Summary:

- Despite bearish sentiment, I remain bullish on Apple due to expected earnings and revenue growth, especially in the Services segment.

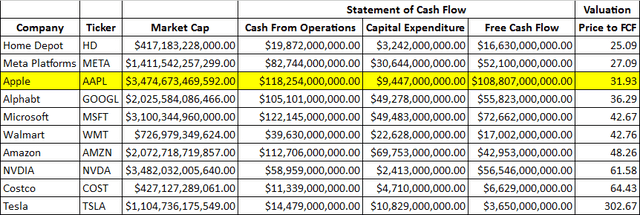

- Apple’s robust financials, including $108.81 billion in free cash flow and significant shareholder returns, highlight its profitability and shareholder-friendly nature.

- Potential risks include dependency on iPhone sales, lack of innovation, and economic factors like tariffs and interest rates, but the macroeconomic environment looks favorable.

- AAPL’s valuation appears attractive given its EPS growth prospects and potential tax savings under a Trump administration, making 2025 a promising year.

PM Images

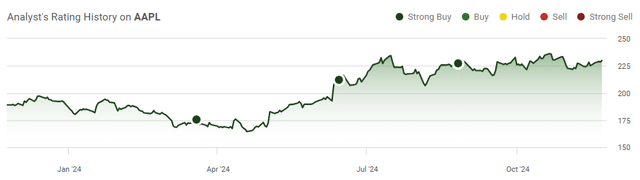

It’s still perplexing to me that so many people are bearish on Apple (NASDAQ:AAPL), the market’s most profitable company. Since Q4 2024 earnings were released on 10/31, 21 articles have been published on Seeking Alpha, with only 2 articles being bullish. More than half of the analysis was bearish, and the number of references about exiting AAPL as Warren Buffett sells was astonishing. Nobody knows what Berkshire Hathaway (BRK.B) will do with the capital raised from selling more shares of AAPL, but just because BRK.B is selling doesn’t mean AAPL is going to decline in value. BRK.B could be looking to raise cash for an acquisition for all we know. I am not sure I have ever seen a time when the overall trend on AAPL was as bearish as it is right now. Being bearish on AAPL hasn’t worked in the past, as every retracement has resulted in a buying opportunity. After going through AAPL’s Q4 and 2024 fiscal year results, I am very bullish heading into the holiday season and 2025. I believe that shares of AAPL look relatively inexpensive on a forward basis based on the amount of earnings and revenue growth they are expected to produce. Services is on track to become a $100 billion revenue-producing business segment in 2025, and I wouldn’t bet against AAPL as shares should benefit from a strong macroeconomic and business environment in 2025.

Following up on my previous article about Apple

Since 2018 I have never written a bearish article about AAPL (articles can be read here). I’m not jumping on the bandwagon, and over time, all my price predictions have been reached. Since my last article was published in August, shares of AAPL have traded sideways as they have appreciated by 1.37% compared to the S&P 500, climbing 1.48%. In my previous article, I discussed my outlook on the next upgrade cycle and why following Buffett may not be the best idea. I am following up with a new article now that Q4 earnings have been released. I am very bullish on AAPL heading into the holiday season and 2025 because I believe AAPL will sell more products and services as rates decline and the economy becomes stronger.

Risks to investing in Apple

Just because I am bullish on AAPL doesn’t mean that shares will continue to appreciate in value. AAPL is now a $3.47 trillion company, and doubling from here isn’t going to be easy. There are several risk factors to consider before investing in AAPL, from products to economic factors. AAPL is still dependent on the iPhone, and if we don’t see an extended upgrade cycle, AAPL runs the risk of not hitting its forward estimates. Many have also discussed the lack of innovation in AAPL products, and we could see users leave the AAPL ecosystem for Android products if Alphabet (GOOGL) is able to innovate at a quicker pace. Now that President Trump is coming back into office, we can see tariffs play a bigger role in his trade negotiations. If he does impose larger tariffs on China, there is no guarantee that AAPL will get an exemption, and if they don’t the increased costs will bleed into their margins. There are also economic risks to investing in AAPL. If the economy gets hotter, there is a chance that the Fed will halt its rate reductions and even raise rates. If that happens, it could impact future business expansion and limit the number of new products and services purchased from AAPL. I am very bullish on AAPL heading into the holiday season and believe that 2025 is going to be a strong year for AAPL. Everyone should do their own research and read some of the bearish articles while conducting their due diligence.

