Summary:

- Ford model e segment is a significant drag on the overall profitability of the company, with a $1.2 billion loss in Q3 and a negative EBIT margin of -104.4%.

- Should Congress eliminate the $7,500 EV tax credit in 2025, I anticipate a drop in EV demand and an increased reliance on discounts and company-based incentives.

- I anticipate intense pricing pressures as over 150 new EV models hit North America by 2026, forcing Ford to scale down production and offer company-based incentives.

- Ford’s inventory levels, at 91 days compared to a target of 50-60 days, increase the likelihood of write-downs if price adjustments are required in 2025.

- Due to its low valuation, high dividend yield, and uncertain Congressional decision on tax credits, I believe shorting Ford is not a wise idea, despite my sell rating.

simonkr/E+ via Getty Images

Ford Motor Company (NYSE:F) is catching the eye of both value and dividend investors. From a valuation perspective, the stock looks quite appealing and provides a compelling forward dividend yield of 7%.

Furthermore, from an earnings perspective, revenue has been increasing consecutively for the past 10 quarters, with both EPS and revenue projections surpassed in Q3 this year.

However, if we dive deep into the fundamentals and overall market dynamics (especially for electric vehicles), in my view, the outlook for this company doesn’t look that appealing.

In the past quarter, management guided a full-year EBIT loss of approximately $5 billion for the Ford Model e segment. Additionally, the EBIT for the Ford Blue segment was revised downwards from a range of $6-$6.5 billion in Q2 2024, to an expectation of $5 billion.

In my view, there is strong evidence to suggest that the EV segment is dragging down the profitability of the company.

In fact, the main pillar of my bear thesis is centered around this segment.

I believe there is enough evidence to suggest that the EV tax credit in the US could disappear next year. If this is the case, I believe the Ford Model e segment will further pressure the company’s profitability in 2025, as demand for EVs decreases and company-based incentives for its EV fleet increase. Additionally, I foresee a high chance for an inventory write-down if Congress approves this initiative.

However, there are big risks to my bear thesis, which is the main reason I believe it is not wise to short this company at the moment. The attractive valuation ratios and the high dividend yield could increase its share price before Congress decides to cut (or not) the current EV tax incentives.

Current Performance

In Q3 2024, Ford delivered results that were in line with investors’ expectations. The Detroit-based manufacturer surpassed both EPS and revenue estimates.

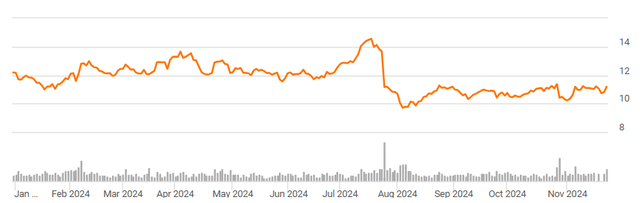

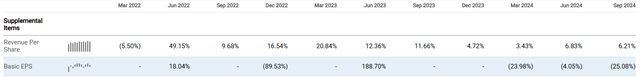

From a revenue perspective, this was the 10th consecutive quarter experiencing an increase in revenue.

However, we can’t say the same about EPS.

As seen below, the company’s EPS experienced a double-digit YoY decline in Q1 and Q3 this year.

Even more concerning is the decline in operating income, which achieved a double-digit YoY decline for the past 4 consecutive quarters.

For a highly established company like Ford, my investment style weighs profitability significantly more than revenue growth.

