Summary:

- Super Micro has surged 110% since November 14 due to the appointment of a new auditor and the submission of a compliance plan, avoiding delisting from Nasdaq.

- The relief rally was driven by technical factors, including oversold conditions and short covering; however, the timing of financial filings and the potential for accounting issues remain uncertain.

- Although no accounting fraud, its reputation has been damaged, as large customers may shift orders to competitors, including NVIDIA, leading to further downward revenue revisions.

- The company maintains $5 billion inventories on balance sheet, which could face impairment losses and impact earnings due to reduced orders.

- Despite a low valuation after the rally, SMCI’s stock should be heavily discounted due to these uncertainties. I expect more visibility in the next earnings release before reconsidering my rating.

designer491/iStock via Getty Images

Valuation Does Matter, Surged 110% in a Week

Super Micro Computer, Inc.’s (NASDAQ:SMCI) stock experienced a strong relief rally since its low on November 14, following the company’s announcement of a new auditor and the submission of a compliance plan to Nasdaq to avoid delisting. Prior to that, the stock had been under significant selling pressure as it approached its previous deadline of November 16th.

I believe this relief rally can be attributed to the stock’s extremely oversold condition. In my recent article, I maintained a “hold” rating on SMCI, discussing a potential scenario where valuation does matter, and the recent panic selloff signaled a contrarian buying opportunity if the company could avoid delisting.

The stock’s near-term rally was driven by several factors, including distressed valuation, technical oversold conditions, and short covering. However, many uncertainties still remain, including the timeline for completing its filings and, more importantly, the risk of downward revenue revisions due to potential order reductions by major customers. Therefore, after a 70% rally since my last rating, I am downgrading the stock from “hold” to “sell,” as I believe the market has not fully accounted for inventory risks and that the current revenue consensus remains optimistic. Moreover, I also believe that a return to the stock’s 1H CY2024 trading range is unlikely in the near to mid-term.

Avoiding Delisting from Nasdaq but Not Out of the Woods Yet

According to SMCI’s website, the company previously received a non-compliance letter citing delays in filing its 1Q FY2025 10-Q and FY2024 10-K. SMCI later submitted a compliance plan to Nasdaq on November 18th, indicating that it would complete the filings, but the timeline was not specified. Additionally, the company appointed BDO USA as its independent auditor. While I believe SMCI has done a better job this time compared to 2018 when the stock was delisted from Nasdaq but later regained compliance and was relisted in early 2020, the stock price experienced a similar relief rally following the news.

Despite a 110% rebound from its recent low, SMCI’s forward valuation multiples are still trading nearly 20% to 25% below their 5-year averages. However, I expect the company will face downside revenue revisions from sell-side analysts due to the potential loss of major customers following the compliance issue. A recent report cited that NVIDIA Corporation (NVDA) is moving orders away from SMCI to reduce the supply disruptions. SMCI’s inventories have been spiking in recent quarters on its balance sheet, as the company awaits the shipment of its Blackwell-based liquid cooling solution, GP200.

During the recent NVDA’s 3Q FY2025 earnings call, the company indicated that Blackwell is in full production and expected to exceed its previous revenue guidance. However, SMCI’s management did not provide an optimistic tone and guided a significantly weaker-than-expected revenue outlook. It’s not surprising that Jensen Huang referred to Super Micro as one of its “really incredible” partners, and SMCI also noted during the earnings calls that there have been no changes to allocations. I believe the orders will be impacted if not completely shifted elsewhere.

However, there is an upside risk to my sell rating, and will change my rating to buy if management raises significantly stronger-than-expected revenue guidance for FY2025 in the next earnings call and comments that their inventories are expected to normalize as supply constraints for Blackwell chips improve. I believe SMCI’s management will likely have access to the latest updates from NVDA, which could positively influence their outlook.

