Summary:

- Meta Platforms’ stock experienced declines since October 2024, but recent pullbacks and strong Q3 earnings suggest a “buy” rating is now warranted.

- Q3 earnings of $6.03 per share beat estimates by 14.86%, with annualized growth rates of 37.36%, indicating strong near-term bullish prospects.

- Despite some operational slowdowns, Meta’s forward price-earnings metrics remain attractive compared to MAG-7 peers, supporting its potential for better returns.

- Technical signals show strong support around $544, suggesting a solid base for long positions, with a bullish outlook holding true unless the stock breaks below support at $505.30.

Robert Way

When I last covered Meta Platforms, Inc. (NASDAQ:META) on October 8th, 2024, with my article “Meta Platforms: Increasingly Unpredictable”, the stock was beginning to reverse in the downward direction after posting new record highs. My main assertions in the article centered around the fact that the stock has a long history of developing unpredictable (and somewhat erratic) price action after major peaks are seen in share prices. Ultimately, I argued that it was best to simply stand aside with this stock and wait for a deeper pullback in share prices before entering into new long positions. In the periods that followed, the stock did, in fact, experience continued trending movements in the downward direction and has accumulated losses of as much as -7.2% during this period of time. In contrast, the S&P 500 has posted gains of 2.88% since the article was written. However, now that we have seen a well-timed pullback in META share prices, I believe that it is time to revise my prior outlook to an upgraded “buy” rating based on the fact that the stock is showing strong potential for generating better returns into the end of 2024.

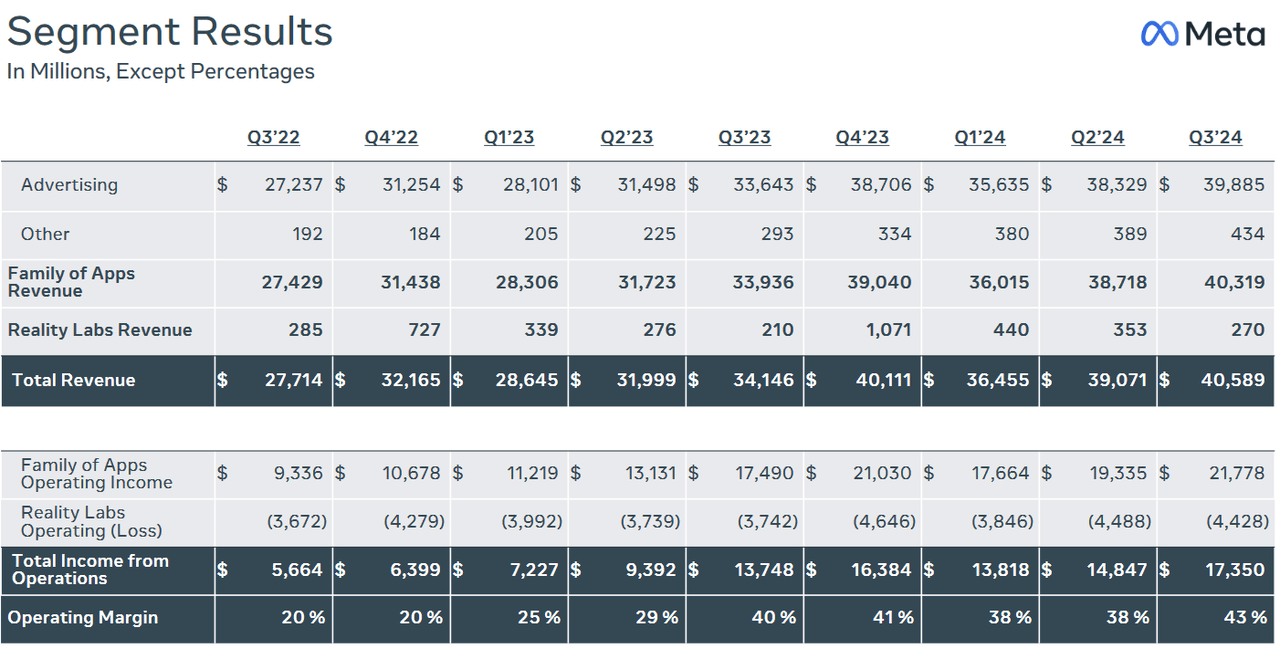

Meta Platforms: Q3 2024 Earnings Figures (Meta Platforms: Q3 2024 Earnings Presentation)

