Summary:

- Despite regulatory risks and a potential Chrome divestiture, Google’s valuation remains attractive due to strong earnings growth and a forward P/E ratio of 19.5x.

- The DoJ’s proposal to split-off Chrome and possibly affect Android poses risks, but the ecosystem’s core services like Search and YouTube should remain resilient.

- Google’s conservative fair price is estimated at $181.9, with conservative assumptions, offering a reasonable margin of safety and potential for long-term growth.

robertcicchetti

Before the Q3 earnings, I wrote an analysis of Google (NASDAQ:GOOGL) (NASDAQ:GOOG), explaining that I liked the thesis for its growth prospects, diversification, and attractive valuation, even with the risks of AI and regulatory risks.

In these few weeks, some things have already changed in Alphabet’s thesis: 1. The price has changed. Since publication, Google stock has seen gains of ~7%, from just over $169 to $181 and more recently it has given back all those gains, trading at around $167; 2. Earnings in the last quarter showed YoY growth of over 30%; and most importantly, 3. DoJ wants the Google Chrome split off to happen, also with the possibility of affecting the Android division (with the idea of dismantling it).

Even so, with this bad news, I decided to initiate a position in Google. This is because it seems that the falls that occurred after the news, together with the earnings growth and earnings revision, are enough to mitigate the (high) risks by bringing a pretty interesting valuation.

The Chrome Split and Its Risks for Google

If this option were to materialize, it would certainly not be positive. Of course, with the sale of Google Chrome, which is a valuable and important asset, there would be more cash for the company and consequently for the shareholders, since it is an amount that can be used for dividends, buybacks, CapEx, or M&As. However, I don’t think it’s so coherent to try to look at the glass half full.

Although Google Chrome is not a relevant line of revenue, it is an important part of Google’s ecosystem, being the world’s leading browser with over 60% market share. This means that at least a few hundred million people use the browser, i.e. more data and control over how people will use Google’s services, which can offer greater synergy and functionality with its products such as Gmail and even YouTube, but especially Search, which is the main line of revenue and part of which depends on being present in the main browsers on both desktops and mobiles, being present in both Androids and Safari.

The question here is how much this could affect revenue growth in the medium and long term. In Q3, search growth was 12% YoY, maintaining strong momentum and adding positive signs for the short and medium term, with strategies such as AI, Circle to Search, and Lens working.

Assuming that the pre-DoJ growth for this revenue was ~10% (a random number I took just to illustrate my point), how much should this drop to? It’s a question without an easy and definite answer, but I don’t believe that the sale of Google Chrome should have a significant impact on the long-term growth for this or other segments, despite hurting the ecosystem. So perhaps it would be conservative to estimate only small declines in growth, since users who use Google search (or YouTube, Gmail, and others) will most likely continue to use it regardless of the browser or who owns it.

It’s still not trivial and shouldn’t be overlooked. There is a possibility that Chrome will be sold for an amount of money that is not so attractive to the shareholder since without the ecosystem, the browser becomes a less valuable asset. Another relevant point is that Google itself has mentioned several points about how this DoJ proposal could affect its services, with problems related to privacy, chilling the investments the company has been making in AI, among others.

Furthermore, if additional measures are implemented, such as those related to Android, Pixel, and even the deal with Anthropic, an even bigger drop could materialize in Google stock, making the scenario more cloudy.

