Summary:

- Caterpillar’s resilience against cyclical headwinds is impressive, driven by innovation, a strong balance sheet, and a commitment to shareholder value.

- Despite short-term revenue declines, Caterpillar’s focus on AI, connected assets, and digital tools positions it for long-term growth.

- Strong dividend growth and aggressive buybacks enhance shareholder value, with a 31-year streak of dividend hikes and a healthy payout ratio.

- Caterpillar’s ability to adapt to long-term trends like AI power demand and potential cyclical upswing suggests continued solid returns.

Ekaterina Kiseleva

Introduction

“Cyclical headwinds.“

I have used these two words in many articles this year, as big parts of the economy did not enjoy the benefits that came with artificial intelligence and other secular trends.

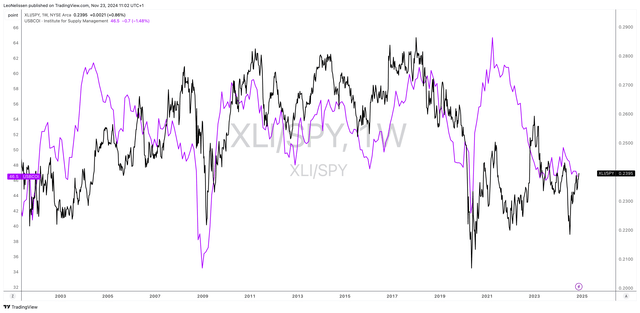

This includes the industrial sector, which has underperformed the S&P 500 in recent years, pressed by leading indicators like the ISM Manufacturing Index.

The chart below compares the ratio between the industrial ETF (XLI) and the S&P 500 (black line) to the ISM Manufacturing Index. As we can see, the market simply “didn’t care” for cyclical industrials.

TradingView (XLI/SPY Ratio, ISM Manufacturing Index)

With that said, some companies were surprisingly strong. This includes Caterpillar (NYSE:CAT), a very cyclical company due to its massive footprint in construction, resources, and energy/transportation.

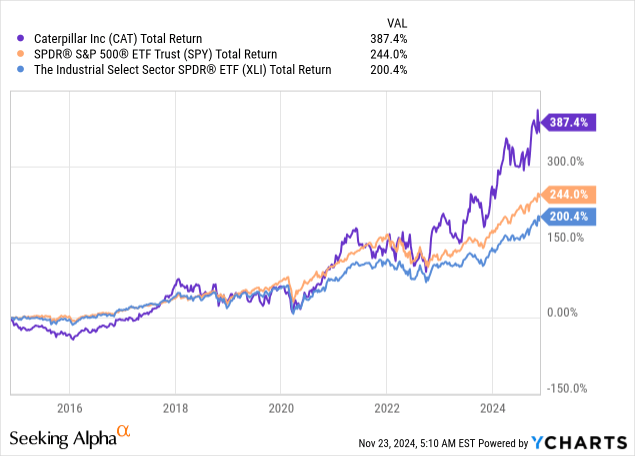

Caterpillar has returned close to 390% over the past ten years, beating the tech-heavy S&P 500 and its industrial peers by a wide margin!

My most recent article on the company was written on August 20, titled “Dividend Resilience: Unveiling Caterpillar’s Secret Sauce.” Since then, shares have returned another 16%, ten points more than the Standard & Poor’s 500.

I am currently up 200%, excluding dividends.

In this article, I’ll update my thesis, using its latest earnings, an important HQ visit of Goldman Sachs with Caterpillar, and other major developments that explain why this yellow machinery giant continues to surprise investors.

So, let’s get to it!

