Summary:

- Interest rate cuts were supposed to help Opendoor — but they did little to fuel growth.

- Exisitng home sales remain below 4M, the lowest since 1995.

- Elevated housing market uncertainty forced Opendoor to maintain higher spreads, thus delaying Opendoor’s rescaling efforts.

- These are reasons why investors are throwing in the towel on Opendoor stock.

- Opendoor stock is the worst-performing stock in my portfolio — but I continue to believe in its future potential.

Orla/iStock via Getty Images

Introduction

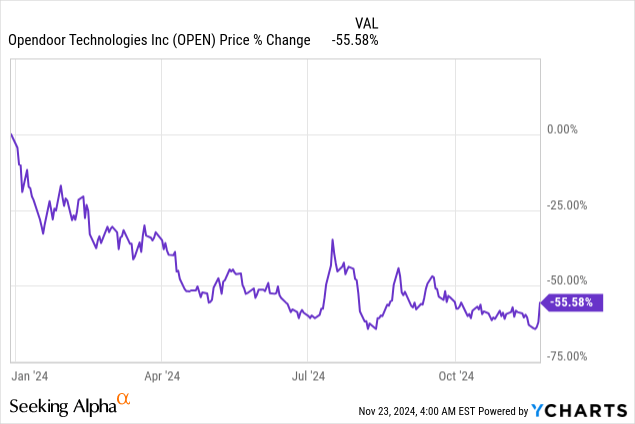

Opendoor (NASDAQ:OPEN) — the number one e-commerce platform for residential real estate — is by far the worst-performing stock in my portfolio, down more than 50% YTD.

I must admit, it has been incredibly frustrating holding the stock despite the company repeatedly outperforming both guidance and expectations. Furthermore, interest rate cuts — which should be a tailwind for the highly cyclical and highly rate-sensitive real estate industry — have not helped the stock much either.

Nobody cares about this company anymore — investors, analysts, you name it. Heck, its earnings call was so short that it lasted only 24 minutes with only three analysts on the call. It’s that bad.

Despite being beaten and forgotten, I believe that the iBuying business model is the future — that Opendoor is the future.

The stock is still down 90%+ from its peak. At a Market Cap of just $1.4B in an industry worth trillions of dollars, the upside potential for Opendoor stock is massive.

Growth: Rescaling Delayed

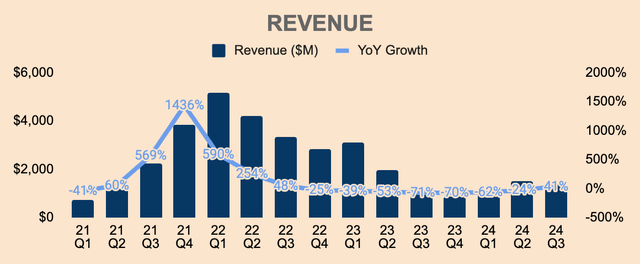

Looking at Q3 results, Revenue for the quarter was $1.4B, up 41% YoY. This beat both the high end of management’s guidance and analyst estimates by about $0.1B. More importantly, this marks the first quarter of positive YoY Revenue growth, after seven consecutive quarters of negative growth.

Author’s Analysis

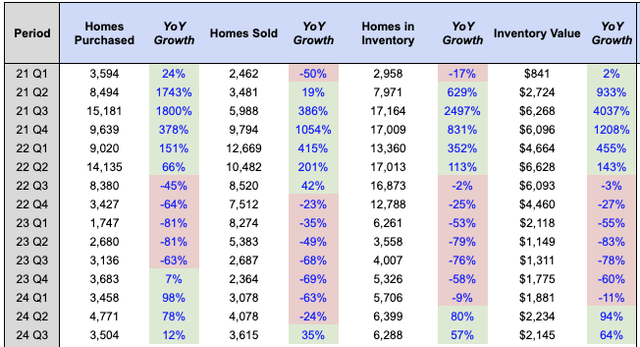

This was driven by 3,615 Homes Sold in the quarter, up 35% YoY. The company also purchased 3,504 homes in Q3, up 12% YoY, leaving 6,288 Homes in Inventory, up 57% YoY, worth $2.1B in Inventory Value, up 64% YoY.

As you can probably tell, Opendoor is reentering growth mode.

Author’s Analysis

However, keep in mind that all of the metrics above were down sequentially, due to seasonality as Opendoor enters the colder months where real estate transactions typically cool down as well.