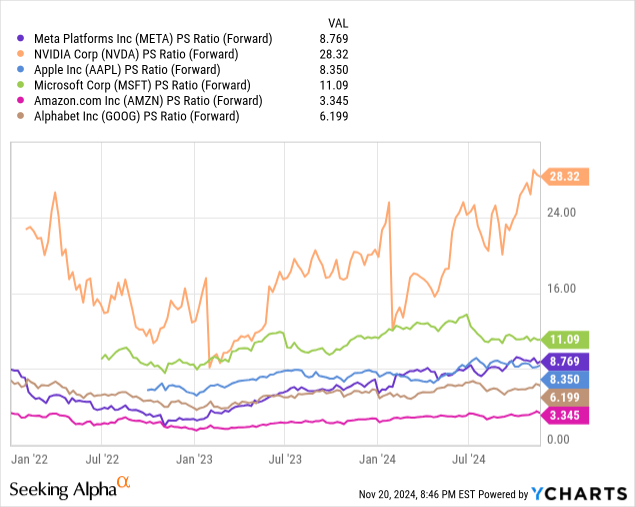

Since my previous article was written, we have had a major earnings update that has helped to strengthen my perspective on this stock’s near-term bullish prospects. For the third-quarter period, Meta Platforms generated earnings of $6.03 per share, which surpassed consensus estimates by a fairly wide margin of 14.86% and indicated gains of 37.36% in relation to the figures posted in Q3 2023. Broader revenue figures were a bit less impressive, beating expectations by just 0.74% and showing annualized growth rates of 19%. On the surface, net income appears to be quite strong (at $15.7 billion) because this amounts to annualized gains of 35%. However, this is actually the weakest net income growth rate Meta Platforms has posted since Q2 2023, so there is at least some evidence of operational slowdown here. Additional negatives can be seen with Meta’s daily active user figures (3.29 billion), which disappointed estimates, and in full-year capex guidance, which was increased from $37-40 billion to $38-40 billion. More broadly, capex is now expected to see substantial increases through the end of next year as the company continues to funnel money into infrastructure and artificial intelligence operations that use Nvidia (NVDA) GPUs.

Meta Platforms: Q3 2024 Earnings Figures (Meta Platforms: Q3 2024 Earnings Presentation)

Additional positives can be seen with Meta’s Q3 advertising figures, which generated annualized growth rates of nearly 19% (at $39.9 billion) and this is quite significant because more than 98% of the company’s quarterly revenue figure is derived from advertising operations. Quarterly operating losses from the Reality Labs segment ($4.4 billion) were not as bad as initially feared ($4.68 billion), and sales from the segment actually saw annualized gains of nearly 30%. For the full-year period, total expenses guidance was revised lower from $96-99 billion to $96-98 billion, and total revenue guidance for the period is now seen within a $45-48 billion range (creating a midpoint that surpasses prior estimates).

