Summary:

- Taobao and Tmall generated RMB99 billion in revenue, with strong customer retention and a 2% rise in management revenue.

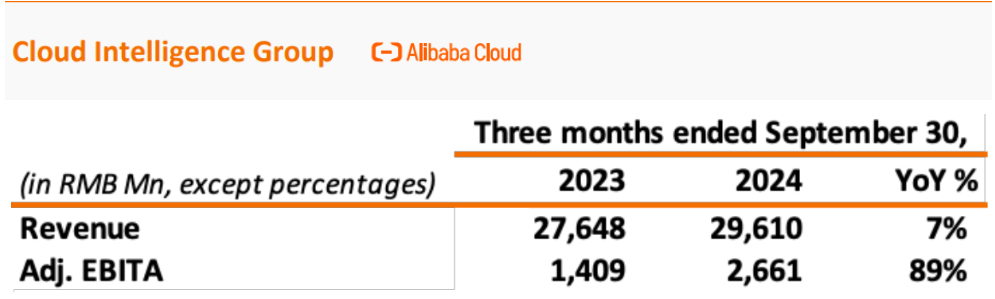

- Alibaba Cloud grew 7%, driven by AI services, with adjusted EBITA up 89% and 9% margin increase.

- The AIDC segment saw 29% YoY growth, with AliExpress focusing on faster delivery to boost margins.

- Alibaba repurchased $10 billion worth of shares in H1 FY2025, reducing the share count by 4.4% and attracting HK$46 billion inflows.

- Alibaba’s stock price of $83 is below the $90 target, with neutral momentum and subdued volume, indicating range-bound movement.

Robert Way

Investment Thesis

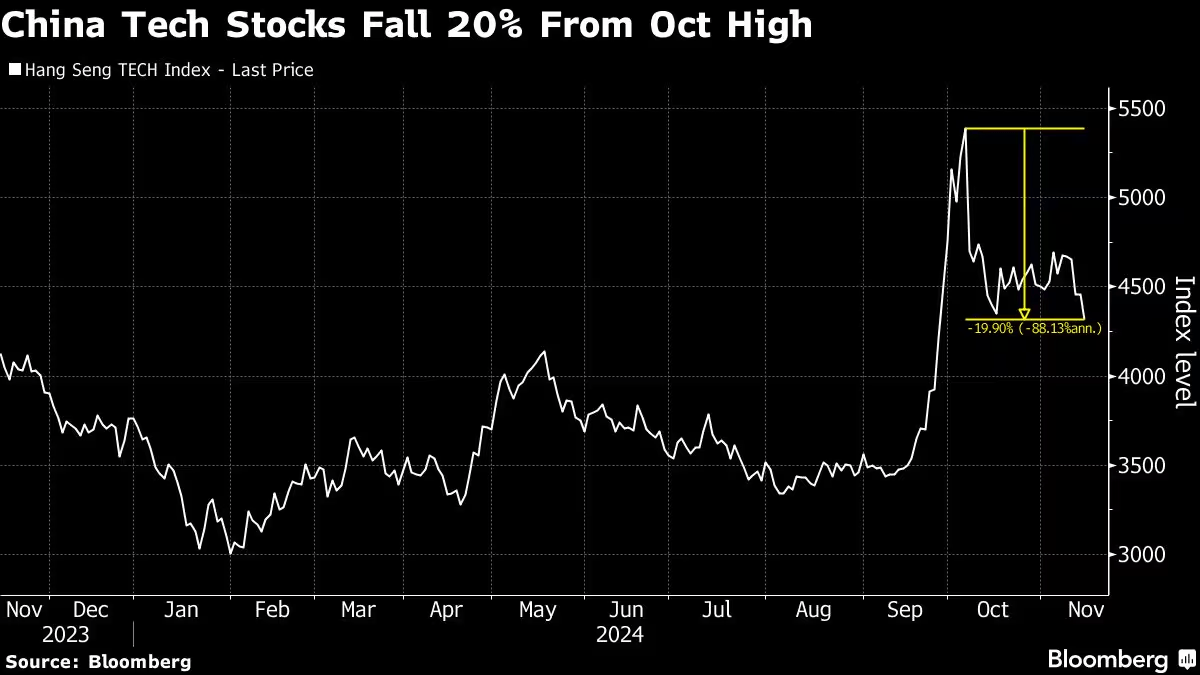

Following up on my earlier analysis, Alibaba Group (NYSE:BABA) has rallied due to China’s ambitious stimulus measures to revive its economy. The stimulus provided a short term boost to Asian equities but wasn’t enough in bringing meaningful and lasting growth, since most of the stimulus went toward fixing local government debt instead of growing economic activity. To make things worse, President Trump’s re-election and his stance on China likely means higher tariffs and stricter regulations on Chinese companies.

