Summary:

- McDonald’s will reintroduce the McRib sandwich on December 3rd and offer half-gallon jugs of McRib sauce starting November 25th.

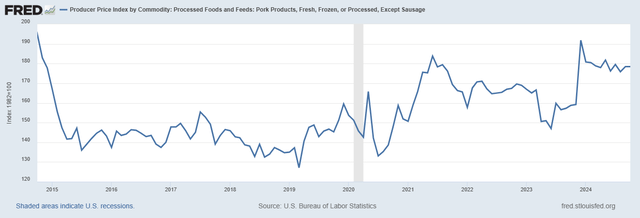

- No price point announced, but higher pork prices suggest potential sticker shock for customers.

- McRib is another attempt to restore comps and traffic that cannot succeed over the long term.

- The real problem with McDonald’s is high daily prices that do not provide good value and are unaffordable for large swaths of the public. A radical re-thinking is necessary.

David Paul Morris/Getty Images News

NEW YORK (November 22nd) – McDonald’s (NYSE:MCD) (NEOE:MCDS:CA) announced Wednesday morning that it would return the “McRib” sandwich to participating restaurants on December 3rd. For the first time, fans of the sandwich can also buy half-gallon jugs of McRib sauce on-line beginning November 25th. Earlier this evening, MCD dropped details of another widely anticipated effort to boost traffic: It will continue to offer it’s $5 McValueTM meal as well as BO+$1GO on certain selected items and in-app exclusives, as illustrated here:

The New “McValue” Menu (McDonald’s)

The iconic burger ‘n fries franchise restaurateur did not announce a price point for the McRib; however, given recent pork prices, customers craving the “oh-so-good” pork sandwich will likely suffer some sticker shock.

Pork Products, Fresh, Frozen, or Processed, Except Sausage (FRED)

While pork prices have come down somewhat from a peak in December 2023, they are still 11% higher than they were the last time the McRib was offered in November 2023. Moreover, sandwiches tend to be a bit more complex and labor-intensive to prepare, involving grilling the frozen ribs then braising them in McRib sauce in a microwave and assembling it on a roll with pickles and onion. (Here’s a rare look at the making of the sandwich)

A Progression of One-Shots

McDonald’s seems to have been struggling against its own history for years and is now in a quandary: to meet market expectations, it must show growth. But to show growth, it must raise prices as traffic has stalled.

MCD’s former CEO, Steve Easterbrook, an accountant by training, deftly managed the MCD balance sheet to refranchise an enormous number of company-owned outlets to create an “asset-light” company before he was ousted for violating company personnel policy.

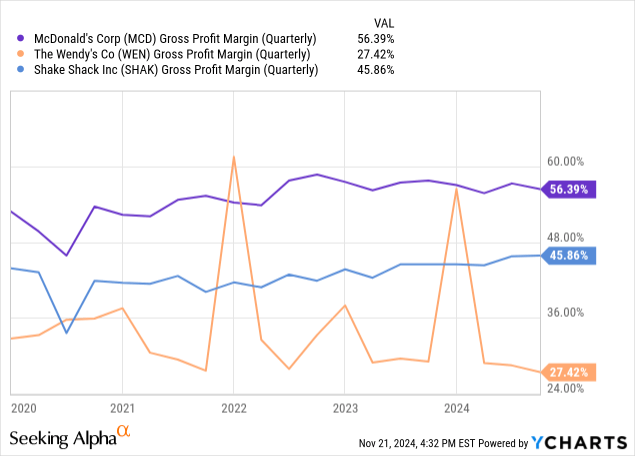

Easterbrook’s term, from 2015 to 2019, emphasized refranchising, and changed a large portion of the revenue mix of the burger slinger from low margin restaurant operations to higher franchise fees, allowing MCD to have a higher gross margin than its competitors, including even Wendy’s, which is 95% franchised and has been from its inception. McDonald’s had reportedly been just 81% franchised before Easterbrook brought it to 95% franchised.

