyzing two of the best AI contenders, Microsoft (MSFT) and Google (GOOG). Now, it is time to dig deeper into Meta Platforms (NASDAQ:META). Meta is leading the 1-year return among the general market and its closest peers. Is it overvalued and should we sell?

Meta is one of the most profitable companies, and it has a solid digital advertisement business through its social network platforms. I consider Meta an investment opportunity because is adding AI capability to enhance its platform’s value. The company is monetizing AI capabilities and developing the metaverse space by selling VR glasses to diversify its revenue sources. At the same time, I highlight that Meta is very disciplined in controlling costs to improve margins. My price target is $987 per share, a 78% premium over its current stock price. So, my recommendation is to buy the stock.

Cash cow protected

Meta’s main business is advertising, which accounts for almost 96% of its total revenue. It is less diversified than Google (GOOG), which has an advertising business that accounts for 78% of its total revenue. It is a priority for Meta to maintain this business. I expect growth rates to increase just slightly in the coming years.

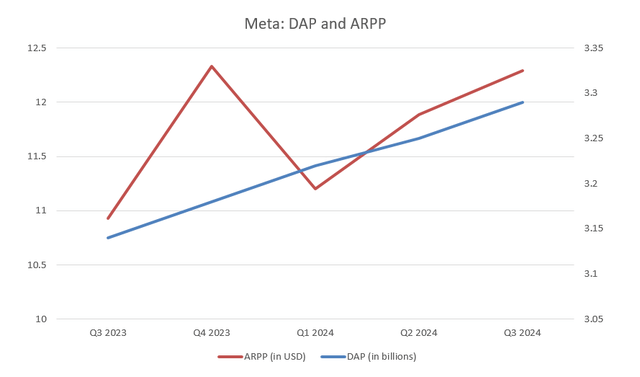

Meta’s key metrics indicate moderate growth, with Daily Active People (DAP) reaching 3.29 billion in September 2024, up 5% from the previous year. Since Meta now has a big penetration in a global population of approximately 8.2 billion, growth rate should slow. In this context, projects like Elon Musk’s Starlink make sense to expand the total addressable market.

Meta seems to have improved ad-targeting capabilities, driven by advancements in its AI technology. Average Revenue Per Person (ARPP) rose by 12% year-over-year, reaching $12.29 in Q3 2024. Management assigns this improvement to AI tools, boosting ad conversion rates by 7%. Looking ahead, I expect ARPP (Average Revenue Per Person) growth to stabilize, likely matching inflation rates with an extra 2-3% on top.

Meta’s increase in DAP (daily active people) and ARPP (average revenue per person) highlights its ability to grow its platform’s value consistently. Ad impressions aren’t growing as fast anymore, which suggests the market is maturing. The good news is that the average price per ad has risen. This is largely because of better ad targeting and then more interest from advertisers, especially in international markets

WhatsApp Business Platform revenue, increased significantly by 48% for Q3 2024. This is a diversified business with respect to core digital advertising. Still, $434 million is too small to move the needle.

However, the company faces tough competition from TikTok, YouTube Shorts, and Snap, where total advertisers increase year over year. New players like Reddit compete aggressively for advertisers. In the last quarter earnings call, management said thousands of new advertisers were incorporated into the platform.

Another headwind comes from two big clients. Chinese e-commerce giants Shein and Temu, previously among the largest advertisers for Meta and Google, have reduced their U.S. advertising spend in the July-September period compared to the same period last year.

A different AI strategy

Meta is taking a bold approach, different from Google, OpenAI/Microsoft, and Amazon. Its strategy is to make its large-language model, Llama, open source. The target is to attract developers. By offering the model for free, AI startups and companies can cut costs. Open sourcing doesn’t just save money. It creates collaboration, speeds up innovation, and strengthens network effects. Over time, this approach could boost Meta’s platform value.

Meta also benefits from having the biggest private dataset across its family of apps ((Facebook, Instagram, WhatsApp, and Messenger)) along with public web data, giving it a significant edge over competitors and competing for face-to-face with Google with data from YouTube. Monetization remains a challenge, but Meta aims to offer paid services alongside the free model Llama. Meta AI, a service that is a direct competitor to ChatGPT, is expanding globally, with deals involving celebrities like Awkwafina and John Cena to lend their voices to new AI assistants.

