Summary:

- UnitedHealth Group has underperformed the broader market in 2024 but shows potential for bullish activity in 2025 despite regulatory uncertainties.

- UNH delivered strong Q3 results with EPS of $7.15, beating expectations, and revenue of $101 billion, driven by higher service usage.

- Risks include policy uncertainty and potential premium increase restrictions, but the stock remains slightly undervalued with a target price near $618.

- Technical indicators are positive, with strong support and an upward-trending 200-day moving average, suggesting a bullish target of $665.

JHVEPhoto

UnitedHealth Group (NYSE:UNH) has slightly underperformed the broader market so far in 2024. The $553 billion market cap Health Care sector company sports a dividend yield about on par with the S&P 500, and investors are hopeful that a technical breakout that occurred earlier this year portends more bullish activity in 2025.

But there may be headwinds in the managed healthcare space considering unknown regulatory changes from Capitol Hill. The Health Care Select Sector SPDR ETF (XLV), of which UNH is a top holding, has stumbled since Donald Trump earned a victory over Kamala Harris.

While macro pressures could weigh, the reality is that UNH continues to deliver earnings strength amid solid leadership. I reiterate a buy rating on the stock, though the valuation gap between the current share price and where I consider intrinsic value to be is no longer all that tight.

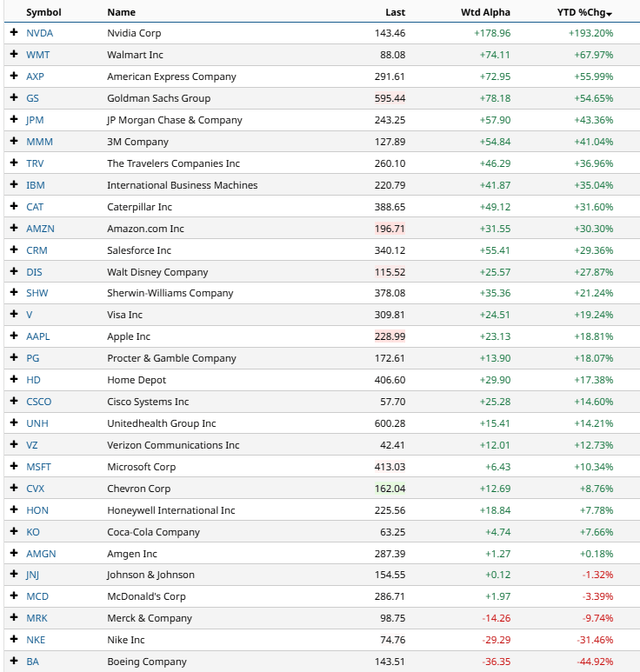

YTD Dow Jones Industrial Average Component Returns: UNH Near the Middle of the Pack

Barchart

Back in October, UNH reported a solid set of quarterly results. An early season reporter, UNH’s Q3 non-GAAP EPS verified at $7.15, above the Wall Street consensus target of $7.03. The Minnesota-based company’s revenue number was also better than expected at $101 billion, a more than 9% increase from the same period a year earlier, which beat forecasts by a material $1.5 billion.

Looking closer at the quarter, UNH’s solid Q3 results were driven by strength in its Optum and UnitedHealthcare areas, evidenced by higher service usage despite the negative impact of a notable cyberattack during the reporting period. Important for health insurers, the 2024 medical cost ratio increased to 85.2% in Q3, compared with 82.3% in the same quarter last year.

The higher ratio was largely the result of Medicare funding reductions and its overall business mix. Efficiency gains prevailed, though, given a sequential downtick in it’s the current-year operating cost ratio (13.2% versus 13.3% in Q2 2024).

The management team confirmed its FY 2024 EPS guidance to be in the range of $27.50 to $27.75, which at the time was close to the consensus estimate. But shares fell hard in the session that followed, -8.1%, which was the worst earnings reaction going back at least three years, according to data from Option Research & Technology Services (ORATS). Still, it was another in a string of beat of bottom-line EPS figures that dates back to 2019.