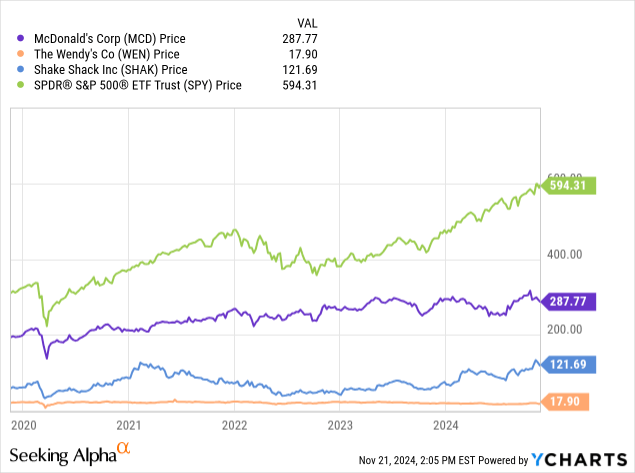

Easterbrook’s other innovation, “All Day Breakfast”, was initiated in 2015. But that experiment was relatively short-lived; it ended in 2020 because of various operational difficulties, although it may still be available in some locations. Easterbrook’s innovations greatly boosted the MCD share price. But it appears Easterbrook’s innovations, corporate and operational, have run their course. The Golden Arches has struggled to meet investor expectations in 2024. While MCD stock has appreciated since 2020, it is, with its peers and near peers, substantially below Alpha, although it is doing somewhat better than the rest of the pack

Stock Prices of Quick Serve Burger Chains (YCharts)

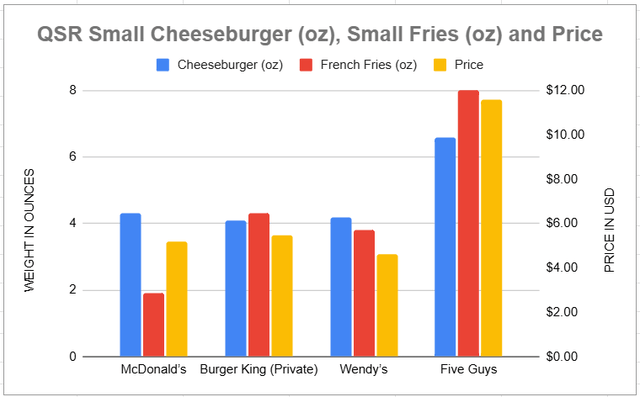

Much of that, though, is probably attributable to MCD gross margins. A recently published price comparison, summarized in the chart below, showed McDonald’s was 12% more expensive than Wendy’s for a comparable small burger and fries meal, even though Wendy’s offered nearly double the fries.

Select QSR Published Meal Costs (The Stuyvesant Square Consultancy from Published Data)

Margins and Margins

While the year-end margin volatility of Wendy’s (WEN) illustrated below is absolutely remarkable (very curious as to why WEN has these weird year-end (fourth quarter) spikes), the bigger story is the MCD gross margin; higher even than the more upscale and more costly “casual dining” chain Shake Shack (SHAK), used here as a publicly held company comparable to the privately held Five Guys in the above chart.)

Gross Profit Margins of MCD, WEN & SHAK (YCharts)

At nearly 30 percentage points above the gross margin of its nearest peer (WEN), and more than 10 percentage points above the more upscale “casual dining” SHAK, one must question whether MCD is worth it’s mostly higher prices. IMHO, it certainly is not. Anecdotally, I only eat MCD when the MCD app is offering specials (most recently, it’s $3 Filet-o-Fish app special, which has since been discontinued).

