Summary:

- LAC is an early-stage lithium producer with a promising asset in Nevada, poised to benefit from the projected lithium supply gap over the next two decades.

- Despite current oversupply issues, LAC’s Thacker Pass project is well-funded and on track to begin production by 2027, with significant revenue potential.

- LAC’s partnership with General Motors and federal support de-risk the project, making the stock undervalued with a potential 5x upside.

- We rate LAC a ‘Strong Buy’, despite the significant execution risks.

Just_Super

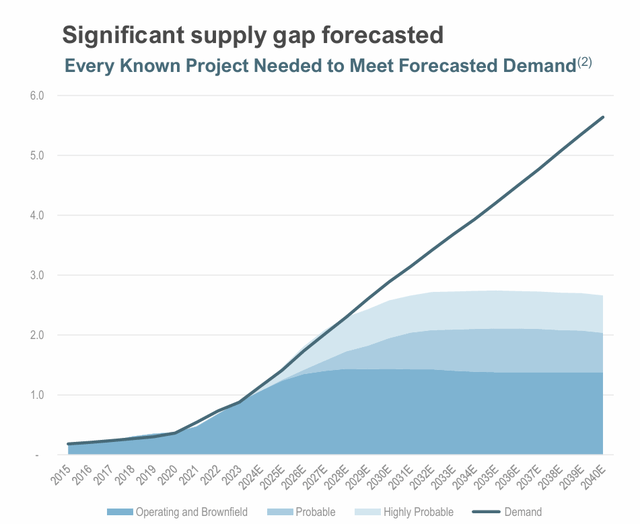

Here’s an interesting stat we just came across – by the year 2040, some analysts are expecting that the global supply of Lithium, the metal at the heart of the green energy revolution, will only meet about half of global demand.

In other words, over the next 15 years, we’re going to be running significantly short on a core input to one of the most important electronic components of tomorrow – batteries.

While the long-term outlook for lithium producers is strong given this looming gap, recent oversupply issues have led to a wipe-out in the sector, with many stocks losing 80% or more in value from highs.

In this article, we’re taking a look at Lithium Americas (NYSE:LAC)(TSX:LAC:CA), an early-stage lithium producer with rights to mine a particularly attractive bit of land in the north of Nevada.

The company hasn’t yet begun digging, but it is nearing the end of the long and arduous process of getting everything in order to begin mining operations.

While the company has a significant execution challenge in front of it, if management can pull it off, we think the shares look extremely undervalued at their current price.

Today, we’ll explore the long-term opportunity LAC is targeting, outline our thoughts on the company’s prospects, and ultimately explain why we’re so bullish on this potential lithium supply gap play.

Sound good? Let’s dive in.

LAC’s Financials

Let’s begin, as always, by looking at LAC’s financials.

In short, LAC is currently an empty husk of a business worth around $800 million in market cap.

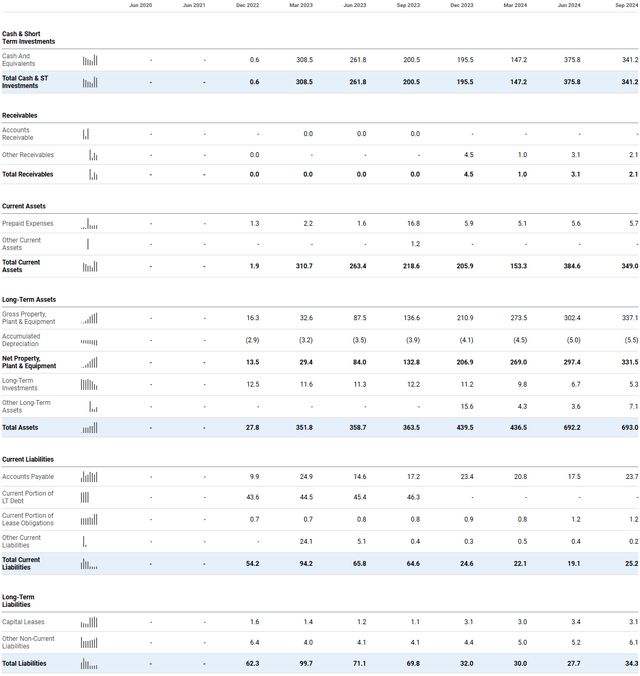

The income statement is basically completely empty as LAC has not yet begun producing lithium carbonate, but the firm does have an interesting balance sheet:

