Summary:

- Alphabet’s Google Cloud saw significant 35% growth in Q3, outpacing AWS and Azure, indicating potential positive momentum in its cloud business.

- Despite this growth, Google’s cloud and AI revenue remains a small fraction of its overall business, with advertising still the dominant revenue source.

- Google is losing ground in the advertising sector to Meta Platforms, which is growing faster and now commands over 60% of Google’s ad revenue.

- The impressive cloud growth is insufficient to offset the declining ad business, making it hard to justify Google’s valuation even with moderate EPS outperformance.

I Like That One

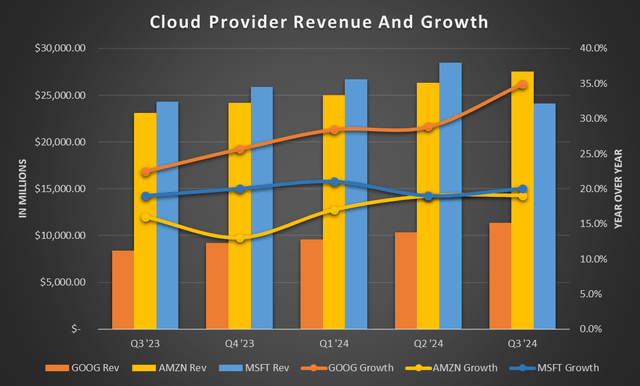

As the large language model competition continues among the largest tech companies, the ramp to maturity is quickly approaching. As this ramp continues and begins to plateau, we’ll see the strongest emerge and become the winners of this phase of AI. To this end, Alphabet (NASDAQ:GOOG)(NASDAQ:GOOGL) saw the highest growth in cloud in Q3. However, the company is still third behind Amazon’s AWS (AMZN) and Microsoft’s Azure (MSFT). Obviously, growth is the priority as market share will follow, but nonetheless, accelerating growth stands out among the competition. However, much like other tech companies, just because AI-based revenue grows doesn’t mean it’s meaningful to the overall business and financials.

Google Setting Itself Apart

After reporting Google Cloud growth of 29% in Q2 ’24 and 22.5% in Q3 ’23, seeing 35% growth in cloud revenue this past quarter is enough to think something might be brewing – something good. If you compare this to AWS and Azure, it seems Google may be hitting a stride.

Chart author’s, data from company earnings reports

While it’s not the leader in the cloud market by market share, its year-over-year growth is hitting an inflection the other two major players aren’t seeing. My previous gripe with Google and its cloud business, which I shared with Tech Cache subscribers over the summer, was it wasn’t outpacing the growth of Azure and AWS. But now it seems to have taken a turn where it is and has been for a few quarters. Of course, my other gripe was Google’s lack of advertising growth and having its butt handed to it by Meta Platforms (META), but I’ll get to that shortly.

At any rate, in the cloud world, what’s changed or in the process of changing?

The first is Google is getting back to its roots and helping customers with a garage full of tools.

What do I mean?

Well, Google has cybersecurity, enterprise applications, generic AI acceleration, and a wheel-around toolbox approach to working with major companies. The company says, “What do you need? Here’s the tool.”

For example, Snap (SNAP) is using Gemini in its own product, its MyAI chatbot. Meanwhile, Deloitte is using its Mandiant-based Google Threat Intelligence and Security. This competes in some areas with other pure-play cybersecurity names, but if Google becomes this one-stop shop, integration will be easier for customers.

Therefore, Google is a bit unique in this AI services market and isn’t much different than Nvidia (NVDA) on the infrastructure side and working with its customers on what CUDA software libraries and frameworks they need to accelerate their specific industry workloads (ex: cuLitho).

It seems it’s finally coming together for Google.

This is also the maturity Google needed to have. The money is in enterprise and business-to-business. No longer is Google the Google of free services; of the individual user. Its client end-user tools have lacked quality and have had poor iterations software-wise these last few years, so it’s no surprise to hear its focus hasn’t been there. The bottom line in this industry is mobile devices are a margin drag, and end-user tools are a loss leader, but enterprise sales are giving way to 17% operating margins at this stage – this early – in the game:

We generated Q3 revenues of $11.4 billion [in Cloud], up 35% over last year with operating margins of 17%.

