Summary:

- NIO’s 3Q24 earnings reaffirm my long-term positive sentiment. I reiterate my buy rating while disclaiming that this stock is not for the faint-hearted.

- I update my positive outlook this quarter and now expect growth to be supported by the new L60 vehicle and international expansion efforts, prioritizing profitability.

- NIO’s stock underperforms peers and the S&P500, but Beijing’s stimulus plan and economic revival efforts should benefit the EV sector in China.

- Additionally, the long-awaited focus on profitability, improved gross margins, and strategic international expansion should pay off more meaningfully next year.

- I hereon share my positive sentiment on NIO and why I see green shoots for 2025.

Neurone89/iStock via Getty Images

Investment thesis:

What was shaping up to be a good day for NIO (NYSE:NIO) got disrupted by an underwhelming outlook. Long story short, NIO reported 3Q24 earnings Wednesday before the bell, and the results make me reiterate my long-term positive sentiment on the stock. I’m now more confident that the company is better positioned to benefit from 1. the ONVO brand new L60 vehicle that should widen NIO’s presence in the broader mainstream family market and 2. management’s efforts to expand to international markets while also prioritizing profitability.

Despite a record number in EV deliveries for the quarter, up 11.6% year-over-year and 7.8% sequentially, management’s outlook for 4Q24 didn’t impress investors. The company now expects to deliver 72,000 to 75,000 units, resembling a 43.9%- 49.9% year-over-year growth rate and total revenue for the range of $2.8 billion- $2.9 billion, for 15%- 19.2% year-over-year growth but missing analysts’ expectations at $3.18 billion. The stock was down ~2% in pre-market trading due to the miss on guidance, but that didn’t last long, and the stock regained some of these losses when the stock closed ~1% higher at the end of the trading day. I mentioned this once, but there’s no harm in saying it again: NIO isn’t for the faint-hearted. The stock is down ~14% since I last wrote on NIO in mid-October. My sentiment is catered more toward the long-term investors who want to ride the wave of concern to the top.

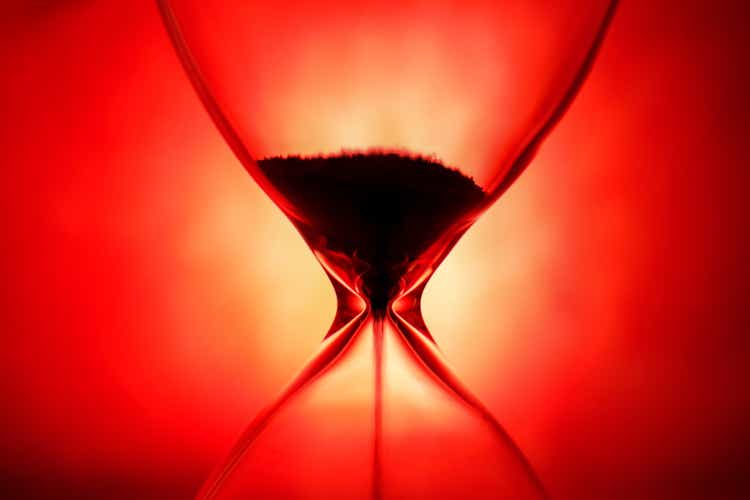

Stock performance:

NIO is currently underperforming the S&P500 and the domestic peer group on the one-month chart. The stock is down 10.9%, against the S&P500, up 1%, XPeng (XPEV) up 20%, Li Auto (LI) down ~10%, and BYD Co Ltd (OTCPK:BYDDF) down 8%.

YCharts

What I’m seeing is that NIO isn’t standing out in the red, and the drop echoes the broader struggle of Chinese stocks. I don’t think we’ll see this trend taint into FY25, particularly as the Beijing stimulus plan should act as a helping hand to the EV sector in China. I discussed this further in my previous note, but I’ll reiterate it again since it still proves relevant. The Chinese government’s efforts to revive the economy should reflect positively on consumer spending, in spite of fears of U.S. President-elect Donald Trump slapping up to 60% tariffs on all goods imported from China. Chen Zhiwu, a top finance professor at the University of Hong Kong, thinks the tariffs “might force the leadership in Beijing to have no other choice but to focus on the economy.” Since Trump’s first term and through Biden’s term, the Chinese economic growth slumped from 7% to 4.5%. This might be China’s wake-up call to focus more inward than outwards when it comes to reviving its economy.

