Summary:

- StoneCo’s stock has dropped over 22% post-Q3 results, attributed to macroeconomic headwinds and market-driven factors, presenting a potential buying opportunity for patient investors.

- Higher interest rates in Brazil and rising inflation are impacting StoneCo’s financial services segment, delaying visible improvements in financial performance.

- Company-specific issues include a maturing payments acquiring business, slower client growth, and the overpaid acquisition of Linx software, affecting investor sentiment.

- Despite challenges, StoneCo trades at a significant discount to its intrinsic value, offering substantial upside potential with limited downside risk for value investors.

Maskot

StoneCo (NASDAQ:STNE) is a Brazilian fintech company specializing in payments processing, banking and customer relationship management software. Since reporting its third quarter results, its stock has lost over 22% in market capitalization (at the time of writing). In my previous article about StoneCo I discussed its situation, arguing that despite an attractive valuation at first glance, the company is in the transitional period, paying for past mistakes. My conclusion was to remain cautious until the company improves its operations – a difficult task in the intensely competitive Brazilian market. In this article, I will explain the main factors behind the recent pullback in Stone’s stock price. While some factors are fundamentally driven, others stem from broader market conditions and weaker results from competitors. I believe the current valuation presents an opportunity where the risk – reward profile is favorably tilted toward being bullish, as possible loss should be limited, while the upside could be substantial. Like poker, when the odds are in your favor, increasing your bets is often a wise strategy. For patient investors, the current price could offer a profitable investment opportunity.

Bloomberg

Macroeconomic headwinds

In its 3Q24 financial report, the company reported total revenue and income of BRL3,206 mil., representing a 6.9% year-over-year growth. The financial services segment accounted for 88% of total revenues, while the software segment contributed a modest 12%. Financial services, which include working capital financing and fees from payments, so called MDR or merchant discount rate, are heavily influenced by Brazil’s interest rate environment. Higher rates essentially mean more expensive working capital financing and increased MDR charged to merchants.

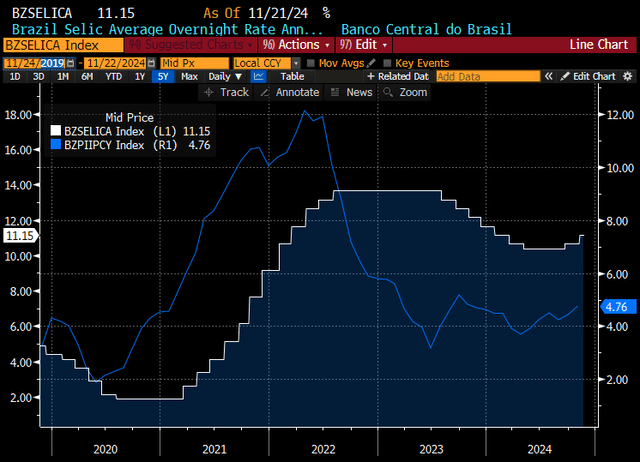

Since June 2023, the Banco Central do Brasil (Brazilian central bank) has gradually reduced its main interest rate, Selic overnight rate, from 13.75% to a low of 10.50% by mid-2024. However, rising inflation – approaching 5% as of May – forced the Brazilian central bank to raise the interest rate again to 11.25%. During the last earnings call, management acknowledge ongoing macroeconomic headwinds due to a more restrictive interest rate environment and higher yields across the Brazilian yield curve. With no signs of easing inflation in Brazil, higher interest rates are expected to persist for the next several quarters. While StoneCo will eventually pass higher financing costs into its services, visible improvements in financial performance may take several quarters to materialize.

