Summary:

- Snowflake Inc.’s stock surged post-FQ3 earnings but remains overvalued based on limited AI revenue and decelerating growth.

- The company is only targeting 23% YoY growth in FQ4 despite the investor excitement.

- The stock’s rally is driven by AI hype and multiple expansions, pushing the valuation similar to pre-IPO Databricks with up to double the growth rates.

- Investors should consider cashing out of Snowflake due to downside risks on a stock trading at 15x FY26 revenues, especially as Snowflake’s growth continues to point to decelerating.

da-kuk

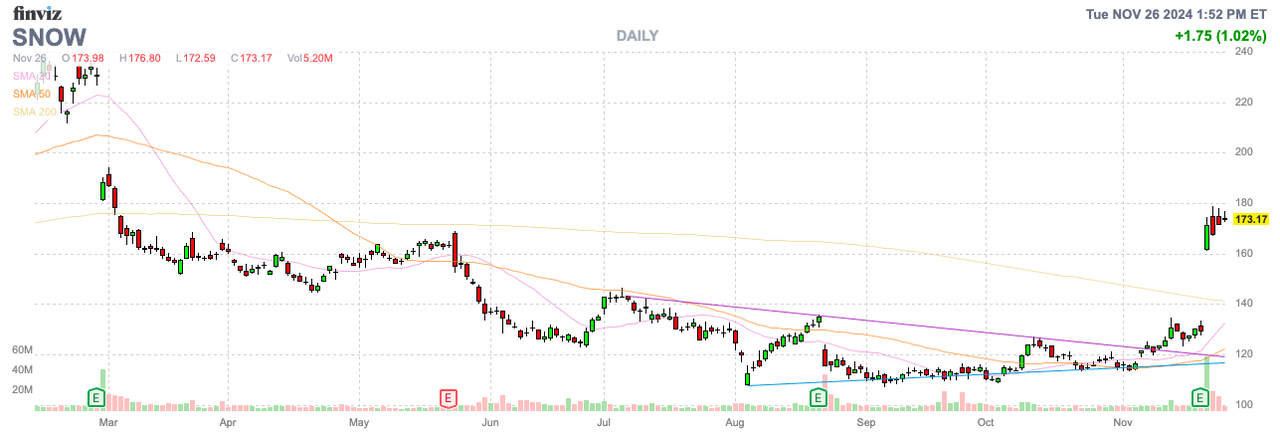

After a rough patch that saw Snowflake, Inc. (NYSE:SNOW) shares collapse over 50% from the yearly highs, investors came rushing back into the stock following a promising FQ3 earnings report. The AI data company highlighted some bright spots in the quarter to overcome past issues with data security. My investment thesis remains Bearish on the stock after the big rally back up to $175 and the related rich valuation.

Deceleration Hasn’t Ended

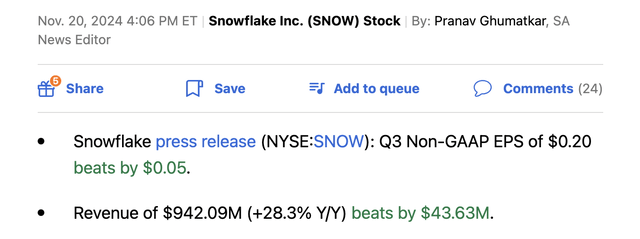

Snowflake soared following the strong FQ3 earnings where the company smashed analyst estimates last week as follows:

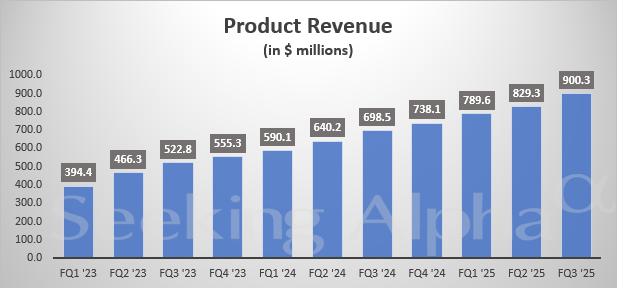

The AI data company beat revenue estimates by a massive $44 million. The problem here is that Snowflake only guided product revenue growing sequentially from $900 million to $906 to $911 million in FQ4 after growing by $71 million over the FQ2 level.

Source: Seeking Alpha charts

The big beat naturally makes investors think the AI revolution has started and Snowflake will return to massive growth. The reality is that guidance isn’t supportive of such growth, with key product revenue only targeted at 23% growth YoY in FQ4, due in small part to the slower holiday season.

While the stock has shot up due to AI hype, the company downplayed the AI revenue contribution with AI products including Cortex, Document AI and Snowpark Container Services producing limited revenues.

On the FQ3 earnings call, CFO Mike Scarpelli discussed this dynamic with AI still a fraction of the business as follows (emphasis added):

We are seeing an uptick in new products. I would say Cortex is starting to take off. It’s still very much in the early innings, and we are very optimistic of what that’s going to do in the future based upon what we’re seeing and Snowpark continues to track as expected, will be 3% of our revenue for the year and growing very nicely year-over-year.