In addition, management is expecting a “more challenging macro environment” in the back half of the year, which is why they have increased spread levels embedded in their offers. This has resulted in a sizeable drop in seller conversions, which explains the 27% QoQ decline in Homes Purchased in Q3.

To make matters worse, Opendoor ended the quarter with only 1,006 homes under contract for purchase, which is down 39% YoY and 44% QoQ.

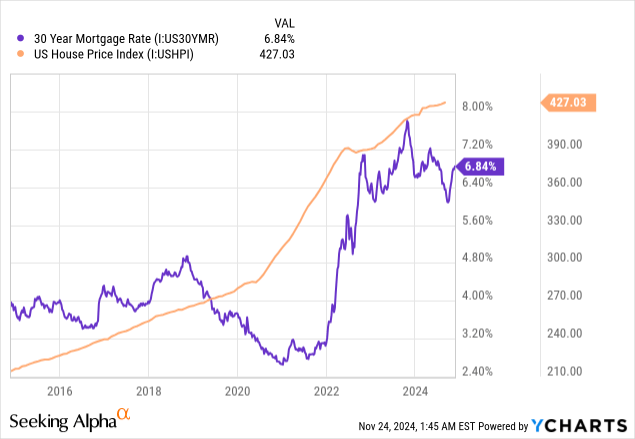

Previously, management expected that the interest rate cuts would improve housing market conditions. However, despite the 50bps rate reduction in September, the housing macro remains unfavorable as many homebuyers and homesellers stay on the sidelines:

- Mortgage rates remain high at about 7%, reducing affordability.

- Home prices are at record highs, reducing affordability.

- Delisting rates continue to climb, suggesting waning seller interest.

- Clearance rates continue to fall, suggesting lower buyer demand.

As a result of the factors above, existing home sales remain below 4M, below the annual average of over 5M, and the lowest since 1995. That translates to a lower potential volume for Opendoor.

Due to elevated uncertainty in the housing market, Opendoor has maintained higher spread levels YoY through the back half of the year, leading to lower acquisition volumes. In Q4, management expects to purchase 2,200 homes, much lower than Q3’s acquisition volume of 3,504 homes.

Consequently, management issued soft Revenue guidance of just $925M to $975M in Q4, well below analyst estimates of $1.27B.

Lowered guidance means further delays in Opendoor’s rescaling efforts. Without sufficient transaction volumes, Opendoor won’t be able to achieve breakeven Adjusted Net Income.

This is why market participants are beginning to lose their patience — and therefore, are starting to abandon Opendoor stock altogether.

Profitability: Positioning For Efficient Rescaling

On a more positive note, higher embedded spreads mean better unit economics as Opendoor acquires homes at a wider margin of safety. This protects the company from impending home price volatility, ensuring that Opendoor will continue to be able to sell said homes at a profit, even if we see a substantial drawdown in home prices.

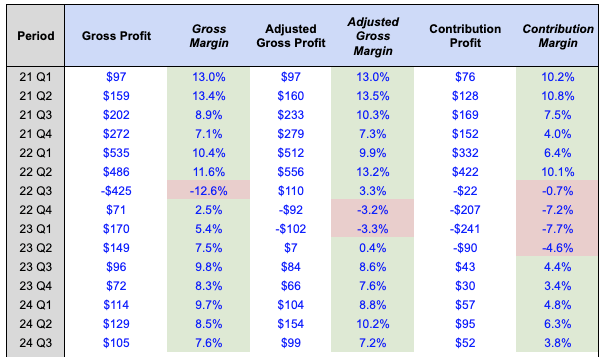

That said, here’s what Opendoor’s unit economics look like in Q3:

- GAAP Gross Profit was $105M at a 7.8% Margin, down 220bps YoY.

- Adjusted Gross Profit, which aligns the timing of inventory valuation adjustments when the home is sold, was $99M at a 7.2% Margin, down 140bps YoY.

- Contribution Profit, which includes direct and selling costs, was $52M at a 3.8% Margin, down 60bps YoY. This came in above management’s guidance of 2.9% to 3.5%.

As you may have noticed, margins across the board are down YoY, and this was primarily due to lower home price appreciation.

Author’s Analysis

Management also expects lower HPA moving forward, which is why they have also issued soft Q4 Contribution Profit guidance of $15M to $25M. Alongside lower HPA, slower acquisition volumes also pressured margins due to Opendoor’s “resale mix shift from newer, higher-margin homes toward older homes with lower margins”.

