Summary:

- Altria, with a $90 billion market cap and more than 7% dividend yield, remains a valuable long-term investment due to its strong earnings.

- The company faces a significant regulatory burden and declining industry volumes, posing challenges to its growth.

- Despite these challenges, Altria continues to achieve robust earnings growth and offers substantial shareholder returns.

- The primary risk is the industry’s double-digit decline, which may impact Altria’s ability to sustain long-term returns.

krblokhin

Altria (NYSE:MO) is one of the largest producers and marketers of tobacco in the world, with a $90 billion market capitalization. The company has a dividend yield of more than 7%, and it’s heavily outperformed since we last recommended it. The company has continued to achieve strong earnings, and as we’ll see throughout this article, it represents a valuable long-term investment.

Altria Regulatory Burden

Altria has a massive regulatory burden that’s meant to prevent disadvantaged minors from using tobacco.

Altria Investor Presentation

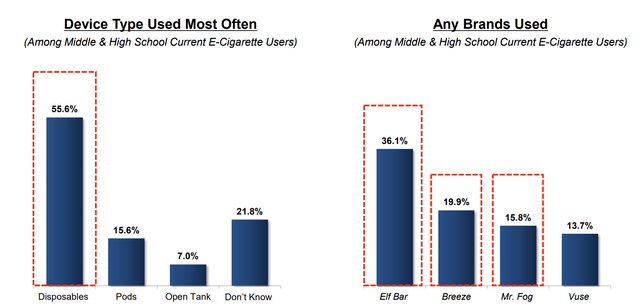

The company has seen disposable products most commonly used among middle and high schoolers, with brands such as the China-based Elf Bar dominating. These are primarily devices that are not owned by Altria, meaning that increased regulation against these products would also enable Altria to build loyalty with its products once customers hit legal age.

Altria Investor Presentation

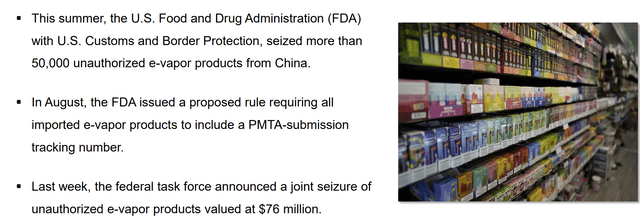

The company has continued to see massive seizures of illegal E-Vapor products from China, and the FDA is continuing to place more regulation in place as a result. This regulation, as discussed above, will help to prevent Altria’s core and legal products. Altria already spends substantial funds on its regulatory burden, but it’s working to improve things.

Altria Volume Growth

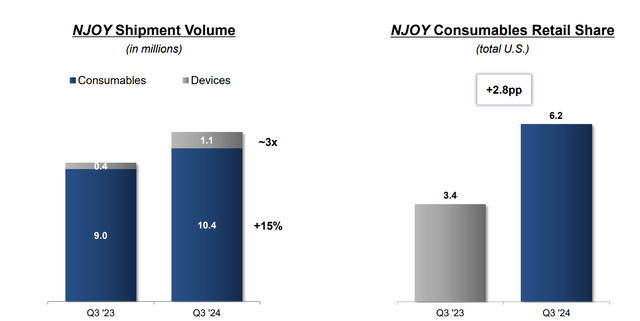

Altria has managed to grow its NJOY vapes substantially YoY in parallel, showing its market strength.

Altria Investor Presentation

The company grew devices shipped by a massive ~3x YoY, and the company managed to grow consumables by 15%. The company managed to grow its retail share substantially as a result, almost doubling it, which shows the strength of its market offerings. Vape is a much lower portion of the market, and the company is positioning itself quite well here.

We expect it to continue to grow volumes as a result.

Altria Earnings Growth

Altria has managed consistent earnings growth despite operating in a dying industry.

