Summary:

- Earlier this year, CEO William Brown said 3M’s products are aging. Now and in the near future, it seems like the company is focussing on new products and research.

- It seems like the uncertainty-creating lawsuits are now largely settled, but the costs will weigh on the company for several years to come.

- Nevertheless, 3M has a strong financial position and rewards its shareholders with dividends and buybacks, but I’m waiting because I believe it is slightly too expensive.

jetcityimage

Investment Thesis

3M (NYSE:MMM) is a strong and very investor-friendly company that returns much of its earnings to shareholders. However, I believe that entry timing is crucial when it comes to investing in slow-growing value stocks. Given the likely growth figures for the next few years and also relative to its own recent valuation history, I think the share is currently slightly overvalued. Even if you like certain stocks, it pays to be patient as an investor. There were fantastic entry points in 2023 and earlier in 2024, but currently, I prefer to wait.

Company Overview

3M is a global, diversified technology company that has been in business for 122 years. On their website, you can see an interesting timeline of their history. The company currently has around 85,000 employees. 3M sells in over 200 countries worldwide and has over 60,000 products under many different brands. These products are used in numerous industries. It would go beyond the scope of this article to list them all, just to name a few: automobile, health care, transportation, electronics, energy, and more. The 3M website gives a detailed overview, and in each of the categories, you can also see the corresponding products.

The past: Financial Progress & Trends

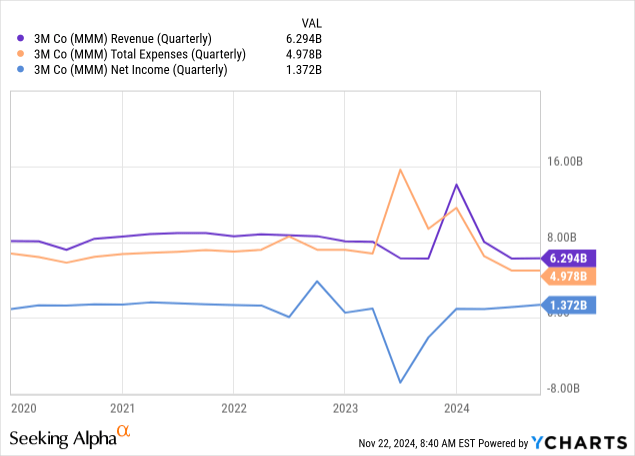

First, I want to provide a short overview of revenues, expenses, and net income over a longer period. This helps to give a clearer picture of the company’s direction.

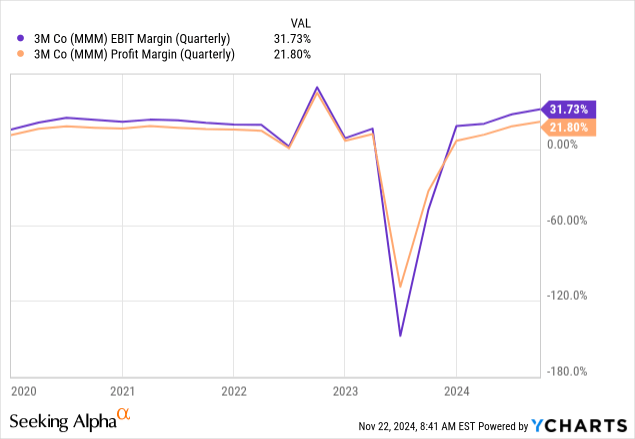

The margin development shows that the EBIT and profit margins have improved in recent quarters, and overall, the profit margin of almost 23% is quite good. In this longer-term view, however, we still see that margins tend to remain constant, which is certainly typical for industrial companies. To significantly increase EPS, the company will have to increase sales rather than expand the margin.