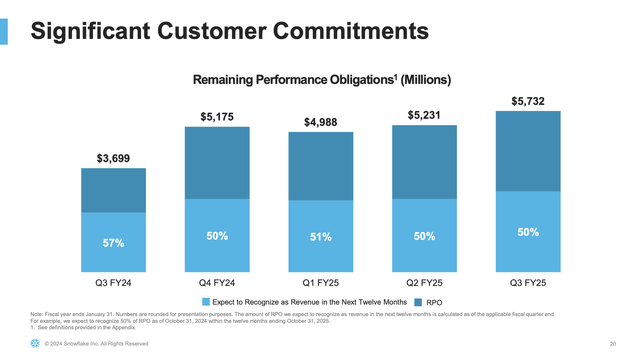

The general industry is starting to focus more on RPOs from billing, with Snowflake showing a massive boost in RPOs from the prior FQ3 levels. RPOs jumped over 55% to $5.7 billion in FQ3 from only $3.7 billion last October quarter.

Source: Snowflake FQ3’25 presentation

Again, the devil is always in the details. Snowflake saw a massive boost in RPOs back in FQ4 ’24 when the current RPO value dipped from 57% of total RPOs to only 50% due to an extension in the contract commitments of bigger customers.

Since the start of FY25, Snowflake has only grown RPOs from $5.175 billion to $5.732 billion for only 11% growth over the three-quarter period after the big boost during the last FQ4. As an example, one major customer signed a 5-year deal for $250 million in commitments in a sign of how some large new contracts are extended way beyond a period of a couple of years.

Priced Like A Pre-IPO Stock

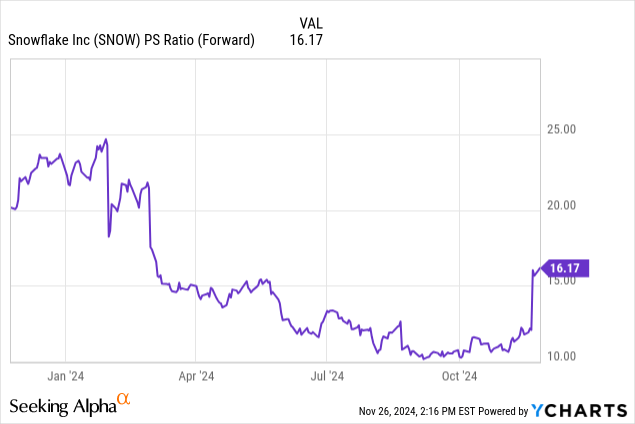

The stock has rallied due to multiple expansion, not any real change in the financial picture of the company. Snowflake now trades at 16x forward sales expectations, versus closer to 10x at the lows.

The stock has a market cap of nearly $64 billion based on a fully diluted share count of 364 million. The company has spent $1.9 billion this FY to repurchase shares. However, Snowflake would best served waiting for better valuations to utilize its cash, especially after issuing $2.3 billion worth of convertible debt stuck on the balance sheet now, contributing up to 20 million shares in the diluted share count.

The numbers definitely suggest Snowflake might sneak by mostly unscathed from the data security issues. Though, some guidance does question whether some customers in the pipeline haven’t somewhat delayed implementations, with sales growth again targeted to slip substantially in FQ4.

Overall, Snowflake guided to FQ4 product revenues of $908.5 million at the midpoint. Assuming $40+ million in other revenues, the company is forecasting sales for the January quarter in the $950 million range, with the consensus analyst estimates up at $955.5 million for 23% growth overall.

So despite the big beat, analysts haven’t increased FY26 revenue growth beyond the FQ4 rate of 23%. The stock isn’t priced for this growth rate at nearly 15x forward sales targets of $4.4 billion.

Databricks apparently is being valued at $55 billion in a new funding round, raising at least $5 billion in capital to challenge Snowflake. The other major AI data company was expected to reach $2.4 billion in annualized revenues this year and is likely a major contributor to why Snowflake has seen growth rates decelerate this year, outside the data security issues.

While Databricks could get a valuation at over 20x current sales, the business would trade at only 15x forward sales assuming sales in the range of $3.6 billion in 2025 based on a 50%+ growth rate. The private AI data company would have much faster growth rates than Snowflake.

As a reminder, Snowflake went public for over $200 and quickly rallied to nearly $400 within months and eventually collapsed to a low of nearly $100 this year. If the stock currently trades at close to the valuation multiple of a pre-IPO company, Snowflake is likely vastly overvalued based on the public market history of the stock and current growth rates.

Takeaway

The key investor takeaway is that Snowflake is back to trading based on AI hype, while the company is actually reporting limited related revenues. Investors should use the current strength to cash out due to the downside risk, with the AI data company likely to report decelerating growth outside another massive sales beat that appears highly unlikely.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to end November, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.