Summary:

- Lithium Americas offers significant long-term value despite the current lithium market glut and stock price declines due to its large Thacker Pass deposit and low-cost production potential.

- LAC benefits from strong US government support and General Motors’ investment, positioning it well for future growth in the domestic EV supply chain.

- Key risks include potential project delays, cost overruns, and further lithium price declines due to economic slowdowns and increased supply.

- Long-term investors may find LAC undervalued. If it achieves competitive production costs and meets development timelines, it has substantial profit potential.

- Lithium Americas aims to have similar costs to South American miners, as lithium is less labor intensive than most mines, and the US project may have greater capital efficiency.

simonkr

Lithium mining companies are often a target for investors looking to ride the wave of long-term transitions toward electric vehicles. Most lithium is currently produced in brines in South America. However, major developers such as Lithium Americas (NYSE:LAC) offer a pure-play focus on the North American lithium market in Nevada’s Thacker Pass deposit. Research indicates this deposit is the largest in North America and potentially the largest in the world. If developed and operated at a sufficiently low cost, Lithium Americas could become one of the most powerful lithium producers globally.

Since Lithium Americas Argentina (LAAC) split off from LAC, both companies have seen sharp stock price declines. This trend correlates to the sharp fall in lithium prices since the COVID-era shortage peak. The market is in a glut, which may grow as LAC expands in US production. LAC is down over 60% since its launch last October, but has held its ground over the past six months. It is up nearly 80% since its September trough, potentially encouraging a mix of value and growth-focused investors looking to buy it at a discount. Thus, I believe it is an opportune time to broadly analyze the company and the lithium market.

Lithium Americas May Be Profitable in A Glut

The company faces significant support from US companies and regulators. General Motors (GM) also owns a large stake in the firm as it seeks to develop a vertically integrated EV supply chain. There is some risk regarding EV demand as Trump may remove electric vehicle tax subsidies. That said, his ally Elon Musk seeks to improve lithium mining capacity in the US, making LAC a potential benefactor despite some regulatory risks to EVs in general. In October, LAC benefited from a Department of Energy loan of $2.6B with a 0% spread to Treasury rates to fund the development of this project.

However, supply expansion may not benefit LAC. The North American uranium market shares the fundamental issue facing Lithium Americas, as I’ve detailed regarding Cameco. Although there are only a small number of lithium deposits in the world, those deposits are vast. Though development costs are steep, once completed, they can yield tremendous output. The Thacker Pass region is expected to produce enough lithium for 800K vehicles per year.

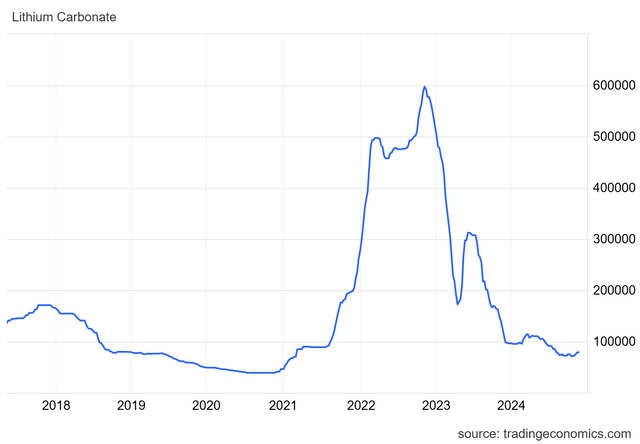

Still, the core issue is that South American mines should have lower production costs than LAC in the US due to lower wages and regulations in the region. Accordingly, the lithium market is generally in a chronic glut despite tremendous demand growth over the past decade. The COVID-era led to an acute shortage as production fell short while demand rose. However, it was short-lived, and lithium prices are now back at pre-COVID glut levels. See below:

Lithium price in CNY/T (TradingEconomics.com)

This chart depicts prices in Yuan since China is a voracious demand driver for lithium globally. Converting, the current USD price of a ton of lithium is ~$10.9K. Notably, Morningstar analysts estimate the all-in sustaining breakeven price for LAC’s Thacker Pass at $7K per ton. The company estimates it should initially produce around 40K tons per year and up to 80K as its development is completed.

At current prices, based on the AISC estimate, we should expect around $3K to $4K in profits per ton. That implies an operating profit of about $120M annually, up to $320M at the high-end output and low-end cost estimate. LAC’s market capitalization is just $870M today. The stock would likely be undervalued today, even at the low-end operating profit range. The $2.3B in debt will give it ample leverage, but I feel it is highly beneficial for equity investors, given the meager interest rates. Due to this, its cost of capital is heavily skewed toward equity, discouraging equity dilution as it can receive cheap DOE funding for growth.

If these estimates prove correct, at current prices, LAC’s forward “P/E” (in 2028 terms) may be around 2.7X to 7.3X today. There are two critical risks to that estimate. One, the all-in-sustaining cost estimate may be too low. Morningstar’s analysis implies LAC should produce at similar costs to Albemarle (ALB), which should benefit from lower labor costs in Brazil. However, I think this may be reasonable, given that LAC will benefit significantly from being closer to US EV battery factories.

More importantly, lithium mining is comparatively capital-intensive compared to labor-intensive. This makes it fundamentally different than other types of mines, like precious metals, which are very labor-intensive. Since lithium is more capital-intensive, we may expect the Thacker Pass project to use cutting-edge equipment with potentially greater redundancy (parts, energy, etc.) than an American operation. On that note, the company’s managers are generally experienced in the lithium industry and are likely using that expertise to follow best practices found in previous operations.