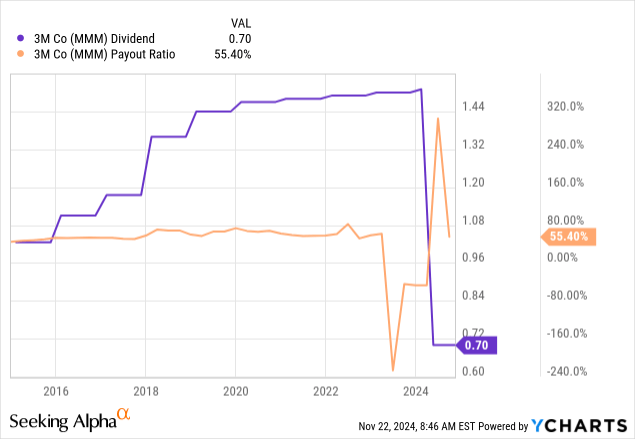

Dividend

After the dividend cut, the annualized payout is around $2.80, equating to a dividend yield of 2.2% on the current share price. Given the payout percent ratio, there is definitely room for increases in the future.

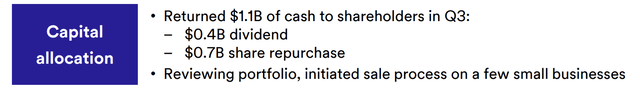

The company states that $1.1B was repaid to shareholders in Q3. Assuming an annualized amount of $4.4B, while the market capitalization is $69B, this would mean a yearly capital return of around 6% to investors. This shows the power of buybacks and that the dividend cut and the current dividend yield are only part of the bigger picture. It’s not sure that it will be $4.4B annualized, but it should be somewhere in this range.

The present: Valuation & current developments

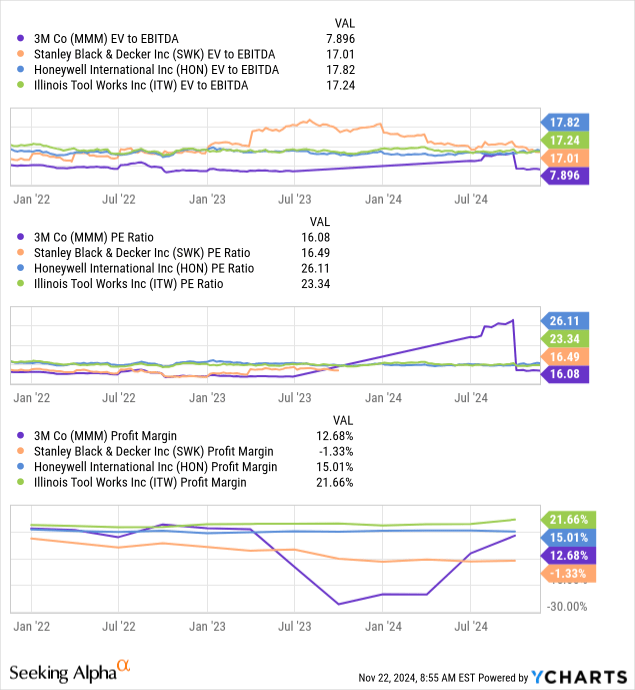

The company is currently valued at an enterprise value of $76B, its market cap is $69B, and its net debt is about $6.5B. As far as valuation is concerned, we can look at different approaches and compare some of them with competing companies:

EV/EBITDA, PE ratio, and profit margin compared to:

All four companies are industrial manufacturers and compete directly with each other in some markets. They are all established companies with diversified business models. However, of course, it must be noted that companies are rarely comparable 1 to 1, and the range of market capitalization also diverges quite a bit.