Altria Investor Presentation

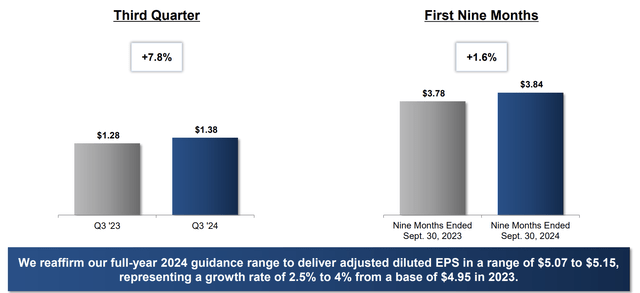

The company saw 3Q earnings increase by almost 8% YoY and for the first 9-months, the company has achieved almost 2% YoY growth. The company’s annualized EPS of more than $5 / share puts it at just above the threshold for a double-digit P/E showing the company’s continued relatively low valuation. Those earnings are what supports the company’s dividend of 7.3%.

Altria Investor Presentation

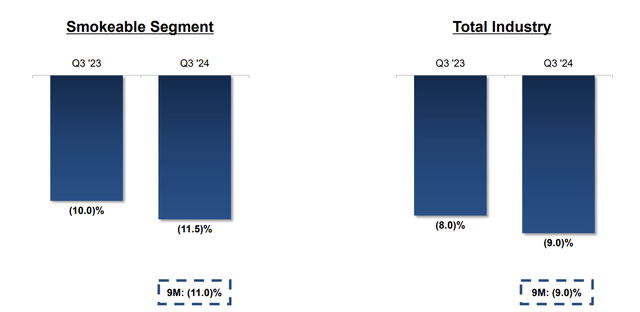

The company has seen continued YoY declines in its smokeable segment that have gotten slightly worse YoY. The company is underperforming the overall industry, but that underperformance is by roughly the same amount YoY, so it’s not a changing concern. The company has a number of premium and higher cost brands that impact this.

More importantly, the company is seen its non-smokeable products grow substantially, as we discussed above, which is balancing out much of this risk.

Altria Shareholder Returns

The company remains committed to shareholder returns, with billions returned.

Altria Investor Presentation

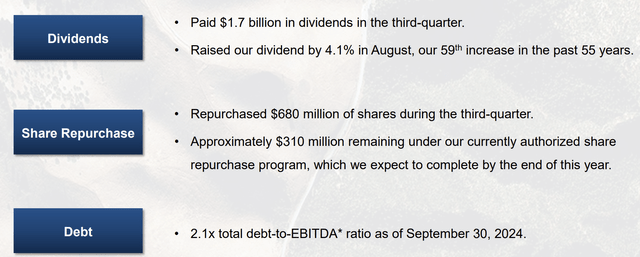

For a company with a market cap of just under $95 billion, the company pays $6.8 billion in annual dividends, driving its yield of more than 7%. The company announced another dividend increase of just over 4%, maintaining its dividend aristocrat status and the company’s 59th increase in the past 55-years.

It’s important that this history of increases has come almost entirely in the years since the U.S. Surgeon General warning against smoking, a time when the industry has continued to see decline. The company has also continued to repurchase shares and expects to finish its current authorization by year-end.

The company’s debt-to-EBITDA came with some mistakes such as Juul, but overall, remains quite strong.

Thesis Risk

The largest risk to our thesis is that Altria is an industry that is declining by double-digits. The company is working on alternatives, but fundamentally the industry is in decline. Perhaps lower risk alternatives can be proposed, and eventually the industry can line up with alcohol; however, alcohol use has been declining as well. This can hurt Altria’s ability to generate long-term returns.

Conclusion

Altria’s smokeable products are in continuous decline. However, the company lives in a highly regulated industry, and it’s done a great job of increasing those regulations and working around them. That’s enabled the company to do a good job of maintaining a strong market position for itself, which has enabled the company to drive strong cash flow.

The company is committed to continuing to generate strong shareholder returns. The company has a dividend yield of more than 7% that it can comfortably afford and a long history of increasing that dividend. We expect the company to continue its shareholder returns, making it a valuable long-term investment. Let us know your thoughts in the comments below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.