Summary:

- Microsoft shows strong performance in AI, cloud, and gaming, despite mixed outlook and recent stock depreciation.

- Core business thrives, with significant growth in Microsoft 365, Dynamics, LinkedIn, and cloud services; gaming revenues boosted by Activision acquisition.

- Despite potential risks from global trade tensions, Microsoft’s growth opportunities and favorable macro environment make it a BUY.

Jean-Luc Ichard/iStock Editorial via Getty Images

Microsoft (NASDAQ:MSFT) has been showing a great performance ever since it began involved in the generative AI field, first by investing in OpenAI and later by launching its own AI tool Copilot. While the company reported a relatively mixed outlook recently, which led to the depreciation of its stock, Microsoft still has plenty of growth opportunities that can create additional shareholder value in the long run. Its cloud business is expected to continue to grow at an impressive double-digit rate, its core business continues to thrive, and its gaming business has entered its ‘golden age’ thanks to the acquisition of Activision. Although some risks remain, overall Microsoft remains a good company to own right now.

Microsoft Once Again Delivers On Its Promises

The last time I covered Microsoft was in August. Back then, the company’s shares tumbled after the Q4 earnings report and created an opportunity for me to acquire Microsoft’s stock at a reasonable price. Since that time, Microsoft’s shares haven’t moved much in either direction, but there’s an indication that the upside is still there.

The latest earnings report for Q1 showed that Microsoft’s revenues increased by 16.1% Y/Y to $65.59 billion and were above expectations by $1.03 billion. At the same time, the GAAP EPS of $3.30 was above the consensus by $0.19. Those are pretty solid numbers, which make me optimistic about Microsoft and its ability to continue to show a solid performance in the following quarters.

The company’s core business continues to thrive, and the revenues of Microsoft’s Productivity and Business Processes division increased by 12% to $28.3 billion. The significant boost in revenues was possible thanks to the growth of the company’s Microsoft 365, Dynamics, and LinkedIn products. For over a year, Microsoft has been integrating its Copilot AI assistant into those and other products, to scale its customer base and boost its sales. In the latest conference call, the company’s management noted that almost 70% of Fortune 500 businesses are now using Microsoft 365 Copilot. Considering that the generative AI market is expected to increase at a CAGR of ~46% by the end of the decade, it’s safe to say that Microsoft has plenty of areas for growth and a double-digit growth rate of its business in the following years is possible.

It’s likely that Microsoft’s cloud business will also thrive in years to come. The revenue in Intelligent Cloud in Q1 was up 20% to $24.1 billion, and the overall cloud computing market is expected to grow at a CAGR of 17.8% until 2032. At the same time, in the latest earnings call, Microsoft’s management said that Azure’s revenues are expected to grow from 31% to 32% in Q2, which indicates that the demand for Microsoft’s cloud services is likely to remain significant for a while.

Finally, while Microsoft’s More Personal Computing business increased its revenues by 17% to $13.2 billion in Q1, it will likely continue to boost its sales in the future as well. Microsoft’s management said that in Q1 the search and new advertising revenues were up 18% and the revenue growth of Bing outpaced the broader search market. At the same time, the Xbox business has witnessed an aggressive growth of revenues thanks to the completion of the purchase of Activision, while its gaming service Game Pass set a new record for total revenues and average revenue per user.

All of those developments indicate that Microsoft has more than enough growth opportunities to continue to deliver an outstanding performance. Considering that the U.S. economy has been growing at a stable rate, while inflation is expected to slow further in the foreseeable future, the favorable macro environment should also help Microsoft continue to grow in the future.

What’s Next For Microsoft’s Shares?

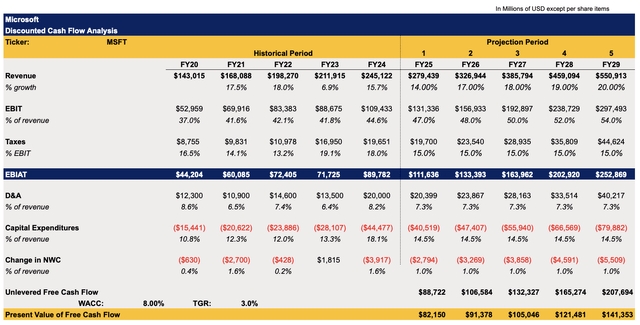

My latest valuation model which was published along with the recent article on Microsoft in August showed that the company’s fair value is $465.35 per share. Given the fact that Microsoft recently released a new earnings report and updated its outlook, I decided to update my model, which can be seen below.

For FY25, the revenue growth rate has been slightly decreased due to the company’s mixed outlook and currently closely correlates with the consensus. However, as was the case with the previous model, I expect the growth to reaccelerate in FY26 and beyond since the macro environment is expected to remain favorable and the demand for generative AI tools and cloud services is unlikely to significantly slow down. The fact that Azure is expected to grow at 31% to 32% in Q2 alone is still a pretty bullish signal.

The tax rate assumptions in the model have been slightly decreased, since the potential implementation of Trump’s new tax reform can result in a lower corporate tax rate and be beneficial for the company. The assumptions for other metrics mostly remained the same and closely correlate with Microsoft’s historical performance.

Microsoft’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

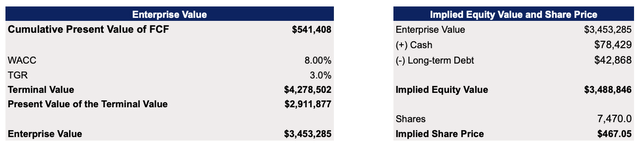

Thanks to the fact that lower tax expectations were able to offset the slightly lower revenue growth rate this fiscal year, the updated model shows that Microsoft’s fair value is $467.05 per share. This is slightly above the previous expectations and above the current market price by ~13%.

Microsoft’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

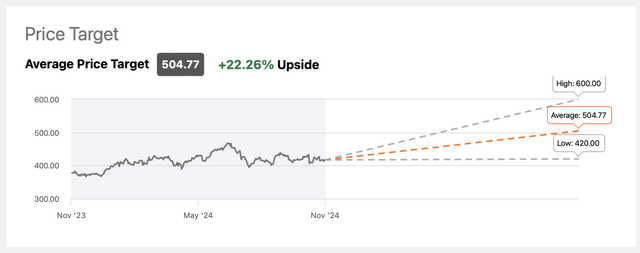

At the same time, the consensus on the street is that Microsoft’s upside is even greater than what my model assumes. That’s why I believe that Microsoft remains a BUY at the current levels.

Microsoft’s Consensus Price Target (Seeking Alpha)

Major Risks to Consider

I see one major risk that can undermine Microsoft’s growth story. The potential implementation of new tariffs on Chinese and other goods could reaccelerate the inflation rate and hinder the economic growth of the United States. The potential retaliation to Trump’s tariffs by other governments could also escalate the global trade war, which could result in a 7% loss of global GDP. This could make it much harder for Microsoft to scale its business and continue to grow at a double-digit rate, despite all the growth opportunities that it has going for it.

The Bottom Line

Despite the lower-than-expected outlook for the cloud business, Azure is still expected to grow at an impressive double-digit rate in the foreseeable future. The core business of Microsoft also remains healthy and has plenty of growth opportunities to generate great returns and create additional shareholder value along the way. Finally, Microsoft’s expansion in the gaming industry has created new growth opportunities for the company, which it already began monetizing. Considering this, I believe that Microsoft remains a good investment in the current environment and continue to hold its shares in my portfolio for now.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Bohdan Kucheriavyi is not a financial/investment advisor, broker, or dealer. He's solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.