Summary:

- Google investors were hit last week as the market reacted negatively to the DoJ’s “radical and sweeping” proposals to unwind Google’s dominance.

- Google’s core business remains robust, driven by growth in Google Cloud, YouTube monetization, and Generative AI integration.

- Google’s valuation is not excessive, suggesting that pessimism is already priced into the stock.

- I argue why investors have not bailed out of the stock despite the pessimism in the financial media.

- Investors seeking an early Christmas present to buy more Google shares shouldn’t miss the recent pullback.

Justin Sullivan

Google: DoJ’s “Radical” Proposals Hit Optimism

Alphabet Inc. (NASDAQ:GOOGL) (NASDAQ:GOOG) investors have struggled to regain momentum, even though the S&P 500 (SPX) (SPY) and the Nasdaq (NDX) (QQQ) reached new highs in November 2024. As a result, it has become increasingly clear that the market remains concerned over potential punitive regulatory actions on Google’s business model.

Over the past week, the DoJ has worsened the uncertainties for Alphabet investors as they threatened to compel Google to divest its Chrome browser, among other requirements. Google has already anticipated these changes, as the company highlighted in an October 2024 blog post, which the company termed as “radical and sweeping.” As a result, the Mountain View-headquartered company is expected to continue its fight against the DoJ, notwithstanding the department’s success in obtaining the guilty verdict on Google as an illegal monopoly. The parties are scheduled for a hearing in April 2025 to determine the necessary remedies. However, a final court ruling isn’t expected until August 2025. Furthermore, Google is almost certainly expected to appeal the verdict and the DoJ’s proposed remedies, suggesting the court case could take years to resolve.

Alphabet CEO Sundar Pichai reminds investors at Google’s recent Q3 earnings call that the company will continue to “vigorously defend” itself against the DoJ. He also warned that these proposals could have “unintended consequences,” underscoring the wide range of possibilities on Google’s leadership and consumer impact. Therefore, I believe it’s justified for investors to be concerned about these changes. But has the market gone into hiding over the case? Also, investors must question whether the market has reflected pessimism, even as the deadline for the April hearing draws closer.

The incoming Trump administration could take a “less Draconian” stance against Google, although the chances are far from certain. Moreover, observant investors should recall that the first Trump administration initiated the DoJ’s case against Google, even as the Biden administration took it further. Furthermore, the Tunney Act “guarantees judicial oversight” over the Google case, potentially limiting the ability of the Trump administration to affect or change the course of the case.

Google Remains A Fundamentally Strong Business

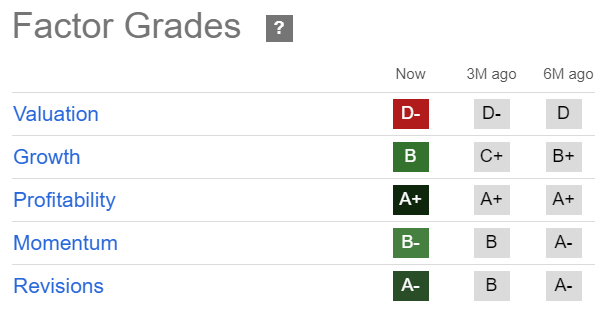

GOOGL Quant Grades (Seeking Alpha)

GOOGL’s “D-” valuation grade underscores its growth-based thesis (“B” growth grade), even as the stock has underperformed the market since July 2024. Moreover, Wall Street analysts have lifted Google’s estimates, as the company delivered a robust Q3 report recently. Hence, I assess that the market has not turned its back on GOOGL, demonstrated by its still solid “B-” momentum grade. While it indicates a downgrade from the “A-” rating over the past six months, buying sentiments on the stock remain constructive.

I believe the market has astutely recognized the core competitive advantages of Google’s ecosystem. While reflecting caution on the DoJ’s recent proposals, investors have likely understood that Google’s business model has remained resilient. In addition, Google has also bolstered the use of Generative AI across its pivotal growth drivers across Search (visual and multimodal), Google Cloud (35% YoY revenue growth), YouTube monetization and engagement. Hence, its core consumer engine has continued to deliver. At the same time, it invests in growth CapEx (expected to increase in 2025) to compete more effectively against the likes of Microsoft (MSFT) and Amazon (AMZN).

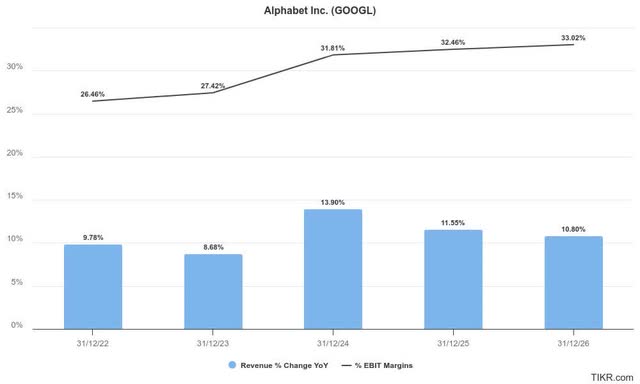

Consequently, it has improved the market’s assessment of Google’s execution (“A-” revisions grade), underpinned by its robust profitability. As seen above, Google’s adjusted EBIT margins are expected to continue scaling higher as Wall Street lifts its forecasts on Google’s revenue growth prospects over the next two years.

