Summary:

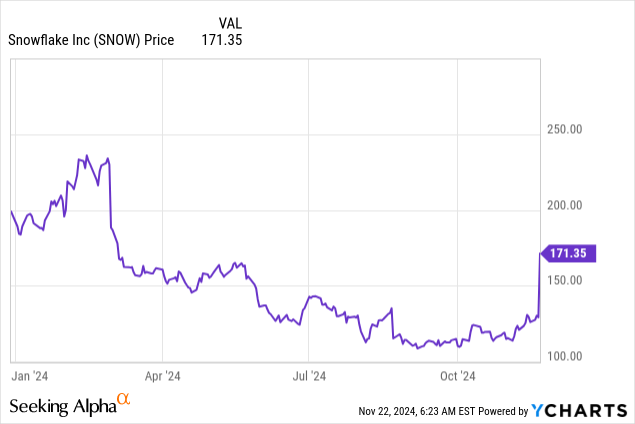

- Snowflake’s Q3 earnings exceeded expectations, with $0.20 adjusted EPS and $942M in revenue, driving a 33% stock surge on Thursday.

- Strong customer acquisition, near-30% top line growth and an increase in FY 2025 revenue guidance affirm Snowflake’s growth potential.

- Snowflake’s free cash flow margin improved sequentially, and the platform generated a solid $78.2M in FCF in Q3.

- The company’s valuation at a 13.0X price-to-revenue ratio remains justified by its robust double-digit growth trajectory.

pingingz

Shares of Snowflake (NYSE:SNOW) surged 33% on Thursday, the day after the cloud-based data company reported much better than expected third fiscal quarter earnings and raised its outlook for FY 2025. Snowflake is seeing strong customer acquisition momentum which resulted in higher than expected product revenues. Snowflake’s retention rate also remained steady quarter-over-quarter while the company reached more customers in the October quarter than ever before. While Snowflake is not cheap, strong execution and an improved outlook for FY 2025 make shares of the software company a strong buy!

Previous rating

I rated shares of Snowflake a strong buy in August due to the company having very strong free cash flow and good customer retention: The More It Drops, The More I’ll Buy. In the October quarter, Snowflake reported near-30% top line growth, a higher free cash flow margin Q/Q and strong retention yet again. I believe the raised guidance for FY 2025 together with Snowflake’s other achievements in the October quarter continue to make the cloud-based software platform a strong buy for growth investors.

Snowflake’s Q3’24

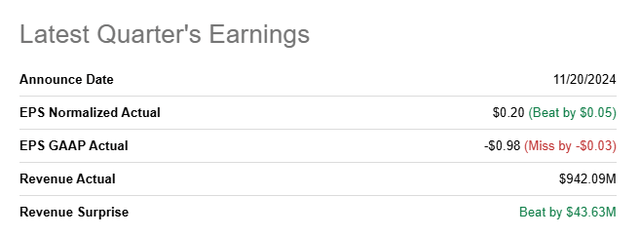

The cloud-based software company generated better than expected bottom and top line results for its third fiscal quarter: Snowflake earned $0.20 per-share in adjusted EPS, out-performing the average prediction by $0.05 per-share. The company’s top line came in at $942M, beating the consensus estimate by $44M.

Seeking Alpha

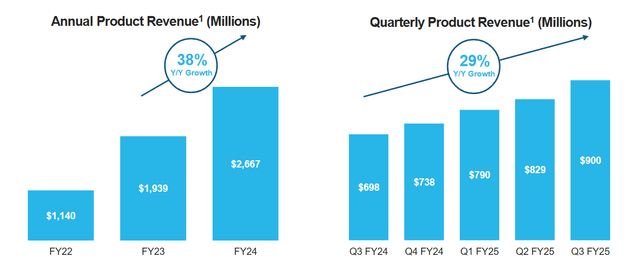

Snowflake blew past consensus estimates as well as its own guidance on stronger than expected customer acquisition and demand for Cloud services. The software company grew its total customers 4% quarter-over-quarter to an all-time record of 10,618. Importantly, Snowflake out-performed its own guidance in terms of product revenues, which made up the majority of revenues for the company (96%): total product revenues surged 29% year-over-year to $900M which compares against a projection of up to $855M in product revenue. The stronger than expected performance has been driven by customer acquisition as well as high customer net retention rates.

Snowflake

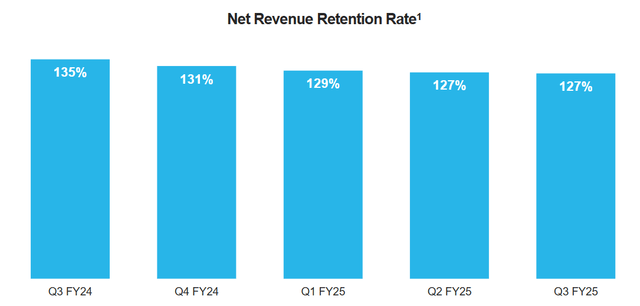

Customer retention is a key metric for software companies that run platform businesses and therefore have considerable scale benefits. Net revenue retention is an important measure to quantify a software company’s potential to monetize its customer base and upsell it to premium products.

Net revenue retention is calculated by dividing product revenues from a defined customer pool by product revenues from the same customers in the previous reporting period. The result is a percentage figure that expresses by how much companies are increasing their platform-spend from one period to the next. In the case of Snowflake, this percentage remained steady at 127% in the October quarter, meaning the typical customer increased its platform spending by 27% Y/Y in Q3’25. Although the longer-term trend points south, a 127% retention rate is pretty good for a software company.