Bloomberg

Market-driven factors

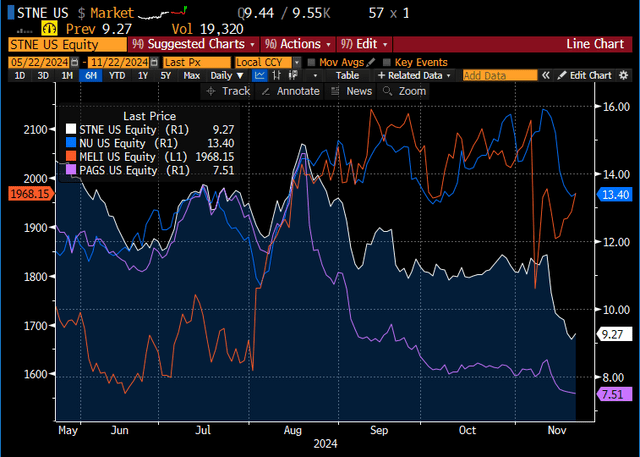

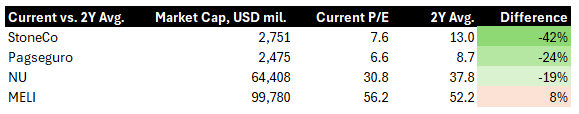

StoneCo’s main competitors include PagSeguro (PAGS), MercadoLibre (MELI) and Nu Holdings (NU), while smaller players are either Cielo or Rede. Recent 3Q reports for MELI or NU, showed both companies missing analyst’s expectations – MELI on profitability, and NU on revenue growth. Investors reacted to negative news by selling shares of both companies, causing both companies to lose nearly 20% of their market capitalization. While MELI’s shares have partially recovered, NU remains in a downward trend. PAGS, similarly to STNE is affected by macroeconomic headwinds due to its banking-dependent business model.

Bloomberg

Company-specific factors

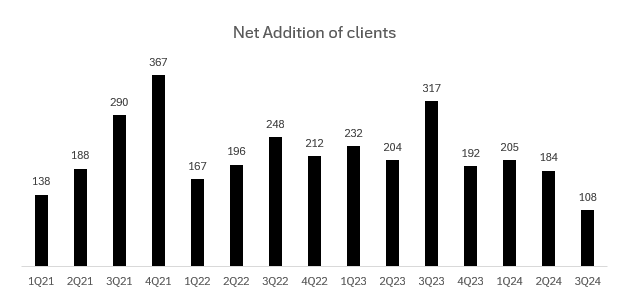

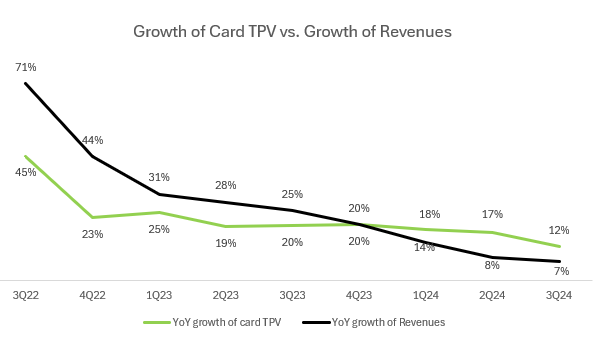

Beyond macroeconomic and market-driven issues, there are also company – specific factors also impacting investors’ sentiment. Analyzing company financials, it is evident that StoneCo’s main business segment, payments acquiring, has matured. This observation is apparent in smaller addition of new clients, slower growth of revenues, or slower growth of TPV (total payment volume) from MSMB clients. Additionally, the introduction of PIX as a payment method, has cannibalized use of debit cards, which carry higher MDR’s than PIX. In 3Q 24, StoneCo added only 108 thousand new MSMB clients – the smallest increase in the past three years.

Growth slowdown is also visible in the year-over-year comparison of card TPV and growth in total revenues. Furthermore, the ill-fated acquisition of Linx software, which StoneCo significantly overpaid for, continues to weight on the company as the management needs to decide how to manage this asset. Previously viewed as a growth stock, StoneCo has lost its growth appeal among many institutional investors, as evidenced by Berkshire Hathaway’s exit two quarters ago. However, with the current market capitalization near to USD 2.8 billion, StoneCo may attract attention either from value investors or from turnaround specialists.

Investor relations

Investor relations

Valuation

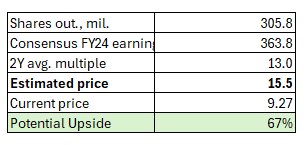

StoneCo currently trades at the market cap of USD 2.8 billion, with a market consensus earnings for FY24 of USD 363 million. This implies a P/E multiple of 7.6x, which is 42% below its 2Y average. Although PAGS looks cheaper on a P/E multiple basis than STNE, PAGS has always traded with a lower multiple. In contract, despite recent declines, MELI and NU, remain valued relatively close to their 2-year average multiple. Their valuation is not as attractive, either on historical basis or in relative basis. If StoneCo trades at its two-year average multiple of 13.0x, its fair value would be around USD 15.5 per share, or 67% above the current price.

Market data

Own work

Closing thoughts

StoneCo is currently navigating a transitional period, marked by slower growth, a maturing payments acquiring business and higher interest rates. Despite these challenges, the stock trades below its intrinsic fair value and could provide substantial profit if negative factors will subside. With a large discount to its intrinsic value, investors may find downside risk limited while benefiting from any improvement in market sentiment.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of STNE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.