There’s Cyclical Weakness

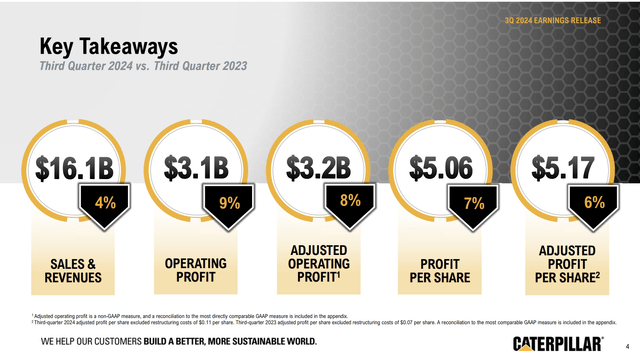

While its stock price may suggest something else, Caterpillar is not immune to cyclical headwinds. Its 3Q24 earnings perfectly reflect this, as the company reported 4% lower revenues, a 9% decline in operating profits, and a 6% decline in adjusted earnings per share.

To add some details, sales to users in Construction Industries fell by 7%, with significant weakness in North America due to reduced rental fleet loading and other cyclical headwinds. However, the good news is that its dealers’ rental fleet continued to grow.

Sales in Resource Industries dropped 18%, which reflects softness in mining and heavy construction. According to the company, declines in articulated and off-highway trucks were significant contributors.

However, the company reported high product utilization rates, low numbers of parked trucks, and strong rebuild activities, which is a good indication of continued strong aftermarket demand. I expect that to last, as commodities are still at somewhat elevated levels.

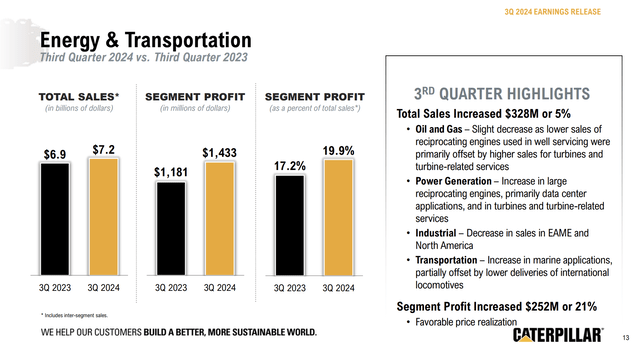

Meanwhile, in Energy & Transportation, revenue was up 5%, supported by secular growth in power generation from data centers thanks to AI and cloud computing. Moreover, sales of turbines and turbine-related services in oil and gas were strong. I expect this momentum to speed up if we get a bottom in oil and gas prices in the months ahead.

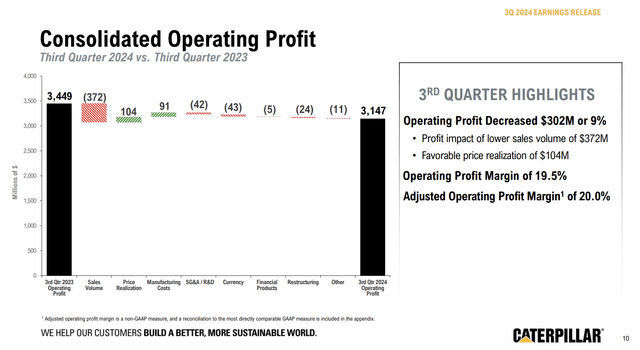

In general, we see that volume was the biggest headwind, as the $372 million sales volume headwind more than offset the gains from better pricing and lower manufacturing costs.

This resulted in a total operating profit decline of $302 million, which translates to the 9% contraction I already briefly mentioned.

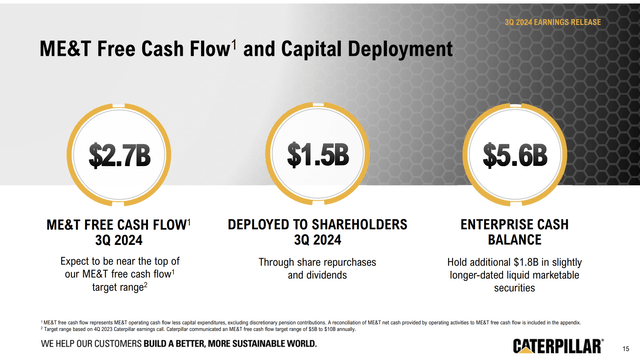

The good news is that while cyclical headwinds are an issue, Caterpillar’s balance sheet is not something we need to worry about, as the Dividend Aristocrat has $5.6 billion in cash and an additional $1.8 billion in marketable securities. It also generated $2.7 billion in ME&T (machinery, energy, and transportation) free cash flow, enough to cover the $1.5 billion it spent on dividends and buybacks, but more on that later.