In short, the firm has about $340 million in cash, alongside $331 million in net property, plant, and equipment. This accumulated PPE is mostly from Thacker Pass construction costs and infrastructure built in advance of (hopefully) the full-scale production launch.

The firm doesn’t have much in the way of liabilities, as of September 30th, 2024, which makes the company’s enterprise value materially lower than one might initially expect:

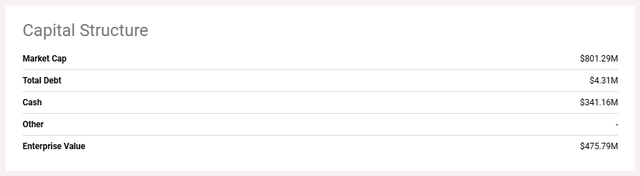

Looking ahead, the company’s main operational push is to bring Thacker Pass online:

The company markets the mine as “The largest known Measured and Indicated (M&I) Resource in North America”, which makes it an interesting asset.

From a geopolitical point of view, Lithium is a key component in many supply chains, including those that are related to the military. Fighter jets need batteries and electrical components just as much as electric vehicles, which is, in our view, partly why the federal government has been pushing to help LAC get the mine up and running.

A recent grant from the DOD and loan from the DOE for the development of on-site processing facilities should ease financial pressure on LAC, and provide a smooth financial ramp for scaling production.

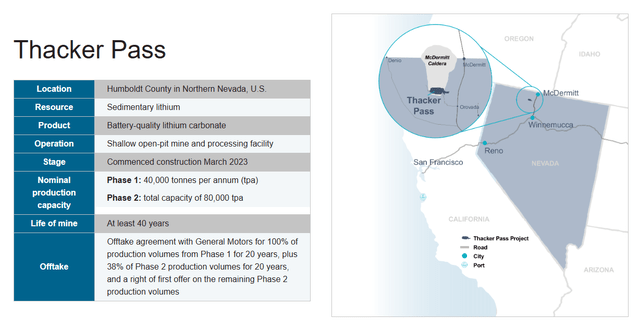

Additionally, LAC recently partnered with General Motors (GM) on a joint-venture structure for the mine. This makes economic sense for both parties, as GM will be able to access a stable, low-cost source of Lithium carbonate for EV production, and the terms of the deal also appear accretive to LAC shareholders over the long run:

This agreement should help LAC with initial Lithium Carbonate offtake, which also boosts the project’s early economics and de-risks it from an operational POV.

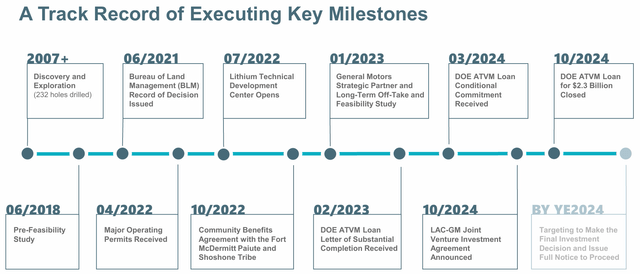

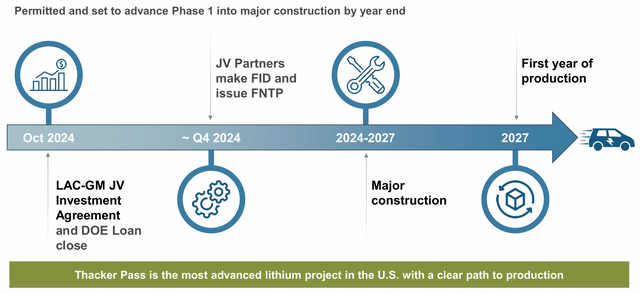

Timeline wise, LAC has been hard at work getting all of the pieces in place to begin major construction on the mine:

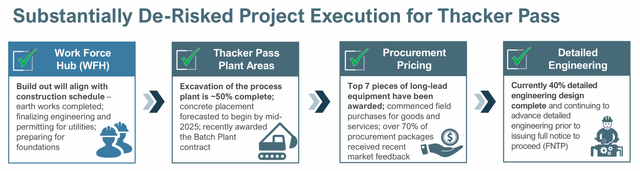

Going forward, the firm has essentially begun a full build out of the mining infrastructure required, and every step that gets completed means that investors are one step closer to revenue coming online:

For our two cents, we think the Thacker Pass mine is well-funded, and with only a small gap in finances remaining, it appears highly likely that the mine will open as scheduled.

This is the single most important step in turning LAC into a viable business.

LAC’s Valuation

So – with Thacker Pass on track for opening in 2027, what should investors be paying for LAC’s stock?

Right now, shares are trading at roughly 1.1x FWD book, but this doesn’t take into account the company’s true potential.

Once Phase 1 is up and running in 2027-2028, what will LAC’s financials look like?

Here’s how we see it.

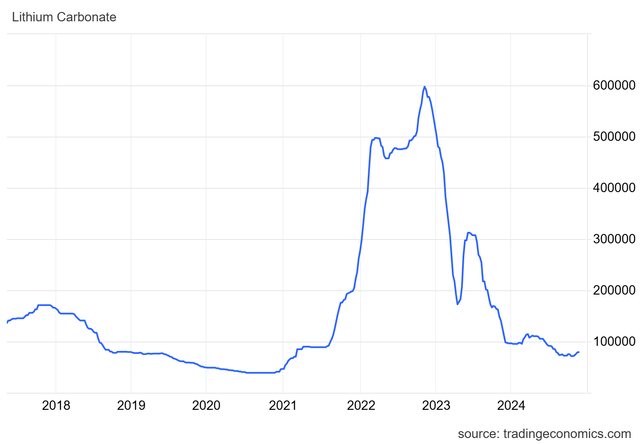

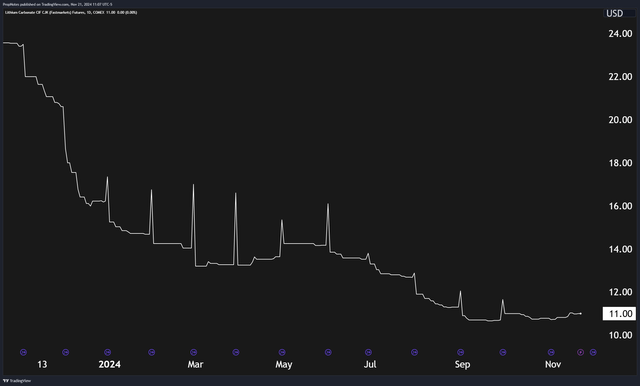

As it stands, Lithium Carbonate prices are trading at roughly 79,000 CNY per tonne in Shanghai:

In USD, this equates to roughly $10,900 per tonne, or roughly $10.9 per KG.

Lithium prices on COMEX appear similar at present:

During Phase 1, LAC expects to produce around 40,000 tonnes per year, which would, at current prices, equate to roughly $436 million in revenue.

Here’s the thing – we anticipate Lithium prices will increase over the life of the project, as a result of the impending projected supply gap by 2030, through 2040:

This doesn’t count new production that this projection hasn’t picked up on that will inevitably come online throughout the next decade plus, but the lag time for setting up lithium mining is quite long, and thus we see a serious supply / demand imbalance setting the stage for higher prices over the interim.

