Summary:

- NVDA continues to regard SMCI as a key partner during the ongoing data center capex boom, with it signaling further excellence in its future sales.

- SMCI’s ability to onboard a new auditor implies a potential reversal, as similarly observed in the stock’s near doubling from the mid November 2024 bottom.

- These developments suggest that SMCI’s FQ1’25 Business Update numbers may be reliable to a large extent, lending strength to its high growth investment thesis.

- This is significantly aided by the cheap FWD PEG non-GAAP ratio and the excellent capital appreciation prospects over the next few years.

- Even so, SMCI’s ability to complete its 10Q and 10K filings on time is crucial to avoiding delisting and restoring investor trust, with the next three months being highly critical.

10’000 Hours

SMCI May Be On The Path Towards Redemption – If All Things Fall In Place

We previously covered Super Micro Computer, Inc. (NASDAQ:SMCI) in early November 2024, discussing the numerous events that had contributed to the stock’s meteoric rise and fall thus far.

Given the numerous headwinds reported in October and November 2024, we had downgraded the stock to a Hold instead, with us preferring to watch out for the upcoming FY2024 10K and FQ1’25 10Q filing, along with the onboarding of the new auditor for more clarity.

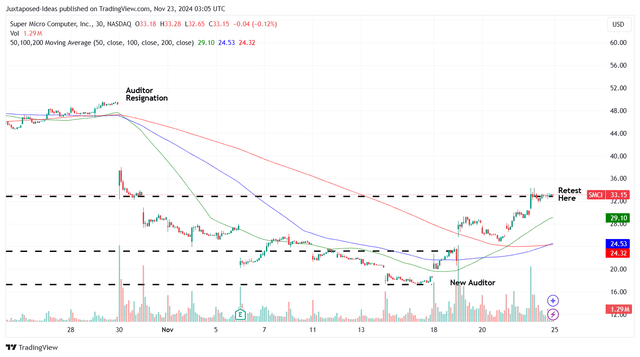

SMCI 1M Stock Price

Trading View

Since then, SMCI has seemingly found a floor at the $18s by mid November 2024, after losing -67.1% of its value since the news release of the delayed FY2024 10K filing in late August 2024.

At the same time, the stock has also enjoyed a near doubling recovery upon numerous catalysts, one being the recent Nvidia (NVDA) earnings call on November 20, 2024.

Jensen Huang has given a quick shout out to SMCI during the recent earnings call, with it implying their still intact long-term partnership, no matter the recent redirection of orders:

And we’ve got great partners, everybody from, of course, TSMC and Amphenol, the connector company, incredible company, Vertiv and SK Hynix and Micron Spill, Amkor and KYEC and there’s Foxconn and the many the factories that they’ve built and Quanta and Wiwynn and gosh, Dell and HP and Super Micro, Lenovo and the number of companies is just really quite incredible, Quanta. (Seeking Alpha)

Naturally, everything really hinges on SMCI’s ability to convince the market and the shareholders that there have been minimal issues in its accounting methods, perhaps merely a misunderstanding between the Taiwanese management team and the American accounting firm.

Here is where things get interesting.

By November 18, 2024, SMCI has already successfully engaged another accounting firm, BDO USA as its auditor, effective immediately.

While this particular company may not be part of the US Big Four accounting firms, namely Deloitte, Ernst & Young [EY], KPMG, and PricewaterhouseCoopers [PwC], it is important to note that BDO USA is the US member of the international BDO network of independent member firms, with the latter bring the fifth largest accounting firm in the world.

This development highlights numerous tailwinds for SMCI indeed, since it lends credibility to the company’s ability to complete the FY2024 10K and FQ1’25 10Q filing, potentially avoiding another delisting.

One, it goes without saying that the successor firm, BDO USA, has been rather brave, given the challenging task related to the critical examination of SMCI’s governance and financial numbers – one which has contributed to EY’s relatively public (and painful) resignation in October 2024.