According to Lei Xing, a Chinese auto industry expert, China is taking over the world, “except North America. The U.S. will be the last frontier.” When you think about it, the U.S. is currently merely playing catchup with China. Over the past 15 years, China rolled out a public charging network that’s over 10 million strong, used incentives and subsidies to convince billions of drivers to migrate to electric vehicles, and introduced over 100 EV brands with many pricing options. In both July and August of this year, over half of total automotive sales in China were either electric or hybrid. Back to NIO, the way I’m looking at it now is the stock remains cheap for the growth potential it has in China and abroad.

What was, is, and everything in between:

On deliveries:

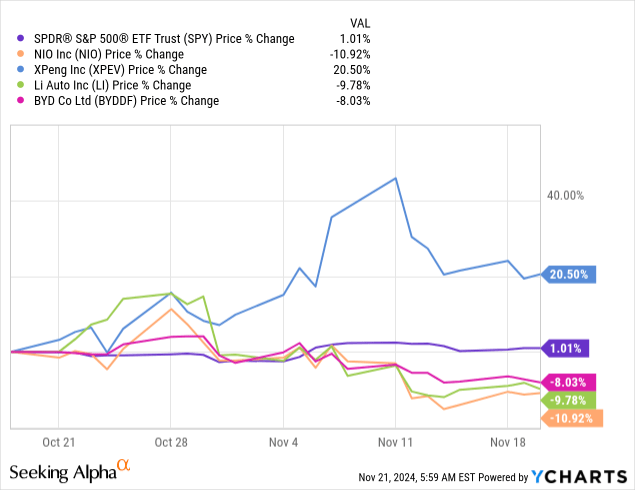

NIO posted weaker-than-anticipated revenue for the quarter, but gross margins improved, and free cash flow turned positive. The EV leader reported revenue down 2.1% year over year but up 7% sequentially, marking the second-highest quarterly revenue in NIO’s history. Regarding deliveries, NIO reported another record of 61,855 vehicles for the quarter, within its guidance range of 61,000 to 63,000 vehicles, up 11.5% year over year and 7.81% sequentially.

CnEVPost

As previously mentioned, NIO’s guidance for 4Q24 rubbed investors the wrong way. Since management is expecting deliveries in the range of 72,000 to 75,000, this guidance basically means that NIO is expected to deliver around 51,024 to 54,024 vehicles in November and December; that is, of course, considering it delivered 20,976 vehicles in October. On the latter, the company delivered 16,657 vehicles from the premium smart electric vehicle NIO brand and 4.319 vehicles from the company’s family-oriented smart electric vehicle brand ONVO.

On profitability: “From now and beyond”

For the third quarter, vehicle sales were down 4.1% year over year but up 6.5% quarter over quarter. The decline year over year was due to lower average selling prices resulting from changes in product mix, offset by higher deliveries. The sequential increase, on the other hand, is mainly due to increased delivery volume. Cost of sales was down 5% year over year but increased 5.8% sequentially. The decrease resulted from lower material costs per vehicle, and the increase was mainly due to higher delivery volume.

The company’s gross profit was also up 31.8% year over year and 18.9% sequentially. The gross margin was 10.7%, the highest since 3Q22, above the consensus of 10.6%, and higher than the 8% in a year quarter, and 9.7% sequentially. Vehicle margin was 13.1% in 3Q24, up from 11% in a year ago quarter and 12.2% last quarter, mainly due to decreased material cost per unit. I expect this to continue into 2025 due to management’s hyperfocus on profitability after the launch of the ONVO brand. According to management on the earnings call, their primary focus is to keep

Enhancing our premium brand positioning and improving our product profitability.

Starting in October, the company began dialing back on promotions and incentives, which affected their sales volume for the short term. Over the last month, however, there was a “bounce back momentum on our order backlog.” Going into next quarter, management is confident that they could realize a vehicle margin of 15% in Q4 for the new brand and 20% in 2025. I’m more concerned about next year when the company plans to continue improving vehicle margins and the supply chain. The so-called “iterations and upgrades” on the smart hardware are also expected to improve the cost structure and provide more competitive products and costs.