In conjunction with this article, I ordered “McDelivery” on November 11th to a location in Brooklyn’s DUMBO neighborhood. I ordered a “Big Mac” (free because the NY Jets had won on Sunday, in a NYC promotion), and a Chicken Big Mac sandwich. No beverages; no fries. It was more than $12, delivered. I could have gotten a fresh cooked, double cheeseburger from a nearby tavern for under $10. And it is a better burger. I would not have ordered had the Jets promotion with the free Big Mac – two Big Macs for $12 – not been available.

It seems McDonald’s has been struggling to meet customer – and investor – expectations for most of 2024.

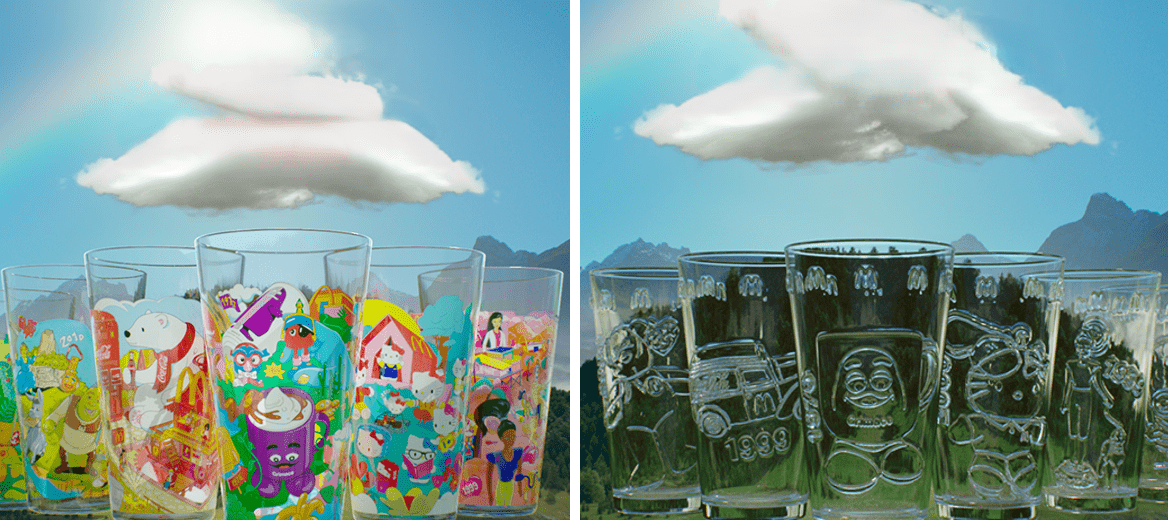

First Quarter US SSS increased 2.5%, but that was on a “strategic menu price increases.” Second Quarter US SSS declined 0.7% for the first time since the pandemic, on less traffic, but offset by price increases in the average ticket. Diluted EPS for that quarter dropped 6% (5% in constant currencies) even after taking account of impairments. In August, MCD ran a limited time special of collectible glass and plastic cups give away, illustrated below, for two weeks to arrest the decline. It resulted in an increase in US SSS of 0.3%, for 2024Q3, but still another “slightly negative comparable guest counts.”

McDonald’s Collectible Cubs (McDonald’s)

It now appears that MCD will reboot the last month of 2024Q4 with sales of the McRib and McRib sauce to further arrest the decline. By contrast, in 2023, MCD enjoyed relatively robust comps. It’s not clear why the 2024 comps have been so challenging for the chain. But I submit that the “strategic price increases” that kept 2024 revenue comps steady likely cut traffic so that McDonald’s earnings growth has “stalled”.

In aerodynamics, an aircraft that climbs too rapidly with insufficient power loses lift and is said to “stall”. To recover, a stalled aircraft points its nose down to accelerate and re-establish lift.

McDonald’s could take a lesson.

Like an airplane gaining altitude too rapidly without sufficient power, McDonald’s price escalations without greater value have caused comps and revenue to “stall”. To recover, it’s time to push the prices down and re-establish lift: Cut prices by at least 15%, preferably more, and recognize that the demand for MCD meals is highly elastic and may quite possibly have met its limit in the United States. Stop with the promotions; stop with the gimmicks. Stop with the “limited time offers” unless they’re to market test a new menu item.

