Summary:

- NIO reported better than expected Q3 earnings, but missed on revenue on Wednesday.

- NIO achieved record deliveries in the third-quarter and improved vehicle margins to 13.1%.

- The EV maker is seeing solid momentum for its ONVO-branded EVs and is guiding for a significant ramp in deliveries until March 2025.

- NIO now targets break-even by FY 2026.

- Shares are unreasonably cheap given the significant improvements in the EV maker’s business and positive break-even outlook.

Andy Feng

NIO (NYSE:NIO) reported slightly better than expected earnings results for the third fiscal quarter on Wednesday that showed record quarterly deliveries and an improving vehicle margin trend. The EV maker also announced that it is seeing strong demand for its ONVO-branded electric vehicles and that it plans to scale deliveries up to 20,000 units per month by March 2025. The delivery outlook for Q4 is solid and implies up to 50% year-over-year delivery growth. In my opinion, NIO has considerable upside revaluation potential if it continues to ramp up deliveries and revenues in FY 2025.

Previous rating

I rated shares of the electric vehicle start-up a strong buy in my work in August — Moment Of Truth — due to an expansion in the firm’s vehicle margins and the launch of ONVO-branded EVs. NIO further improved on its vehicle margins in the third fiscal quarter, and the EV company achieved a record volume of deliveries in Q3’24 as well. NIO is also starting a new EV brand, firefly, in order to broaden its appeal to prospective EV buyers in the compact segment. What I continue to like the most about NIO is the company’s margin trend and low valuation based off of revenue.

NIO’s Q3: strong delivery momentum, higher vehicle margins

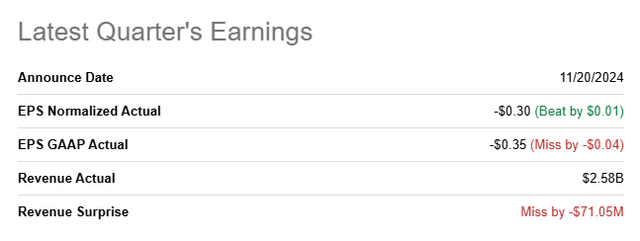

NIO reported adjusted earnings of $(0.30) per-share for the third-quarter, which beat the consensus estimate by $0.01 per-share. The top line came in at $2.58B, which missed the average prediction by $71M.

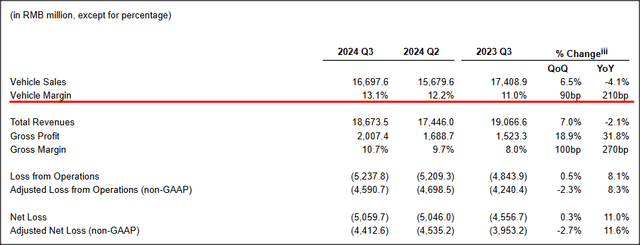

NIO achieved total revenues in the third-quarter of 18.7B Chinese Yuan ($2.67B), showing 7% quarter-over-quarter growth, which was driven mainly by an increase in deliveries and a broadening product portfolio.

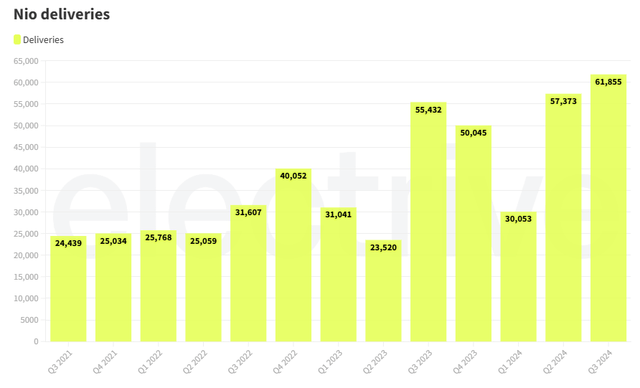

In Q3’24, NIO delivered 61,855 electric vehicles, showing a year-over-year growth rate of 12%. October was also the sixth straight months in which deliveries exceeded the monthly mark of 20,000 units. NIO’s total Q3’24 deliveries of 61,855 EVs included 832 ONVO-branded electric vehicles, while in October ONVO deliveries totaled 4,319 units.

ONVO is a new low-price electric vehicle brand that NIO started in order to accelerate its delivery growth while offering consumers a more affordable EV solution. NIO started to deliver ONVO-branded EVs only in September, but market demand for these new lower-cost electric-vehicles seems to be strong: as of November 14, 2024 ONVO delivered a total of 7,000 L60 SUVs. The company plans to scale its monthly L60 deliveries to 10,000 by December and then grow this delivery volume to 20,000 units per month by March 2025.

Favorable vehicle margin trend

NIO is generating higher margins in its core EV business, which is a trend that started in the first half of 2023. Since then, NIO has successively improved on its vehicle margins which reached 13.1% in the September quarter, mainly due to improving production cost efficiencies.

In the third quarter, NIO expanded its vehicle margins by 90 basis points quarter over quarter, reaching the highest point since Q4’22. For comparison, XPeng (XPEV) and Li Auto (LI) generated vehicle margins of 8.6% and 20.9% in the September quarter. Therefore, Li Auto remains the most efficient EV company in the electric vehicle start-up group in terms of margins, and the EV company is also the only company here that is already profitable. NIO is currently targeting to reach breakeven in FY 2026.

