Summary:

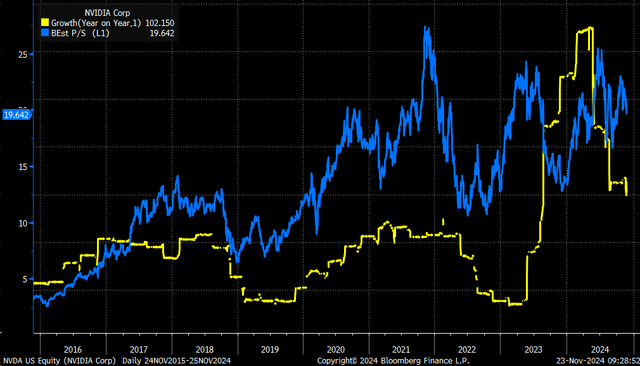

- Nvidia’s revenue growth rate is slowing, and the current valuation leaves little room for further stock price appreciation.

- The company’s predictable revenue and guidance patterns make it difficult to surprise the market, impacting investor sentiment.

- Historical comparisons to Cisco, Microsoft, Meta, and Amazon show that slowing growth typically results in a contracting price-to-sales multiple.

- Nvidia faces two major issues: predictable revenue forecasts and the likelihood of a contracting price-to-sales multiple due to slowing growth.

JasonDoiy

NVIDIA (NASDAQ:NVDA) (NEOE:NVDA:CA) stock still has two significant problems, and this quarter’s results and guidance did little, if anything, to solve them. The revenue growth rate continues to slow, and despite this, we have yet to see a meaningful shift in the amount that investors are willing to pay for that growth.

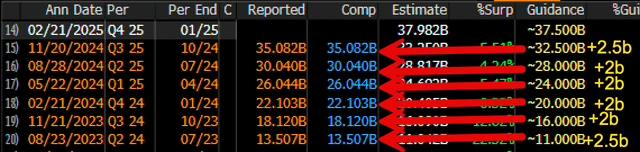

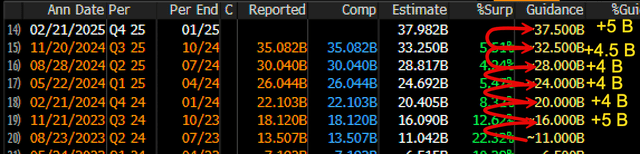

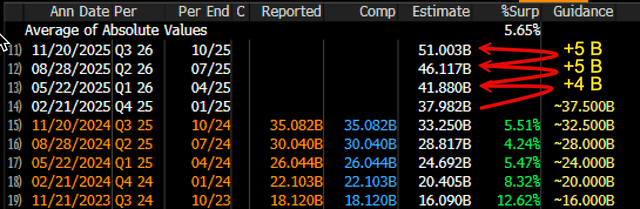

The other problem is that the company has lost its ability to surprise the market. As noted previously, simply following the pattern of beating by $2 to $2.5 billion and raising by $2 to $2.5 billion made it reasonably easy to predict that the company would report revenue around the $35 billion range and guide to around $37 billion.

Therefore, it may be safe to assume that the company will report revenue for the current quarter in the $34.5 to $35 billion range, followed by revenue guidance of $36.5 to $37 billion.

The funny thing is that analysts are continuing the pattern into the future. Making it even more challenging for Nvidia, analysts assume that revenue continues to grow at the upper end of the revenue pattern we have seen over the past several quarters.

So, at this point, the company is not growing fast enough to justify the multiple that investors are currently paying for the shares at roughly 20 times 12-month forward sales because this leaves little to no room for further stock price appreciation.

Even if analysts have correctly projected the current pattern well into the future and see revenue rising to the estimated $275 billion by the end of fiscal 2028, assuming its current market cap of about $3.5 trillion, the price-to-sales ratio would be 12.7, considering the market cap stays constant. Still a lofty multiple for any company.

Historical Comparisons

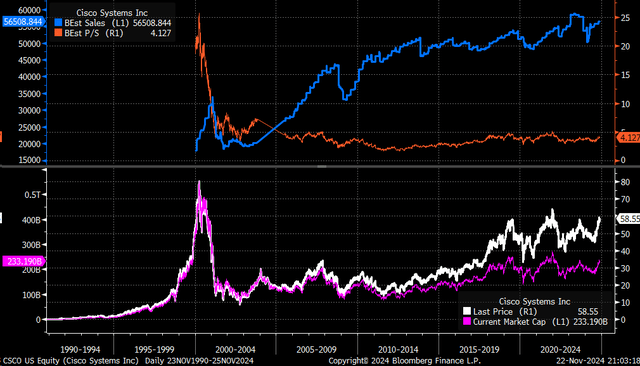

Ironically, Cisco (CSCO) saw something similar. In the late 1990s, analysts projected huge sales growth numbers for the business, which resulted in the stock trading at about 25 times its next four quarters’ sales estimates. The company eventually went on to not only reach those lofty expectations but exceed them over time. However, the market never valued the business the same way. As a result, Cisco’s stock still trades for less than the highs seen in the dot-com bubble, and the market cap is half what it was back then.

So, none of this says that Nvidia can’t grow its revenue over time. The question is how much investors will be willing to pay for that type of revenue. Generally speaking, as revenue growth slows, the multiple that investors are willing to pay for that growth contracts.

