Summary:

- I reiterate 3M a hold due to its fair valuation near $130 per share and mixed technical indicators.

- Despite a strong mid-year rally and solid Q3 earnings, MMM’s growth prospects and valuation multiples remain modest.

- Key risks include potential margin pressures, supply chain issues, and global GDP growth weakness, which could impact future performance.

- The stock is consolidating gains with support at $123-$125 and resistance at $140, suggesting a trading range in the near term.

josefkubes

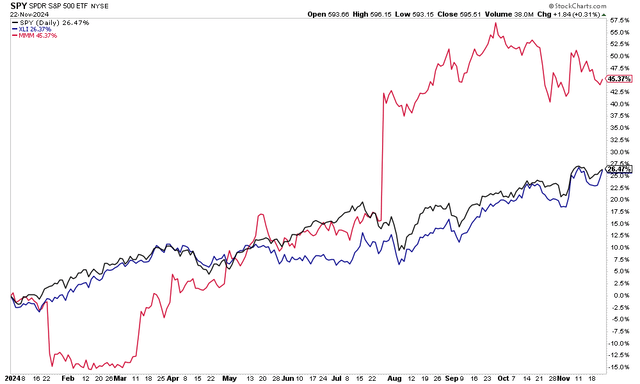

3M (NYSE:MMM) soared mid-year, posting its best earning-day reaction in the company’s history, but the rally has stalled lately. Still up more than 45% in 2024 (total return), shares of the Minnesota-based Industrials sector stalwart have eased off the momentum pedal, and I reiterate a hold rating.

Its most recent earnings report was encouraging, but MMM is no longer a gem of a value story. Its mid-high teens earnings multiple appears fair when considering its EPS growth rate. The upside case is perhaps solid nominal US GDP growth next year and the reality that the company is a household name in the USA – something President-elect Trump certainly would appreciate.

Following its Q3 report, let’s get a refresh on MMM’s fundamentals, valuation, and technical situation. All three areas point to a neutral stance in my view. MMM is down 4% with dividends included since August, underperforming the S&P 500 by about 10 percentage points.

MMM Consolidating 2024 Gains, Alpha vs S&P 500 and XLI

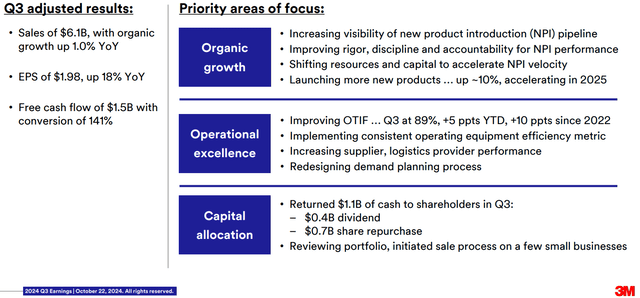

Back in October, 3M reported a solid set of quarterly results. Q3 non-GAAP EPS of $1.98 bettered the Wall Street consensus estimate of $1.90, while revenue of $6.1 billion, down 27% from the same period a year earlier (keep in mind that MMM completed the spin-off of Solventum, its former health care business, on April 1, 2024), was a modest $40 million beat. GAAP EPS from continuing operations soared 154% on a YoY basis to $2.48. The firm’s adjusted free cash flow was healthy at $1.5 billion.

The management team hiked its FY 2024 adjusted EPS guidance to be in the range of $7.20-$7.30 from $7.00-$7.30, but the stock did not react all that well to the more sanguine outlook; MMM dropped 2.3% in the session that followed the report, the worst earnings reaction since January of this year. Of course, that came after a strong rally, with the stock touching a 2-year high the day before the third-quarter release.

3M remains focused on three areas: Organic growth, Operational excellence, and Capital allocation. Its Industrial segment added 0.9% in Q3, while its Transportation and Electronics business was up 2% on an adjusted basis. But there was a 0.7% decline in its consumer segment, so it will be key to watch macro indicators regarding a potential pickup in household spending that would benefit the $70 billion market cap company.

