Summary:

- My Dean’s List is a small group of companies earning top grades across all five of Seeking Alpha’s Quant factors, signifying “excellence” in valuation, growth, profitability, momentum, and EPS revisions.

- Of this group, General Motors is my top pick for 2025 due to improving EV momentum, an attractive valuation, and solid financial performance.

- Tenet Healthcare has crushed the market, driven by high-acuity services, operational efficiency, and strong free cash flow, making it the top performer of the group over the past five years.

- Discover Financial Services stands out for dividend growth, combining a low payout ratio and a fourteen-year streak of increasing distributions, amid merger uncertainties.

DNY59/E+ via Getty Images

As a university professor, it’s always rewarding to see students make the Dean’s List. At my institution, the honor requires a GPA of 3.5 or above, which means achieving mostly A’s. Writing recommendation letters for these high achievers is a breeze compared to those who’ve struggled for one reason or another. In some ways, analyzing companies is similar: making the case for the best-of-the-best is easy, while recommending businesses with obvious weaknesses—declining market share, rising costs, inconsistent earnings, etc.—requires more nuance.

Here on Seeking Alpha, we have our own evaluation system in the form of Quant factor grades. However, while the best students excel in all their courses, stocks rarely achieve top marks in every Quant category. A company showing an A+ for growth may score an F in valuation, like NVIDIA (NVDA). Similarly, a strong valuation grade may stem from grim expectations, like Merck’s (MRK) following a glut of negative EPS revisions.

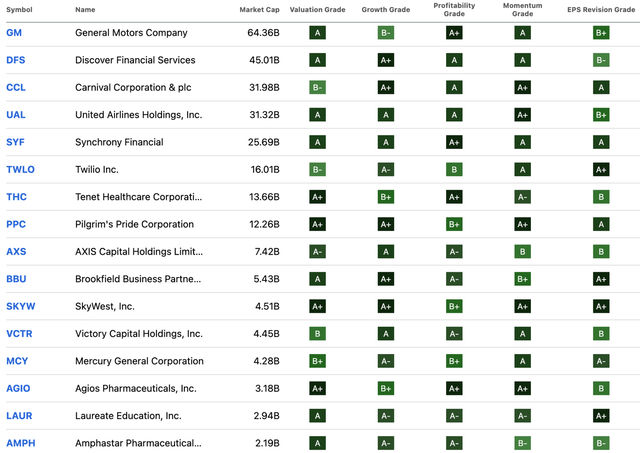

Out of the 4,440+ companies rated on Seeking Alpha, only sixteen currently meet my “Dean’s List” threshold. This article will walk you through the screening process I used to narrow the investible universe to honor roll-worthy businesses. I’ll explain why my top pick from this group for 2025 is General Motors (NYSE:GM), and also spotlight two other companies that ticked special boxes in my analysis: Tenet Healthcare (THC) and Discover Financial Services (DFS).

Screening Process

Using Seeking Alpha’s screener tool, I applied the following filters:

Quant Factor Grades – Growing, profitable companies that are undervalued and on an upswing? Yes, please. Criteria: B- or higher for all five factors: Valuation, Growth, Profitability, Momentum, and EPS Revisions.

Market Cap – Smaller companies are often more volatile, more sensitive to economic shifts, and more prone to performance skew over shorter timeframes. Criteria: minimum $2B.

I then manually eliminated those with three or more factor grades of B, as this lowers their “GPA” below 3.5. They’re impressive, but unworthy of the Dean’s List. This produced a list of just sixteen companies:

Seeking Alpha

General Motors: A Top Pick for 2025

GM is one of the largest global automakers, producing a diverse lineup of vehicles ranging from internal combustion engine (ICE) models to electric vehicles (EVs) and autonomous driving technologies. GM’s North American operations are its most profitable, led by a strong portfolio of trucks, SUVs, and crossovers. Its aggressive push into electrification includes the Ultium battery platform, which provides a scalable and cost-effective foundation for its EV lineup. Its strategic investments in Cruise, an autonomous vehicle subsidiary, highlight GM’s efforts to lead in electric and autonomous vehicle markets over the long term.