As a result of soft Revenue and Contribution Profit guidance, management expects a full-year Contribution Margin of 4.5%, which falls short of their annual target of 5% to 7% Contribution Margin. Not the end of the world, but still not good enough.

The silver lining is that Opendoor still maintains positive unit economics despite the challenging housing environment.

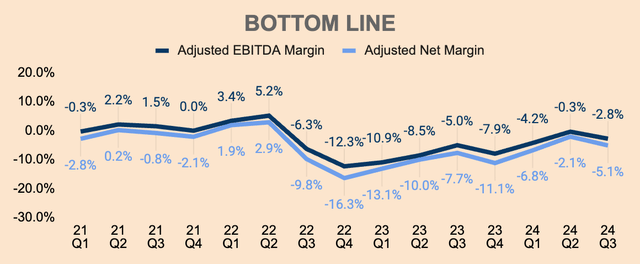

In addition, Opendoor’s overall profitability in Q3 improved YoY:

- Adjusted EBITDA was $(38)M at (2.8)% Margin, which improved 220bps YoY. This was ahead of management’s guidance of $(70)M to $(60)M.

- Adjusted Net Income was $(70)M at a (5.1)% Margin, which improved 260bps YoY.

Author’s Analysis

Improvements in Opendoor’s bottom line were due to lower Operating Expenses as a result of decreased Marketing Expenses and cost discipline across all functions of the business.

Moreover, management expects approximately $85M of annual expense savings in 2025 due to ongoing cost-cutting initiatives, including laying off 300 employees, or 17% of its workforce. This should make Opendoor a leaner and more efficient business overall.

More importantly, this should position Opendoor well to rescale the business, thus accelerating Opendoor’s path to profitability — the housing market just needs to cooperate a little bit for management to step on the gas pedal.

One thing I do want to note is that the actions we’ve taken today were primarily in our fixed cost structure and will not impair our ability to rescale the business. We are focused on growing the business when the housing market turns, and we’re intent on doing that in a sustainable way.

(Interim CFO Christy Schwartz — Opendoor FY2024 Q3 Earnings Call)

All in all, despite a tough housing environment, Opendoor was able to outperform its guidance and improve its bottom-line margins.

Opendoor just needs to rescale — but unfortunately, management doesn’t believe it’s the right time to do so. Until then, Opendoor stock will continue to struggle.

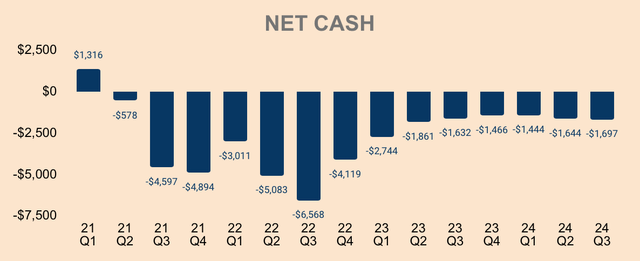

Health: Net Seller Once Again

On the bright side, taking a more conservative stance means a healthier margin profile, thus putting less pressure on its balance sheet, especially when the tide turns for the worse.

As it stands, Opendoor has $1.7B of Net Debt, which has been relatively stable over the last few quarters.

Author’s Analysis

The difference is that Opendoor has relatively more Homes in Inventory on its balance sheet, at about 6,288 homes as of Q3, which is up 57% YoY. In dollar terms, that’s $2.1B of Inventory value, up 64% YoY. Put simply, Opendoor has much more working capital which can be converted into cash.

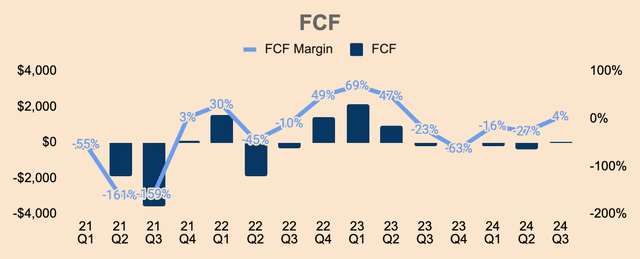

Speaking of which, Free Cash Flow turned positive in Q3, at a meager $56M, after four consecutive quarters in the red. This is because Opendoor was a net seller of homes in Q3.

