Summary:

- I maintain my “Buy” rating for PayPal thanks to its undervaluation, strategic turnaround success, and strong medium-term growth prospects despite competitive and macro pressures.

- Q3 FY2024 earnings showed 9% YoY TPV growth, 6% revenue growth, and 22% non-GAAP EPS growth, driven by mobile checkouts and strategic acquisitions.

- PayPal’s innovations like Fastlane and PayPal Everywhere, along with Venmo’s growth, highlight its efforts to enhance consumer and merchant experiences.

- I believe PayPal’s focus on innovation and strategic partnerships will drive future growth, with potential upside exceeding 40% by 2025.

- I reiterate my “Buy” rating for PYPL stock today.

Images By Tang Ming Tung/DigitalVision via Getty Images

Intro & Thesis Update

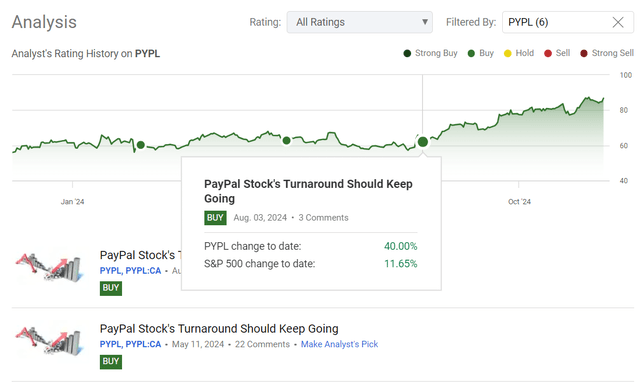

I initiated coverage of PayPal Holdings, Inc. (NASDAQ:PYPL) stock in May 2023 and have since authored 6 articles. The first 2 articles were published with a “Hold” rating but already in November 2023, I upgraded my rating to “Buy” after analyzing the company’s financials (as well as turnaround plans) at the time and observing an increase in its fair value. In my most recent article in early August, I argued that PayPal still had a fairly good chance of recovery in the medium term “due to its cheap valuation, the potential unlocking of new growth drivers, and the shareholders’ return policy that management adhered to.” As time has shown, my bullishness paid off as the stock managed to beat the S&P 500 index (SPX) (SPY) almost by a factor of 4:

Seeking Alpha, my coverage of PYPL stock

After assessing PayPal’s most recent financials and corporate events, I decided to maintain my “Buy” rating today. I still see the current valuation as undervalued, and the firm’s turnaround plan keeps defeating skeptics’ fears.