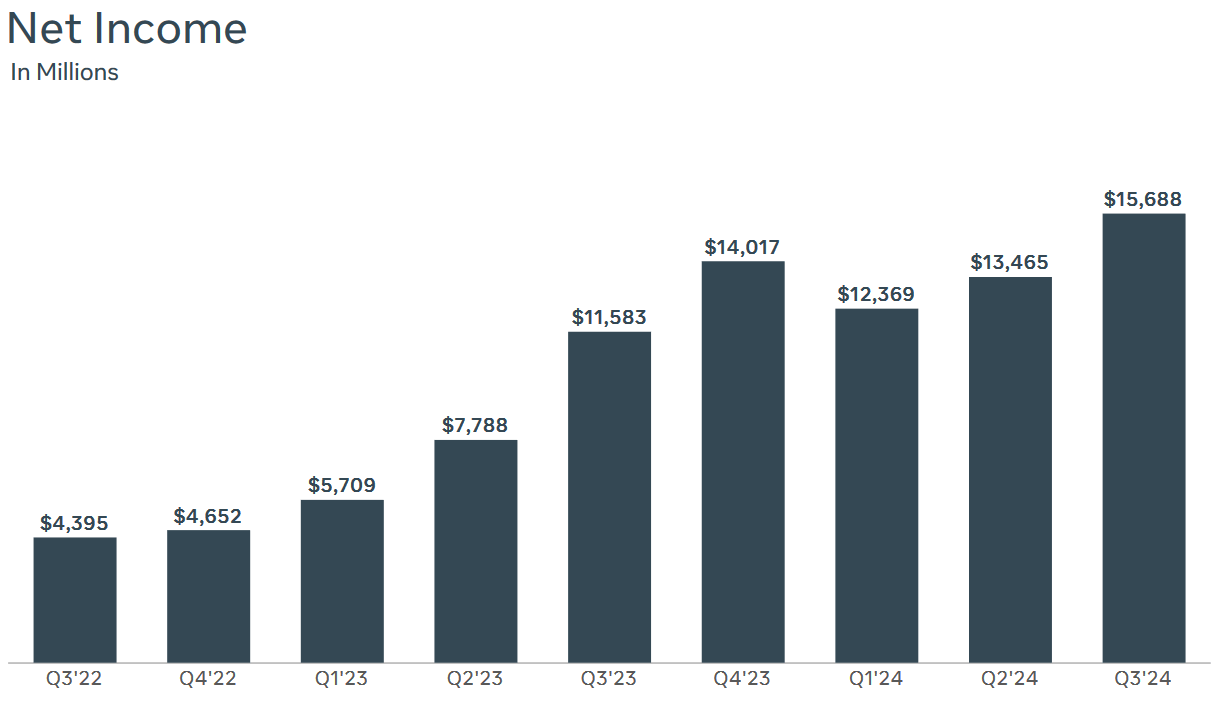

Meta Platforms: Comparative Forward Price to Earnings Valuations (YCharts)

Data by YCharts

In light of these performances, Meta Platforms has seen slight increases in its forward price-earnings metrics, but these figures are still holding at highly attractive levels (25x) when compared to most of the MAG-7 cohort. For example, Apple, Inc. (AAPL) and Microsoft Corp. (MSFT) are currently trading with forward earnings valuations of 30.97x and 31.73x, respectively. Of course, these stocks are a bit cheaper than Amazon, Inc. (AMZN) at 39.71x. However, after this, forward price-earnings valuations within the mega-cap peer group really start to expand to somewhat extreme levels because Nvidia is currently trading at 50.98x forward earnings and Tesla (TSLA) is trading at levels that are almost completely off the chart (at 138.03x). At the moment, the only stock within the MAG-7 peer group that is currently trading at a lower forward earnings valuation is Alphabet, Inc. (GOOG) at 22.05x.

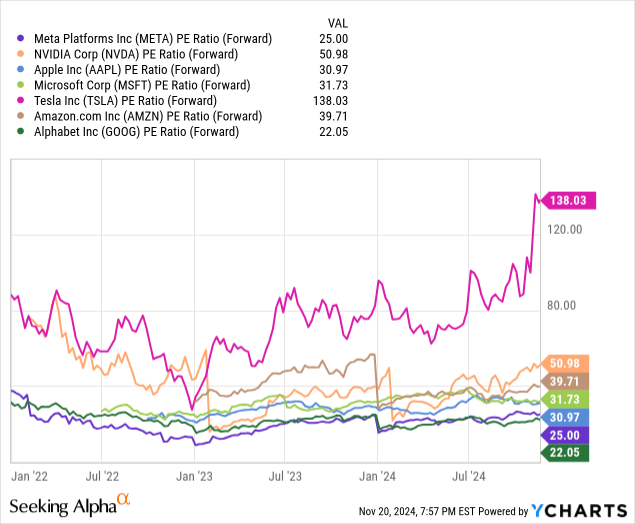

Meta Platforms: Comparative Forward Price to Sales Valuations (YCharts)

Data by YCharts

However, if we compare these companies using the forward price-sales metric, Meta Platforms (at 8.769x) does not look quite as appealing because the stock has actually been trending into more expensive levels for most of the last two years. Using this metric, three mega-cap technology companies are currently trading with cheaper forward price-sales valuations: Amazon at 3.345x, Alphabet at 6.199x, and Apple at 8.35x. Only two companies here trade with higher forward price-sales ratios, and these can be found in Microsoft (at 11.09x) and Nvidia (at 28.32x).