In addition to generating free cash flow close to the top of its guidance range, the aforementioned balance sheet comes with an A rating from S&P Global.

With that said, there’s much more to it, including an upbeat outlook and a lot of secular growth.

Caterpillar’s Future Remains Bright

Looking ahead, Caterpillar revised its full-year sales outlook slightly lower due to weaker-than-expected performance in the third quarter and adjustments in dealer rental fleet loading within Construction Industries.

However, the good news is that the company reaffirmed its expectation for full-year adjusted operating profit margin to exceed the high end of its target range.

Free cash flow guidance was also raised, with expectations now near the top of the $5 billion to $10 billion range. That’s a big deal, as it’s all about earnings and free cash flow generation. After all, free cash flow is tangible cash that can be used to invest in the business and reward shareholders.

Moreover, I like the company’s outlook of potentially bottoming demand in key areas. This includes Resource Industries. While machine volume declines are expected to continue, the rate of decline is set to moderate.

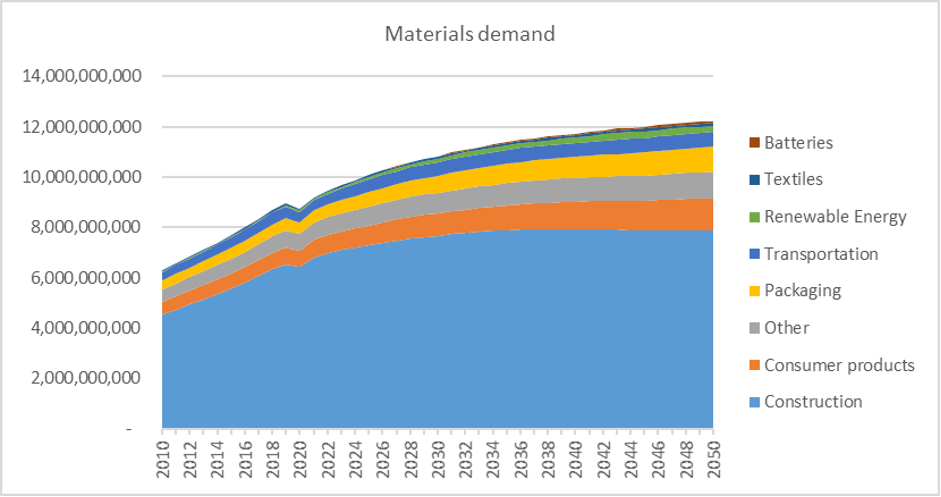

Going forward, Caterpillar sees opportunities in rebuilding activities, autonomous solutions, and the energy transition, which could increase commodity demand and drive growth. This includes commodities like copper and lithium, which require substantial mining investments to satisfy future demand.

Using World Economic Forum expectations (based on Rystad Energy data), total “materials” demand is set to double in the 2010-2050 period, mainly field by non-construction industries.

World Economic Forum

On top of that, the company is a winner of the AI trend, which includes powering data centers. These data centers need efficient engines. The same goes for mining trucks and oil and gas customers who need engines to power commodity production operations.

Hence, the company announced plans to boost the production capacity of large reciprocating engines by 125% compared to 2023 levels.

With that said, earlier this month, the company had a call with Goldman Sachs, which included a broader review of the business and some fascinating intel.

CEO Jim Umpleby, who has been at the top of the Texas-based company since 2017, has tripled the company’s earnings so far. One reason is the company’s biggest focus on underperforming products. As obvious as this may sound, the company has challenged its managers to either massively improve lagging products or divest them.

It has also implemented an enterprise component strategy, which focuses on the lifecycle value of every machine and engine component. This includes making careful decisions about the supply chain based on questions like: does it make sense to produce certain parts in-house, or should they be acquired for suppliers?

