Summary:

- Despite undeniable industry challenges, Altria shares have returned 46% year-to-date. Surprisingly, MO shares have maintained these gains despite potential risks associated with the appointment of RFK Jr. as HHS Secretary.

- In this article, I weigh the potential risks of RFK Jr.’s MAHA campaign for Altria Group, especially given the tobacco company’s concentrated U.S. exposure.

- However, in addition to the risks, I also highlight why the appointment of RFK Jr. could actually turn out to be a net positive for Altria.

krblokhin

Introduction

I have written quite extensively about Altria Group, Inc. (NYSE:MO), the manufacturer and distributor of Marlboro brand cigarettes in the U.S., here on Seeking Alpha. Over the years, I have become somewhat more cautious given the continued high single-digit (or sometimes even double-digit) declines in cigarette volumes, the still far from mature portfolio of smoke-free products and, finally, the diminishing headroom in terms of price elasticity of demand and efficiency gains.

In my previous articles, I have disclosed that despite the undeniable challenges, I am comfortable holding a relatively large Altria position, representing around 3% of my portfolio in terms of invested capital. As I’ve explained at length, my decision to stop actively buying MO shares is largely a result of risk management in my portfolio.

Nevertheless, as a shareholder, I am of course following the performance of the company and its shares, which have performed extremely well so far this year. Since the beginning of 2024, MO shares have gained 39% in value, and if including the three quarterly dividends paid so far, the year-to-date return increases to 46%.

Admittedly, given President-elect Trump’s intention to nominate Robert F. Kennedy Jr. (RFK Jr.) as secretary of the U.S. Department of Health and Human Services (HHS), which oversees the Food & Drug Administration, FDA), the continued strong performance is puzzling.

RFK Jr. has vowed to fight chronic disease under the campaign “Make America Healthy Again” by, for example, restricting certain food ingredients, reducing the offerings of processed foods in federal programs, and curbing the influence of drug manufacturers. However, his views on tobacco in general and cigarettes in particular are not really well known – a search on the subject turned up surprisingly little.

Therefore, I think it’s a good time to assess and weigh the potential risks for Altria Group, especially given the fact that the company is de facto only operating in the U.S. However, in addition to the risks, I will also highlight why the appointment of RFK Jr. could actually prove positive for Altria.

Altria: Reckoning Looming Amid RFK Jr. Nomination? Dare To Think Differently

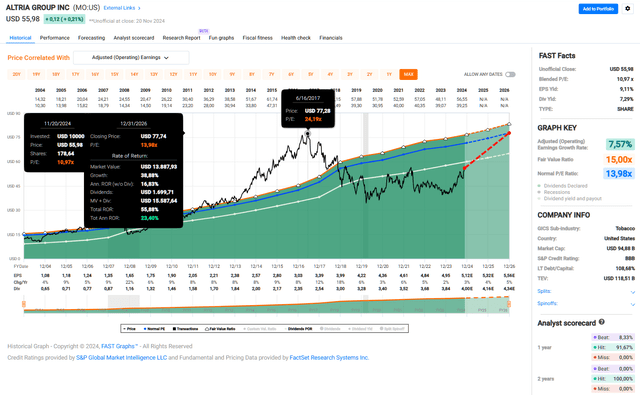

First of all, I think it is important to review the valuation of Altria shares in a historical context. MO stock reached its all-time high in mid-2017 at around $78. The decline was largely triggered by the announcement of the FDA’s Comprehensive Plan for Tobacco and Nicotine Regulation, which hinted at impending regulation of the maximum amount of nicotine allowed in cigarettes and the use of flavors, including menthol, in tobacco products. From then on, MO shares declined in a volatile pattern until they bottomed in the mid-$30s at the height of the COVID-19 pandemic in March 2020.

While it seems logical to price in regulatory headwinds after such a significant announcement, it should be added that Altria stock was clearly overvalued in 2017, trading at 24 times adjusted earnings.