It’s hard betting against Apple, considering it’s the most profitable and shareholder-friendly company in the market

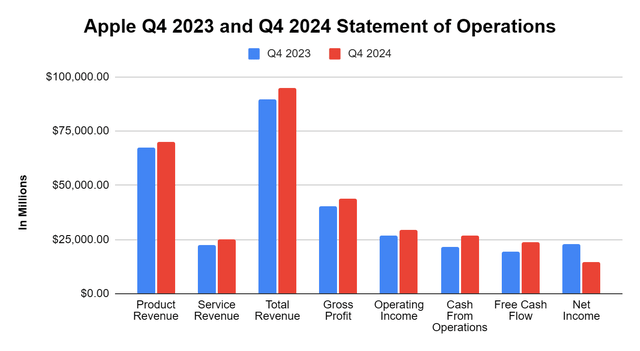

Everyone has an opinion, but numbers can’t be distorted. No matter what type of company you are $1 of revenue will always be $1 of revenue. AAPL just ended its 2024 fiscal year, growing every metric on a YoY basis except for net income due to paying more in taxes. In Q4, on a YoY basis, AAPL increased the amount of revenue it generated from products by 4.13% ($2.77 billion) and Services by 11.91% ($2.66 billion). This led to an overall increase of $5.43 billion (6.07%) of revenue generated in Q4 YoY during Q4. Here is something that the bears seem to look past as AAPL’s customers are voting with their wallets and spending more on products and services. AAPL increased its gross profit in Q4 by 8.54% ($3.45 billion) and grew their gross profit margin to 46.22% from 45.17%. Operating income grew 9.72% ($2.62 billion) YoY, while the cash from operations that were produced increased 24.14% ($5.21 billion). AAPL’s free cash flow (FCF) came in at $23.9 billion in Q4, which was an increase of 22.99% ($4.47 billion) as they generated $1.84 billion in FCF per week. This is one of the aspects of the company that the bear case doesn’t take into consideration. Regardless of if you don’t like the products, or don’t believe that AAPL is innovating, a population of consumers is spending enough money for AAPL to generate almost $2 billion in FCF per week.

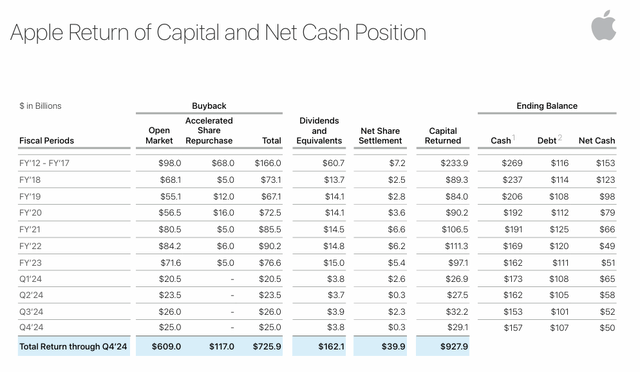

Steven Fiorillo, Seeking Alpha

Bottom-line profitability did slip from $22.96 billion of net income in Q4 2023 to $14.74 billion in Q4 2024, but that is because of the provision for income taxes. The amount that AAPL paid in taxes during Q4 increased by 267.99% as they paid an additional $10.83 billion in income taxes than they did in Q4 2023. People are getting bearish on AAPL, yet AAPL announced the iPhone 16 lineup, Apple Watch 10, and AirPods 4 during Q4 in addition to releasing the first set of features for Apple Intelligence. There is a lot to be bullish about as Apple Intelligence could supercharge Services revenue as it could bring an entirely new line of monthly recurring revenue to this business segment. AAPL also returned over $29 billion to shareholders in Q4 and delivered $1.64 in diluted EPS which was up 12% YoY. In the past year, AAPL has allocated $95 billion toward buybacks and $15.2 billion to dividends, which makes it the most shareholder-friendly company in the market. Since 2012, AAPL has returned $927.9 billion in capital back to shareholders as they have repurchased $725.9 billion worth of shares and paid over $160 billion in dividends. As AAPL continues to repurchase shares and grow its revenue and profitability, its EPS could continue to increase quicker than expected and provide investors with more earnings beats in the future. The bear case about the relevancy of AAPL’s products and services is based on opinions, while AAPL’s profitability and capital allocation are based on facts.

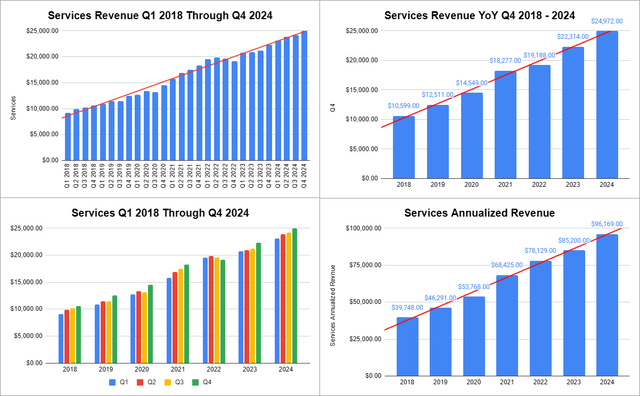

In less than a decade, AAPL has grown the Services division into a $96.17 billion run rate business. The growth has been incredible and allowed AAPL to diversify away from being just a hardware company. In 2024, Services accounted for 24.59% of AAPL’s revenue, which is up from 22.22% in 2023. In 2024, Services growth rate expanded to 12.87% as it added $10.97 billion in revenue YoY compared to 9.05% in 2023 when Services added $7.07 billion in revenue. Services experienced YoY growth in each quarter during 2024, as there have only been 3 negative quarters of growth on a QoQ basis since Q1 2018. Since 2019, the least amount of YoY revenue growth that Services has produced was $6.54 billion in 2019, and this places Services on track to exceed $100 billion in revenue in 2025. AAPL grew a business from nothing, and Apple Intelligence could help Services growth rates expand. Few people thought Services would reach a $100 billion run rate, and with the help of AAPL Intelligence, we could see that it would reach a $200 billion run rate by the end of this decade.