NIO also announced the launch of a new brand, firefly, which is meant to focus exclusively on the compact segment, which is expected to see its first product launch in the first half of 2025. It would be the third brand, after NIO and ONVO, and it could be a lever for delivery growth for the EV company going forward as consumers become more price-conscious.

NIO’s Q4 guidance

The delivery outlook for the fourth-quarter was solid, in my opinion, especially because ONVO is seeing a significant production ramp. For the fourth-quarter, NIO expects to deliver 72,000 and 75,000 electric vehicles to customers, which would represent a year-over-year growth rate of 43.9% to 49.9%. Based off of this projected delivery volume, NIO would be set to achieve total revenues in the range of $19.7-20.4B Chinese Yuan ($2.8-2.9B) which implies a year-over-year growth rate of up to 19%.

NIO’s valuation reflects deep value for investors

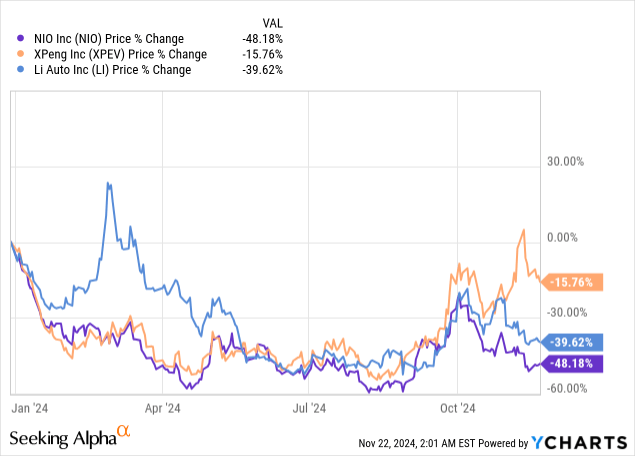

NIO’s shares are cheaply valued in large part because investor concerns about Chinese companies and a slowdown in the EV market have heavily weighed on valuations after the pandemic.

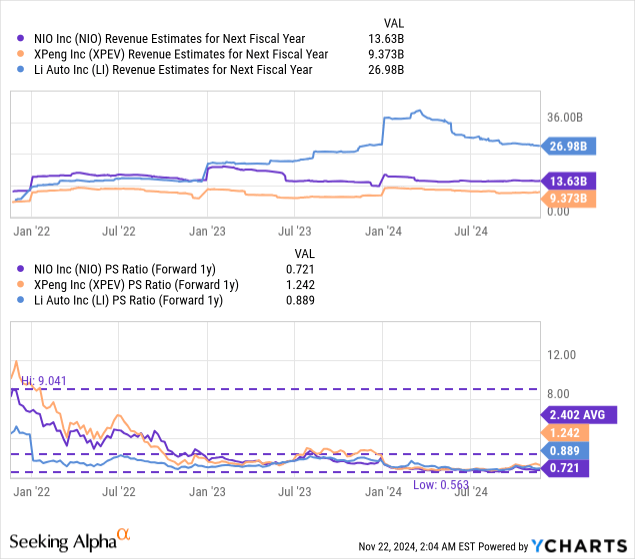

NIO is currently valued at a price-to-revenue ratio of 0.72X, which compares against a 3-year average P/S ratio of 2.4X. Li Auto (LI), which is by far the most profitable EV start-up (excluding BYD, which is not a start-up), is trading at a price-to-revenue ratio of 0.89X.

Li Auto is also growing faster than any other of the industry group start-ups discussed here: Li Auto deliveries surged 45% in the third-quarter, compared to 12% for NIO and 16% for XPeng. Li Auto’s industry group-leading vehicle margins and stronger than average delivery growth are the reasons why I believe Li Auto represents the deepest value for investors, especially with the P/S ratio being as low as it is: Strong EV Choice, Low Price.

In my last work on NIO, I said that I saw a fair value multiplier, based off of revenues, of 1.5X for the EV company. Since NIO continued to improve its vehicle margins in the third-quarter and expects a solid increase in deliveries in Q4’24, I continue to believe that this is a reasonable valuation ratio for NIO, especially with the company now guiding for break-even in FY 2026 as well. A 1.5X P/S ratio implies a fair value of $9.80 per-share… which means shares of NIO could double their price and I would not see the EV maker as overvalued.

Risks with NIO

I have said before that NIO’s focus on lower-cost EVs poses a potential margin challenge for the electric vehicle company and I still believe that growing margin pressure — mainly because of growing competition that is forcing the release of lower-cost/margin electric vehicles — is the most significant risk for EV start-ups. What would change my mind about NIO is if the company were to see a reversal of margin gains as it ramps up ONVO-branded production and deliveries. What would also negatively influence my opinion on NIO is if the company were to delay its profitability targets beyond the target date of FY 2026.

Final thoughts

NIO beat EPS estimates for earnings and continued to see sequential margin improvements. LI Auto is still leading the EV start-up group with its vehicle margins, but NIO’s trend is nonetheless very positive. What is also positive is NIO’s consistency in deliveries recently — achieving six straight months of deliveries exceeding 20k units per month. ONVO-branded EVs are surging, and the company is seeing a favorable delivery trend here, with deliveries expected to scale to 20k per month by March 2025. Finally, the outlook for Q4 is positive and investors can expect to see up to 50% Y/Y delivery growth, with ONVO being a key catalyst. Shares of NIO are undervalued and could easily double as the company works its way towards profitability.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NIO, LI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.