The L60:

The ONVO brand started delivering its first model, the L60, on September 28th, and with it entering the family market. Through aiming for that market, early results show a hit with family users thanks to “its spacious carbon ultra-low energy consumption, comprehensive safety features, and the hassle-free charging and swapping experience.” In terms of smart driving, NIO’s smart driving reached over 610,00 users, with over 78% activating the “Navigate on Pilot.” This was rolled out with L60, making ONVO the first brand to “deliver vision-based navigation guided smart driving on urban road.”

ONVO L60 is expected to hit 10,000 in December and 20,000 units by March, which is lower than market expectations but within the company’s “reasonable speed and pace.” I think what a lot of people are failing to realize is the cutting-edge technology this car will have; for instance, with 900-volt high-voltage architecture and several new technologies implemented into the vehicle, I think the brand is well within its right to take its time to cultivate high customer adoption.

Considering the long delivery time, I expect that to weigh on the short term but not the long term. Although management didn’t disclose specifics regarding the conversion rate, it gave us a taste of what it would look like. According to William Li, the company’s Founder, Chairman, and CEO:

This conversion rate is higher than any existing new product.

Valuation:

NIO has a market cap of $9.7 billion and an enterprise value of $9.98 billion. The stock price is down over 37% in the past 52 weeks, with a beta of 1.90, indicating a price volatility higher than the market average. This is not unusual for NIO, as one look at the stock’s year-to-date performance tells the story. The company continues investing in R&D and its market expansion, which, I think, is an excuse for the low profitability at the moment. Management noted that:

Regarding the R&D expenses in general, we will be having our investment in R&D for around RMB3 billion per quarter ($42.2 million) and we will be stabilizing at around that level. But because of the differences of the projects and also at the different stages of the R&D, the actual spending, there will be ups and downs in the actual spending for every quarter.

As for the next quarter, R&D expenses are expected to be higher than 3Q, and in 2025, expenses should be around $42.2 million non-GAAP. I am optimistic about management’s hyperfocus on profitability, and I am looking forward to seeing their margins pick up more meaningfully next year.

The market sentiment is cautiously positive on the stock, with around 18% of Street Analysts giving it a strong buy, 39.3% a hold, and the rest a sell. The PT mean and median have had a wild ride, to say the least. Back in late August, the PT median was $7.10, down to $6.05 in September, up slightly to $7 in October, and now stands at $6.80. The PT mean was at $7.9 in late August, down to $7.19 in September, up to $7.5, and is currently down to $7.39. I think despite the wins of this quarter, the market remains wary of NIO’s growth potential.

As for the valuation metrics, and compared to its domestic peers, NIO seems to remain relatively inexpensive at current levels. With the EV/Sales ratio (TTM) at 1.14 and EV/Sales at 1.04, NIO trades are slightly higher than Li Auto, with EV/Sales (TTM) and EV/Sales at 0.49. NIO is in line with BYD’s, with EV/Sales (TTM) at 1.08 and EV/Sales at 1.02. However, NIO remains cheaper than XPeng with EV/Sales (TTM) at 1.92, EV/Sales at 1.82, and Tesla with EV/Sales (TTM) at 11.09 and EV/Sales at 10.78.

What’s next: Globalization efforts (again)

In my last note, I watched NIO’s collaboration with UAE’s CYVN Holdings, and this quarter led me to put more weight on this collaboration. By November 28th, the first NIO house in the MENA region while sales, and delivery have already started in the UAE. Through the new products of ONVO and Firefly, the company plans to accelerate its entry into the international market. Firefly is NIO’s third and latest brand, and it’s set to make its global debut on NIO Day 2024. The first product is set to be delivered during 1H25, targeting the boutique compact car market. I think the product lineup this brand offers will further enhance NIO’s position and market reach, allowing it to cater to more customers. According to management, both ONVO and Firefly have a broader market, which is globally speaking and helps in international expansion efforts. I reiterate my buy and emphasize that this stock is truly not for the faint-hearted.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.