With CEO Bill Brown at the helm (formerly the chief executive of L3 Harris Technologies (LHX)), there’s hope for a sustained recovery across all segments.

Solid Operational Performance Continued Through Q3

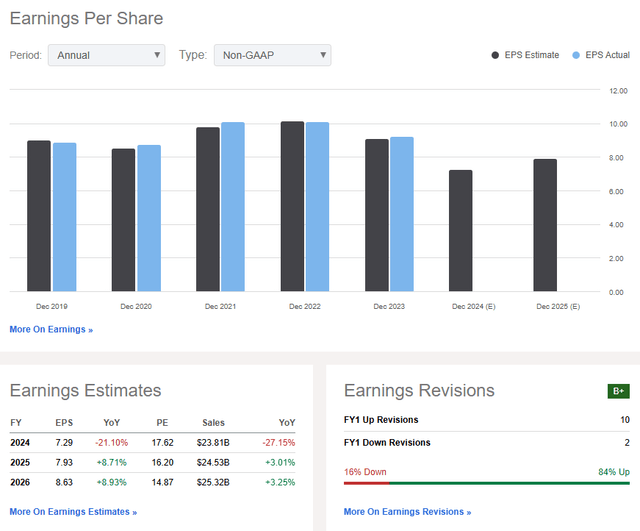

On the earnings outlook, analysts expect $7.29 of non-GAAP EPS this year – that’s up modestly from the consensus target in my summertime analysis. Out-year estimates have also ticked up, now with an 8.7% growth rate while a similar trajectory is forecast into 2026. Sales growth appears to be tepid, however, which will keep a lid on the valuation multiple.

But over the past 90 days, there has been a high 10 sell-side EPS upgrades for 3M compared to just a pair of downgrades. Finally, profitability trends remain stout, though its free cash flow yield is low.

3M: Revenue & EPS Forecasts, Earnings Revisions Trends

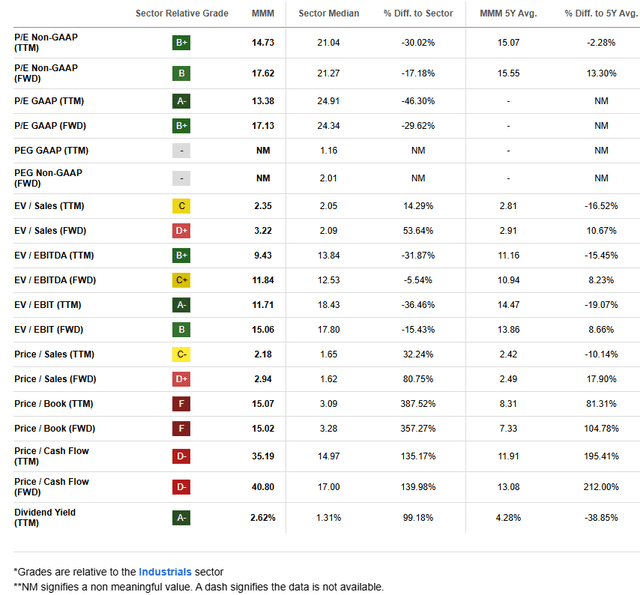

On valuation, if we assume $7.85 of operating per-share earnings over the next 12 months and apply a 17 multiple, the same as what I figured in August, then shares should trade near $133. That’s a smidgen higher than my previous valuation target, but I’m reluctant to grant 3M a sector-median P/E multiple given the earnings growth rate over the quarters ahead. With just a $5 buffer to fair value, a hold rating is warranted.

What’s more, both the price-to-sales and EV/EBITDA ratios appear fair compared to its history and the sector.

MMM: Mixed Valuation Metrics

Key risks include potential hits to gross margin as that metric has not been all that encouraging recently – higher labor costs and any supply chain issues could threaten margins. Also, any future litigation risks comparable to what has transpired in the last few years would almost certainly cost MMM a few multiple figures. At a high level, a macro slowdown and ongoing GDP growth weakness globally would be headwinds in the year ahead.

