Summary:

- Snowflake Inc.’s sales growth slowed to 28%, with adjusted operating margin dropping to 6.25%, prompting a focus on cost management and go-to-market strategy to boost growth.

- Despite AI/ML feature expansions and strategic partnerships, Snowflake’s functionality lags competitive CSPs that offer more robust AI & analytics capabilities.

- Snowflake is facing a migration out of its storage service as customers adopt Iceberg, or the ability to leverage external data sources on Snowflake’s platform.

seekingalpha.com/symbol/SNOW/balance-sheet

timandtim/DigitalVision via Getty Images

Snowflake Inc. (NYSE:SNOW) reported a mixed Q3 ’25 earnings result on November 20, 2024, as sales growth moderated to 28% with the adjusted operating margin declining to 6.25%, down from 9.80% in Q3 ’24. Despite the headwinds faced in the last few quarters, management is taking the initiative to manage down costs & operating expenses while bolstering its go-to-market strategy in an attempt to accelerate top-line growth.

Given the potential headwinds faced as a result of Snowflake’s slow adoption of AI capabilities, I have reason to believe that the firm may be in a continuous state of playing catch-up to its competitors through acquisitions. This could potentially result in less durable revenue and tighter operating margins going forward. Given these factors, I am reiterating my SELL rating with a price target of $136/share at 11x eFY26 price/sales.

Be sure to review my previous coverage of Snowflake here:

Snowflake’s Decline May Not Be Over.

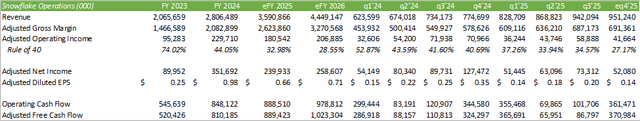

Snowflake Operations

Management is taking action to improve Snowflake’s operations through flattening the corporate structure by eliminating redundant management layers to drive faster decision-making and shorten the time to deployment of AI features. Management is also making major changes to its product features by removing underperforming applications to better align to the overall product portfolio with the intent of improving operating margins.

Snowflake is hitting the ground in expanding its AI footprint by expanding its ecosystem for developers. In q3’25, Snowflake deployed over 1,000 use cases in its AI/ML products for customers to leverage. The firm is also improving its data operability to allow for broader use cases for customers through its partnership with Microsoft (MSFT) and ServiceNow (NOW).

In Q3 ’25, Snowflake launched Unistore and Snowflake Open Catalog, among others, to expand customers’ development abilities on the platform. Unistore was designed to simplify and unify transactional and analytical data onto one platform. Open Catalog broadens Snowflake’s reach in open data formats with Apache Iceberg based on Apache Polaris. Snowflake also expanded its Cortex AI offering by partnering with Anthropic to roll in more powerful and complex models.

Management noted in the Q3 ’25 earnings call that customer adoption of Cortex is ramping up. Cortex was launched towards the end of 2023 as a fully managed service that provides customers access to AI/LLM models and includes Snowflake Copilot and Universal Search. The product was designed to be serverless, meaning that all functionality is performed in the cloud.

In q3’25, Snowflake had 500 accounts adopting Iceberg. Management anticipates that contributions from its data engineering features will offset the potential loss of storage revenue going forward. Accordingly, storage remains 11% of Snowflake’s consumption revenue. As a result of the strong data engineering product offerings, Snowflake signed $350mm+ in total contract value deals in Q3 ’25 and expects this momentum to continue going into the close of the fiscal year.

In Q3 ’25, Snowflake announced its intent to acquire Datavolo, a data pipeline management company. Datavolo will bring ETL functionality to Snowflake’s offerings, allowing for customers to leverage applications data for analytics and AI modeling. Datavolo uses Apache NiFi for automating data flows between enterprise data sources for GenAI applications. The intent of the acquisition was to broaden Snowflake’s exposure to the data lifecycle captured to simplify the process and improve the cost structure for customers.

As part of their growth initiative, management is focused on improving their go-to-market strategy by expanding the sales staff. Much of the drive will be in identifying and bringing new workloads into production and bringing these features to the market. This, in part, should help offset any headwinds created by the decline in storage services. This can also create an opportunity for Snowflake by providing customers with a more robust data analytics platform to analyze existing structured and unstructured data stored with Snowflake. Bridging the gap is Iceberg, which allows customers to leverage Snowflake’s analytics platform with external data sources.