These uncertainties will not materially affect Alibaba’s great fundamentals and long-term potential. Speaking prudently, this was the time to readjust my portfolio’s risk and take some profits on the way up after several years of holding the stock. Also, that is a question of balancing overexposure and not ceasing for one second to believe in the growth story of Alibaba, as I still maintain a meaningful position in BABA with conviction in its prospects and negotiate the turbulence of the time with an increasingly diversified portfolio.

However, the shift in the narrative, in addition to Alibaba’s resilience and growth proved in key segments, shows another upward trend. This is an opportunity for investors to get on board with the momentum, too, as the regulatory risks seem to no longer hang over Alibaba’s potential and give way to sustainable growth.

E-Commerce Stability and Monetization Advances

First up, Taobao and Tmall platforms managed to derive RMB99 billion in revenue with a slim 1% growth over last year. Here, RMB93 billion is generated from domestic commerce alone. The real fundamental in Q2 FY 2025 is customer management revenue, which rose by 2%. The metric is tied to the gross merchandise value (GMV) that Alibaba grew through improving user retention and a software service fee addition. This 0.6% fee on completed GMV didn’t impact the merchants due to rebates and tools like Quanzhantui (an AI-powered marketing tool that improved ad spending efficiency). Moving to loyal customers stats, 46 million 88VIP members by Q2’s end. These aren’t the average online shoppers, as they buy frequently and may continue to boost that GMV. Moreover, retention metrics are solid here, pointing to near-term revenue stability.

Now, let’s pivot to the Cloud Intelligence business, Alibaba’s playground in tech. Cloud top-line hit RMB29.6 billion this quarter with a 7% jump. This is mainly based on double-digit growth in public cloud services and triple-digit expansion in AI-related products. Now this triple digits in AI is a trend as it is rolling for five straight quarters. If AI keeps embedding itself into every tech business, this segment may have exponential scaling with massive profitability.

In Q3, adjusted EBITA for the cloud segment soared 89% with margins up four percentage points to 9%. This marks a sharp shift towards higher-margin AI-related products. This kind of profitable growth linked with global level advanced tech adoption makes Alibaba’s cloud business less of a luxury segment and its offerings more like the infrastructure backbone for businesses.

Alibaba

Moving to the AIDC (Alibaba International Digital Commerce), the segment topline grew by a solid 29% YoY through high cross-border businesses like AliExpress and Trendyol. AliExpress is heavily focused on its Choice program, which provides faster delivery, and with that, AIDC is focusing on its economics in action. Better delivery equals happier customers, which translates into higher-order volumes and then fatter margins.

Similarly, Trendyol is also expanding aggressively in Europe and the Gulf facing seasonal demand issues, but optimizing its operations. With all that, profitability remains a concern, AIDC’s adjusted EBITA clocked in at a loss of RMB2.9 billion due to hefty investments in expansion. However, these are strategic losses aimed at capturing high-growth markets over the long term. Logically, profitability in Europe and the Gulf regions could transform AIDC into a consistent cash cow.