Hence, Google’s dominance and competitive advantages aren’t expected to crater, bolstering the company’s resilience against the DoJ’s “radical” proposals. As the company seeks to exhaust its legal avenues against the court’s ruling, Google’s hold over the market isn’t expected to be dissipated, bolstered by its improvement and strength in Google Cloud’s growth prospects. In addition, the company also has long-term growth optionality in Waymo, as its autonomous driving and robotaxi segment is likely still undervalued by the market.

GOOGL Stock: Valuation Isn’t Excessive

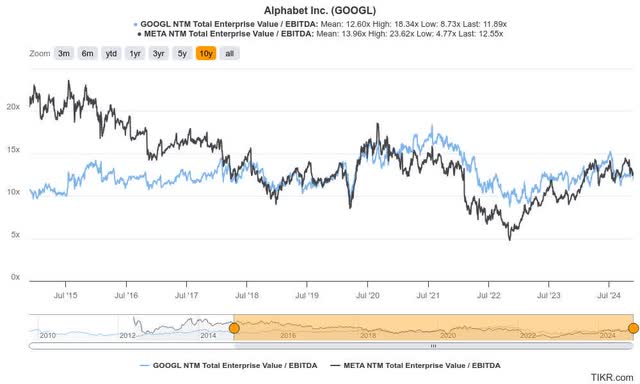

GOOGL Vs. META valuation (TIKR)

GOOGL’s valuation also isn’t excessive. The stock’s forward adjusted EBITDA of 11.9x is below META’s (META) metric of 12.6x. Furthermore, GOOGL’s forward adjusted PEG ratio of 1.27 is more than 12% below communications sector peers’ (XLC) median of 1.45. Hence, bulls could argue that pessimism has likely been priced into the stock. While not assessed to be deep-value, it also suggests that the market hasn’t seen the need to hammer GOOGL’s valuation, taking into account its fundamentally strong business model.

Notwithstanding my optimism, the DoJ’s landmark case against Google could significantly impede the company’s ability to compete effectively. Hence, investors will likely keep GOOGL’s valuation “under wraps” over the next two years, lowering the stock’s re-rating potential.

Therefore, it could bolster the opportunities of its rivals, such as in the rapidly evolving AI space. For instance, Amazon has strengthened its partnership with Anthropic, gaining traction as the AI company’s primary cloud computing service provider moving forward. In contrast, Google could face calls to “unwind” its previous investments in Anthropic, potentially weakening its ability to compete more effectively against its hyperscaler peers.

Is GOOGL Stock A Buy, Sell, Or Hold?

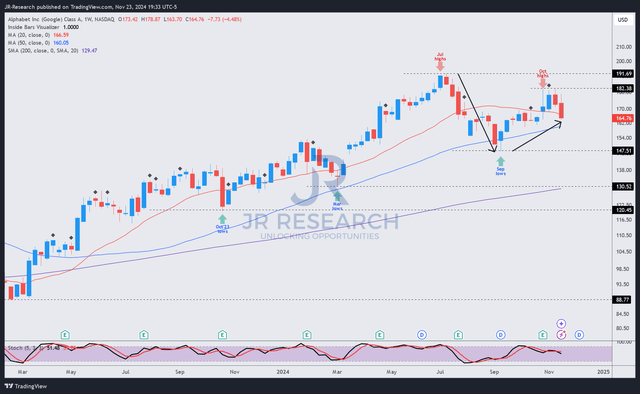

GOOGL price chart (weekly, medium-term, adjusted for dividends) (TradingView)

GOOGL’s price action suggests the market hasn’t bailed out of the stock, notwithstanding the financial media’s pessimism. Accordingly, the stock has managed a higher-low price structure since its August 2024 bottom, leading to a surge as the company reported its Q3 earnings in October 2024.

However, market sentiments have been tempered since then, as last week’s downside volatility has dissipated those recent gains. Investors must note that unless continued downward momentum leads to the collapse and decisive reversal of GOOGL’s August lows, betting on the bears might not make much sense.

Dip buyers are anticipated to return to undergird GOOGL’s uptrend bias, which is supported above its 50-week moving average (blue line). Hence, I assess that the recent pullback has offered high-conviction investors another fantastic early Christmas present to double down. While the DoJ’s action is expected to stymie a more aggressive valuation re-rating, it has not torpedoed the market’s optimism about the stock.

Rating: Maintain Buy.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL, AMZN, META, MSFT, QQQ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!