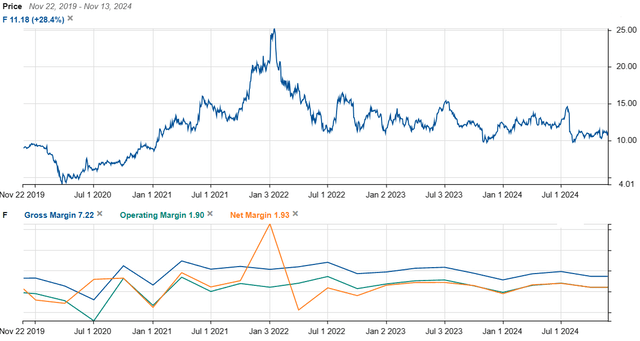

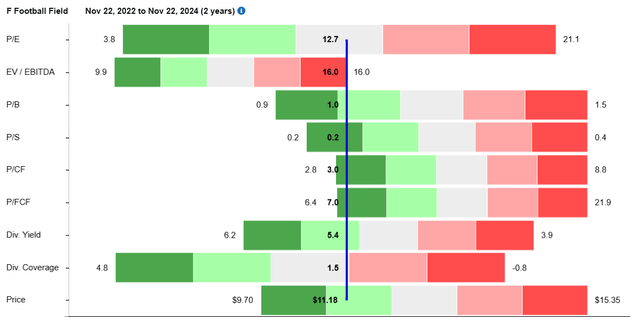

Therefore, the chart below, representing price and profitability metrics over the past 5 years, is not particularly encouraging.

Since mid-2022, the company’s profitability ratios have suffered a decline, and, as I will cover below, I do not see any immediate clear actions from the company that could restore its profitability metrics in the short term (i.e. before the end of 2025).

In fact, I see a big catalyst that could lead to a significant decline in its profitability metrics, which I discuss below.

Why EV Losses Could Deepen in 2025

It’s clear that out of all the company’s divisions, the EV segment (Ford Model e) is the one putting the biggest strain on profits.

I have compiled the results from the latest 10-Q to better reflect the drag of the EV segment:

| Segment | EBIT (in millions) | EBIT Margin (%) |

|---|---|---|

| Ford Pro | $1,814 | 11.6% |

| Ford Blue | $1,627 | 6.2% |

| Ford Model e | -$1,224 | -104.4% |

On top of that, during the last earnings conference, CEO Jim Farley projected that over 150 new electric vehicle models will be available in North America by 2026.

…No doubt there’s a global price war and it’s fueled by overcapacity, a flood of new EV nameplates, and massive compliance pressure. In our home market in the US, no OEM is immune. Since Q1 of last year, EV volumes have grown 35%, while revenues in total are flat at $14 billion. That means the progress on volume has been fully offset by prices. We’re expecting roughly 150 new EV nameplates to hit North America by the end of 2026.

Therefore, I foresee the high competition leading to a decline in EV prices, encouraging manufacturers to offer significant incentives to gain market share.

In fact, Ford already took the initiative to introduce a year-end sales event offering significant discounts on its electric vehicles in light of the aggressive leasing tactics of some of its competitors.

These incentives include 0% financing for 72 months, $5,000 in bonus cash, and a complimentary home charger with standard installation. For leases, Ford is providing up to $10,500 in lease cash on the 2024 Mustang Mach-E and up to $6,500 on the 2024 F-150 Lightning.

Therefore, I believe the company’s best move is to reduce costs in underperforming regions and focus on scaling up EV production to achieve economies of scale.

On November 20, Ford announced 4,000 job cuts in Germany and the UK by 2027.

Unsurprisingly enough, this announcement comes after the $2 billion Ford Cologne Electric Vehicle Center began mass production of the all-electric Ford Explorer in June this year.

However, overall, Ford has trimmed EV capacity by 35% YoY to align with market demand.

We’ve already reduced $1 billion in our EV costs this year. We remade our battery footprint. We trimmed our capacity to — by 35%, in line with where we think the market will be in a few years.

In fact, I believe the company’s high inventory levels could lead to a potential write-down if pricing adjustments are made going into next year. To put things in perspective, Ford reported ending Q3 with 91 days of gross stock for all vehicles, which exceeds its target range of 50-60 days.

However, I believe the next factor overshadows any possible inventory write-downs or competitive pressures.

Elon Musk has expressed support for Donald Trump’s plans to eliminate the federal EV tax credit, which currently provides up to $7,500 to consumers purchasing electric vehicles.

At first glance, it might seem counterintuitive for Tesla’s own interests; however, Musk believes that ending the credit would devastate Tesla’s competitors, particularly the Detroit-based automakers like Ford and General Motors.

If Congress approves this initiative, I foresee a significant selloff in Ford’s share price, as I expect demand for their electric SUVs to decline drastically.