However, due to increasing media coverage of a menthol ban as well as failed investments in former e-vapor leader Juul Labs, Inc. and cannabinoid company Cronos Group Inc. market sentiment increasingly turned pessimistic, which I believe is best illustrated by the long-term FAST Graph chart in Figure 1. For a long time, Altria shares traded at only about eight times adjusted earnings – despite undeniably strong earnings growth (orange and blue lines in Figure 1). The change in interest rate policy beginning in early 2022 certainly also contributed to negative sentiment, although I would argue that the expected headwinds from the FDA were a main reason for the poor performance in these years.

Figure 1: Altria Group, Inc. (MO): FAST Graphs chart, based on adjusted earnings per share (FAST Graphs)

It is quite possible that under President-elect Trump, RFK Jr. will want to accelerate the implementation of the menthol ban, as it would clearly fit well with the MAHA campaign and make a strong statement in that direction after a decision on the ban under the Biden administration was delayed only in April 2024. However, judging by the radical shift in investor sentiment since the FDA announcement in 2017, I argue that the market has long priced in a ban.

I don’t think it’s an exaggeration to say that the market is increasingly recognizing that a menthol ban will most likely not have the devastating impact on Altria that was previously anticipated. I looked at Altria’s exposure to the menthol cigarette market in a separate article and explained why, even under fairly conservative assumptions, Altria would still be able to pay its generous dividend. Only in the highly unlikely event that 100% of current menthol smokers quit would Altria’s dividend payout ratio in terms of free cash flow (slightly) exceed 100%.

One could even hypothesize that President-elect Trump’s libertarian stance is positive for Altria because, after all, smoking is a free choice decision. From RFK Jr’s statements in other contexts, I think one can conclude that he would adopt a “freedom of choice” stance. So while final passage of the menthol ban is not an unrealistic expectation, I seriously doubt that measures such as extending the smoking ban or reducing nicotine levels to trace levels are likely. They could be perceived as paternalistic by the general public and therefore at odds with the largely libertarian stance of the incoming administration.

I would even go so far as to imagine a promotion of smoke-free alternatives under the MAHA banner, which should benefit Altria. Remember, for example, that in the U.K. “free” e-cigarettes have been distributed to encourage cigarette smokers to switch to these modified-risk products. Similarly, the proliferation of oral nicotine products such as snus is thought to have a major impact on the decline in cigarette smoking in Sweden. Granted, Altria does not have the strongest smoke-free portfolio, and competitor Philip Morris International Inc. (PM) – via ZYN and IQOS – would be the main beneficiary of the presumed promotion of smoke-free alternatives in the U.S., but a tailwind for Altria should clearly not be ruled out.

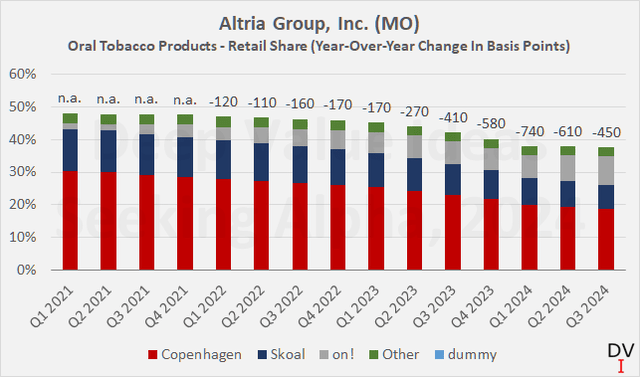

Figure 2 shows the market share of Altria’s oral nicotine products (its vaping and especially heated tobacco business is still at a relatively early stage), suggesting that the company is losing more and more share to industry leader ZYN. However, it should be noted that the gray bar representing the market share of on! is growing at a rapid pace, almost completely offsetting the decline in Copenhagen and Skoal. While the overall year-over-year decline in market share is still quite significant, the sequential changes in the second and third quarters of 2024 do indeed suggest that the bottom is near.