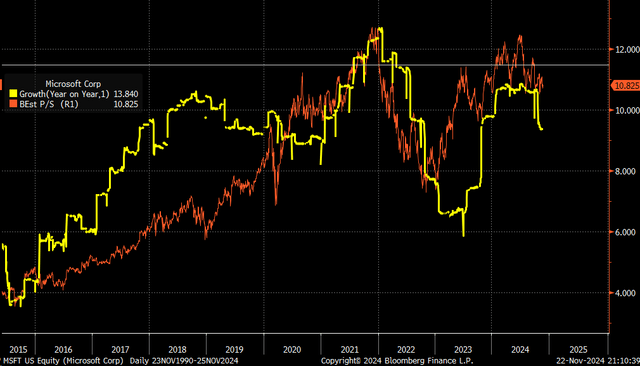

This has been the case in many companies, Microsoft even being one. The stock has struggled recently, and it isn’t because revenue isn’t rising, or the company is performing poorly. Perhaps it is because the revenue growth rate, after accelerating in 2023, is now slowing, and as a result, the price-to-sales ratio is contracting.

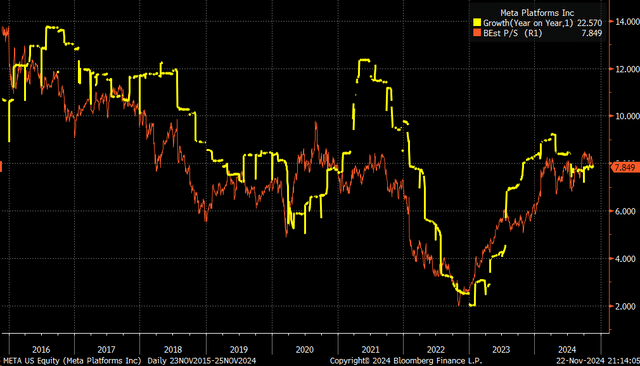

The same pattern is present in Meta (META), with the stock’s price-to-sales ratio simply trading with its growth rate. Since November 2022, the stock multiple has expanded rather dramatically, and that was because the company’s revenue growth accelerated. So it should be no surprise that now that stock sales growth has started to slow, the price-to-sales ratio has stopped expanding.

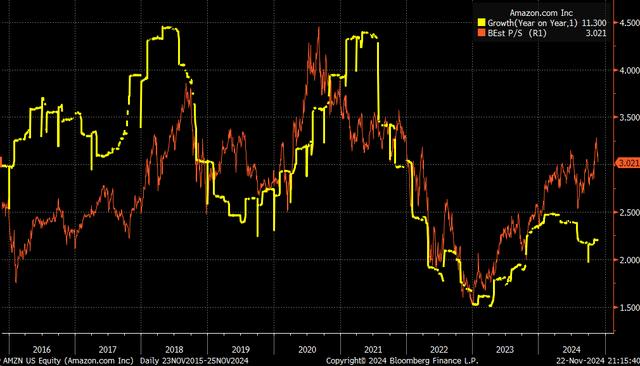

It is the same situation for Amazon as well. Revenue growth slowed drastically starting in 2021 and rebounded in early 2023. As revenue growth began to recover, the sales multiple began to rise. But notice that since sales growth only recovered modestly, the multiple expansion was more modest.

The same has been the case for Nvidia in the past, and if companies like Amazon (AMZN), Microsoft (MSFT), and Meta have been held to the standard of sales growth rates impacting sales multiple, then Nvidia isn’t likely to be immune to this process either. In fact, in the past, Nvidia has been held to this very same process.

So, at this point, there appear to be two problems for Nvidia. The revenue and guidance path looks pretty predictable and manageable to forecast. The other problem is that slowing growth will also result in the price-to-sales ratio to contract. Just how much and how low those multiple contracts could make a very big difference in what this stock is worth in the future.

Chances are the grandiose projections and valuation will be just that grandiose projection, ones that never come to fruition, at least not anytime soon.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Charts used with the permission of Bloomberg Finance L.P. This report contains independent commentary to be used for informational and educational purposes only. Michael Kramer is a member and investment adviser representative with Mott Capital Management. Mr. Kramer is not affiliated with this company and does not serve on the board of any related company that issued this stock. All opinions and analyses presented by Michael Kramer in this analysis or market report are solely Michael Kramer’s views. Readers should not treat any opinion, viewpoint, or prediction expressed by Michael Kramer as a specific solicitation or recommendation to buy or sell a particular security or follow a particular strategy. Michael Kramer’s analyses are based upon information and independent research that he considers reliable, but neither Michael Kramer nor Mott Capital Management guarantees its completeness or accuracy, and it should not be relied upon as such. Michael Kramer is not under any obligation to update or correct any information presented in his analyses. Mr. Kramer’s statements, guidance, and opinions are subject to change without notice. Past performance is not indicative of future results. Neither Michael Kramer nor Mott Capital Management guarantees any specific outcome or profit. You should be aware of the real risk of loss in following any strategy or investment commentary presented in this analysis. Strategies or investments discussed may fluctuate in price or value. Investments or strategies mentioned in this analysis may not be suitable for you. This material does not consider your particular investment objectives, financial situation, or needs and is not intended as a recommendation appropriate for you. You must make an independent decision regarding investments or strategies in this analysis. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Before acting on information in this analysis, you should consider whether it is suitable for your circumstances and strongly consider seeking advice from your own financial or investment adviser to determine the suitability of any investment.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Join Reading The Markets – Get The First Two Week – Offer End 12/2/24

Reading the Markets helps readers cut through all the noise, delivering daily video and written market commentaries to prepare you for upcoming events.

We use a repeated and detailed process of watching the fundamental trends, technical charts, and options trading data. The process helps isolate and determine where a stock, sector, or market may be heading over various time frames.