Revenue Consensus May Still Be Optimistic

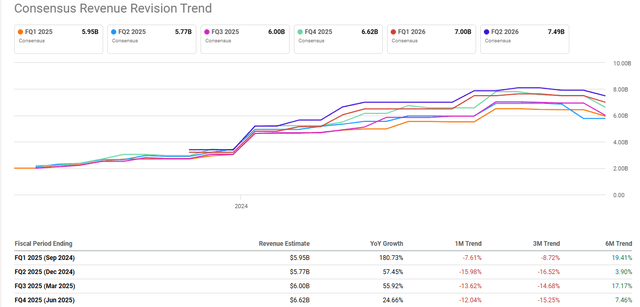

However, if NVDA indeed shifts its orders away from SMCI, I believe the company’s revenue consensus in 2H FY2025 will likely be revised downward. According to Seeking Alpha’s revenue revisions trend, we can see a downward revision over the next quarters driven by a weak 2Q FY2025 revenue outlook guided by the management. Despite this, there is still a positive revenue revision trend over 6 months horizon.

Inventories May Face Potential Impairment Due to Customers Shifting Orders

SMCI is currently holding nearly $5 billion in inventory, which has doubled from 12 months ago. Due to potential orders decline, particularly from large enterprise customers, the company needs to focus on reducing its inventory levels. This situation also increases pricing pressure, which could negatively impact its gross margin. Additionally, it raises the risk of inventory impairment, where the market value of the inventory falls below its book value, which can affect the company’s earnings outlook.

Recent Rally Was Largely Driven by Short Covering.

From a technical standpoint, SMCI’s price is currently approaching $39 for now, recovering nearly 68% of the total drawdown following the disassociation of its previous auditor, E&Y. This strong recovery indicates that the stock has largely priced in the recent positive developments. From a positioning perspective, SMCI has maintained a high short interest in recent weeks. I believe the recent rally was primarily driven by short coverings, indicating higher volatility in the near term. Until we see more clarity in the next earnings release and management’s updates on the Blackwell volumes and its financial filing timelines, I think the recent rally creates an opportunity for investors to exit and stay on the sidelines for now. Of course, the upside risk also includes continued short covering as the price rises, but the stock is no longer in an oversold condition at this point.

Low Valuation Does Not Equal Cheap Valuation

Due to the recent sharp rebound, I admit that the stock is still trading at a significant discount at 11.7x of non-GAAP P/E fwd and 0.8x of EV/sales. However, it’s a little misleading to focus on its forward multiples right now for two reasons. The company still needs to work on its FY2024 10K and 1Q FY2025 10Q fillings. We can’t fully rely on the company’s recent financials if they have not been audited and fail to comply with Nasdaq rules, as this could lead to an inaccurate assessment of SMCI’s valuation multiples.

Second, as previously mentioned, if SMCI’s customers shift their orders to its competitors, the company’s current revenue consensus would be likely overstated, leading to further downward revisions, which would result in higher forward valuation multiples. Therefore, despite the recent rally driven by technical factors, I believe it’s still too early to tell that SMCI is out of the woods. We also can’t speculate on these two scenarios, but we can put a significant discount to its valuation right now, meaning SMCI should be trading at a much cheaper valuation. Nevertheless, the risk and reward are not that attractive for holding the stock after a nearly 110% rally in just 6 trading days.

Conclusion

I believe the 110% rebound from SMCI’s November 14 low has alleviated much of the panic selling pressure, as the risk of delisting from Nasdaq has largely diminished. But the question now is: what’s next? For investors with a high-cost basis, holding the stock might be an option for them if they have a high tolerance for volatility. For those who bought the dip and have seen a decent return, it may be wise to take profits and remain on the sidelines until the next earnings release.

Assuming that SMCI’s accounting issues have been resolved, the company’s reputation has taken a hit. Furthermore, its revenue outlook remains uncertain, particularly with potential order reductions from major customers and inventory challenges. I believe the recent rally is more a result of technical factors than any fundamental improvements. Therefore, I’m maintaining a cautious outlook and downgrading SMCI to a “sell” rating, as I believe the risks currently outweigh the potential rewards in the near to mid-term.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.