Summary:

- Nvidia’s Q3 2024 earnings exceeded expectations, but concerns over Blackwell chip issues and inventory shifts are affecting the forward outlook on growth.

- Revenue and gross profit are trending to nearly double FY 2024 levels, but operating expenses are trending high as well.

- Blackwell chips face overheating issues, potentially affecting adoption rates and giving rivals like AMD and Sambacore time to catch up.

- Long-term growth may be tempered, but Nvidia remains crucial in the chip industry. Meanwhile, the stock trajectory will likely offer tactical opportunities for investors in FY 2025.

David Tran

American chipmaker Nvidia’s (NASDAQ:NVDA) earnings release for Q3 2024 (or “FY 2025” in their reporting convention) wasn’t expected to be a disappointment, and it certainly wasn’t: Adjusted earnings per share (EPS) came in at $0.81 cents against an expectation of $0.75 while revenue ran at $35.08 billion versus an expectation of $33.16 billion.

However, the share price instantly plunged 2% in after-hours trading and an overall “deceleration” in share price growth is being implied. The reasons for this are somewhat complex.

Trend Drilldown

In terms of revenue, the company’s line item trends have plenty to cheer. As one drills down through different layers, however, there are some signs of dampening.

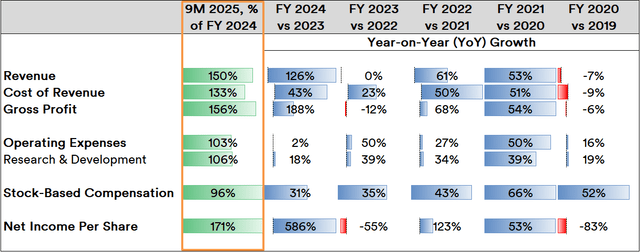

Created by Sandeep G. Rao using data from Nvidia’s Financial Statements

Note: The analytical framework here is similar to the one in the article about Nvidia’s previous earnings release.

At 9 months (“9M” or three quarters) of FY 2025, revenue and gross profit for the entirety of the Fiscal Year (FY) is trending to close at nearly twice that of the previous FY. FY 2024 itself was a landmark period wherein the stock’s massive breakout began after the balance sheet doldrums of FY 2023.

Operating expenses, on the other hand, are also poised to be about 30-40% greater than the previous year while stock-based compensation (SBC) is poised to close at around 50% higher on the back of the stock’s massive climb. Despite the company’s net income per share trend (after restating to nullify the 10:1 stock split made earlier this year) showing a comfortable doubling over the previous year, it is still very, very far from the dizzying 586% gain it posted in FY 2024.

Interestingly/unusually, the company’s earnings release this quarter leans hard on its rising success in Asia, particularly Japan and India. While legacy Asian powerhouse Japan is in the throes of transforming its industrial base, India’s vast and evolving industrial base – which has been instrumental in piling on strong Gross Domestic Product (GDP) gains for the republic over a little over the past decade – is in the midst of steadily-increasing adoption of AI for greater operational efficiency and next-generation economy-building. Both countries’ stocks have registered heightened institutional attention worldwide over the past year.

Curiously, though, the company’s much-vaunted edge via its newly developed Blackwell chip suite finds precious little mention this time beyond a statement that Foxconn will bring into operation three factories to manufacture the GB200 Grace Blackwell Superchips. The Blackwell chip suite generally is twice the size of the company’s previous offering but is purportedly 30 times faster at tasks like ChatGPT-like applications. However, industry journals report that Blackwell chips are overheating when used in datacenter servers despite iterated redesign tests of the server racks.

This might be why, unlike as of the first half (H1) of FY 2025, the company’s inventory levels have shown a somewhat drastic shift over historical trends.

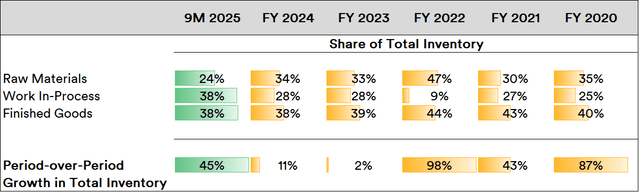

Created by Sandeep G. Rao using data from Nvidia’s Financial Statements

While finished goods remain steady in the present and near levels established over the past two FYs, the work-in-process (WIP) levels register a 36% increase over the same period while raw materials register a 29% decrease.

