Summary:

- Innovative Industrial Properties is a triple net lease cannabis REIT with a 105-property portfolio, yielding 7.1% and trading at a near-record low valuation.

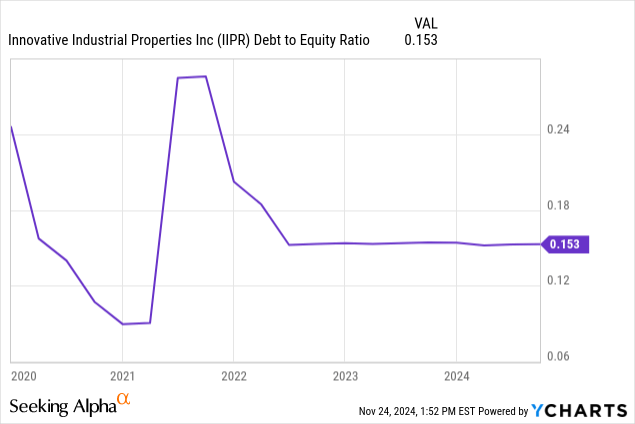

- IIPR’s low leverage, with a debt-to-equity ratio of 0.15x and strong liquidity, significantly reduces investment risk despite industry uncertainties.

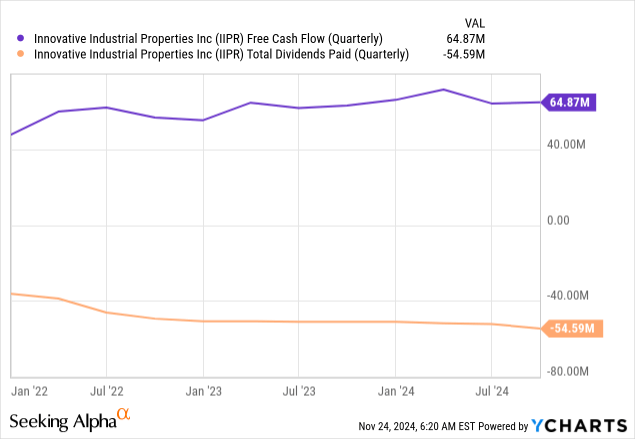

- The REIT’s free cash flow exceeds its dividend payments, enabling opportunistic investments and potential future dividend increases.

Yanukit Raiva

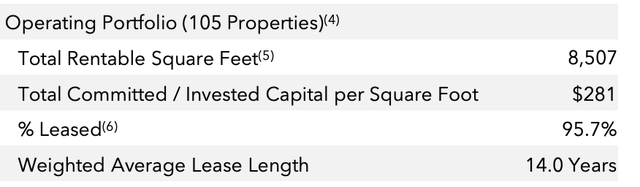

Innovative Industrial Properties (NYSE:IIPR) has performed strongly year-to-date, up 11.6% on a total return basis, even with the ticker dipping in recent weeks following Florida’s rejection of recreational cannabis legalization. The vote by the Sunshine State, the third most populous in the US, presents an intense rain check on the broad blue sky dream of recreational cannabis attaining national legitimacy. IIPR is an internally managed triple net lease cannabis REIT with a 105-property portfolio spread across 8.5 million rentable square feet and with a heavy focus on industrial cannabis buildings that constitute 92% of annualized base rent (“ABR”).

Innovative Industrial Properties Fiscal 2024 Third Quarter Supplemental

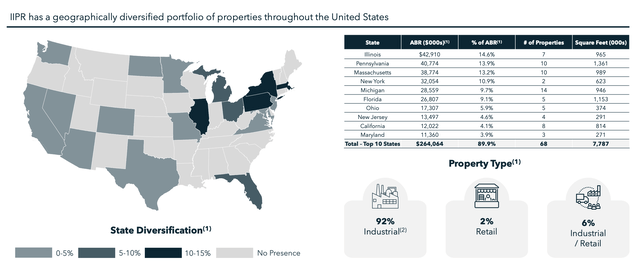

The REIT last declared a quarterly cash dividend of $1.90 per share, kept unchanged from its prior distribution and $7.60 per share annualized for a 7.1% dividend yield. The industrial properties are mission-critical greenhouses and cultivation facilities that are also relatively fungible in terms of operators. The industry is highly regulated, so these facilities are still in demand even if the original operator defaults on rent. The REIT is also somewhat geographically diversified with around 90% of ABR from ten states, with the largest share of this being Illinois at 14.6%.