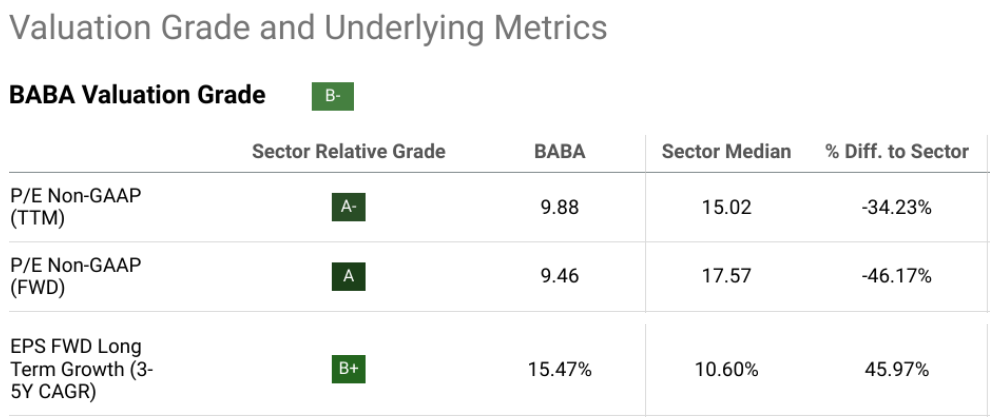

Finally, Alibaba already repurchased $10 billion worth of stock in H1 FY2025 and led a net share count reduction of 4.4% over two quarters. Further, the inclusion of Alibaba in the Southbound Stock Connect program led to HK$46 billion in net inflows into its Hong Kong-listed shares by September. Now, this inflow of Mainland China capital indicates an increasing street stance in Alibaba stock’s long-term prospects. In numbers, the forward P/E (non-GAAP) for BABA stock stands at 9.46 against a sector median of 17.57 with 46.17% undervaluation. At the same time, the stock is attached with an EPS forward growth (3-5Y CAGR) of 15.47%, outpacing the sector median of 10.53% with a 46.89% edge.