How significant would be this potential selloff?

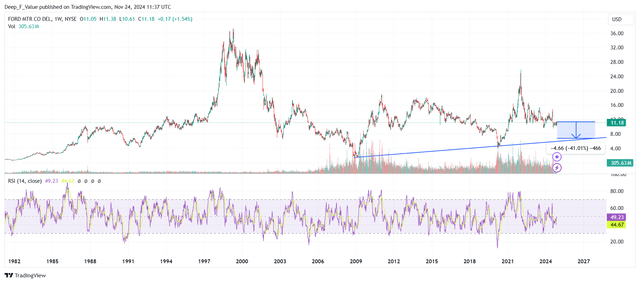

Well, technical analysis plays a small factor in my investment style, however, but I don’t disregard it entirely.

A quick look at the weekly chart below suggests that a selloff could find support after a 40% decline, at around $7 per share.

How I Can Be Wrong

Despite my sell rating, I am not shorting Ford at the moment.

In my view, the risk of an increase in the share price prior to Congress’s decision on EV tax incentives is too high, considering the attractive valuation ratios of this stock.

Price to sales, price to earnings, price to book value, and price to cash flow are trading significantly (double digits) below the sector median.

If we look at the historical range of the company’s valuation ratios over the last 2 years, we can see P/B, P/CF, and P/S trading close to the historical minimum.

However, EV/EBITDA remains at the maximum of this 2-year historical range, and over 50% above the sector median

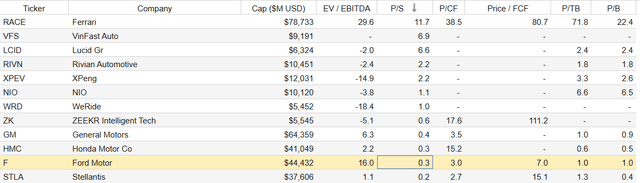

If we compare the company’s valuation metrics with some of its industry peers (notice not all of them are direct competitors), we can conclude that the company looks quite undervalued.

The table below is sorted by P/S in descending order.

If we were to use other valuation metrics, like P/CF and P/B, we would arrive at a similar conclusion: the company is undervalued.

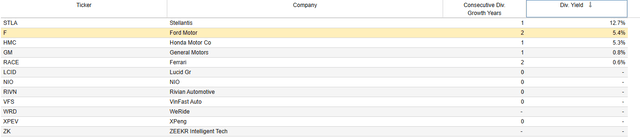

Additionally, this stock also attracts dividend investors, considering the 5.37% dividend yield over the past 12 months.

Furthermore, the dividend yield is quite attractive when compared to its industry peers (again, I need to emphasize that these are industry peers, not direct competitors).

Therefore, I believe Ford’s current low valuation ratios and high dividend yield could attract value and dividend investors, looking to buy high dividend yield shares at a discounted price.

Therefore, there is a high risk that the share price could increase before Congress decides on cutting (or not) the EV incentives, which is why I’m not shorting the stock at the moment of writing this article.

Additionally, there is no guarantee that Congress will approve this decision. If they don’t, my bear thesis could fall apart.

As a side note, this is the main reason I don’t rate this stock as a strong sell.

Conclusion

To wrap up, I rate Ford as a sell, mainly because the EV segment is dragging down the company’s profitability, along with the likelihood of a near term catalyst that could worsen this negative impact.

I anticipate that high competition in the EV market by 2026 will lead to price pressures and increased in-house incentives by manufacturers like Ford, leading to a further decline in profitability margins.

Speaking about incentives, I’m projecting that the potential elimination of federal EV tax credits could highly impact demand for Ford’s electric vehicles. Another concern is the company’s high inventory levels, which, I believe, could necessitate write-downs if pricing adjustments are required next year.

While cost-cutting measures and production adjustments are steps in the right direction, I’m not convinced they will be sufficient to offset the challenges in the near term.

However, I believe that shorting the company is not a wise idea at the moment, considering the high dividend yield and attractive valuation ratios among its industry peers. This makes the stock appealing to investors looking for good value and dividends, which might cause the share price to rise before Congress decides on cutting (or not) the EV tax incentives.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.