Summary:

- Microsoft’s EPS beat by a whisker, while Revenue missed by a hair.

- Stock is up nearly 5%, buoyed by Cloud results and AI plans.

- Q2 FCF shows a massive decline. But is that a reason for concern?

- Stock maybe fully valued but remains one to pounce on during weakness.

Jean-Luc Ichard

Microsoft Corporation (NASDAQ:MSFT) has just declared its Q2 earnings as covered by Seeking Alpha here. While EPS and revenue more or less came in line with expectations, the strength in Cloud business and the continuing hype about the company’s AI plans have triggered a 5% rally after hours. Please bear in mind, though, post-earning prices are very volatile and things may have turned south by the time you are reading this article. But fear not, this article is not about a quick trade.

I have a history of analyzing dividend coverage based on free cash flow after earnings as can be seen here and here.

Why cash flow over EPS

When evaluating dividend coverage, most investors and analysts tend to look at earnings per share (“EPS”). We prefer free cash flow (“FCF”) as a better indicator of financial health for these reasons:

- Earnings tend to be up and down depending on rare events and write-offs.

- Earnings are more prone to GAAP-related fluctuations.

- Cash flow is king.

Let us see how Microsoft’s dividend coverage looks after this recent quarterly result.

- Total shares outstanding: 7.454 Billion

- Current quarterly dividend per share: $0.68

- Quarterly FCF required to cover dividends: $5.068 Billion

- Microsoft’s FCF in Q2: $4.9 Billion

- Microsoft’s Payout ratio using Q2 FCF: 103% ($5.068 billion divided by $4.9 billion). OUCH!

- Microsoft’s Q2 EPS reported: $2.32

- Payout ratio using Q2 EPS: 29% ($0.68 divided by $2.32)

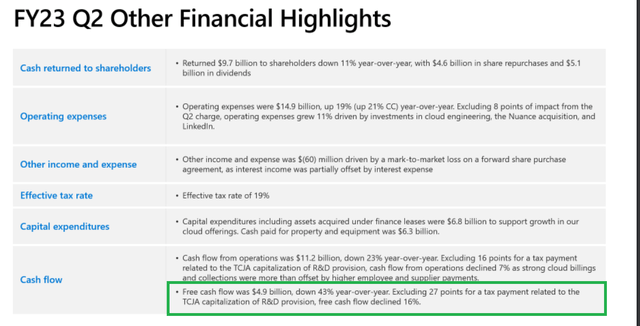

What’s with that massive decline in FCF? As shown below, that’s a 43% decline YoY compared to the $8.615 Billion recorded in Q2 2022. Is the dividend in danger? Maybe. Maybe not. Only way to find out is to read the fine prints as well to see how the annual FCF (trailing twelve months) looks. As reported by Microsoft below, FCF took a massive hit this quarter due to a tax payment related to R&D. For who aren’t familiar, this is a result of the relatively new act that went into effect in 2022 that requires companies to capitalize and amortize R&D expenses over 5 years (if domestic) or 15 years (if foreign). Prior to this, companies had the option of either deducting or to capitalize and amortize R&D expenses. Ignoring this impact, the apples-to-apples comparison results in a FCF decline of 16%, a far cry from the 43% that showed up on first glance. In other words, the adjusted Q2 FCF was $7.254 Billion, which gives Microsoft a Q2 FCF payout ratio of about 70%.

With that exception out of the way, let us run the same numbers above based on full year.

- Total shares outstanding: 7.454 Billion

- Current annual dividend per share: $2.72

- Annual FCF required to cover dividends: $20.274 Billion

- Microsoft’s trailing twelve months FCF: $59.63 Billion

- Microsoft’s Payout ratio using TTM FCF: 34% ($20.274 Billion divided by $59.63 billion). Yes, that’s more like it.

- Microsoft’s TTM EPS: $9.12

- Payout ratio using TTM EPS: 29% ($2.72 divided by $9.12)

The annual numbers look a lot better and reaffirm a couple of my beliefs:

1. Dividend coverage remains as strong as I had written in this article, so much that company can afford to double its payout to shareholders and still have plenty left to fund its growth.

2. Short-term fluctuations are normal even for a business as established as Microsoft. I wrote the same about IBM in the article linked above and never did I think the same may hold true for Microsoft to the extent that the quarterly Free cash flow would be less than the dividend payout.

Forward-Looking Thoughts and Conclusion

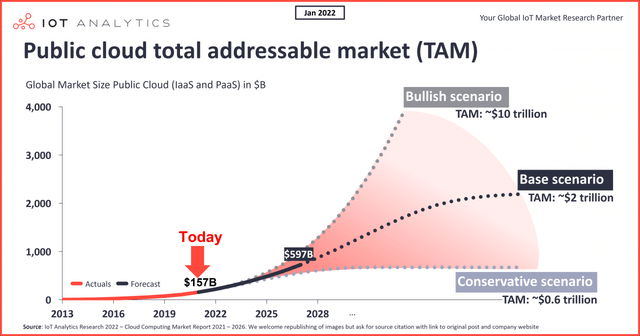

- Cloud revenue once again grew at a monstrous pace at 22%. While the pace of growth has slowed, it is impressive growth, nonetheless. Detractors (maybe rightly so) point out that the competition is increasing and the top two incumbents, Amazon Web Services (AMZN) and Microsoft Azure will face margin pressures. Fair argument but the Total Addressable Market is so enormous that the field can have many successful players beyond the big two.

Cloud TAM (iot-analytics.com)

- Personal Computing continues its weakness with a third consecutive quarter showing negative revenue growth. However, as can be seen in the 2022 vs. 2023 revenue by segment, the weakness in this segment is more than offset by the growth in Cloud and Productivity/ Business Processes.

- Satya Nadella continues his push into AI as his quote from the earnings call align with the company’s recent actions on ChatGPT.

“The age of AI is upon us, and Microsoft is powering it. We are witnessing nonlinear improvements in the capability of foundation models, which we are making available as platforms”

- Given the balance sheet and fundamental strengths, I fully expect another juicy dividend increase (10% at least) from Microsoft in September, marking its 14th consecutive annual dividend increase.

- While this may make little fundamental difference, I also believe the time might be ripe for the Microsoft to split its stock.

- Overall, I believe Microsoft is perhaps the best big tech stock to own as it offers a unique mix of sticky existing business, exciting new prospects including AI and further Cloud expansion, a bit of dividend income and enormous potential for dividend growth. The only thing that may not be in favor of the stock right now is its valuation, as evidenced by Seeking Alpha’s “F” rating. Do I believe the stock is cheap here? No. But quality and safety are rarely cheap. I give the stock a “Buy” rating but with one word of caution. Dollar cost your way into the stock and look for weakness to pounce.

What are your thoughts on the earnings in specific and Microsoft in general? Please leave your comments below.

Disclosure: I/we have a beneficial long position in the shares of MSFT, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.