seekingalpha.com

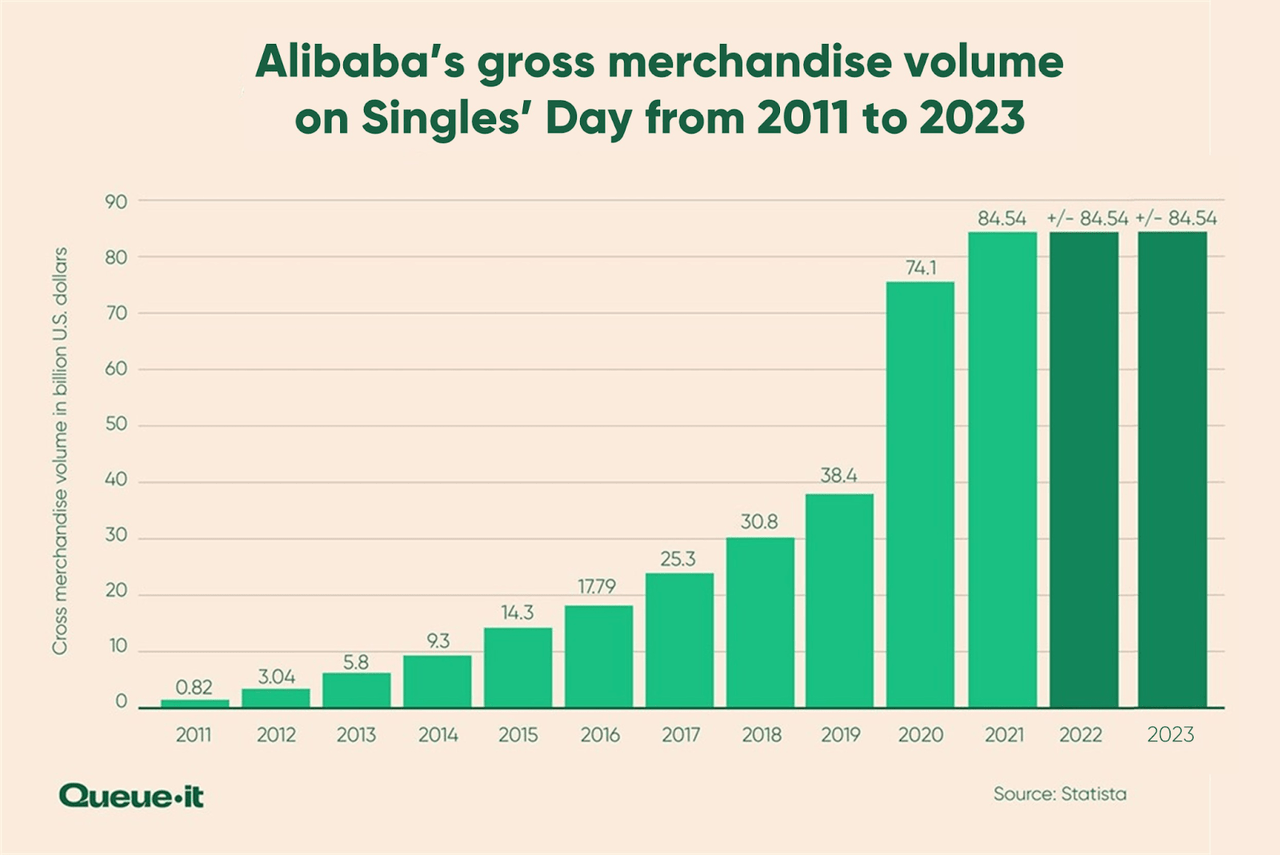

Downside: Dependence on Subsidy-Driven Promotions and Merchant Incentives

Alibaba’s major reliance on subsidy-fueled campaigns like Singles’ Day reveals a structural vulnerability in deriving organic growth. In reality, when a company funds platform coupons more aggressively than its merchants, then it does not exactly give off vibes of investor confidence. Now, if Alibaba’s consolidated coupon expenses hover around 2-3% of GMV during these campaigns and GMV stands at $80 billion, then we are staring at a coupon cut of $1.6-$2.4 billion. This is a recipe for thinner margins, and management’s pitch about the long-term advertising perks of these campaigns feels more like trying to sell desserts when the main course is not hitting customers right.

Queue It

Overall, we achieved relatively robust GMV growth during the campaign period. I would say that the results that merchants achieved based on what we discussed with them going into the campaign in terms of their expectations and then the feedback we got from them after the campaign is that results exceeded their expectations. I would say that overall results exceeded our expectations.

– Eddie Wu, Chief Executive Officer (Q2 earnings call)

The phrase “exceeded their expectations” is being trumpeted as being tied more to short-lived benefits from Alibaba’s deep subsidies than a thriving, long-cycled ecosystem. Merchants are happy now because of platform-funded discounts. However, the catch is that if competitors like JD.com or Pinduoduo can offer a comparable coupon baggage, merchants might just pack their bags. Now if Alibaba keeps absorbing the bulk of promotional costs to keep merchants around, valuation based on profitability will have to take a back seat.

Moreover, Alibaba stock’s recent failed optimism is leaning on national stimulus measures, subsidies, and trade-in programs that may boost segments like home appliances or electronics. But, relying on external economic crutches feels a bit like having a business success plan living on the government moves. Sure, double-digit growth in subsidized categories sounds great, but it cannot mask the issue. Once those subsidies fade, the growth story could unravel fast. In short, even these stimulus-driven stock spikes don’t solve Alibaba’s fundamental inefficiencies.

Bloomberg

Alibaba Stock: Technical Momentum Is Bullish With Neutral Strength

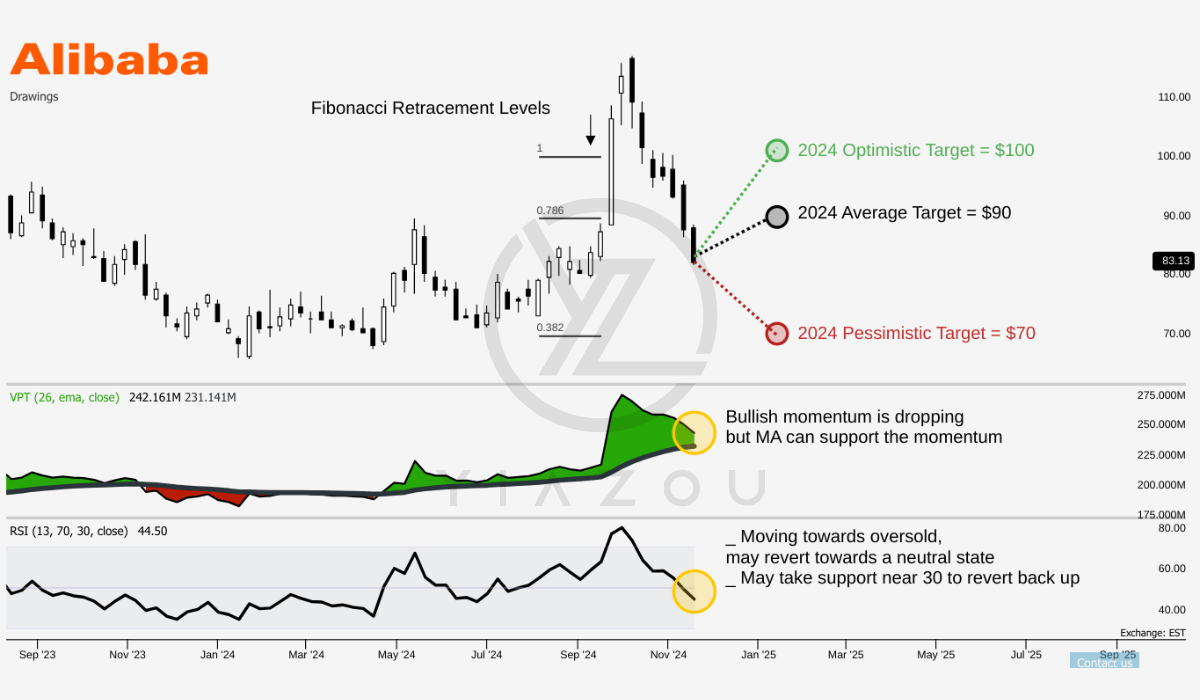

The current stock price of $83.10 sits below the average price target of $90. It aligns with the 0.786 Fibonacci retracement level. The optimistic projection of $100 corresponds to the full Fibonacci extension suggesting a potential rally contingent on improved sentiment. Conversely, the pessimistic target of $70 is in line with the 0.382 Fibonacci retracement level and highlights downside risks tied to broader bearish pressures.