The macroeconomic environment sets up well for Apple heading into 2025, and I think the current valuation is inexpensive

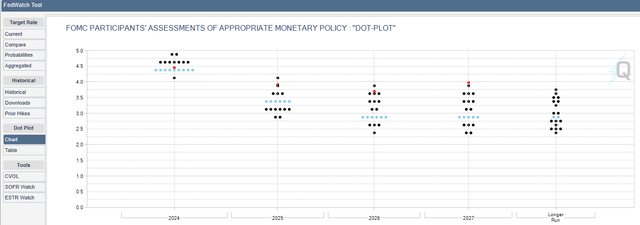

My bull thesis revolves around AAPL being able to grow its top and bottom lines through a better business and operating environment. The Fed has reduced rates by 75 bps since September, and based on the Fed Dot Plot, it looks like rates will decline to around 3.5% in 2025 and 3% in 2026. GDP in the U.S. has grown YoY each quarter for 10 consecutive quarters, and oil is trading well off its multi-year high of around $71. President Trump ran on lowering corporate taxes to 15% and making the business environment easier to operate in through deregulation. As the Fed continues to lower rates, businesses will be more inclined to tap the debt markets to fund future growth due to continued economic growth. As businesses and the economy expand more capital will be allocated toward goods and services, which is very bullish for AAPL. In 2024, AAPL generated $123.22 billion in operating income and paid $29.75 billion in corporate taxes, which worked out to a 24.14% tax rate. If AAPL generates the same amount of operating income in 2025 as they did this year and the corporate tax rate declines to 15%, then AAPL would save around $11 billion on their tax bill and increase their earnings from continuing operations by roughly 11.7%. An additional $11 billion in profits would correlate to an additional $0.73 in EPS based on their 15.12 billion shares outstanding. AAPL could end up being a huge beneficiary in a Trump economy, and I think this is being overlooked.

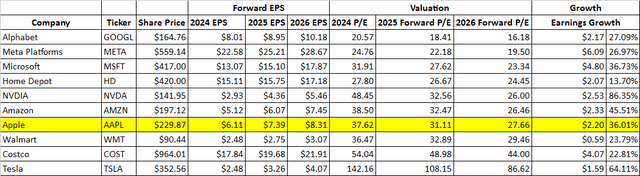

AAPL may have a market cap of $3.47 trillion, but shares still look attractively valued based on the profitability generated by its underlying operations. AAPL just finished their 2024 fiscal year and generated $6.11 in EPS. Over the next 2 years, AAPL is expected to grow its EPS by $2.20 or 36.01%. AAPL is trading at 37.62 times its current earnings and 27.66 times 2026 earnings. I think the market needs to rethink what is expensive, considering companies like Walmart (WMT) and Home Depot (HD) are trading at 36.47 and 54.04 times 2024 earnings. Looking out to 2026, WMT and HD trade at 29.46 and 44 times 2026 earnings. Everyone talks about paying a larger valuation for growth, and AAPL is expected to grow its EPS by 36% over the next 2 years. AAPL is still the only company that is generating over $100 billion in FCF on an annual basis. In 2024, AAPL produced $108.81 billion in FCF and currently trades at 31.93 times its FCF. Except for Meta Platforms (META) this is the lowest price to FCF in the Magnificent Seven and a much cheaper price point than WMT and COST, as they are trading at 42.76 times and 64.43 times FCF. Overall, I think that AAPL looks inexpensive based on its profitability and the potential to continue expanding in 2025.

Steven Fiorillo, Seeking Alpha Steven Fiorillo, Seeking Alpha

Conclusion

Shares of AAPL haven’t done much since the election, and I feel that many investors are overlooking how AAPL could benefit over the next several years. The Republicans will come into 2025 controlling all 3 legislative branches, which will make passing President Trump’s policies much easier. I think that AAPL will be a large beneficiary of a better business environment when companies are likely to expand and a tax policy that may become extremely favorable. AAPL could shave more than $10 billion off its tax bill on an annual basis, dropping to the bottom line if corporate taxes go to 15%. I think that shares of AAPL are attractively valued, and 2025 could be a big year as Services surpass a $100 billion run rate, upgrade cycles heat up, and new economic policies are passed.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL, TSLA, NVDA, META, AMZN, GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.