Summary:

- Innovative Industrial Properties remains rated a ‘hold’ due to ongoing uncertainty in the cannabis market and mixed financial results despite attractive valuation.

- Recent quarter revenue dropped 1.7% year-over-year, with a decline in leased properties from 98.5% to 95.7%, raising concerns about tenant stability.

- Cannabis prices hit an all-time low, impacting tenant financial health; however, four major tenants showed improved revenue and cash flows year-over-year.

- Despite valuation improvements, industry challenges and tenant net losses justify maintaining the ‘hold’ rating, though a soft ‘buy’ upgrade could be considered soon.

Morsa Images

Back in early August of this year, one company that I decided to downgrade from a ‘buy’ to a ‘hold’ was Innovative Industrial Properties (NYSE:IIPR). For those not familiar with the business, it is a REIT that owns and leases out properties for the cannabis industry. With the prospect of further cannabis legalization, this industry has been viewed in the past as an appealing one. But in recent years, the picture has changed. After seeing the stock skyrocket by 111.4% at a time when the S&P 500 trailed that, I believed that uncertainty in the cannabis market, combined with mixed financial results from the company, warranted the aforementioned downgrade.

Since then, shares have underperformed my expectations. Whenever I rate a company a ‘hold’, it is my assertion that the stock should perform more or less along the lines of the broader market. But since then, shares have risen by only 0.7% while the S&P 500 is up 15.7%. As much as I wish that an upgrade was warranted, I do believe that heightened uncertainty in the cannabis market does not justify that. This is in spite of the fact that, from a valuation perspective, the business has gotten even cheaper. So for now, I am keeping it rated a ‘hold’.

Taking a puff out of IIPR

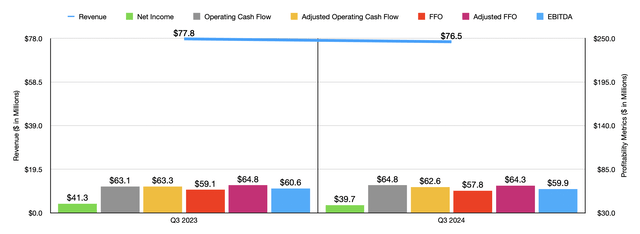

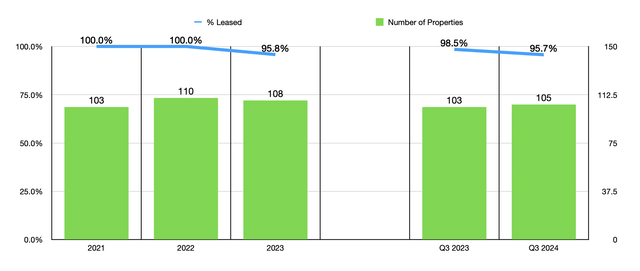

In my previous article about Innovative Industrial Properties that was published in early August, investors had access to data covering the first quarter of the 2024 fiscal year. Results now extend through the third quarter. During the most recent quarter, revenue for the company came in at $76.5 million. This represents a decline of 1.7% compared to the $77.8 million the business reported one year earlier. This is in spite of the fact that the number of operating properties owned by the firm grew from 103 to 105. These numbers do not include three other properties that are either under development or redevelopment, since they are not generating any income for the business.

The drop in sales from the enterprise was primarily due to a $3 million drop in contractual rent and property management fees that stem from properties that the company came back into possession of or sold since June 2023. $1.3 million of the $3 million drop experienced was because of the reclassification of two sales-type leases that began earlier this year. Another $1.3 million was associated with contractually due rent and property management fees that the company was not able to collect during this time. The picture would have been worse had it not been for the fact that it benefited to the tune of $4.6 million from higher contractual rent and property management fees driven mostly by contractual rent escalations, improvement allowances at existing properties that pushed rents higher, new leases, and other factors.