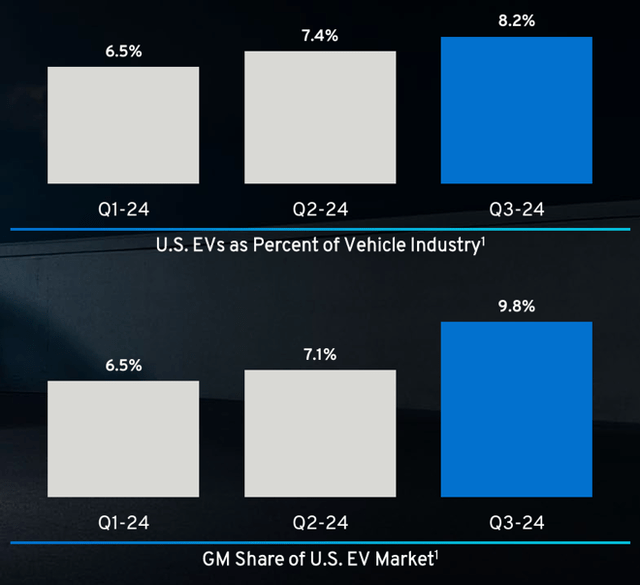

EV Market Share: 2024 (GM Q3 2024 Earnings Deck)

General Motors appears well-positioned for growth through 2025, supported by its solid recent performance in revenue and profitability. The company’s momentum with EVs is a primary driver of optimism; deliveries surged 60% YoY in Q3 2024, and GM plans to introduce several new models, such as the Cadillac Escalade IQ and Chevrolet Equinox EV, to target high-demand segments. These launches are expected to support GM’s goal of achieving EV profitability on a per-unit basis in the near future.

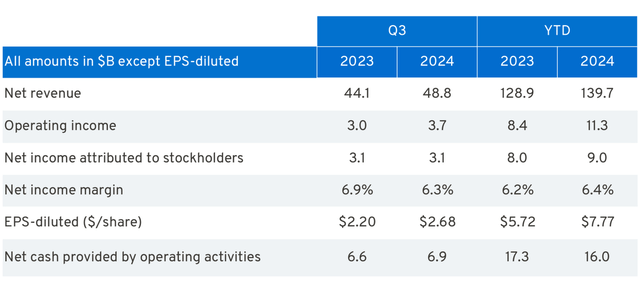

From a financial perspective, GM’s performance in 2024 has exceeded expectations, leading to upward revisions in guidance. Adjusted EBIT is projected to reach between $14B and $15B while free cash flow is estimated at $12.5B to $13.5B, highlighting strong operational execution and cost management. This financial strength will allow GM to balance investment in new technologies with shareholder returns. A favorable valuation also strengthens the investment case for GM. The company’s forward P/E ratio of approximately 5.7x and earnings yield close to 20% are at a significant discount relative to peers. Although the stock has doubled over the past year, it remains attractively valued, offering further upside potential if GM executes effectively on its growth strategies.

GM Q3 2024 Earnings Deck

Beyond financial metrics, GM’s focus on vertical integration provides a competitive edge. Its partnership with LG Energy Solution to manufacture Ultium batteries in the U.S. ensures supply chain security and lowers production costs. This initiative is critical as the company scales EV production amid rising competition in the segment. Government policy changes could also act as a tailwind for GM. A shift in the U.S. administration’s approach to EV subsidies and regulatory requirements for ICE vehicles is expected to support GM’s profitability. Given that ICE vehicles still account for 80% of its U.S. sales, any relaxation of EV mandates or incentives for ICE vehicles could provide short-term financial relief and stabilize margins.

Potential risks for 2025 include:

- Debt and Capital Expenditures – Net debt stands at $95B, a substantial burden requiring careful management. High capital expenditures for EV development and autonomous vehicle investments could constrain free cash flow and limit shareholder returns in the near term.

- Competitive Pressure in EVs – GM lags behind Tesla (TSLA) and emerging competitors in EV market share. Achieving profitability and scaling production to meet demand remain critical hurdles as it competes in an evolving market.

- International Weakness – The company has experienced declining market share and profitability in key international markets like China and Brazil. While North America leads profitability, weak performance abroad limits global diversification.

- Operational and Regulatory Challenges – Recent recalls and job cuts, though aimed at improving efficiency, highlight underlying vulnerabilities. Additionally, changes in regulatory environments, especially in Europe and China, could introduce new costs or disrupt supply chains.

- Cruise Uncertainty – The autonomous vehicle unit continues to operate at a loss, and its ability to deliver shareholder value remains unproven. Ongoing investments in this segment present a long-term risk if profitability is delayed.

Wall Street analysts have a consensus price target of $59.26 per share, suggesting GM is currently fairly valued. However, some are more bullish with targets between $65 and $70. Over the past three months, 21 analysts have raised their EPS estimates for the upcoming fiscal year, compared to just two downward revisions. Based on this, I rate GM a Buy within its current trading range of $56–$58, seeing modest near-term upside potential.