One analyst on the Q3 ’25 earnings call raised concerns relating to the two top-10 customers that have yet to renew their long-term contracts, managing their instances on a month-to-month basis. In Q2 ’25, management noted that these two customers can continue to pay on a monthly basis through the end of the year. Accordingly, top-10 customers add $40-50mm in RPO and the two customers are not included in the firm’s measurement.

Snowflake Financial Position

Snowflake reported a 29% year-over-year increase in net revenue for q3’25 to $900mm paired with a decline in adjusted gross margin of 72.94%, down -196bps from the previous year. Adjusted operating margin also declined to 6.25% in Q3 ’25, down from 9.80% in Q3 ’24. Snowflake’s “Rule of 40” came in at 34.57% in Q3 ’25, improving sequentially from 33.94% but declined on a year-over-year basis from 41.60%. I define “Rule of 40” as the sum of year-over-year revenue growth and adjusted operating margin.

Looking ahead to Q4 ’25, I’m forecasting Snowflake to generate $951mm in net revenue, a 23% increase on a year-over-year basis, with an adjusted operating margin of $42mm for a “Rule of 40” at 27.17%. I’m forecasting adjusted EPS to come in at $0.14/share for Q4 ’25.

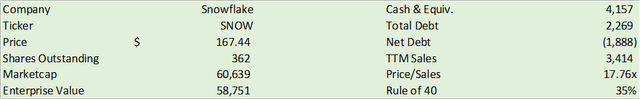

In Q3 ’25, Snowflake issued $1.15b in 2027 0% convertible senior notes and $1.15b in 2029 0% convertible senior notes. Proceeds from the issuances were used to pay for the capped calls and share repurchases. The remaining cash from the issuances will be utilized to repurchase shares, engage in M&A activity, and to finance operations. As of q3’25, Snowflake had $4b in cash & equivalent and $2.2b in convertible senior notes on the balance sheet.

Risks Related To Snowflake

Overall, I believe Snowflake is in a good financial position; however, my biggest concern is that Snowflake may not be able to maintain its high level of growth as other data storage and engineering platforms outpace Snowflake in AI-related capabilities. Companies like Databricks are said to provide users with more advanced AI capabilities at a lower cost of consumption.

Bull Case

Snowflake is scaling beyond its traditional data storage and BI capabilities with additional AI/ML features, allowing for customers to better leverage their existing data for new AI applications. Snowflake is making the platform more accessible by allowing external data sources. Though Snowflake’s AI development capabilities are not as advanced as competing cloud storage and data engineering platforms, the software is user-friendly and allows for robust data analytics for business intelligence needs.

Bear Case

Despite the robust analytics capabilities, Snowflake may be limited on its AI/ML functionality, leading customers to potentially consider other cloud platforms for a unified, universal platform. Given the acceleration of interest in AI applications beyond GenAI by enterprises, it is likely that Snowflake will be playing catch-up to provide the capabilities necessary for builders to develop their applications on the platform. This may result in both customer churn and narrower operating margins as a result.

Valuation & Shareholder Value

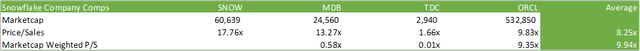

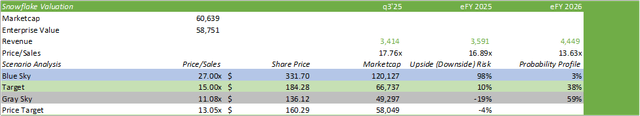

SNOW shares currently trade at 17.76x trailing twelve-month price/sales, a significant premium over its peer average of 8.25x. I do not believe that this high valuation is justified given the potential headwinds Snowflake may face as more enterprises seek to go beyond business intelligence by implementing more advanced AI capabilities for business optimization.

Snowflake has repurchased $1.9b in shares year-to-date and has $2b remaining under its March 2027 share repurchase authorization.

Using an internal valuation model based on my eFY26 sales forecast and the stock’s historical trading valuation, I have reason to believe that SNOW shares may be overvalued after the large +30% price run-up post-q3 ’25 earnings.

On average, SNOW shares should trade at around the $160/share price at 13x eFY26 price/sales. Given the potential headwinds in place in my risk analysis, I believe SNOW shares may fall back to my gray-sky scenario of eFY26 11x price/sales at $136/share. I am reiterating my SELL rating for SNOW.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.