Higher traffic at lower prices will provide greater revenue. If MCD can deliver better value at the lower price, such as more freshly cooked (as opposed to barely warm) meals and hot fries delivered more timely, MCD may be able to halt the SSS stall.

Doing all this will require MCD to risk a short-term revenue loss as the market adjusts to the new pricing paradigm and occasional consumers like me come to learn that MCD is offering lower prices and better value. (Note, too, a lot of the marketing team can be cut and their salaries and ad dollars can be redirected to shareholders, improvements, or incentives for franchisees.)

At the restaurant level, MCD franchisees will have to improve their own microeconomic version of factor productivity; to “do more with less” – or at least with the same resources – in order to meet more customer traffic. Among things to consider*:

- Some regular menu items with low daily demand should be dropped. Unless an entre sandwich is regularly generating at least 15% of total traffic for a meal time, drop it. MCD offers five – count ’em FIVE – type of chicken sandwich! Why???

- Stop trying to be Starbucks (SBUX). MCD has an incredible twenty-one types of coffee!

- Do “gimmicky” offerings, whether in food products or premium gifts, no more than 30 days and no more than once a year.

- Eliminate the “specials” that customers like me exploit (at the cost of other customers), and replace them with more reasonable everyday value pricing.

- Abandon more complex breakfast offerings, like flapjacks and fruit & maple oatmeal, so that only hand-held, sandwich-type options are available so as to make breakfast more manageable with a view of re-introducing an “All Day Breakfast” option to eat in the lunch or dinner space for penny-pinching customers.

- Assign one or two workers to do cleaning, maintenance, and inventory management as their full-time job instead of detailing kitchen staff to do it as needed. And in urban centers, like where I live, restaurants are filthy.

- Create a single, dedicated customer pick-up line for app, kiosk, and delivery orders so as to better employ a Pull System. That will make sure the best customer experience – in the form of hot, fresh, food delivered most quickly – comes from the app and kiosks. And customers will come to prefer it.

- Instead of taking audio orders at the drive-thru, make the drive thru an app-delivery line instead of taking audio orders. Customers can pull up to pick up their order at the window once they have ordered through the app. Luddites can order in-person inside the restaurant. Get rid of the speakers and headsets.

*See NOTE, below.

In the meantime, I think MCD has topped out on comps and revenue and that its nearest competitor, WEN, likely has greater price elasticity. I would hold MCD until the McRib year-end bounce concludes and 2024Q4 earnings are reported, and maybe buy puts to lock in any gains (or sell after the earnings drop). Then, monitor WEN for announced price increases and cost savings measures.

In summary, then, retail investors should HOLD McDonald’s, but just until after the start of 2025; then sell it or short it, absent major changes by the chain. Accumulate WEN on a dollar-cost averaging basis when and if they move to increase margins.

_____________________________________

NOTE: Our commentaries most often tend to be event-driven. They are mostly written from a public policy, economic, or political / geopolitical perspective. Some are written from a management consulting perspective for companies that we believe to be underperforming, and include strategies that we would recommend were the companies of our clients. This approach lends special value to contrarian investors to uncover potential opportunities in companies that are otherwise in downturn. (Opinions with respect to such companies here, however, assume the company will not change.)

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The views expressed, including the outcome of future events, are the opinions of the firm and its management only as of November 22, 2024, and will not be revised for events after this document was submitted to Seeking Alpha editors for publication. Statements herein do not represent, and should not be considered to be, investment advice. You should not use this article for that purpose. This article includes forward-looking statements as to future events that may or may not develop as the writer opines. Before making any investment decision you should consult your own investment, business, legal, tax, and financial advisers. We associate with principals of Technometrica on survey work in some elements of our business.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.