– Sundar Pichai, CEO, Google’s Q3 ’24 Earnings Call

Still Not Significant Enough While Ads Weigh

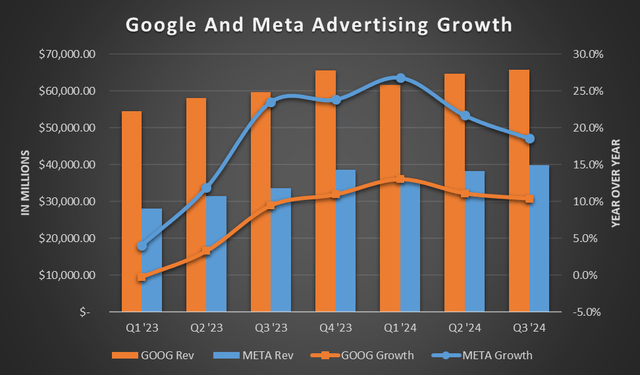

Now, while 35% is great and leads its revenue centers in growth, it’s still one of the smallest revenue centers behind “subscription, platforms, and devices.” Advertising is still the bulk of its revenue, and it remains one of the highest revenue market leaders in the space.

The problem is: There’s no technology leadership here.

It hasn’t figured out how to better target users and provide better tools utilizing AI than Meta. This is why Google grew advertising by 10.4% while Meta grew its ad revenue by 18.5%. And now Meta has reached beyond 60% of Google’s advertising revenues. In the same quarter two years ago, it was exactly 50%. Meta is now within striking distance.

Chart author’s, data from company earnings reports

Google is losing the ad game big time, and, therefore, I cannot justify its business as a whole. Considering the ad business makes up 75% of its revenue and is losing its market share and losing it quickly to its main competitor, there’s too much weight and drag to think only of cloud growth.

So, while the less-than-13% AI and cloud business is growing by 35%, it’s not enough to look the other way as its main business is failing before our eyes. This is the AMD (AMD) problem, where Nvidia is the pure play growing by leaps and bounds, but AMD’s small revenue center directed at Nvidia is hugely overshadowed by its client, discrete, and edge businesses. It’s the same situation here for Google.

So, is Google finding new traction? Yes, it certainly is in cloud and AI as it outpaces its larger competitors. But this is only a fraction of its current business, and even growing at mid-30s percent each year, it won’t overtake the ad business for years to come unless, of course, the ad business slows to a crawl. Even in that case, it would take six to eight quarters before it becomes meaningful to make up for the lack of ad revenue growth.

It’s nice to see Google not stumbling through this AI era anymore, but it hasn’t shifted the company as a whole. As it begins to lap this decent year, it’s hard to justify buying on its 12% EPS estimates for 2025.

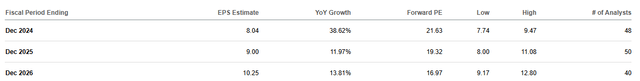

Even if the company managed to beat expectations and provide 19%-20% EPS growth, it, at best, is fairly valued here. And it’s not like this great cloud performance has moved the needle for 2025 estimates. Since the earnings report a few weeks ago, 2025 estimates have only crept up 3.5% – not the growth number, just a move from $8.69 to $9.00. In fact, 2025 growth estimates went down from 13.9% to 12.0% because 2024’s estimates came up further, pressuring 2025’s comps.

Overall Not A Great Growth Story

Google has a low-double-digit growth story ahead of it, even with its positive divergence of cloud growth compared to competitors. While double-digit revenue growth sounds decent, it doesn’t match the earnings growth and valuation.

The problem is Google is very reliant on digital advertising and hasn’t kept up with the technological shift over the last few years. With Meta Platforms breathing down its neck and taking market share hand over fist, Google is in trouble if it can’t also accelerate its advertising revenue. Until that changes, I’m not looking to go long.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META, NVDA, AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Join The Top AI And Tech Investing Group

Do two things to further your tech portfolio. First, click the ‘Follow’ button below next to my name. Second, if you want to see Google’s technical chart analysis, along with more of this two-fold analysis, step up to being a paid subscriber to my Investor Group Tech Cache with a two-week free trial and read more of this type of analysis on other tech stocks and assets.