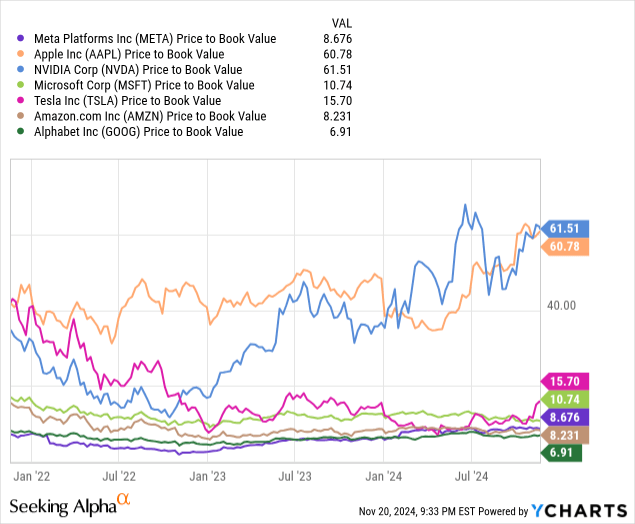

Meta Platforms: Comparative Forward Price to Book Valuations (YCharts)

Data by YCharts

If we take a broader view and assess these companies based on their price-book ratios, we can see that Meta Platforms has been trending higher for several quarters but still maintains its position as one of the cheapest stocks within this peer grouping (with a valuation metric of 8.676x). Two stocks trading at less expensive price-book valuations include Amazon (at 8.231x) and Alphabet (at 6.91x). However, in the other direction, we can actually see a broad divergence amongst the remaining companies. Specifically, Microsoft (at 10.74x) and Tesla (at 15.7x) are still trading at somewhat reasonable price-book valuations. However, companies like Apple (at 60.78x) and Nvidia (at 61.51x) are trading at significantly higher levels at the moment. As a result of each of these comparisons, we can see that Meta Platforms remains attractively valued within this peer group (even with the stock’s upward-trending valuations in some of these metrics).