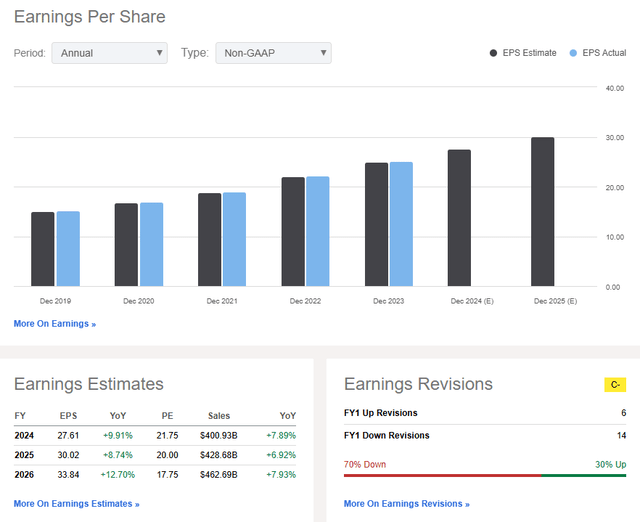

On the earnings outlook, analysts now expect slightly more than $30 of operating EPS in the out year, which would represent a 9% annual jump from between $27.50 and $30 in the current year. EPS growth is seen accelerating by 2026, which should help support a 20x-plus earnings multiple.

Despite a large number of sellside EPS downgrades in the past 90 days, UNH remains a very profitable company – free cash flow per share is $14.20, resulting in a FCF yield of 2.4%.

UNH: Revenue & Earnings Forecasts, EPS Revision Trends

Seeking Alpha

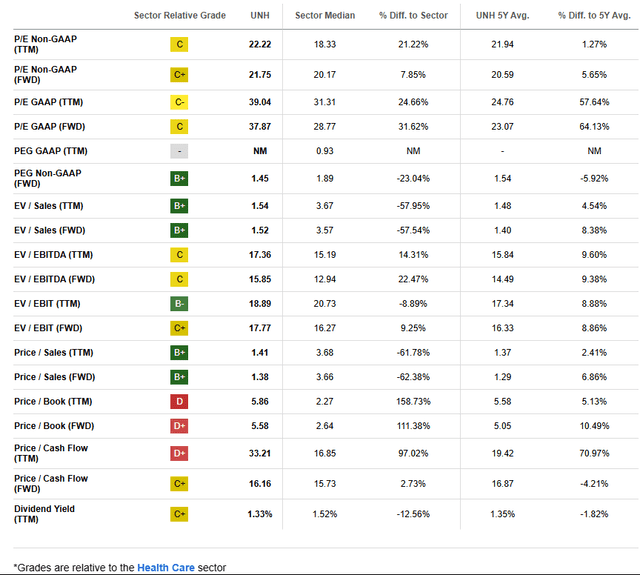

On valuation, I have only modest adjustments from my summer time analysis. If we assume $30 of non-GAAP per-share earnings over the next 12 months and apply a 5-year average P/E multiple of 20.6, then shares should trade near $618, making the large Health Care sector stock slightly undervalued.

That’s a $19 intrinsic value increase from more than three months ago, given modestly higher expected earnings and a steady multiple. Moreover, other valuation metrics are not too far from their respective 5-year averages.

UNH: Mixed Valuation Metrics

Seeking Alpha

Key risks for UNH include policy uncertainty from the new administration and a potential clamping down of insurance-company premium increases, though policies so far have generally been encouraging. Also, prospective investors should monitor developments regarding changes to Medicare that could impact the company.

Elsewhere, healthcare utilization trends compared to pricing hikes UNH can push through is a risk, along with how value-based care programs progress.