Innovative Industrial Properties Fiscal 2024 Third Quarter Presentation

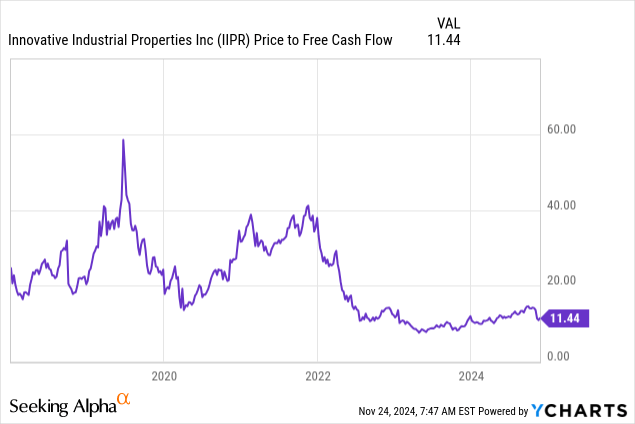

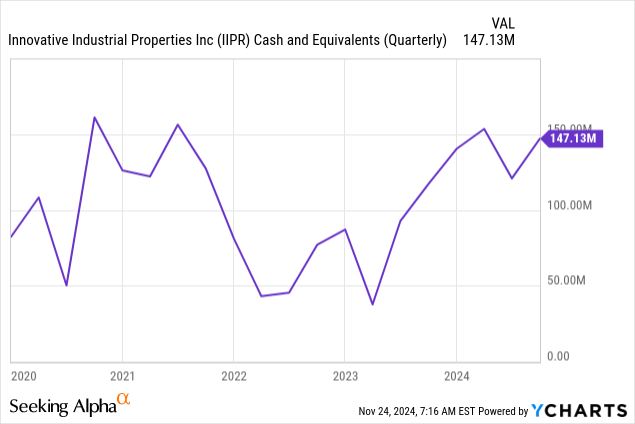

This reduces inherent volatility from changes to state-level cannabis legislature, providing a subtle hedge for funds from operations (“FFO”). IIPR generated a fiscal 2024 third-quarter normalized FFO of $2.02 per share, missing consensus by 1 cent and dipping from $2.09 per share a year ago. The REIT is now trading for 11.44x its trialing 12-month free cash flow, close to an all-time low, even as its cash and cash equivalents of $147.1 million at the end of the third quarter are set to reach a new high.

Innovative Industrial Properties Fiscal 2024 Third Quarter Presentation

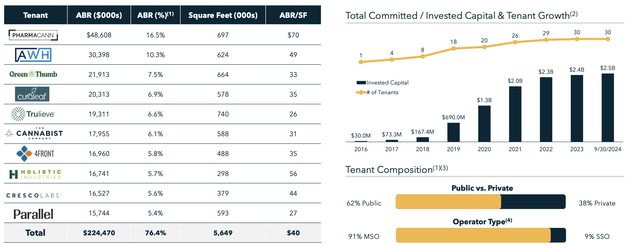

Tenants And Free Cash Flow

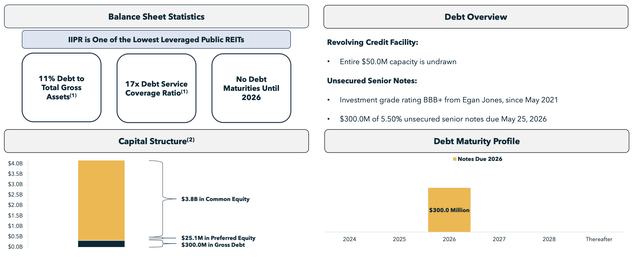

Total liquidity was $222.4 million with the inclusion of a revolving credit facility, which was further expanded by $37.5 million post-period end. IIPR is highly cash-generative, with its free cash flow outstripping its dividend to common shareholders. This means there are funds left over every quarter to pursue opportunistic investments. The REIT purchased a Maryland industrial space of 23,000 square feet post-period end for $5.6 million. This would have been funded entirely through free cash flow, with excess free cash flow left to grow cash reserves.