As management guided for even lower acquisition volumes in Q4, I expect Opendoor to be a net seller of homes in the next quarter or two, thus increasing its cash position. This should allow Opendoor to ramp up home acquisitions at opportunistic prices, which should boost overall profitability as well.

Author’s Analysis

Valuation: Speculatively Undervalued

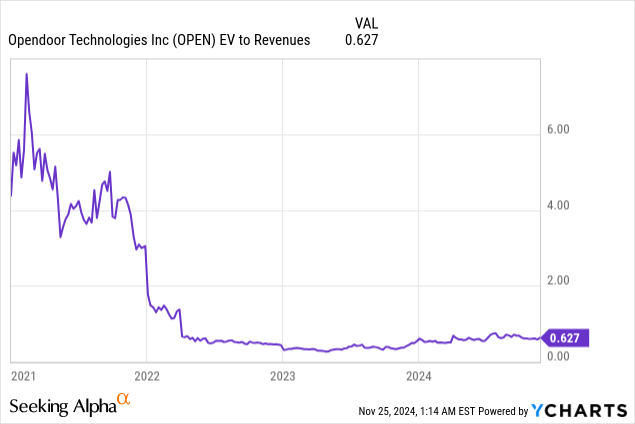

At just $2 a share, I think Opendoor is extremely cheap. It trades at an EV to Revenue multiple of just 0.6x, which is well below its historical ranges, implying relative undervaluation.

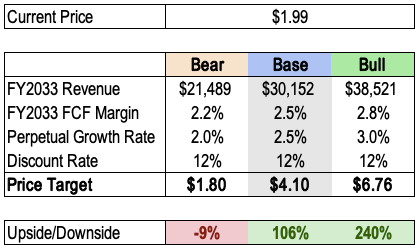

As for me, I have a base-case 12-month price target of about $4.10 for Opendoor stock, implying a 100%+ upside potential based on the current price of $1.99. It is slightly lower than my price target from my previous article, mainly due to lower expected growth rates.

That said, my assumptions are laid out below.

Author’s Analysis

While I think Opendoor stock is undervalued, I think it is one of the more speculative positions in my portfolio.

Any negative news affecting Opendoor stock could drastically impact the stock in the short-to-medium term. The stock will continue to be extremely volatile — sensitive to any developments in the residential real estate market.

By the same token, any slight positive news could serve as a major catalyst for the stock. For example, the NAR recently revealed that existing home sales in November climbed 3.4% month-over-month to 3.96M, slightly beating expectations by 0.01M. Even with this tiny margin of a beat, Opendoor stock skyrocketed 17% in a single trading day with 90M shares exchanging hands on that day, the highest single-day volume ever recorded for Opendoor stock.

Such a positive reaction tells me that there’s just too much pessimism baked into the stock.

Furthermore, additional rate cuts and the eventual decline in mortgage rates should serve as a major tailwind for Opendoor stock. Rates are already high and I don’t think it will go any higher. Sure, they may tick up slightly due to volatility, but in the medium term, rates should come down, which will be bullish for rate-sensitive stocks like Opendoor.

For these reasons, I think there’s much more upside potential than downside for Opendoor’s stock.

Risks

- Higher for Longer: If mortgage rates remain elevated and market participants remain on the sidelines, Opendoor’s rescaling efforts may be delayed even further, leading to prolonged downward pressure for Opendoor stock.

- Failure to Achieve Profitability: And even if Opendoor kicks into high gear, Adjusted Net Income profitability is not guaranteed. Questions remain about the long-term viability and sustainability of the iBuying business model. If Opendoor fails to turn a profit — even at the $10B Revenue run rate target — I think there will be little hope for Opendoor stock.

Thesis

As the stock price suggests, Opendoor looks beaten and forgotten. I think a lot of investors have thrown in the towel on the stock, given the uncertainties in the housing market as well as management’s bleak near-term outlook.

However, it’s worth noting that Opendoor is probably in its strongest position ever with positive unit economics, improving margins with cost optimization, and a disciplined rescaling strategy.

Furthermore, interest rates are expected to come down even further throughout 2025, which should be a catalyst for Opendoor.

Yes, it will take time for the thesis to play out. But considering the ongoing digital transformation in the residential real estate industry and Opendoor’s status as a virtual monopoly in the iBuying business, I believe the thesis will eventually play out.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of OPEN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.