Summary:

- Rivian’s JV agreement with Volkswagen boosted investor sentiment, but the gains from the announcement have dissipated.

- Rivian faces more intense regulatory and competitive headwinds as Trump takes office.

- Rivian’s unprofitability and high capex requirements through 2026 suggest market uncertainties are expected to linger on.

- I argue why RIVN’s ability to demonstrate a more robust production and delivery ramp profile is crucial to lift investor sentiment.

- Unless RIVN shows a clearer path to profitability, investors must be careful to avoid chasing the upward surges.

hapabapa

Rivian: November Gains Nearly Dissipated

Rivian Automotive (NASDAQ:RIVN) investors have failed to shake off the market’s anxieties over its growth profile as RIVN’s recent post-earnings gains dissipated. Notably, investor sentiment was lifted markedly as the Rivian-Volkswagen (OTCPK:VWAGY) partnership was strengthened, sending RIVN soaring. However, the lack of follow-through suggests buyers remain uncertain over whether the additional investments by the German automotive leader could be sufficient to improve Rivian’s operating performance.

As a reminder, both companies have finalized their agreement to form their joint venture officially, with an expected total deal size of up to $5.8B. It’s an improvement from the previously announced $5B investment, corroborating Volkswagen’s confidence in Rivian’s software stack and electrical architecture. As a result, it has significantly improved Rivian’s near-term financial conditions and liquidity profile, paving the way for the company to launch its R2 SUV sometime in FY2026.

In my previous Rivian article, I urged investors not to fall in love with the stock, even as it has plunged deep into a bear market from its July 2024 peak. I raised concerns over the EV maker’s profitability metrics, potentially impacted by its ability to ramp production sustainably. In Rivian’s recent Q3 earnings release in early November 2024, the company highlighted continued efforts to mitigate the inventory charges as it seeks to improve its operating efficiencies. It has also communicated its ability to improve revenue per vehicle while lowering its costs for the Gen 2 version of its core R1 model. The EV maker has also secured up to 85% of the bills of materials used for its lower-cost R2 SUV while also aiming to lower the costs of its Gen 2 R1 model by 45%. Hence, these reduced cost projections seem to have provided a more straightforward path to profitability for Rivian as it seeks to rejuvenate its growth drivers.

Production And Regulatory Headwinds Await Rivian

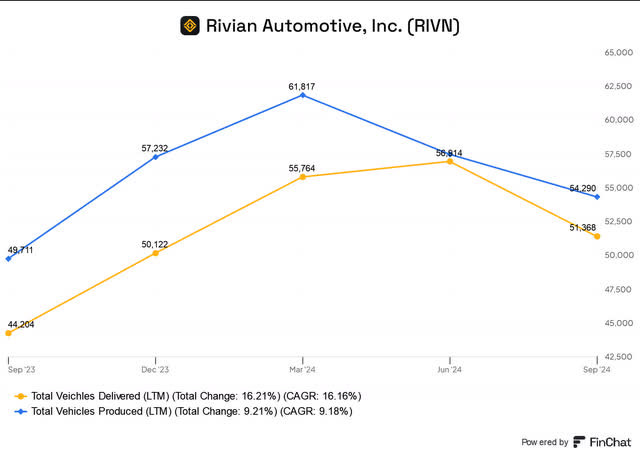

Rivian TTM delivery and production metrics (FinChat)

As seen above, Rivian’s delivery and production performance has faltered over the past two quarters (on a trailing twelve-month basis). It aligns with management’s commentary, suggesting the impact of more intense competition and macroeconomic headwinds.

In addition, the incoming Trump administration has also elevated perceived challenges relating to the EV tax credits and regulatory credits pricing critical to supporting Rivian’s production scale. Rivian reportedly relied on about 42% of leased sales in Q3, underpinning the criticality of the EV purchase tax credits. Hence, I assess that the market has likely lowered its confidence in Rivian’s ability to compete more effectively while fending off renewed challenges from EV leader Tesla (TSLA).