As previous articles about Nvidia indicated, the company has had a resolute “corporate” dominance in its client mix for well over two years now. The advantage is that demand is largely predictable and supply is planned. Potential issues in either material or architecture put a dampener on forward demand, and this might be the cause behind this new development in its inventory levels.

If Nvidia’s chips are to be considered a step ahead of the likes of its leading rivals, Blackwell would have been a second step. If Blackwell looks shaky, the likes of AMD (AMD) as well as other upstarts such as Sambacore have now gained time to level the playing field. This is the downside of gaining a “corporate” base: performance matters a little more than the “brand” while other issues can potentially be ironed out via discussions, collaborations, and joint ventures.

The company has assured investors that problems in the Blackwell suite have been ironed out already, but that remains to be determined by increasing corporate intake. As of now, Blackwell’s adoption trend is running a little light.

Market Behaviour

While analysts at large banks have been largely effusive in their praise for the company’s earnings results, they also drew parallels with convictions behind Taiwan Semiconductor Manufacturing Company Limited (TSM or “TSMC”) based on the fact that, while Foxconn might be ramping up in its contribution towards Nvidia’s product lineup, TSMC remains its core supplier.

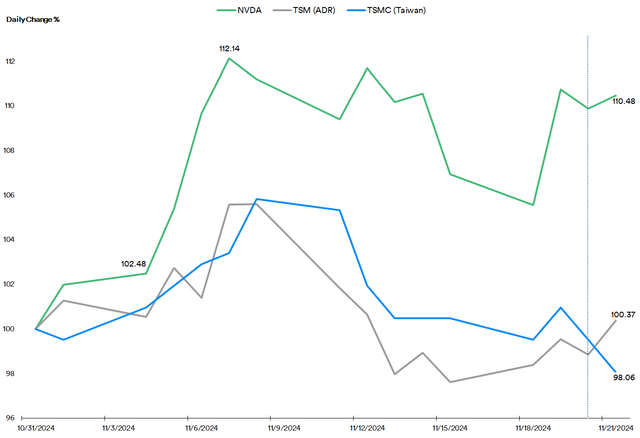

TSMC is available as an American Depositary Receipt and also traded in the bourses in its homeland Taiwan. The overall stock performance between these three tickers over the course of November has been markedly different.

Created by Sandeep G. Rao using data from Yahoo! Finance

It is immediately evident that TSMC’s” American ticker” shows substantially stronger performance over its “homeland ticker” in this period. Concerns over Nvidia’s forward outlook might have kicked in from the 8th onwards until the week of the earnings release, wherein Nvidia rose 4.8% as of the day before the earnings release. In both ADR and “homeland ticker”, TSMC didn’t perform nearly as well as Nvidia’s “tactical booms” but nearly always showed a pronounced underperformance during Nvidia’s “tactical busts”.

As of the 21st, TSMC’s “homeland ticker” was markedly different in trajectory as compared to its ADR but early trends out of Taipei for the 22nd show volumes nearly 8 times greater than that on the 21st. This might be on account of increased attention in TSMC’s ADR (which necessarily requires that the “homeland ticker” be held) on account of bank analysts’ notes about the stock, or it could be a momentary blip on the backs of Nvidia’s performance.

As it stands, Nvidia’s immediate post-earnings performance has been relatively muted.

In Conclusion

As it stands, the bulk of market conviction principally rests on the company’s Blackwell suite, which is instrumental in securing new datacenter buildouts. The company’s substantial presence in existing datacenter operations, meanwhile, would only face pressure during said datacenters’ replenishment cycles, which are highly variable. While being one step ahead of its rivals gives it an advantage currently, the lead times to replenishment cycles give its rivals an opportunity. If all issues related to Blackwell are smoothed out and client uptake is strong, there is potential for a repeat of FY 2024 in FY 2026. In FY 2025, however, it’s presently unlikely that Blackwell will have a massive presence.

Long-term holders of the stock presently might have some cause for concern: While the company has honed a knack for delivering what its “corporate” clients need, it’s not alone. Massive triple-digit-percentage Year-on-Year (YoY) growth isn’t always going to be a given. However, chips are such a fundamental part of the modern economy that it’s unlikely that the company will ever be wholly irrelevant.

Meanwhile, tactical investors in either direction of the stock’s trajectory are likely to have several field days for the rest of FY 2025.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I lead research at an ETP issuer that offers daily-rebalanced products in leveraged/unleveraged/inverse/inverse leveraged factors with various stocks, including some mentioned in this article, underlying them. As an issuer, we don't care how the market moves; our AUM is mostly driven by investor interest in our products.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.