Snowflake

Snowflake generated $78.2M in free cash flow in Q3’25, a solid $19.4M more than in the previous quarter (+33% Q/Q). On a year-over-year basis, however, Snowflake’s free cash flow dropped 23%, mostly due to higher capital expenditures and software development costs.

In terms of free cash flow margins, Snowflake posted a 1% sequential improvement in its margin to 8%. Software companies benefit from the renewal of licenses at the end and beginning of a fiscal year which is when corporate customers tend to make purchase and renewal decisions for software packages. Therefore, cloud-based software companies like Snowflake see an increase in free cash flows in Q4 and Q1, as you can see in the chart below.

| $ in thousands | Q3’24 | Q4’24 | Q1’25 | Q2’25 | Q3’25 | Y/Y Growth |

| Product Revenue | $698,478 | $738,090 | $789,587 | $829,250 | $900,282 | 29% |

| Professional Services | $35,695 | $36,609 | $39,122 | $39,573 | $41,812 | 17% |

| Total Revenue | $734,173 | $774,699 | $828,709 | $868,823 | $942,094 | 28% |

| Net Cash from Operating Activities | $120,907 | $344,580 | $355,468 | $69,865 | $101,706 | -16% |

| Property, Plant & Equipment | ($8,746) | ($13,072) | ($16,519) | ($5,043) | ($13,440) | 54% |

| Capitalized Software Development Costs | ($9,889) | ($7,029) | ($7,404) | ($5,992) | ($10,032) | 1% |

| Free Cash Flow | $102,272 | $324,479 | $331,545 | $58,830 | $78,234 | -24% |

| Free Cash Flow Margin | 14% | 42% | 40% | 7% | 8% | -6 PP |

(Source: Author)

Snowflake raised its outlook for FY 2024

The cloud-based software platform did not only out-perform top line estimates, but also raised its guidance for FY 2025 product revenue. The software company now sees $3.43B in product revenue for the full fiscal year as opposed to $3.36B previously. This means that Snowflake now projects 29% Y/Y product revenue growth compared to 26% previously.

Snowflake is worth the price

I aggressively recommended Snowflake near 1-year lows in August. Since then, Snowflake’s shares have surged 48% with the majority (33%) of the price gain happening on Thursday.

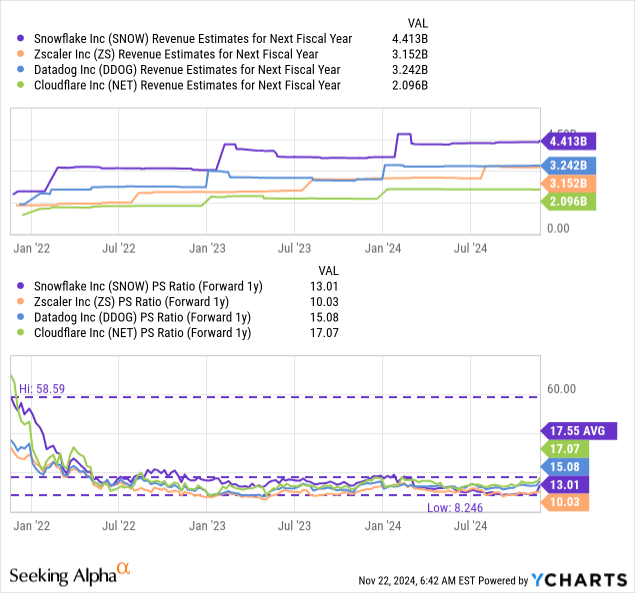

Snowflake is currently valued at a price-to-revenue ratio of 13.0X which is not a high multiplier for large-scale platform businesses that grow their top lines at double-digit rates annually. Historically, Snowflake has also traded at a much higher price-to-revenue ratio of 17.6X… which is a multiplier the company has achieved shortly after the pandemic boosted the company’s top line growth. Other cloud-based data companies like Zscaler (ZS), Datadog (DDOG) and Cloudflare (NET) trade at price-to-revenue ratios between 10.0X and 17.1X with the average platform business being priced at a P/S ratio of 13.8X.

Given the strength in product revenue growth, improving free cash flow margins and a raised outlook for FY 2025, I believe shares of Snowflake are still undervalued and could re-price to a price-to-revenue ratio of ~15.0X… which would still be way below the 3-year average P/S ratio of 17.6X. A 15X P/S ratio implies a fair value in the neighborhood of $198 per-share and calculates to an addition 15% upside revaluation potential compared to Thursday’s closing price. This is a dynamic value, however, and it could rise or fall depending on how well Snowflake executes in terms of customer acquisition, retention, and free cash flow growth.

Risks with Snowflake

Snowflake is growing its product revenue quickly, which is driven both by new customers joining the Snowflake platform and by organic top line growth driven by seasoned customers that ramp up their platform spend. Therefore, Snowflake’s valuation is chiefly backed by the company’s potential to expand its revenue base. What would therefore change my mind on Snowflake is if the cloud-based data platform were to either see slowing product revenue growth or weaker free cash flow margins.

Final thoughts

Snowflake reported much better than expected third fiscal quarter earnings on Thursday. The company’s free cash flow also looked healthy, and FCF margins expanded Q/Q. Snowflake also raised its guidance for FY 2025 product revenue and saw stable net retention rates… of which I believe support my strong buy rating. In my opinion, the cloud-based software enterprise remains an attractive cloud investment, even after Thursday’s 33% increase in market cap. With customers continuing to flock to the Snowflake platform and shares still trading significantly below the longer term price-to-revenue ratio, I believe Snowflake continues to have upside revaluation potential.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SNOW either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.