This is on top of the potential backlash BDO USA may suffer from the new partnership with SMCI, attributed to the latter’s prior delisting in 2018 and $17.5M penalty related to its accounting practices in 2020.

Two, given SMCI’s relatively colorful past, we believe that BDO USA may have completed their due diligence in cross examining the company’s finances while engaging with the top management/ suppliers/ consumers.

This is on top of reviewing the concerns raised by EY, potentially in person, with the latter bound to “bring to the attention of the prospective accountant any matters of which they should be made aware,” as part of the hand over process prior to the acceptance of the new role.

Given these two critical points, we are leaning on the possibility that SMCI may be able to overcome the accounting headwinds, without having to restate “its quarterly reports for the fiscal year 2024 ending June 30, 2024, or for prior fiscal years.”

At the same time, we concur with the management in that “this is an important next step to bring our financial statements current,” with it signaling a fresh new start for the company.

This development implies that SMCI’s FQ1’25 Business Update numbers may be reliable to a large extent, with the FQ2’25 numbers merely impacted by the shifted orders and minimal Blackwell availability – one that may be drastically improved by 2025, as similarly guided by NVDA:

Blackwell production is in full steam. In fact, as Colette mentioned earlier, we will deliver this quarter more Blackwells than we had previously estimated. And so the supply chain team is doing an incredible job working with our supply partners to increase Blackwell, and we’re going to continue to work hard to increase Blackwell through next year. (Seeking Alpha)

While it remains to be seen how things may conclude, we believe that the SMCI management has been effectively communicating its path forward, through the recent Business Update along with the prompt appointment of the new auditor.

With the review process likely ongoing, investors may want to closely monitor the company’s upcoming news releases moving forward.

So, Is SMCI Stock A Buy, Sell, or Hold?

This is a very difficult question to answer indeed.

On the one hand, SMCI remains overly discounted at FWD PEG non-GAAP ratio of 0.28x, with it pointing to its high growth and capital appreciation prospects upon the reversal in market sentiments.

If anything, the quick shout out by NVDA’s top management further exemplify its potential to execute a successful turnaround, significantly aided by SMCI’s expanded manufacturing capacity and the unstoppable data center capex boom, as similarly highlighted by numerous hyperscalers in Q3’24.

The same has been observed in the still promising consensus forward estimates, with SMCI expected to generate a top/ bottom-line growth at a CAGR of +28.9%/ +15.1% through FY2026, despite the recent downgrades.

Based on the lowered consensus FY2026 adj EPS estimates from $4.38 to $3.37, there remains an excellent doubling upside potential to our updated long-term price target from $97 to $74.10 as well, based on the 1Y P/E mean of 22x.

On the other hand, it goes without saying that SMCI may continue to be a battleground stock in the near-term.

This is partly attributed to the notification letter on the non compliance with Nasdaq listing rule 5250(c)(1) received on September 17, 2024, with the management already submitting a compliance plan by November 18, 2024.

Upon the acceptance of the compliance plan, the company may be granted up to 180 days from the 10K due date of August 29, 2024 to gain compliance – with it pointing to three months of further uncertainty prior to the February 2025 deadline.

Even then, part of the gains may also be moderated by the elevated short interest of 16.99%, with the stock likely to remain volatile in the intermediate term.

Lastly, it is uncertain if the management may be able to win back the market’s and the shareholders’ trust ahead, one that will naturally impact the stock’s valuation and stock price trajectory.

One thing is certain for sure, SMCI is only suitable for investors with higher risk tolerance, since the stock is likely to be sentiment driven before things normalize.

Despite one of our criterion being fulfilled (the onboarding of the new auditor), we prefer to watch out for SMCI’s upcoming FY2024 10K and FQ1’25 10Q filing for more clarity, since many things may happen over the course of the next three months.

For now, SMCI stock remains a Hold.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.