Summary:

- Alibaba’s restructuring continues with the formation of the Alibaba E-commerce Business Group, which will be led by Fan Jiang, which looks entirely in line with the company’s focus.

- Despite restructuring efforts since last year, though, Alibaba’s financials remain weak, with Q2 FY25 showing minimal revenue growth and declining adjusted EBITA.

- Market multiples are improving, however, with BABA’s TTM P/E ratio dropping significantly, making the stock potentially more attractive if the trend continues.

Robert Way

China’s e-commerce giant Alibaba (NYSE:BABA) took yet another step forward in the direction of restructuring last week, after appointing a new CEO last year and releasing a new strategy letter earlier this year.

It has now combined its entire e-commerce division together to form the Alibaba E-commerce Business Group, which brings together the domestic e-commerce segment, Taobao and Tmall Group [TTG] and Alibaba International Digital Commerce Group, along with smaller e-commerce segments. The new segment also has a new CEO.

What Jiang’s new role says

It will be headed by Fan Jiang, who was earlier the CEO of the fast-growing international e-commerce segment. The segment saw a robust 31% year-on-year (YoY) increase in revenues in the first six months of its current financial year (H1 FY25, year ending March 2025). The 39-year-old is a computer scientist by training. He had earlier founded Umeng, which provided solutions for mobile app analytics, which was later acquired by Alibaba.

His background is important to the extent that it ties in with the exact focus areas of the company right now. Here’s how.

- Doubling down on tech: This latest appointment follows Eddie Yongming Wu being named the CEO of the company last year. Wu’s promotion coincided with Alibaba’s renewed focus on tech at a time of “brand-new opportunities from the ongoing AI technological transformation” as per a company release from the time. Wu had worked as a CTO earlier and going by Jiang’s bio, the company continues to focus on leadership with a tech background.

- Getting entrepreneurial: His entrepreneurial background is likely beneficial as well. In a strategy update letter earlier this year, Wu said, “For the next ten years, we see ourselves again as a start-up defined by entrepreneurship, innovation, and our mission “to make it easy to do business anywhere.””.

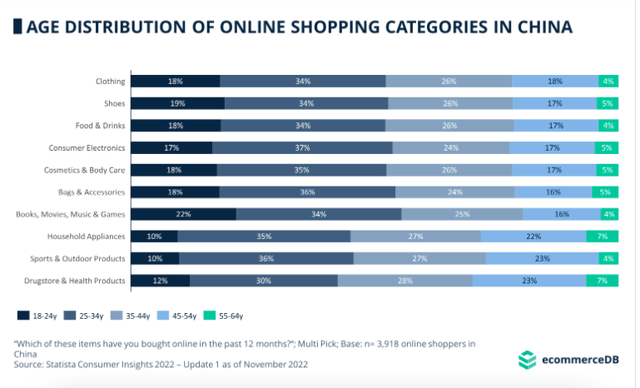

- Millennials in focus: Finally, it’s also in line with the focus on promoting millennials like the Jian to prominent positions, which may well be explained by the segment’s contribution to e-commerce in China. As the chart below shows, customers in the age range of 25-44, which essentially represents millennials, account for the biggest proportion of online spending across categories.

Underwhelming results

The impact of the ongoing restructuring on the company’s financials appears to be a thing of the future, though. For now, Alibaba continues to show underwhelming financials, as seen in its recent Q2 FY25 results. The key financial developments are as follows:

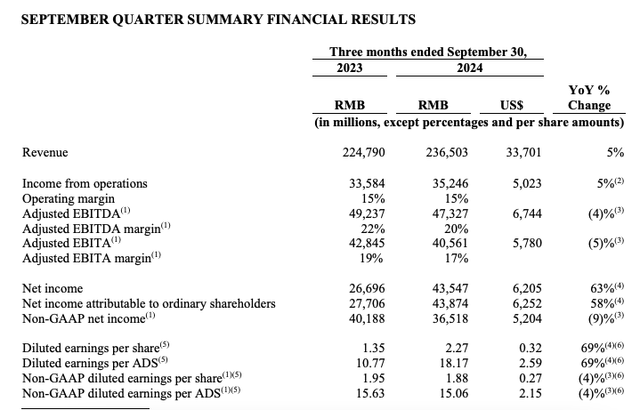

- Revenue growth remained almost at the same level at 5% YoY in Q2 2025 compared to 4% YoY in Q1 FY25.

- The adjusted EBITA contraction worsened to 5% YoY compared to a 1% YoY decline in Q1 FY25. The company ascribes this to “the increase in investments in our e-commerce businesses”.

- But TTG’s performance still lags behind, with just 1% YoY revenue growth and a 5% YoY decline in adjusted EBITA levels. The international e-commerce division did much better, with a 29% YoY revenue growth, though it remains loss making. In fact, its adjusted EBITA losses ballooned by a massive 657% YoY.

- The cloud services segment remained the bright spot, with a 7% YoY revenue increase and 89% YoY increase in adjusted EBITA. But its contribution is small, at 12.5% for revenues and an even smaller 6.6% for adjusted EBITA during the quarter, which explains its limited effect on Alibaba’s overall financials.

- The company’s adjusted net income also saw a 9% YoY decline, even as the GAAP net income showed a robust increase (see table below) largely due to gains on equity investments.

Market multiples are improving

Despite the muted performance, though, there’s something to be said for the market multiples. First, the stock’s trailing twelve months [TTM] GAAP price-to-earnings (P/E) ratio at 16.85x, is much lower than the 26.4x it was at the last I checked. While it remains much higher compared with Temu owner PDD Holdings (PDD) and JD.com (JD) at 9.54x and 10.85x respectively, the gap has reduced in the past month.

Moreover, the difference between BABA’s and its peers’ multiples is far smaller when considering the forward non-GAAP P/E. BABA is at 9.46x compared to PDD at 8.7x and JD at 8.9x. With a decline of over 13% in BABA’s stock price in the past month alone, it could look much better placed soon enough if the trend continues.

On the other hand, though, its continued share buybacks could provide some lift for the price as well. I’m not holding my breath, though. In Q2 FY25, it bought back shares worth USD 4.1 billion, which is around 2.2% of its current market capitalization. And while BABA rose by 36% during the quarter, it’s doubtful whether this is down to the share buyback. The rise coincided with the stimulus from the People’s Bank of China in late September after staying relatively flat through much of the quarter.

What next?

Essentially, now is a good time to watch how the BABA stock story develops. There are two potential catalysts for it going forward. The first, of course, is just its price, which is beginning to get to more attractive levels. If it continues to decline, it can become more attractive compared to peers, flipping it into a stock to buy.

The second is the potential indicated by the company’s restructuring exercise. Even though Alibaba’s financials continue to remain relatively soft, the company’s dogged efforts to breathe life back into its massive but sagging domestic e-commerce segment are noteworthy. The recent appointment of Jiang to head up the newly consolidated e-commerce segment can even be seen as a reflection of its clarity in focus on tech, an entrepreneurial spirit and its target customer segment.

For now, though, the critical driving factor for BABA is the recent earnings report, since whose release the stock is down by 8%. Even if the sluggish revenue growth were explained by the state of the Chinese consumer market right now, the contraction in profits is hard to get past. I’m retaining a Hold rating on BABA.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

—