The company has started construction and expects initial production in 2027, with output ramping up in 2028. Current conditions are not ideal for selling lithium, but that may change over the next three years. There is a fair amount of risk that the project is not completed at projected costs or in time, but with significant DOE funding, I have reasonably high expectations. There is also a risk that the project’s variable costs are not as low as I estimate. Still, I think that may be true, given LAC’s potential edge in capital development and comparatively low long-term labor needs.

Lithium Glut May Expand as LAC Produces

Despite today’s low lithium price, LAC may be undervalued based on the above profit estimates. That said, lithium is already in a glut. LAC promises to expand global production, potentially increasing that glut significantly. This risk may be even greater if EV sales in the US slow due to an end to Federal subsidies. However, Tesla (TSLA)’s share price rocketed over 60% over the past month following Trump’s election. Although risks remain, the market is undoubtedly not bracing for a negative impact on Tesla’s EV sales.

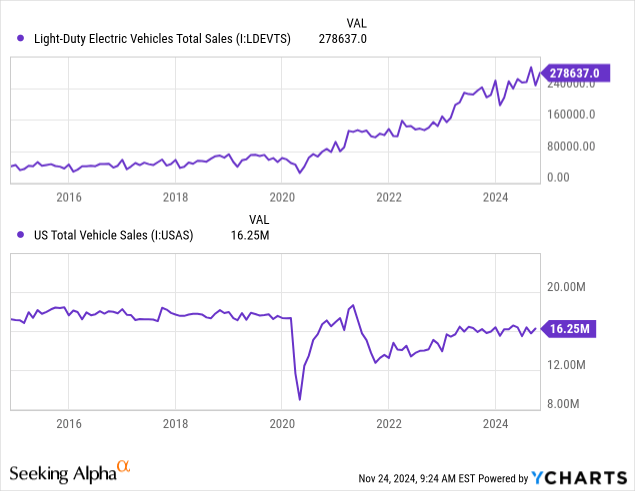

The growth rate of EV sales has declined this year, causing disappointment in the industry. Still, that is mainly due to a general decline in US vehicle sales. High car prices and interest rates push new car loan payments upward toward $1K per month, making vehicles generally unaffordable today. EVs are slowing but have proven far more resilient than vehicles in general, still rising in 2024 despite a stagnant depression in overall vehicle sales:

Electric vehicles have a trend toward becoming cheaper over time as production and supply chains expand and become more efficient. Theoretically, electric vehicles require far less labor to produce than conventional vehicles due to their lack of transmissions and fewer “moving parts.” As with lithium mining, EV factories have high upfront capital costs and lower long-term labor costs. As conventional vehicle producers struggle with labor strikes and union actions, we should expect conventional vehicles to become more expensive. In contrast, EVs may become cheaper as more car companies invest in EV supply chains.

High consumer borrowing rates and, in my view, a stagnant or mildly depressed economy for the median American (not to be confused with the average, skewed by the upper-income group) do not bode well for vehicle demand. 2024 has not been a great year for electric vehicles, leading to a glut in lithium as demand failed to increase as fast as previous estimates indicated.

Lithium has a commodity super-cycle of its own, which seems comparatively fast. Lithium prices skyrocket when EV demand grows faster than lithium supply, leading to a surge in development project funding. As more lithium projects are developed, we’re seeing the market fall back into a glut.

Looking out to 2027-2028, I hope EV demand picks up. That would likely require some improvement in real wages for median borrowers and a decline in vehicle borrowing interest rates. No guarantee will occur, as many expect upcoming economic changes (tariffs or government layoffs, for example) to harm the economy potentially over the next two years. Until policies are created, it is difficult to speculate on what will occur; however, the immediate labor market trend is, in my view, quite negative.

The Bottom Line

At this point, I think there is an equal probability that the lithium glut will expand by 2027-2028 vs. shifting back toward a shortage. I think LAC may be undervalued today if it can achieve low production costs while developing its mines on time and within budget. As long as LAC is below $5-$7, I think it fairly discounts the notable risks in this project and the lithium market. However, I believe the US trend toward greater domestic production and lower dependence on foreign supply, an effort Elon Musk seems to support, puts LAC in a position to continue to benefit from government subsidies or indirect support.

I believe LAC is best seen as a long-term investment with a horizon of at least ten years. Assuming a plan to hold LAC until the 2030s, I think it is a great value and growth investment today. The chief long-term risk is its ability to produce lithium as cheaply, if not more so, than its South American rivals. However, looking out to the 2030s, I expect EV prices will continue to decline while conventional vehicles are phased out, simply due to superior economics. Although not dependent on government subsidies, those are accelerating the transition. Demand for lithium may expand if sold-state battery technologies are produced at scale, an effort numerous car companies are working on today. These batteries may have two to three times more power storage capacity but should require more lithium per battery.

I am bullish on LAC from a long-term value standpoint. Price declines are a potential accumulation opportunity for long-term investors. That said, I would not be surprised to see LAC’s price fall in the short term. The key immediate risks are its ability to develop Thacker Pass on budget and on time and produce lithium at a competitive cost and at the volumes the company has indicated it should.

Secondly, the price of lithium may fall further if the global economy slows. That is possible given most Western economies’ weak labor market and consumer trends. A recession would harm the EV market, but it should harm the conventional car market more (extrapolating current trends), potentially improving EV’s edge in the long term.

LAC is undoubtedly a higher-risk investment, but given its price compared to its high long-term profit potential, I expect long-term investors will be rewarded.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in LAC over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.