Moreover, the RSI stands at 44, below the neutral threshold of 50, indicating a weak momentum without entering oversold territory. Neither bullish nor bearish divergence is observed, and the downward trend in the RSI line reflects a lack of upward momentum. This neutral yet downward-sloping RSI suggests the stock may remain range-bound unless a significant catalyst emerges.

Further, the Volume Price Trend (VPT) analysis reveals a declining trend at 242.16 million, above its moving average of 231.14 million. This divergence (volume slightly outpaces its trendline) points to subdued selling pressure but insufficient buying interest to confirm bullish momentum. The lack of volume-driven upward confirmation further validates the RSI’s neutral stance.

Yiazou

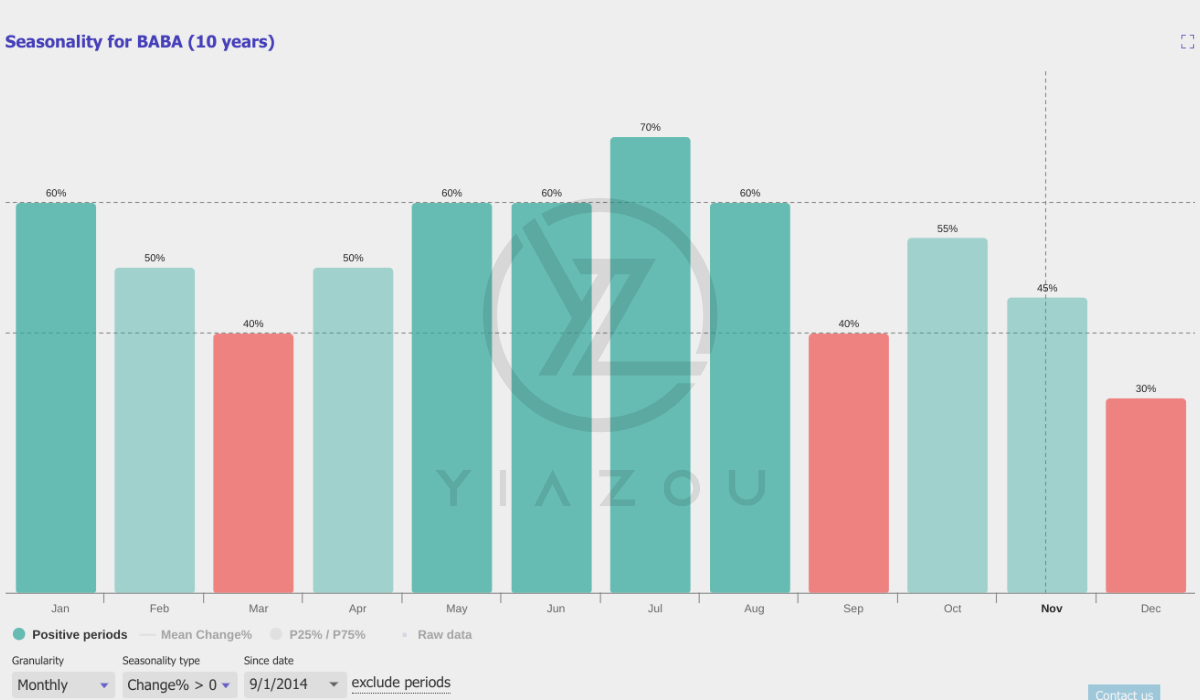

Finally, seasonality adds another layer of caution. With a 45% probability of positive returns in November based on 10 years of historical data, the odds do not decisively favor bullish positioning this month.

Yiazou

Takeaway

While I still believe in Alibaba’s long-term potential, the heightened geopolitical risks and my portfolio’s overexposure to Asian markets made reducing my position prudent. Taking profits felt right, but I’ve kept a meaningful stake because the fundamentals haven’t changed.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BABA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.