Q3 FY2024 Earnings Recap

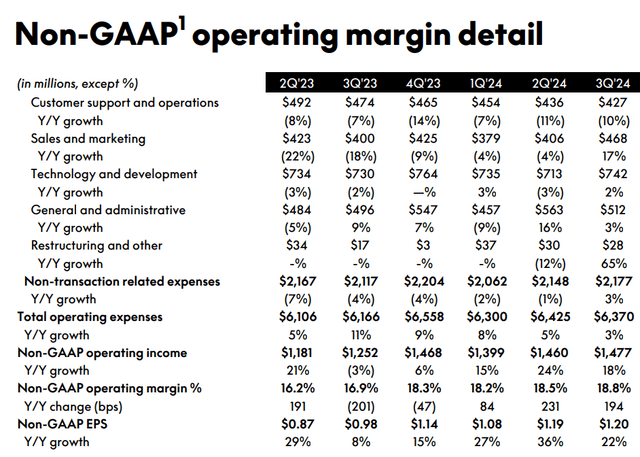

In PayPal’s Q3 2024 report, we see the company is still going through a strategic phase of change, transforming from a payments platform to a full-service commerce platform. During the quarter PayPal experienced a 9% YoY growth in TPV to $423 billion and a 6% growth in revenue to $7.8 billion, fueled primarily by “advances in mobile checkouts and the acquisition of major e-commerce companies such as Amazon (AMZN) and Shopify (SHOP).” New mobile checkout experiences have been particularly effective, with conversions climbing more than 100 basis points for vaulted checkout and up to 400 basis points for once-off checkout. Additionally, the use of BNPLs also grew by 15-20%, suggesting strong consumer acceptance of these open-ended payment options. One of PayPal’s most powerful attributes – its two-sided network of hundreds of millions of users and tens of millions of merchants around the world – remained a competitive advantage of the firm. The OPEX went up by just 3% YoY so the existing operating leverage drove the 18% YoY growth in non-GAAP EBIT. As a result, PYPL’s non-GAAP EPS for the quarter grew by 22% YoY demonstrating the strength of the company’s strategy and cost management.

PayPal’s Braintree platform has also helped it boost transaction margin dollar growth for the second quarter in a row. According to management’s commentary, they were able to negotiate agreements with merchants based on what they offer at the moment and strategic growth opportunities to maximize each party’s benefits. This strategy has resulted in higher transaction margins despite declining volume and revenue. Payments, risk management, and customization are value-added services added by PayPal to further consolidate its market position, which is a great strategic move, in my opinion.

Another innovation has been the advent of Fastlane – which appeals to 60% of e-commerce purchases without a logo. Since Fastlane launched in August and is used by more than 1,000 merchants, PayPal has been improving the guest checkout experience and increasing conversion rates. This, coupled with PayPal’s recent expansion of PayPal Complete Payments to additional regions, such as China and Hong Kong, highlights PayPal’s efforts to broaden and improve its SMB-friendly services.

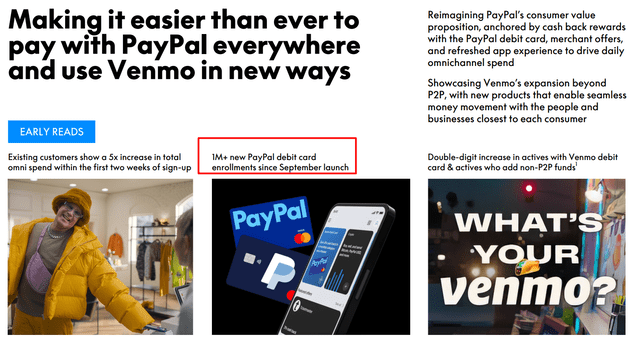

On the consumer front, PayPal is rethinking its value proposition with PayPal Everywhere (introduced in early September this year), a service that promises to position PayPal as the standard for spending, sending, and rewarding on and offline. This program already led to the enrollment of more than 1 million debit card first-time customers, and significant gains in omnichannel spending, according to the management. The company’s focus on cashback offers and promotional campaigns is already helping to change customer perceptions and increase sales for its product suite.

PYPL’s IR materials, notes added

Venmo, PayPal’s peer-to-peer payment platform, is also transforming rapidly. The company continues to focus on helping consumers integrate Venmo more closely into their financial lives, including the growing use of the Venmo debit card and Pay with Venmo functionality. These efforts are already beginning to gain traction, with monthly active debit card accounts up by 30% and Pay with Venmo users up 20% during the quarter. These services average more per account revenue than all Venmo accounts which means there is potential for monetization.

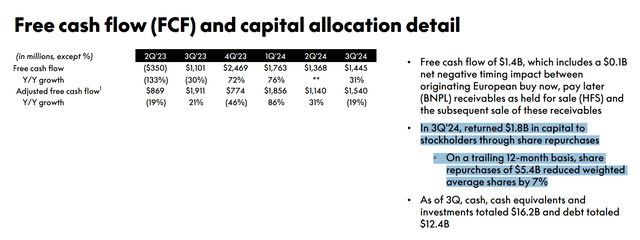

PayPal’s balance sheet remains healthy with $16.2 billion in cash, cash equivalents, investments, and $12.4 billion in debt. PayPal earned $1.4 billion in free cash flow in Q3 (+31% YoY) to finance share repurchases and investments. In fact, PYPL returned ~$1.8 billion and ~$5.4 billion during Q3 and TTM through buybacks, respectively, meaningfully reducing the share count:

PYPL’s IR materials, notes added

For me, the Q3 figures are further confirmation that PYPL is on the right strategic path to renew growth and deliver value to shareholders. Going forward, I think the stabilization of margins will allow PYPL to trade at a premium valuation, which is not currently the case. But more on that later – let’s first look at what management and the market expect.