Uncertain new ventures

Reality Labs grew its revenue 29% over the last year. Meta tries to develop a new market dedicated to Augmented Reality and Virtual Reality services. It is a world to develop from scratch and with high uncertainties. Nowadays this segment makes a small portion of total revenue.

On the other hand, Reality Labs reports losses of $4.4 billion in Q3 2024 compared to a loss of $3.7 billion in Q3 2023, 18% worse. I believe the metaverse vision is too ambitious, but Ray-Ban Meta smart glasses and their capabilities could be a shorter-term project. If they can be the leader in this new market, matched with GenAI capabilities, it will be a future revenue stream.

Prudent and efficient capital management

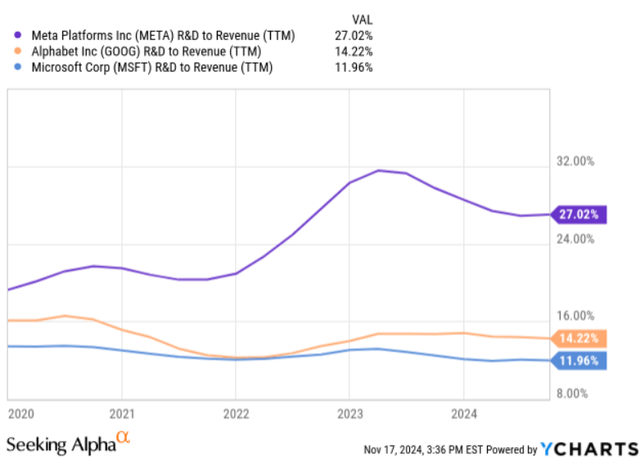

This increase in revenue was accompanied by a stable gross profit ratio of 81-82%. Meta is maintaining its efficiency in managing direct costs relative to its sales growth. Operating expenses, including R&D, general and administrative (G&A), and selling and marketing expenses, remained relatively stable as a percentage of revenue, slightly down 39% from 42% in the same period last year. The company is managing its costs well because they have been reduced. General and administrative expenses have been down 5% of revenue from 6% in the same period last year. These reductions have allowed Meta to increase research and development costs from 27% of revenue to 28%.

On a 12-month trailing basis, it has been around 27%, the highest among other AI contenders. This adds to the argument about its open-source model, where they are investing high without damaging margins.

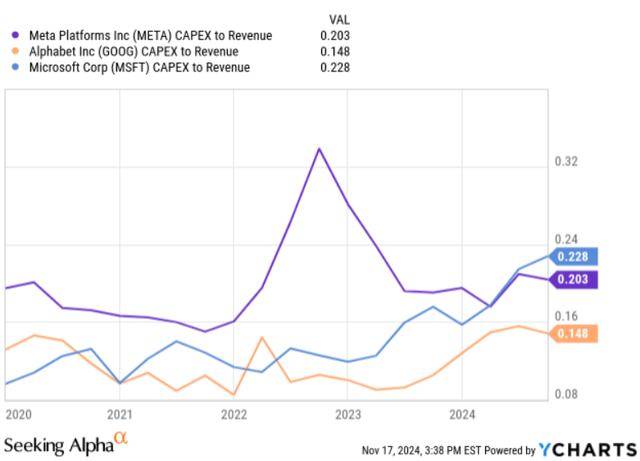

Meta is currently leading in capital expenditures (CAPEX) among major companies like Google and Microsoft in terms of investment in data center technology. However, Meta has recently reduced its investments due to market pressures. On the other hand, Microsoft is ramping up its spending. I will be monitoring this shift closely.

Valuation

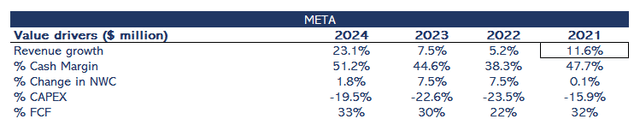

Figure 5 shows the company’s value drivers, considering a year as the last four quarters to capture the latest information. Regarding margins, I utilize a measure I call Cash Margin, which involves adjusting net income for non-cash items such as amortization and depreciation, stock-based compensation, and deferred income tax.