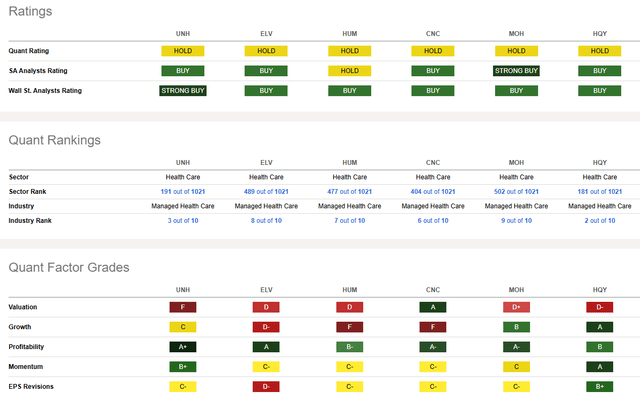

Competitor Analysis

Seeking Alpha

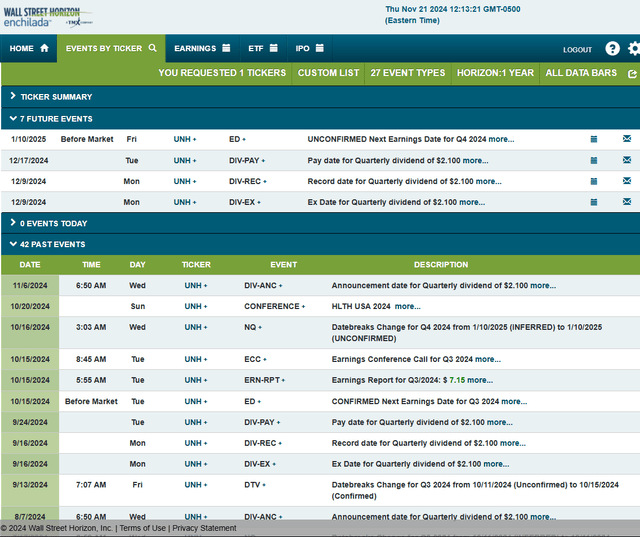

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q4, 2024 earnings date of Friday, January 10 BMO. Before that, shares trade ex a $2.10 quarterly dividend on Monday, December 9. No other volatility catalysts are seen on the calendar.

Corporate Event Risk Calendar

Wall Street Horizon

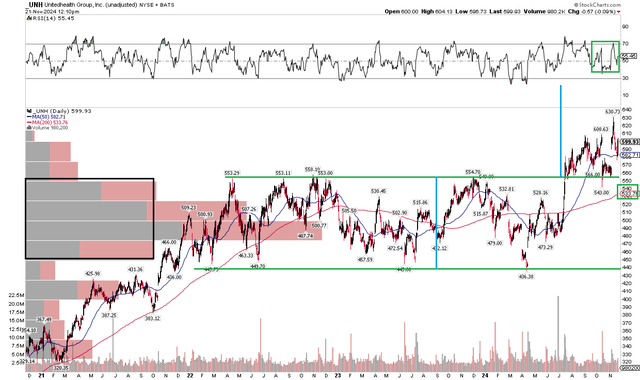

The Technical Take

With a decent valuation and rising uncertainty within the Health Care sector, UNH’s chart is generally encouraging, tipping the scale in favor of my buy rating reiteration. Notice in the graph below that shares remain a key support spot (which was former resistance) that I called out both in Q3 and at the start of 2024. While there was a momentary move under the $553 to $558 zone in mid-October around the earnings report, the bulls managed to bring shares back above critical support.

Also, take a look at the long-term 200-day moving average – it’s now firmly in an upward trend, suggesting that the bulls control the overall trajectory. Furthermore, the RSI momentum oscillator at the top of the chart has been ranging in a slightly bullish area, never reaching technical oversold conditions. Finally, with a high amount of volume by price below where UNH trades today, any protracted pullbacks should be met with buying demand.

Looking ahead, $630 is obviously resistance from the post-election pop, but $665 remains in play based on the height from the multi-year range that I detailed in my previous analysis.

UNH: Bullish Long-Term Breakout Targets $665, Support Near $555, Rising 200dma

Stockcharts.com

The Bottom Line

I have a buy rating on UNH. I see the Health Care sector stalwart as close to fairly priced, but still with some room to run to get to intrinsic value. The chart, meanwhile, is constructive and points to a bullish target about 10% above today’s price.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.