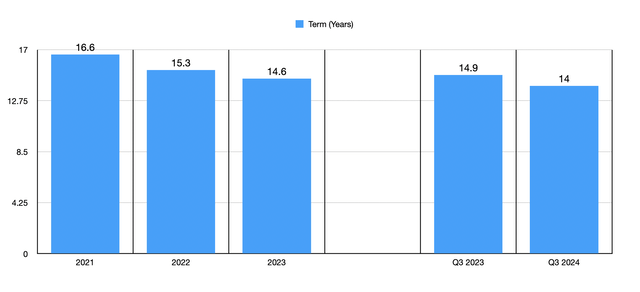

It is also worth noting that while the number of operating properties increased year over year, the percent of its properties leased dropped from 98.5% to 95.7%. As you can tell by looking at the chart above, the company is no longer at the 100% leased rate that it was in prior years. Furthermore, while investors should be happy about the fact that the lease terms are long term in nature, that has also been on a downtrend as the aforementioned chart illustrates. I would like to point out that while longer lease terms do provide some degree of stability for shareholders, these are only relevant as long as the tenants in question are financially able to pay them.

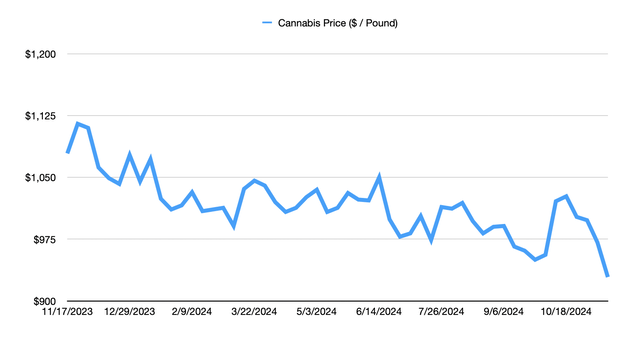

Author – Data from Cannabis Benchmarks

This brings me to one issue that I have with the industry. And that relates to the overall US cannabis market and cannabis prices. In the week ending on November 15th of this year, the spot price for cannabis hit $929 per pound. This is actually the lowest it has ever been. Over the course of a single week, it dropped by 4.3%. As the chart above illustrates, it is actually down a whopping 13.9% year over year. This overall trend is concerning. And it does make one wonder about the tenants that Innovative Industrial Properties caters to.

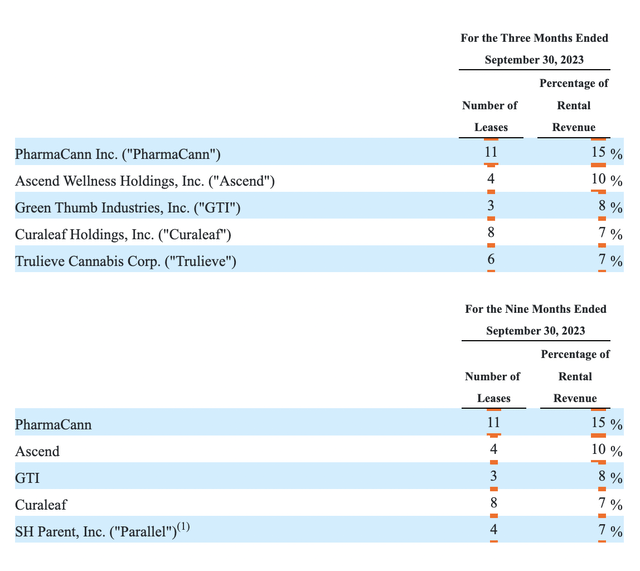

Innovative Industrial Properties

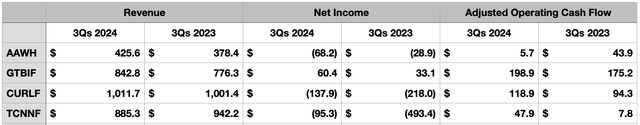

Speaking of tenants, in the image above, you can see the current largest tenants of the company. Unfortunately, the largest of these is not publicly traded. But the other four are. In the table below, I looked at the revenue, net profits, and adjusted operating cash flows, of these four enterprises for their first three quarters of the 2024 fiscal year compared to the same time of 2023. Back when I wrote about Innovative Industrial Properties in early August, I did the same thing. The only difference is that this covered only the most recent completed fiscal year for each business.