Why Google’s Valuation Looks a Little Better Now

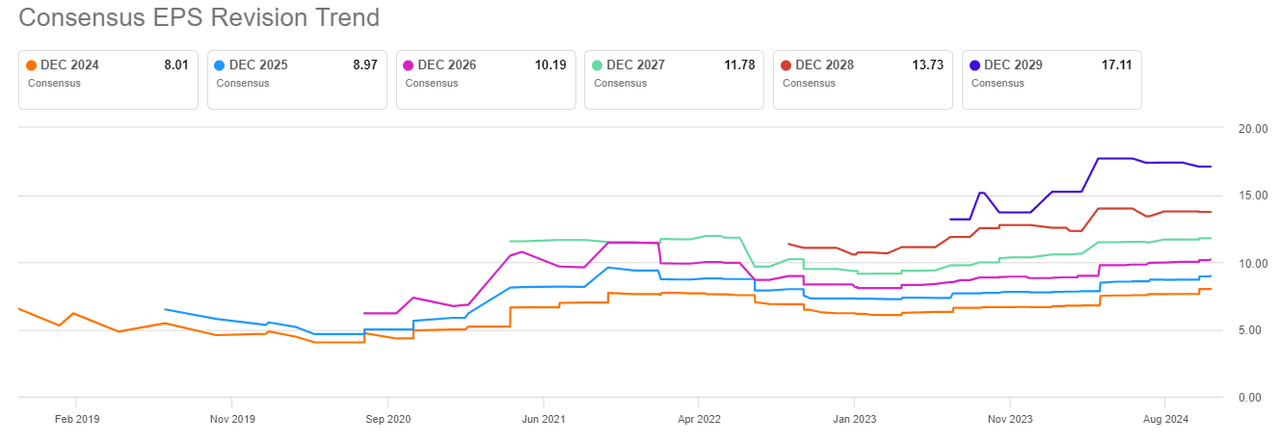

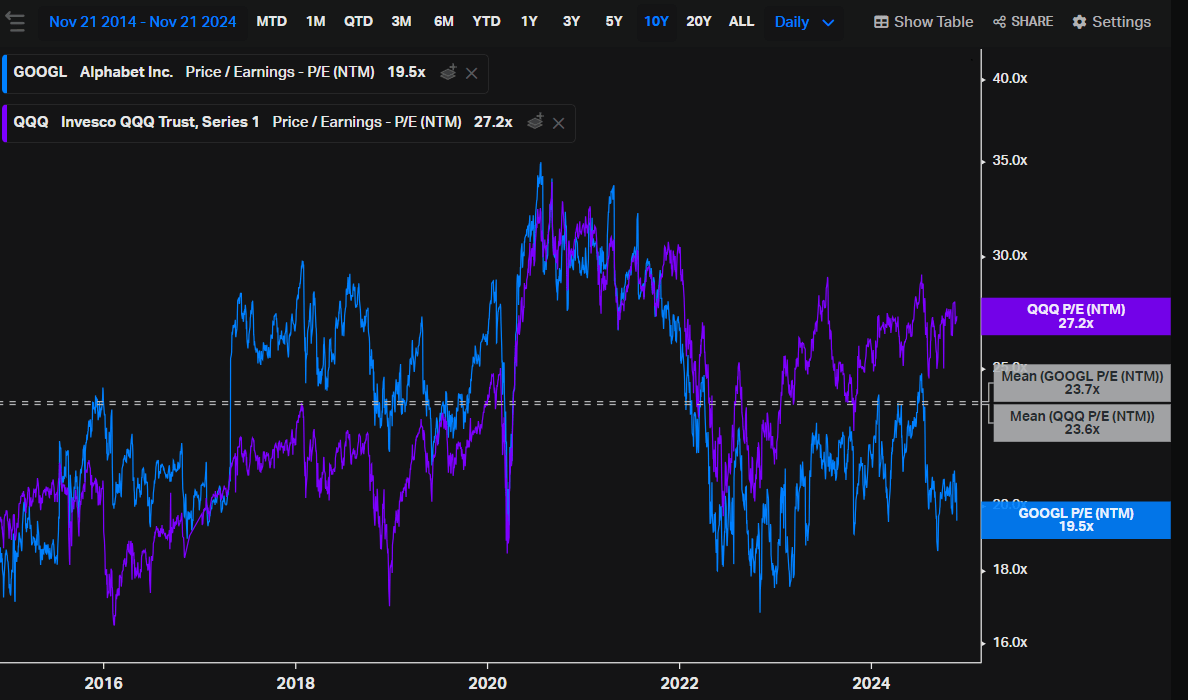

In my last analysis, the forward price-to-earnings of GOOGL stock was 20.6x, and I already considered this level attractive. After the high YoY growth in Q3 net income, there have been small positive revisions for the coming years.

This factor, coupled with the recent falls, caused the forward price-to-earnings to drop to 19.5x, a level more appealing than before (rightly so given the uncertainties), and with an even bigger gap to the Nasdaq index (QQQ), which trades at more than 27x forward earnings.