Historically, prices have ranged between $5,500 and $83,000 per tonne, which means that we’re at the low end of the range. That said, even if prices only gradually increase back up to ~$15,000 – $20,000 per tonne over the interim, then LAC would see a significant potential boost to cash flow in the $600 million – $800 million range, assuming stable production of 40,000 per year.

This also doesn’t take into account LAC’s potential for Phase 2 of Thacker Pass, which could double overall production to 80,000 tonnes per year.

As we see it, we think Thacker Pass could produce anywhere between $600 million and $1.2 billion per year between the years of 2028 and 2040.

If you assume an average of $800 million per year in revenue for Thacker Pass, then you’re looking at ~$500 million in revenue for LAC, given the company’s 62% stake in the mine.

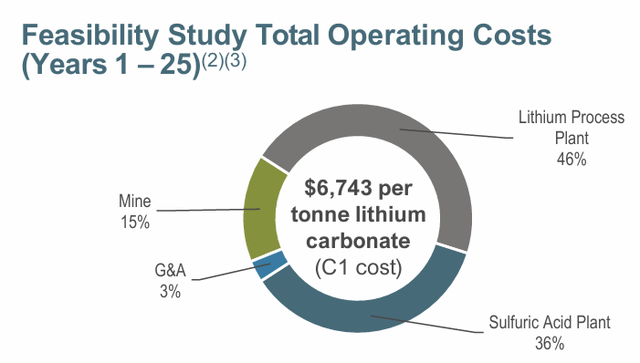

On the cost side, the company is projecting $6,743 per tonne operating costs:

At present, this indicates an operating margin of roughly 41%, given the current Lithium price at ~$11,000.

If prices increase, we’d expect to see margins increase towards the 60% range, given a projected price of $17,500 per tonne.

In the example above, you’d end up with roughly $800 million in revenue, as discussed, with $480 million in operating income.

Given LAC’s 62% stake, this would work out to almost $300 million in operating income at that given run rate.

Looking at ALTM, a leading lithium company, the firm currently trades at roughly 25x blended EV/EBITDA. Assuming a similar valuation on LAC’s operating income, you’d end up with ~$7.5 billion in market cap.

This comparison doesn’t bake in size, however.

Given ALTM’s scale is roughly double LAC’s at present pricing, we’d be happy cutting LAC’s valuation to a more conservative ~$4 billion.

Thus, while there are a lot of inputs to this estimate, but we’d argue that LAC has roughly 5x upside, from $800 million in market cap to potentially $4 billion over the next 5 years if the company can execute.

Risks

There are a huge number of risks associated with this assumption.

First off, LAC’s costs of operation could inflate, the company’s Phase 1 may miss production targets, and the company may never see Phase 2 production hit the market.

Lithium’s price may also remain stagnant.

Long story short, our inputs for LAC’s potential run-rate at full capacity have a lot of moving parts, any of which could misfire, causing our upside estimate to be too aggressive.

We’ve tried to be conservative on each of our projections, but there are always risks that our inputs don’t end up matching reality this far out.

Additionally, there are significant execution risks for LAC in the next 3 years, getting to the point where the company can begin mining operations. The financing looks sound, but if cost overruns or delays hit the project, LAC could run into hot water.

After the mine is up and running, there are also considerable execution risks with the project that come with any capital-intensive endeavor.

Overall, we feel like there’s significant upside with LAC if the company can get Thacker Pass to production, but there are also a lot of paths to material capital impairment for investors.

As we said in the title – LAC is a high potential reward, but also high-risk play.

Summary

Thus, while LAC appears to be a high-upside lithium-linked play in the event management can execute, if they can’t, then the downside risk is also substantial.

This is why we’re quite bullish on the stock, but would also recommend a smaller position size than normal. A small loss shouldn’t be too consequential to a portfolio, but the alpha one could harvest in a potential win could have an impact on total returns over time.

Consequently, we rate LAC a ‘Strong Buy‘, with the added caveat that a smaller-than-average position in this high-risk play appears appropriate.

Stay safe out there!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LAC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.