| Market cap | 5-year avg. revenue growth | ||

| 3M | $69B | 1.3% | |

| Stanley Black & Decker | $13.8B | 6% | |

| Honeywell | $149B | -1.4% | |

| Illinois Tool Works | $81B | 2.2% |

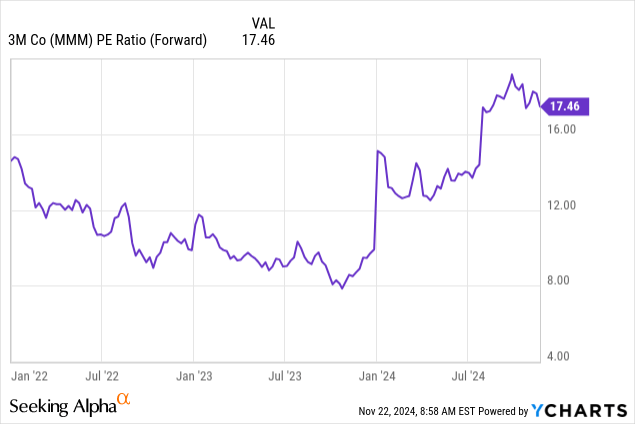

Compared with these competitors, 3M’s valuation appears more attractive, but I wouldn’t call this valuation cheap, especially given current growth rates. Here is the forward P/E of only 3M since the beginning of 2022, showing that the valuation is almost at a 2-year peak.

Q3 2024

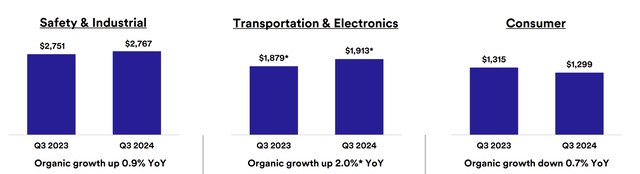

Following the spin-off of Solventum (SOLV), the business has been somewhat simplified and can now concentrate on fewer core areas. However, these have hardly changed YoY—overall growth of 1%. Geographically, Asia contributed the most to growth.

Looking geographically, adjusted organic growth was led by Asia-Pacific, up mid-single digits, driven by our electronics business. The U.S. was flat with strength in home improvement and commercial branding and transportation, offset by a tough comp in personal safety as self-contained breathing apparatus benefited from significant supply recovery last year. And EMEA was down low single-digits due to the decline in global car and light truck builds.

Anurag Maheshwari, Q3 earnings call

Overall, the Q3 results were well received by the market:

- beat estimates by $0.08 with adjusted EPS of $1.98 (vs. adjusted earnings of $1.68 in Q3 2023)

- Adj. operating margin of 23% (vs 21.6% in Q3 2023)

- full-year earnings are expected to be $7.20 to $7.30 a share (vs $7.00 to $7.30 estimated before)

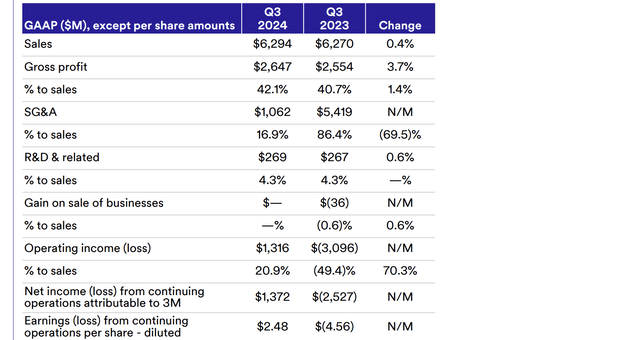

Note that the numbers above are non-GAAP numbers. The legally required GAAP numbers are below. Note that the net income is $1.3B, while I mentioned in the dividend section that $1.1B was returned to shareholders. This means that while the dividend payout ratio may still look good, there is not much room for maneuvering in the overall calculation (if buybacks are taken into account and the actual GAAP figures are used and not adjusted figures).

The future: Outlook

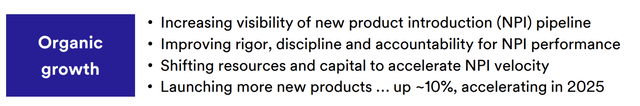

The latest investor presentation mentions that new product launches will accelerate in 2025 and that more resources and capital will generally be used to boost product innovation.

This is excellent news because CEO William Brown discussed the aging products in the Q2 2024 earnings call.