Bonus Award 1 – Top Performer: Tenet Healthcare

Despite signs of undervaluation, five on the Dean’s List have outperformed the broader market in recent years: Tenet Healthcare, Victory Capital Holdings (VCTR), Amphastar Pharmaceuticals (AMPH), Discover Financial Services (DFS), and Laureate Education (LAUR). Each easily outpaced the total return of the S&P 500 from November 2019 to November 2024:

|

5Y TOTAL RETURN |

|

|

1. THC |

357% |

|

2. VCTR |

294% |

|

3. AMPH |

152% |

|

4. DFS |

141% |

|

5. LAUR |

135% |

|

VOO (S&P proxy) |

107% |

* Data from Seeking Alpha

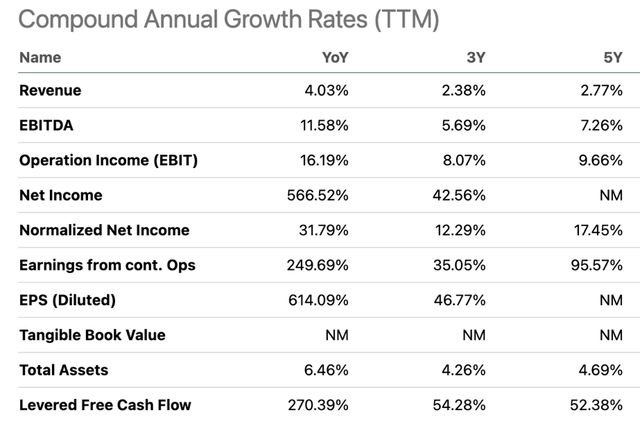

By a substantial margin, Tenet Healthcare was the best investment. The company grew its market cap more than three-fold over this period and provided investors with a total return exceeding 350%. Tenet’s growth metrics also increased steadily, if not dramatically, across the board:

Seeking Alpha

Tenet operates hospitals and ambulatory surgery centers, specializing in high-acuity services that offer high revenue per case and stable demand. It has been divesting underperforming assets to reduce leverage and boost operational efficiency, while investing in new hospitals and ambulatory surgery technology. The thesis here is based on further growth potential, strong free cash flow, and expanding high-margin services. While Tenet is currently a Quant Strong Buy, some Seeking Alpha analysts have been less bullish, expressing concerns with valuation relative to its historical levels, leverage risks, and asset reductions from the divestments.

Bonus Award 2 – Top Dividend: Discover

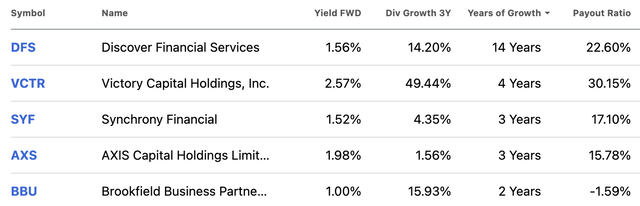

Of the sixteen companies that made the Dean’s List, just five offer a growing dividend:

Seeking Alpha

Discover is easily the top pick for dividend growth investors, combining a double-digit CAGR, a low payout ratio, and at least through 2024, a fourteen-year streak of increasing distributions. The 1.56% forward yield may seem modest for income investors, but at least until recently, the dividend was bolstered by a generous share repurchase program.

Discover is a digital banking and payment services provider, primarily focused on high-margin credit card operations, while also operating the PULSE debit network and owns Diners Club International. The majority of its revenue comes from credit card lending and payment processing fees. The case for investment going forward is clouded by its pending merger with Capital One, which faces antitrust challenges. The merger has led to a pause in share buybacks and dividend increases, creating uncertainty about near-term capital returns. Should the merger fail, investors will find potential long-term value in the company’s exit from the student loan business, a solid CET1 ratio, and stable credit performance, including manageable charge-offs and delinquency rates.

Summary

General Motors tops my Dean’s List as a compelling investment for 2025, driven by its strong momentum in EV growth, attractive valuation, and operational improvements. While challenges such as debt management, competitive pressures, and international weakness remain, GM’s focus on vertical integration and strategic partnerships positions it well for long-term success. Alongside high achievers like Tenet Healthcare and Discover Financial Services, GM exemplifies the potential for undervalued, high-performing companies to deliver solid returns in the coming year.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in GM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.