Koyfin

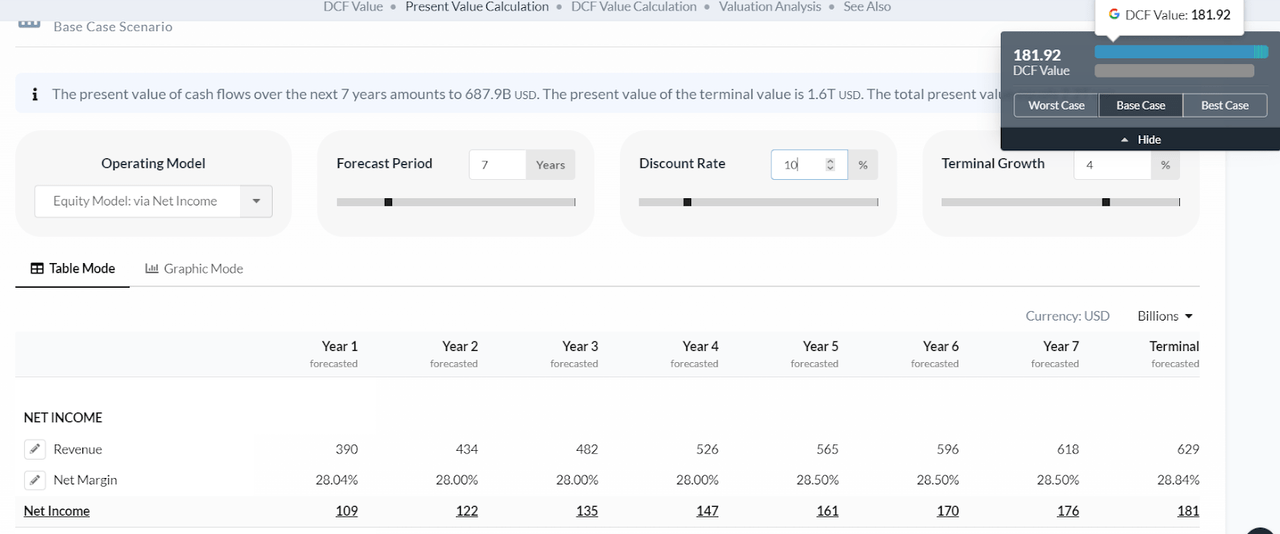

Using slightly below-consensus estimates for 2024 and 2025, and thereafter projecting revenue expansion of 7% and a net income margin that reaches 28.8% in 2029, it is already possible to find compelling values. In 2030, the price-to-earnings would be 13.8x, with an earnings yield of 7.2%, and in 2026 the earnings yield would be ~5.5%. This value is very attractive for a company like Google, which in addition to quality has many optionalities and the possibility of maintaining growth momentum and positively beating these conservative estimates.

Applying very similar assumptions to an Equity model (Net Income as a proxy for FCF), it is also possible to find a fair price of $181.9, using a discount rate of 10% and terminal growth of 4%.

This fair price doesn’t mean that Alphabet should be trading at only ~$180, but rather shows that even with very conservative assumptions, which the company will probably exceed, it is already possible to have a very reasonable margin of safety.

Portfolio Sizing Strategies for Google

The risk of the DoJ, the loss of Chrome, and possibly partial losses of Android matter, also because additional regulations could emerge over the next few years, as well as AI remains a double-edged sword that can boost Alphabet’s business but also hinder the growth of the search segment. In other words, there are risks and uncertainties, which is why the valuation is attractive.

With this in mind, a strategy that I consider ideal is to mitigate this risk by sizing. Having up to 8% or 10% of the stock portfolio in Google still seems reasonable, much more than that may seem to be taking on too much of a specific risk. Not only that but for people like me who are (probably) going to start a position for now, strategies such as buying gradually can lead to buys that guarantee a better margin of safety (i.e., in case the stock goes down).

A Compelling Case for Google Amid Challenges

The DoJ news directly impacts Google’s thesis and could eventually turn out worse than expected, so it should be monitored and considered when investing in the thesis. Still, although Chrome may be sold, I think it’s very unlikely that Google will cease to be a quality company with high-growth prospects.

In this way, I believe that Google stock is at a level below fair value and could be a good candidate for compounding, justifying maintaining the buy rating even in the midst of a more nebulous scenario.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in GOOGL over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.