What I found was that, without exception, all four of these businesses had seen their revenue improve. Three of them had seen their net profits improve as well, and the same holds true from an adjusted operating cash flow perspective. I am encouraged by the fact that these tenants, which collectively account for 33% of the rental revenue that Innovative Industrial Properties receives, are consistently generating positive cash flows. But the fact that three of the four continue to generate net losses is worrisome. On the whole, however, I would say that these companies deserve praise for how well they are performing on a year-over-year basis considering the price of cannabis.

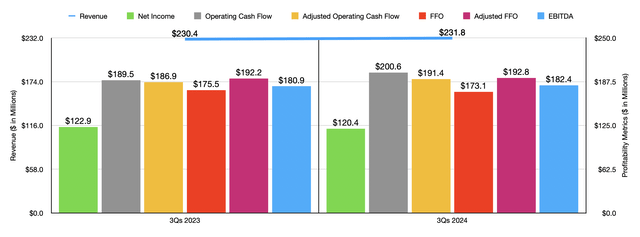

Moving back to Innovative Industrial Properties, I do think it’s worth talking about the profitability of the business. This is something that has been mixed, but slightly negative, in the most recent quarter of this year. As the very first chart in this article illustrated, net income and four of the five cash flow metrics of the company reported declines year over year. However, in the chart above, you can see that revenue for the first nine months of this year is up compared to what it was last year and, while net profits are down, four of the five cash flow metrics of the business are up.

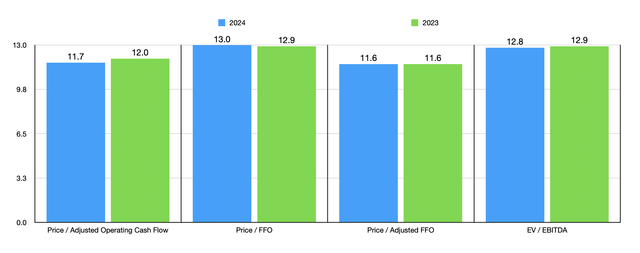

Assuming that the rest of this year looks like the first nine months of 2024 did compare to the first nine months of 2023, the business should generate adjusted operating cash flow of $256.6 million. FFO, or funds from operations, should come in at $228.4 million, while the adjusted figure for this should be $257.1 million. Lastly, EBITDA for the enterprise should be around $246.3 million. Using these estimates for 2024, as well as historical results for the 2023 fiscal year, I calculated above how the stock is currently valued. For a REIT, this pricing is certainly not bad. And compared to other industrial REITs, it’s actually a bit on the low side. In the table below, I compared the company to five similar enterprises. On a price to operating cash flow basis, only one of the companies was cheaper than Innovative Industrial Properties, while another was tied with it. When it came to the EV to EBITDA approach, only one of the firms was cheaper than our candidate was. It is also worth noting that Innovative Industrial Properties is cheaper than it was when I last wrote about it a few months ago.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Innovative Industrial Properties | 11.7 | 12.8 |

| LXP Industrial Trust (LXP) | 13.7 | 42.6 |

| Plymouth Industrial REIT (PLYM) | 11.7 | 13.1 |

| NewLake Capital Partners (OTCQX:NLCP) | 8.6 | 9.0 |

| Terreno Realty Corp (TRNO) | 25.4 | 23.3 |

| Industrial Logistics Properties Trust (ILPT) | 32.3 | 14.9 |

Takeaway

As things stand, Innovative Industrial Properties does appear to be more attractive today than it was when I last wrote about the business. However, I do also have concerns about the industry that it operates in because of declining prices of cannabis and the continued net losses of its largest tenants. Due to these worries and in spite of the company’s valuation, I believe that keeping it rated a ‘hold’ makes the most sense. But in all honesty, it wouldn’t take much for me to upgrade it to a soft ‘buy’.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!