And within the lower spend, the amount we invest on new product development has declined even further as the company shifted more dollars to efforts to exit PFAS manufacturing and work to reduce supply chain cost and resolve COVID related sourcing constraints. As a result of the decline in investment, along with a strategic shift to fewer, but larger innovation opportunities, the number of and revenue from new product introductions has steadily declined over the past decade. The simple fact is that our products are aging.

William Brown

However, if you look in the Income Statement at the expenditure on research and development in recent years, you can see that there has actually been a slight downward trend—inflation is not even included.

In the Q3 earnings call, William Brown said.

And finally, we are shifting about 100 people within R&D to focus on new product development, including those who are rolling off PFAS-related projects and adding more than 50 new engineers in the fourth quarter to high priority focus areas such as specialty materials and films for the automotive, aerospace, electronics and semiconductor markets. After a decade-long slide in new product introductions, we bottomed out and are starting to turn the corner with new product launches expected to be up about 10% this year with a further acceleration next year.

Expected returns

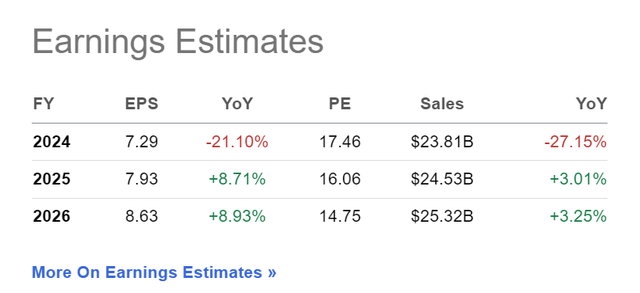

Let’s look at the earnings estimates and the objected growth rates. Note how the EPS is growing much faster than sales, which is an effect of share buybacks.

Let’s assume EPS of $7.90 for 2024. A P/E ratio between 14 and 18 seems fair given the overall growth rates. But, of course, this is subjective and also depends on personal judgment, your existing portfolio composition, and potential opportunity costs (which other stocks offer attractive opportunities at the moment). I would probably accept a P/E of 15 at most for a buy of 3M.

The table below shows that if the share trades at a P/E ratio of only 16 at the end of 2025, then the price will be only $126. As I write this, the share price is $128, meaning you will only get a meaningful return on investment if the share’s P/E ratio remains about the same or even rises.

| Assumed PE | EPS | Stock price 2025 |

| 18 | $7.90 | $142.20 |

| 16 | $7.90 | $126.40 |

| 14 | $7.90 | $110.60 |

In my opinion, the share is currently slightly overvalued. There were attractive entry points from the end of 2023 to the beginning of 2024, but right now, I prefer to be patient and take other opportunities in the market.

Risks

It’s crucial to be aware of the risks and negative aspects. I differentiate between risks, weaknesses, and errors in my analysis or assumptions:

Risks: potential future threats

One risk is a possible negative impact from the Trump administration’s likely China import tariffs, which could come as early as Q1 2025. 3M has thousands of suppliers, so it is virtually certain that the company will be affected in some way. Tariffs will likely result in higher supply chain costs. The company may be able to pass these costs on to customers and thus keep margins stable, but this could hurt demand. In general, the exact impact is difficult to predict.

Weaknesses: already existing disadvantages

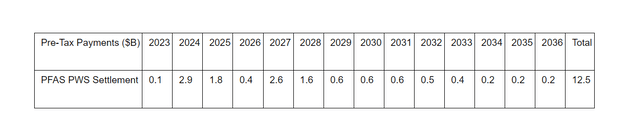

Last year, the company was fined $6B for supplying flawed earplugs to the military that caused hearing loss and tinnitus. Additionally, the company faces a further $10.3B in costs because of PFAS (‘forever chemicals’): 3M has agreed to make payments to numerous public water utilities in the U.S. to settle thousands of lawsuits over PFAS contamination. Under the agreement, the company will make the payments between 2023 and 2029. The table below shows the expected payment schedule. As we can see, these are substantial numbers, especially in 2024 and in the coming years.

The end of PFAS production by 2025 will, at least, free up brainpower to be deployed in other areas; this was mentioned in the Q3 earnings call.