Over the past three years, Meta has experienced an annual growth rate of 11.6%. I expect the company to be able to monetize AI capabilities, and Reality Labs will continue to grow at a good pace. In my model, growth rates in both businesses will be high over the 10 years, ending up in the mid-twenty or thirty percent range. However, as the current revenue base is so high, I expect a moderate improvement from 12% to 14% in total revenue.

I expect that AI models used internally will increase developers’ productivity, as they will with any software company. However, the AI battle will add pressure on research and development costs. Besides, Reality Labs will improve its margin, but as its revenue weighs more over the total revenue, total margins will suffer because hardware margins are lower. I estimate the cash margin will deteriorate from the current 51% to 46% in ten years.

CAPEX investments will remain at their current high levels of 20% until 2029 and then be reduced to 8%. Technology and scale will reduce pressure on investment. Data center technology and GPU prices will decrease over the years.

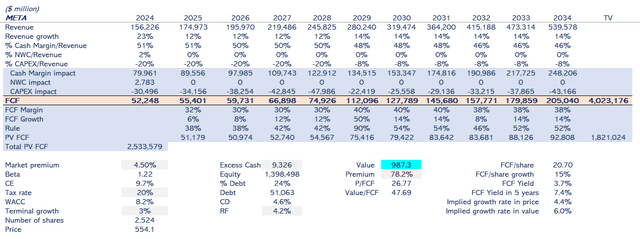

Cash flows will be discounted at an 8.2% WACC because the beta is 1.22. The risk-free rate is 4.2%. The company’s leverage is 24% of total capital. Perpetual growth rate is set at 3%.

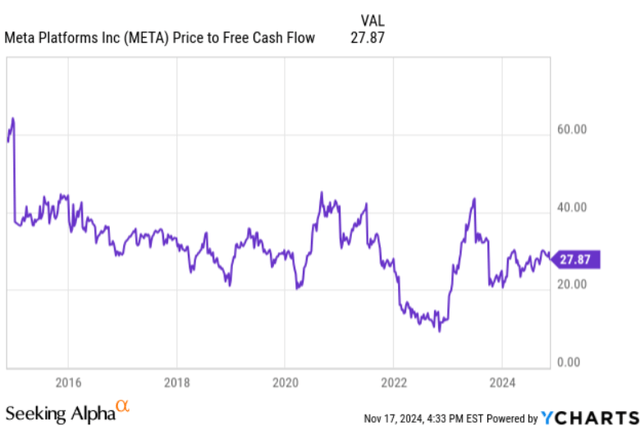

As shown in Figure 6, my value estimate is $987 per share, a 78% premium over its current stock price. My implied multiple Price to Free Cash Flow is 48, meaning I will keep growing the multiple to a level seen in 2015 (Figure 7). My valuation supports the core idea that Meta will be one of the leaders in the AI market with its open-source model.

Risks

As we have seen Meta depends on its AI efforts to defend and to grow its core advertising business. Besides we expect that AI will provide new revenue streams as in the case of Meta AI. If Meta doesn’t get traction on its open source strategy losing the battle over its competitors revenue will suffer.

I think the chance of failing is not high, I assigned a 30-40% probability. If that happens I estimate Meta will lose 15-20% of revenue over the baseline in my model.

Another risk is of not being successful on its Reality Labs strategy. In this case it will be a business that will consume cash and the numbers of years trying to develop it will be years of value destruction. In this case the probability I assigned is higher at 50-60%. The impact will be smaller reducing about 5% over my baseline on total revenue due to its current scale.

Conclusion

Core digital advertising business is 96% of Meta’s revenue. The main priority is to defend and grow this business. Secondly, it must find new revenue streams. AI is a key piece to get both targets and its approach is bold: give away as open source its costly Llama AI model. I think is a good way to extend its platform quickly developing networks effects.

I consider Meta will be successful and my model value the stock at $987 per share, a 78% premium over its current stock price. I recommend buying the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in META over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.