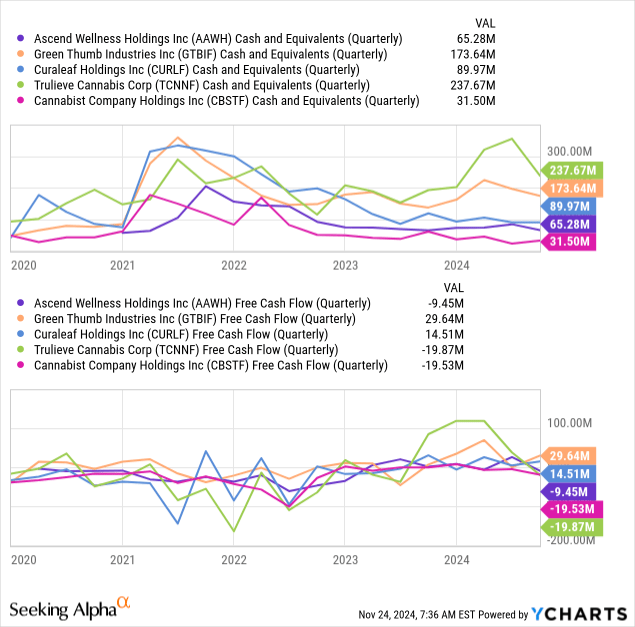

However, the heavy discount on the REIT is cognizant of the heightened risk posed by its tenant base. While the largest tenant, PharmaCann, is private, the bulk of MSOs are public, so we can peer into their financial health. IIPR’s second-largest tenant is Ascend Wellness (OTCQX:AAWH). The company held cash and cash equivalents of $65 million at the end of its fiscal 2024 third quarter, against negative free cash flow of $9.45 million. Other tenants like Trulieve (OTCQX:TCNNF) are better capitalized, but the industry is under stress and faces renewed uncertainty on key initiatives like the rescheduling of cannabis to a Schedule III drug and the SAFER Banking Act on the new White House administration.

Debt Maturity, Liquidity, And FFO Growth

Innovative Industrial Properties Fiscal 2024 Third Quarter Presentation

IIPR’s most investable factor is just how low its leverage is. The REIT has just $300 million of debt on its balance sheet, due in 2026. This is set against gross assets of $2.6 billion for debt-to-gross assets of just 11% and a debt service coverage ratio of 17x. This is set against the backdrop of a falling Fed funds rate, with 75 basis points of cuts through the last two FOMC meetings. IIPR’s debt-to-equity ratio at 0.15x is remarkably low, materially derisking a long position in the common equity and all but securing the safety of the Series A Preferreds (NYSE:IIPR.PR.A).

I expect to see cash and cash equivalents continue to rise, especially with rent from re-leased properties set to commence in the future quarters. Hence, the core risk for bulls here remains regulatory. The US cannabis space could face another regulatory winter if the SAFER Banking Act and cannabis rescheduling are pulled. The dividend is currently 118% covered by free cash flow, which does raise the prospect of a possible near-term raise. A 2% to 2.5% dividend raise would increase IIPR’s quarterly common dividend outlay by roughly $1.36 million, a level that would still be covered by free cash flow.

I don’t think any of IIPR’s tenants are flashing red for 2025 even as the US cannabis industry remains a tough buy for investors. IIPR continues to form one of the more prudent ways to gain exposure to the US cannabis industry, but I’m rating the common shares as a hold due to looming changes to currently positive catalysts on the new administration.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in IIPR over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.