We are shifting about 100 people within R&D to focus on new product development, including those who are rolling off PFAS-related projects and adding more than 50 new engineers in the fourth quarter to high priority focus areas such as specialty materials and films for the automotive, aerospace, electronics and semiconductor markets. After a decade-long slide in new product introductions, we bottomed out and are starting to turn the corner with new product launches expected to be up about 10% this year with a further acceleration next year.

William Brown

Potential errors in my assessment

Of course, I could also be wrong. For example, the company’s legal penalties are not easy to understand and are subject to long-term repayment agreements. These may have a greater impact on future profits than I can estimate.

In addition, I could be wrong in my assumption regarding the valuation; perhaps the market will attribute a higher average P/E ratio to the share when the company shows that it is back on a growth path and all legal disputes have been settled. Perhaps the company will then trade at a significantly higher average P/E ratio over the next few years. If that happens, returns are likely to be excellent over subsequent years.

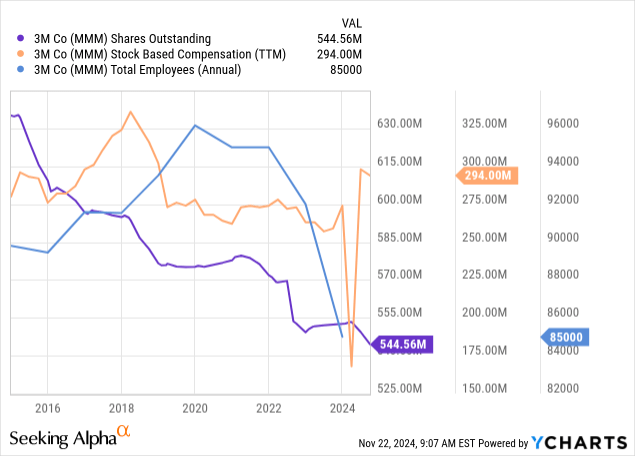

Share dilution, insider trades & SBCs

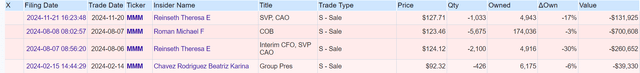

I check these aspects in each article: Excessive share dilution and stock-based compensation (‘SBC’) can be detrimental to shareholders, and insider trading sometimes contains valuable information about management confidence. Since I examine these things in each of my analyses, I have good comparative values and can safely say that 3M is very investor-friendly in all three of these aspects. Apart from 3M, I see very few companies with so little insider trading and SBCs.

In this 10-year chart, we can see that SBCs remain pretty stable, shares are constantly being repurchased, and in the last two years, about 10% of jobs have been cut (probably mostly a side effect of the spin-off).

There is not much insider trading; these are all trades from the last 12 months.

Conclusion

What I like about the share is that it is very investor-friendly and returns a lot of the free cash flow to shareholders. However, I am not buying the share now because it seems slightly too expensive, has little growth (or tends towards almost stagnating sales). EPS growth is strongly driven by share buybacks and not so much by rising revenues.

As an investor, I try to be patient. Every month, I have money available to invest, so I can decide each month to take advantage of only the best buying opportunity. There were opportunities in 2023 to pick up the stock cheaply and thus generate great returns for years, but at the moment, I don’t think this is such a time. That’s why I prefer to be patient, which means not buying now.

|

Investor’s Checklist |

Check |

Description |

|

Rising revenues? |

No |

Increasing over longer periods |

|

Improving margins? |

Yes (for a few quarters) |

Possible competitive edge |

|

PEG ratio below one? |

No |

PEG ratio below one may suggest undervaluation |

|

Sufficient cash reserves? |

Yes |

Vital for the survival & growth, especially of unprofitable companies |

|

Rewards shareholders? |

Yes |

Returning capital to shareholders |

|

Shareholder negatives? |

No |

Actions that disadvantage shareholders (e.g. dilution of shares) |

|

Stock in an uptrend? |

Yes |

Trading above its 200-day moving average? |

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.