This has improved cost-efficiency and improved the company’s aftermarket position. After all, selling a machine is just one way Caterpillar makes money. Aftermarket sales and maintenance operations are where long-term profits are generated.

Moreover, we can expect a bigger focus on buybacks and dividend growth, as Caterpillar has made clear that it is not necessarily looking to use M&A to grow. While it is open to buying growth when it sees attractive opportunities, it has the capabilities to innovate in-house.

But having said that, we’re very open to M&A, but we’re not out elephant hunting because we have to grow. As I mentioned earlier, we have — we believe, a significant number of organic growth opportunities, which we are pursuing. You mentioned the one acquisition we made in the oil and gas space. I think when we — when we bought SPM, we were oil and gas, I believe that as we’re negotiating that and finalizing the deal, oil prices actually went negative. That was the week that that happened. So not bad timing. – CAT Special Call

This includes innovations like remote control of machines to address labor shortages and customer operating efficiencies.

While these innovations won’t offset cyclical headwinds, they improve the company’s chances to accelerate sales growth in strong economic times, as it is a strong incentive for customers to upgrade their equipment. It’s similar to a smartphone producer suddenly releasing a phone with capabilities that are completely new and helpful. This is likely to accelerate the replacement cycle.

Even better, because the company now has 1.5 million connected assets, it collects a ton of data. Using AI and advanced analytics, it can turn this data into valuable insights that help it improve products, allow for predictive maintenance, and reduce downtime losses for customers.

These innovations are available, as the company has doubled its per-unit profits over the past seven years, despite 2-3% average annual growth in end-market demand.

To add some number, by 2026, the company aims to grow its parts and service revenue to $28 billion. That would be up from $14 billion in 2026. Last year, it reached $23 billion.

In order to reach this target, the company is actively working with customers to sell them more innovative equipment, while actively onboarding new customers, with a focus on areas it has somewhat neglected in the past. Neglected areas include smaller customers with up to 20 machines. By using digital capabilities, it becomes much cheaper for dealers to go after these smaller players.

Where’s The Shareholder Value?

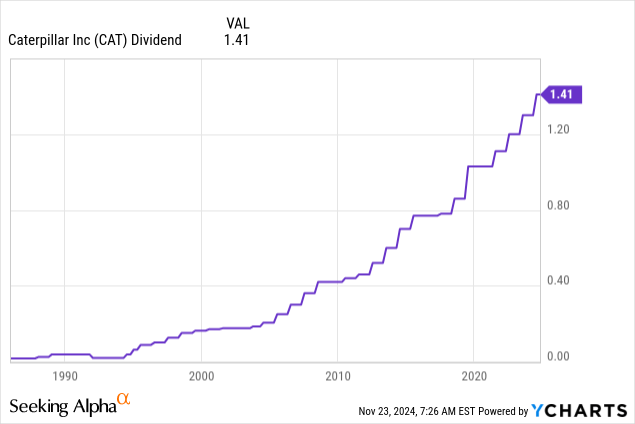

Caterpillar is a Dividend Aristocrat.

It has hiked its dividend for 31 consecutive years.

Currently, the machinery giant yields 1.4%. This dividend comes with a very healthy payout ratio of just 25% and a five-year CAGR of 7.5%. Its most recent hike was 8.5% on June 12.

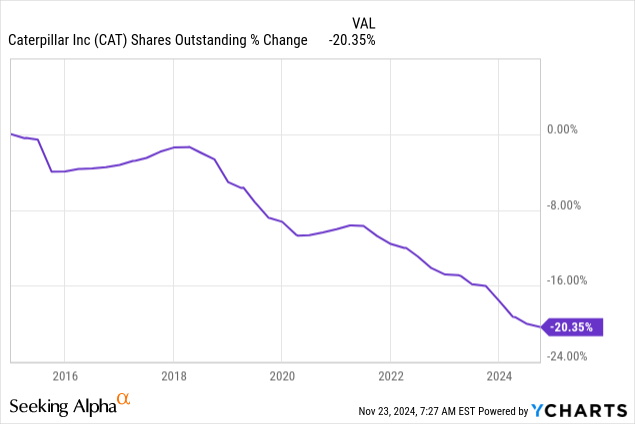

Additional cash is put to work through buybacks. Over the past ten years, Caterpillar has bought back a fifth of its shares. While these buybacks do not end up putting cash in shareholders’ pockets (at least not directly), they significantly improve the per-share value of the company, which has helped it to outperform the S&P 500 in the past.