What’s Next For PayPal?

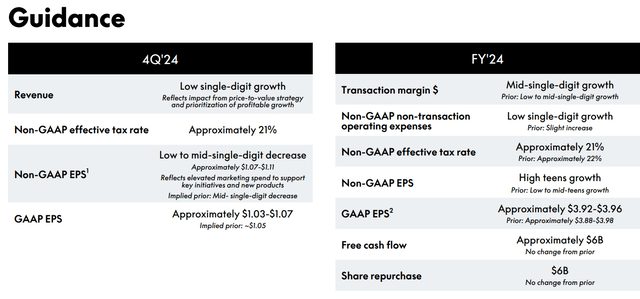

As for Q4 and FY2025, PayPal management anticipates progress in its transformation journey, forecasting low single-digit Q4 revenue growth and keeping transaction margin dollar growth in check.

PayPal is hoping to continue its solid 2024 foundation for FY2025, with a heavy emphasis on long-term growth drivers like branded checkout, Braintree, and Venmo. The firm also expects the possibility of interest rate cuts limiting transaction margin dollar growth.

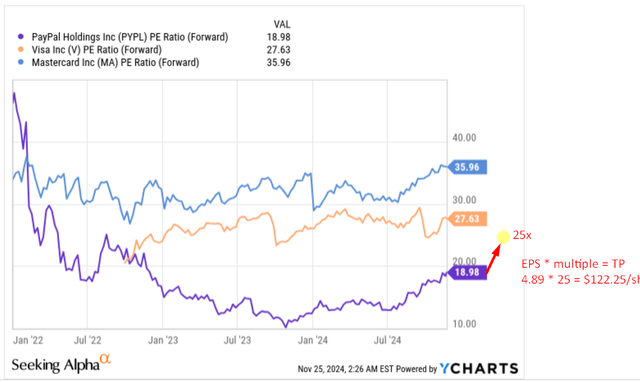

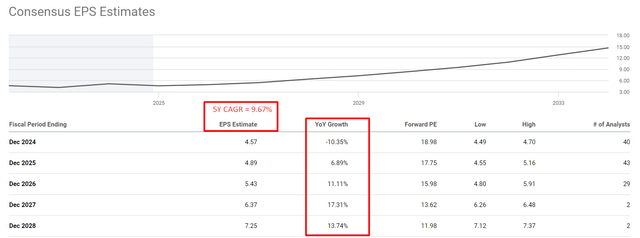

As far as Wall Street expectations are concerned, we are seeing an increase in optimism. First, PYPL is currently trading at 19 times TTM earnings, which is 27.5% more than when I looked at the company in early August 2024. Secondly, over the last six months, EPS growth estimates for the next 3 years have risen significantly, while those for longer periods (to FY2028 and beyond) have been significantly reduced. In other words, the market has become more optimistic about the company’s medium-term strategic turnaround prospects but remains skeptical about PayPal’s competitive advantages in the longer term. I think Venmo’s growth, new crypto offerings, and consistently strong FCF generation capacity should eventually lead the market to be overly pessimistic in the long term. Be that as it may, the EPS growth forecast for the next 5 years looks quite good – the annual EPS decline in FY2024 should be a temporary headwind that is projected to turn to growth next year, which I sincerely believe given the dynamics of the bottom line and the pace of share count reduction:

Seeking Alpha, PYPL, notes added

Valuation Update

When the prospects for PYPL’s business growth and recovery were still vague, Seeking Alpha’s Quant System was giving PYPL a “D+” grade – now that the strategic moves are bearing fruit in the form of improved margins and stabilizing growth, this grade hasn’t changed. However, PYPL stock is actually trading several tens of percent higher than a few months ago. In my opinion, this hasn’t made PYPL’s valuation extremely expensive, as the rise in quotes was primarily due to fundamental changes. Looking at the key valuation multiples today, I would note that despite the premium to the sector median, this fintech giant still trades quite cheaply in terms of its forwarding EV/EBITDA or price/cash flow, which combined with its high profitability and business growth – as well as against the backdrop of improving earnings revisions – allows PYPL to remain a top pick in the fintech world and the transaction and payment processing industry in particular.

Seeking Alpha, PYPL’s Valuation, notes added

According to Morningstar’s proprietary fair value system, PayPal hasn’t yet recovered to its “fair” levels, which is at $104/share (almost 20% higher):

Morningstar Premium, PYPL [proprietary source]![Morningstar Premium, PYPL [proprietary source]](https://static.seekingalpha.com/uploads/2024/11/25/49513514-17325188042643905.png)

This level roughly corresponds to the medium-term level indicated by my technical analysis. In the previous article, I showed that a break of $67/share would allow PYPL to rush higher, which is what eventually happened. I think the immediate targets of $96.5/sh and $104/sh will likely be next:

TrendSpider, PYPL stock, the author’s notes

I think the market’s confidence in PYPL could lead to an extension of the current valuation premium by the end of next year if the company’s margins continue to improve. It is unlikely that the premium will reach that of Visa (V) and Mastercard (MA), but even at 25x earnings and with current EPS consensus the stock might have a potential target price (TP) of $122.25:

So in other words, the upside from here might be still over 40% even considering the recent rally.

Risks Of Buying PYPL

Today, there are several risks associated with investing in PayPal stock that investors should be aware of.

One danger is growing competition as online and point-of-sale transactions become intertwined. Paypal, which is already a dominant force in the online payments space, could find itself under pressure from much bigger, more recognizable, established points-of-sale players. It may force PayPal to come up with innovative and capital-intensive solutions to stay ahead, which may reduce its bottom line and prospects for expansion. Further, PayPal is constantly trying to keep up with new technology and customer trends in the online payments industry, which may put its resources and operational capabilities at risk.

PayPal is at risk of being shut out of new markets due to local governments’ preferences for homegrown companies. In China, for example, Alipay and WeChat have been largely dominated by the government, which has made PayPal hard to penetrate. The same could happen in other developing nations, cutting off PayPal’s expansion and giving it limited access to the growing global digital payments economy. In addition, while Venmo is a very strong growth prospect, its lack of monetization potential could derail PayPal’s attempts to diversify its revenue streams.

Another important thing to note is my valuation findings. While I truly believe PayPal is still undervalued, its quite high P/E, P/S and other key metrics do concern me – there’s a possibility that the stock has reached its fair value. My undervaluation conclusions are quite subjective and should be stressed during your own due diligence on the stock.

The Bottom Line

Despite the clear risk factors I listed above, I think PayPal’s focus on innovation and strategic collaborations should drive the firm’s future development even when competition and macro pressures mount. PayPal’s flexibility in responding to market conditions and its dedication to delivering value to customers and merchants make it poised to continue to succeed in the evolving payments industry.

The Q3 numbers showed me that my initial hopes for a successful turnaround weren’t unfounded. While it’s too early to say that all pain points are left behind, I think the market should look at PYPL with a much clearer perspective. The upside from here may exceed 40% by the end of 2025 if the company keeps delivering on its promises and the Street’s expectations, which I think will be the case.

I reiterate my “Buy” rating for PYPL stock today.

Thank you for reading!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!