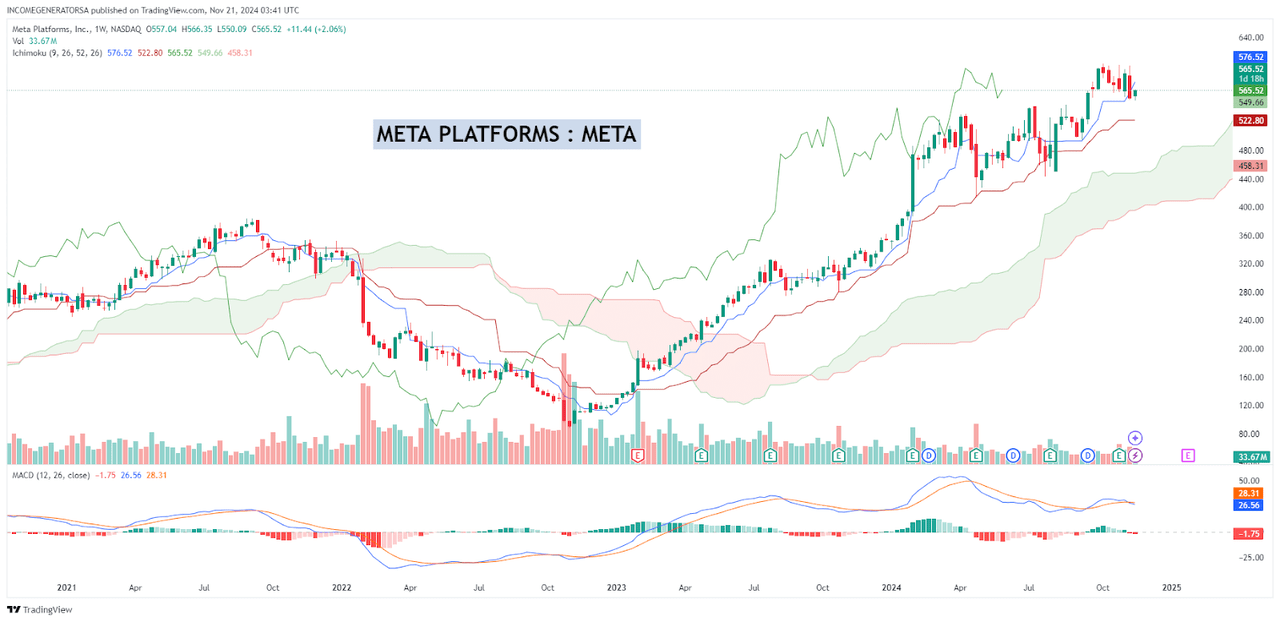

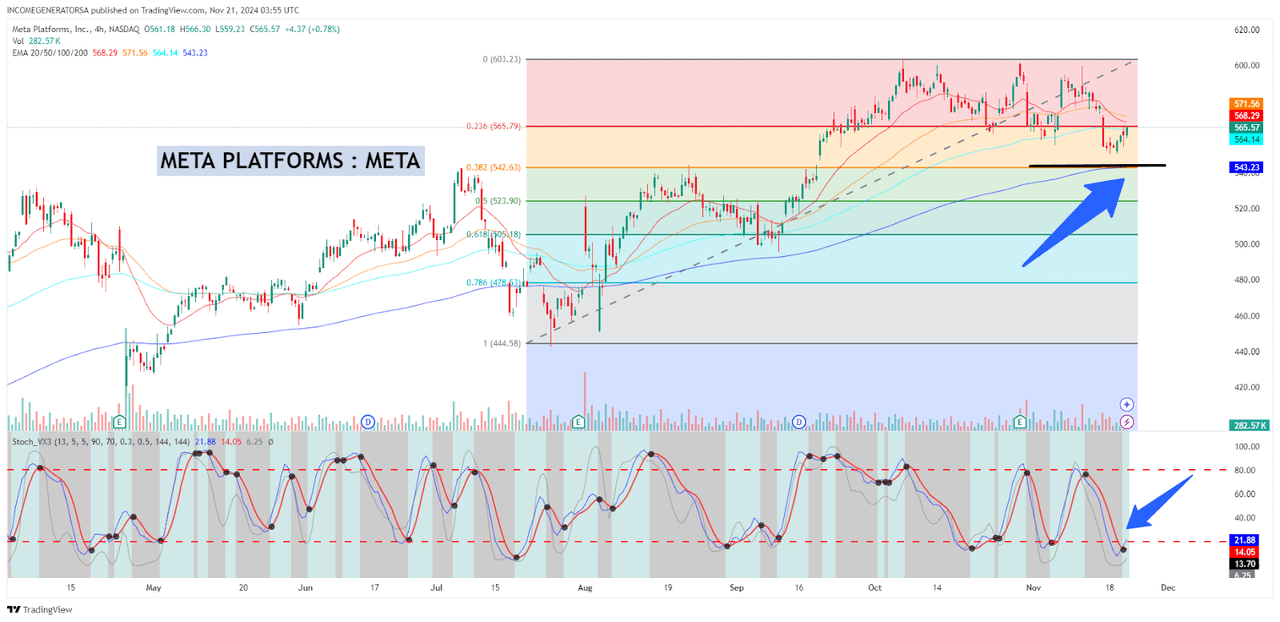

Meta Platforms: Support and Resistance Levels (Income Generator via Trading View)

In part, these attractive forward valuation metrics have been aided by recent pullbacks in share prices, and the stock is currently trading near important support levels that have developed over the last few trading sessions. Specifically, the stock has moved toward the prior highs of $544.24 (which were last seen during the August 22nd, 2024 trading session). Essentially, this price region marked a double-top resistance zone that will now be expected to work as support because this level has been broken and re-tested from the topside. Momentum readings remain positive on the longer-term weekly price charts, and this suggests that the stock might be able to form a base near these aforementioned support zones and target the triple-top resistance formation that currently resides near $603 per share.

Meta Platforms: Support and Resistance Levels (Income Generator via Trading View)

As we can see in the chart above, this pullback into the $544 level is also important because this area marks the 38.2% Fibonacci retracement of the upward trend movement from the July 25th, 2024 lows of $442.65 to the stock’s all-time highs of $602.95 (printed during the October 7th, 2024 trading session). Furthermore, this price level also marks the 200-period exponential moving average on the 4-hour timeframe and stochastic indicator readings on this timeframe are currently rolling over out of oversold territory. This strong confluence of technical signals suggests that long positions can be established in this area, while a break below this level would turn my outlook to a more sideways-consolidative stance. In order to reverse my current bullish outlook (and adopt more bearish positioning), I would need to see the stock break below the 61.8% Fibonacci retracement of the aforementioned upward trend rally (which is located near $505.30 per share). On balance, I thought Meta Platforms posted relatively strong figures during the third-quarter period, and the stock’s relative valuation metrics support the company as an attractive opportunity within the MAG-7 peer group. Now that we have seen the stock display a suitable pullback from record levels toward a well-defined support zone, I think the Meta Platforms might prove to be a solid selection for investors as we head into the final portions of 2024.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META, NVDA, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.