Figure 2: Altria Group, Inc. (MO): Oral tobacco products – retail share of individual brands (own work, based on information from company filings)

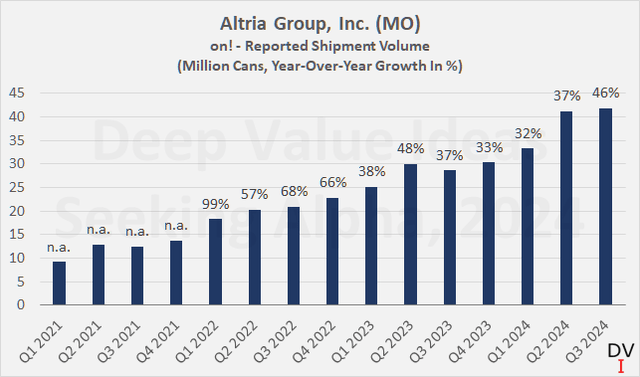

If we look at the performance of on! in absolute terms – i.e. reported shipment volumes on a quarterly basis – we can see that this oral nicotine product continues to grow at a phenomenal rate (Figure 3). If a generally perceived “healthy country” like Sweden – knowing the high adoption of oral nicotine products there – is used as a blueprint by the incoming government to promote oral nicotine products to drive smoking cessation, on! and ZYN are likely to be the main beneficiaries.

Figure 3: Altria Group, Inc. (MO): Quarterly reported shipment volume for oral nicotine product on! (own work, based on information from company filings)

However, more importantly, and this is where Altria’s e-vapor franchise NJOY comes into play, is the fact that I expect the upcoming administration to have a significant positive effect on law-abiding tobacco companies like Altria. The company’s management continues to cite significant competition from illegal e-vapor products that have not completed the required Premarket Tobacco Product Application (PMTA) process with the FDA. To date, according to Altria’s management, the crackdown on illicit products has been very limited, but with the appointment of RFK Jr. and in light of President Trump’s “America First” policy, I believe it is a realistic expectation that the distribution and sale of illicit e-vapor products will become increasingly difficult.

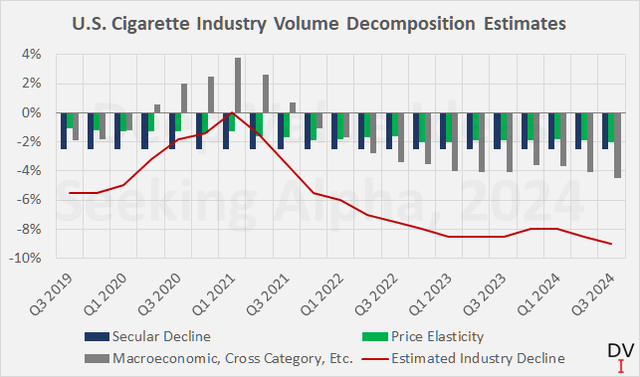

In this context, it is worth noting that Altria’s management has changed the way it breaks down its quarterly estimates for the cigarette industry volume decline with the fourth quarter and full year 2023 report. In the supplemental presentation on slide 2, Altria points to an approximate 4% contribution to the overall volume decline due to “macroeconomic, additional cross category movement & other factors“. Cross-category movements were previously reported separately.

More importantly, the figures for Q1 to Q3 2023 have been revised significantly upwards, as indicated by the “1.5% to 2.5% of cross category movement from cigarettes to e-vapor, primarily driven by illicit flavored disposable e-vapor products” mentioned in the footnotes. A crackdown on illicit flavored e-vapor products would therefore likely provide a significant tailwind for the decline rate of the cigarette industry as a whole (Figure 4), and likely add to NJOY’s already strong growth.

Figure 4: Altria Group, Inc. (MO): Quarterly U.S. cigarette industry volume decomposition estimates (own work, based on information from company filings)

However, I expect that competitor British American Tobacco p.l.c. (BTI, OTCPK:BTAFF– my articles are summarized here) would also benefit considerably from such a development, despite it being headquartered in the U.K. In addition to the expected deceleration in the combustible decline rate, BTI would benefit via its leading e-vapor franchise around the Vuse brand.