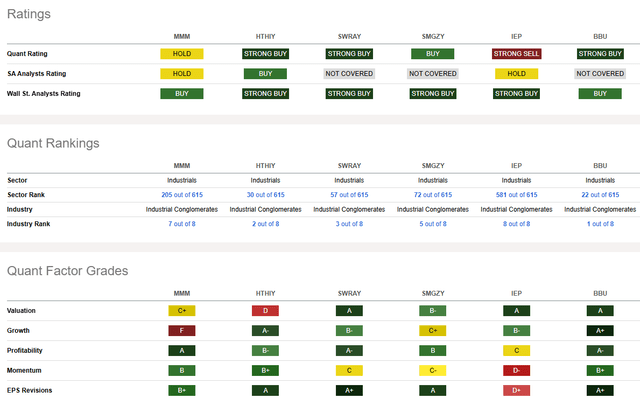

Competitor Analysis

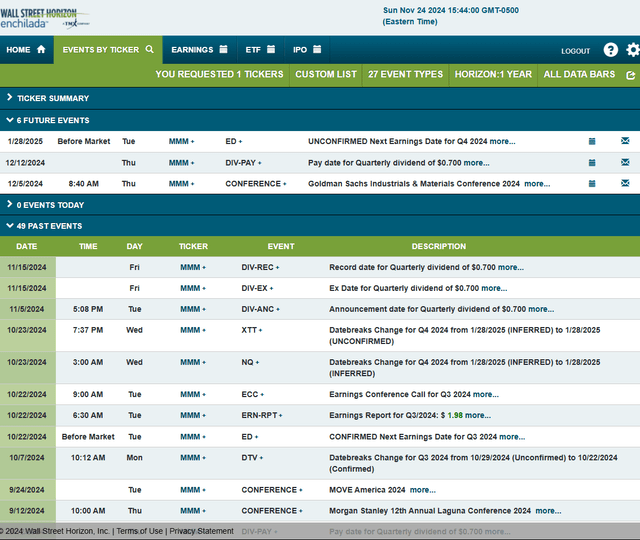

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q4 2024 earnings date of Tuesday, January 28 BMO. Before that, the management team is scheduled to participate in the Goldman Sachs Industrials & Materials Conference 2024 on Thursday morning, December 5.

Corporate Event Risk Calendar

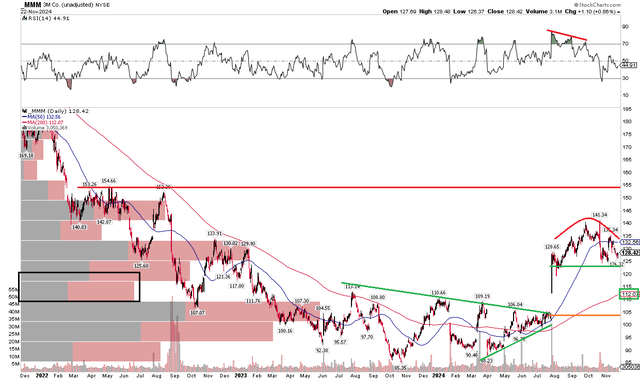

The Technical Take

With shares close to intrinsic value and as the stock consolidates its large YTD gains, the technical chart reveals a key area of support the MMM bulls must defend. Notice in the graph below that $123-$125 is an important range – that’s where shares dipped to in August and October after the massive Q2 earnings reaction move. A double top lingers above at $140, so we may have a trading range unfolding between $125-$140.

But with a rising long-term 200-day moving average, the bulls control the primary trend. That holds in the face of deteriorating RSI momentum as seen at the top of the graph. The bears have their eyes on the $105 spot – the earnings gap from July. With a bit of an air pocket if we break $115, it’s possible to see fast losses, but buying the stock there would appear to be a favorable risk/reward. $155 remains long-term resistance that I highlighted a few months ago.

MMM: Near-Term Bearish Top Possible, $125 Support, Gap Near $105

The Bottom Line

I have a hold rating on 3M. The blue-chip appears fairly valued, near $130 per share, and the technicals buttress a neutral stance heading into year-end.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.