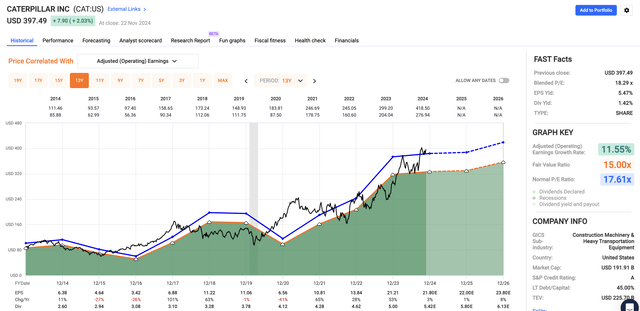

With regard to its valuation, CAT is trading close to its all-time high with a blended P/E ratio of 18.3x, a bit above its long-term average of 17.6x.

Using the FactSet analyst data in the chart above, analysts expect 1% and 8% earnings per share growth in 2025 and 2026, respectively.

Based on current expectations, this implies a fair stock price of roughly $420, 6% above the current price.

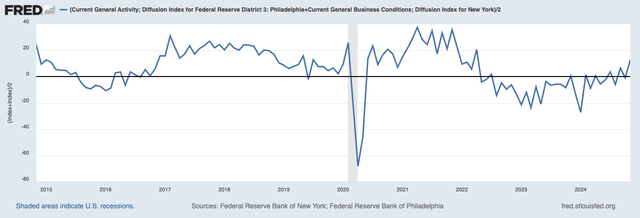

The good news is that we are seeing very positive developments. Leading indicators like the Empire State and Philadelphia Fed manufacturing surveys show upside momentum in business expectations. This hints at a bottom in the ISM Manufacturing Index, further fueled by the election of President Trump, which is expected to trigger broader economic growth.

Federal Reserve Bank of St. Louis

While it is not yet visible in earnings expectations, I believe this could provide upside in a wide range of leading indicators and keep Caterpillar’s rally going.

That’s why I remain bullish, expecting the company to maintain double-digit annual returns for the foreseeable future.

Takeaway

Caterpillar’s resilience in the face of cyclical headwinds remains impressive.

Despite some short-term challenges like cyclical weakness, the company’s focus on innovation, a strong balance sheet, and its commitment to shareholder value put it in a great spot for long-term growth.

Moreover, with a healthy dividend, aggressive buybacks, and strong growth in service revenues, Caterpillar is poised to continue delivering solid returns.

Hence, I believe the company’s ability to adapt and capitalize on long-term trends like AI power demand and the potential tailwind from a cyclical upswing makes it likely we will see a continuation of this rally.

Pros & Cons

Pros:

- Strong Dividend Growth: As a Dividend Aristocrat with 31 consecutive years of dividend growth, Caterpillar offers reliable dividend growth (7.5% CAGR over 5 years) and a healthy payout ratio (25%).

- Innovation & Expansion: The company is leveraging AI, connected assets, and digital tools to boost efficiency and expand its aftermarket services, positioning it for long-term growth.

- Resilient Business Model: Despite cyclical headwinds, Caterpillar’s focus on key industries with secular growth allows it to weather downturns and capitalize on secular trends.

Cons:

- Cyclical Risks: CAT’s performance is tied to cyclical industries, making it prone to economic downturns.

- Valuation Risks: Although CAT’s valuation offers an upside, any significant economic slowdown could pressure earnings and limit stock performance.

- Competition: While CAT has built a moat for itself, competition is always a factor, including from Asian and German exporters.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CAT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.