Conclusion

The year 2024 has been phenomenal for Altria investors so far, with a total return of nearly 50% year-to-date, based on MO stock’s 2023 year-end closing price. While the bull run began early in the year, the election of Donald Trump as President of the United States has pushed MO stock to levels last seen – very briefly – in early 2022 and before that in early 2019, when the trends toward combustible volume declines were much less pronounced than they are today. The headwinds emanating from smoke-free products and illegal vaping devices in particular are also still a relatively new phenomenon when taking such a long-term perspective.

One could argue that the market is increasingly mispricing MO stock in light of the potential appointment of Robert F. Kennedy Jr. as HHS Secretary and his intent to “Make America Healthy Again“. This sounds like a particularly cogent argument, especially in light of the looming ban on menthol-flavored cigarettes in the U.S., which was just postponed by the current administration in April. If the ban were to come into effect under RFK Jr., it would certainly send a clear message to the general public.

However, judging by the valuation trend of MO stock since the FDA first hinted at a menthol ban in 2017 – and of course taking into account that part of the re-rating was due to the obvious overvaluation at the time – the market has long priced in the menthol ban. I personally do not believe that the menthol ban will have a material impact on Altria’s earnings and therefore its ability to pay dividends. I explained my reasoning in a scenario-based analysis based on data from Canada, where menthol cigarettes were banned between 2015 and 2018.

In my view, the market is increasingly looking beyond the menthol ban, which I expect will eventually come into effect. The bears’ main argument for the Altria investment case is the continued significant pressure on combustible cigarette volumes, and it is certainly valid. However, an analysis of combustible cigarette volume trends shows that cross-category movement, largely due to illicit e-vapor products, is contributing significantly to the decline.

I believe it is likely that under RFK Jr. – especially in the context of Trump’s “America First” policy – there will be a successful crackdown on illicit vaping products, which will send a positive message to the general public from both health and an economic perspective. As a result, I am confident that this will lead to secondary effects that will benefit both Altria and the market leader in e-vapor, British American Tobacco. I expect the current above-average volume decline rate in combustible volumes to slow, while the already solid growth of Altria’s e-vapor franchise NJOY is likely to strengthen further. Ultimately, I believe Big Tobacco will also form an oligopoly in the smoke-free categories, primarily due to the significant barriers to entry resulting from the PMTA process and the companies’ massive economies of scale.

Nicotine pouch products, of course, are unlikely to benefit from the expected crackdown on illegal vaping products. However, if a generally perceived “healthy country” like Sweden – knowing the high adoption of oral nicotine products there – is used as a blueprint by the incoming government to promote oral nicotine products to drive smoking cessation, on! and ZYN are likely to be the main beneficiaries.

Finally, it will, of course, be impossible to accurately quantify the headwinds and benefits, but I am confident that the net effect will be positive for Altria (as well as its competitors operating in the U.S.). Therefore, I am very comfortable maintaining my “hold” rating on MO stock – despite the significant price appreciation.

Thank you very much for reading my latest article. Whether you agree or disagree with my conclusions, I always welcome your opinion and feedback in the comments below. And if there’s anything I should improve or expand on in future articles, drop me a line as well. As always, please consider this article only as a first step in your own due diligence.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MO, BTAFF, PM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: The contents of this article, my previous articles, and my comments are for informational purposes only and may not be considered investment and/or tax advice. I am a private investor from Europe and share my investing journey here on Seeking Alpha. I am neither a licensed investment advisor nor a licensed tax advisor. Furthermore, I am not an expert on taxes and related laws – neither in relation to the U.S. nor other geographies/jurisdictions. It is not my intention to give financial and/or tax advice, and I am in no way qualified to do so. Although I do my best to make sure that what I write is accurate and well researched, I cannot be held responsible and accept no liability whatsoever for any errors, omissions, or for consequences resulting from the enclosed information. The writing reflects my personal opinion at the time of writing. If you intend to invest in the stocks or other investment vehicles mentioned in this article – or in any investment vehicle generally – please consult your licensed investment advisor. If uncertain about tax-related implications, please consult your licensed tax advisor.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.