TSLA’s Cybertruck orders have surged as the Elon Musk-led company seeks to establish its credential in a new growth vector. In addition, Tesla has significant scale advantages against Rivian’s lower-priced R2 SUV, which remains a long-term situation, launching in 2026. Therefore, it seems unlikely that Rivian’s operating performance could improve markedly in the near term as assessed interest rate headwinds have been lifted since Trump won the presidential election in early November 2024. As a result, I determine that unless Rivian can convince the market of more robust growth momentum in its commercial EDV opportunities beyond its partnership with Amazon (AMZN), a further valuation re-rating could prove to be an uphill battle.

RIVN Stock: No Clear Path To Sustainable Profitability Yet

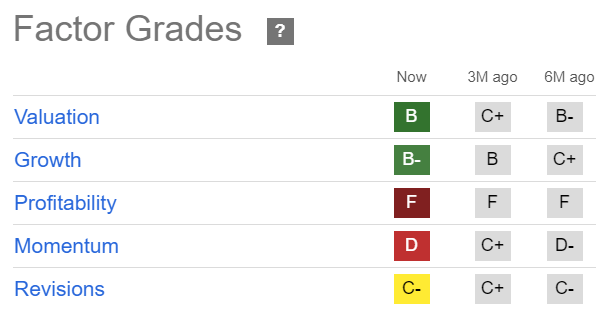

RIVN Quant Grades (Seeking Alpha)

RIVN’s relatively attractive “B” valuation grade must be assessed with reference to its unprofitability thesis (“F” profitability grade). Although management articulated its confidence in reaching positive gross margins by the end of 2024, the company is expected to continue incurring massive capex requirements through 2026 (estimated $4.3B from FY2024-26).

Downgraded Wall Street’s estimates on Rivian corroborate my caution as the company isn’t expected to reach free cash flow profitability through the FY2026 forecast period. In addition, the Volkswagen partnership should not be construed as “free money” given the requirements to satisfy qualifying milestones. While Rivian’s Q3 total liquidity profile of $8.1B suggests no imminent cash flow challenges, the subsequent R2 ramp could introduce more pressing operational issues. Moreover, Rivian has not fully resolved its supply chain headwinds as of Q3, underscoring the persistent difficulty engulfing its ability to scale more effectively.

Consequently, I assess that the market’s optimism on RIVN has soured, notwithstanding its improved valuation profile over the past three months (from “C+” to “B” grade). Accordingly, RIVN’s momentum has been downgraded to a “D” grade, highlighting the lack of sustained buying sentiments on the unprofitable EV stock.

Is RIVN Stock A Buy, Sell, Or Hold?

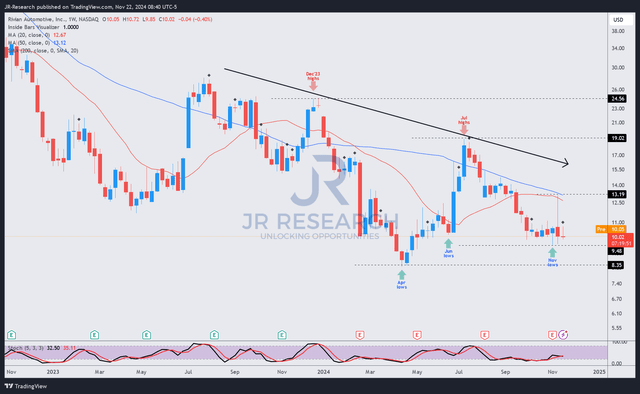

RIVN price chart (weekly, medium-term) (TradingView)

RIVN’s price chart indicates a clear structural downtrend with a series of lower-high price structures corroborating its weak buying momentum. While selling sentiments seem to have subsided as RIVN consolidates above its November 2024 lows ($9.5 level), I’ve not assessed a solid buying proposition for the stock.

Furthermore, the reversal last week after the joint venture announcement suggests buyers weren’t confident in hanging on to their gains, lowering the opportunistic return of momentum-driven buyers. Therefore, I assess that Rivian must demonstrate a more robust delivery and production ramp profile over the next four quarters to justify a valuation re-rating.

Rating: Maintain Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!